Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

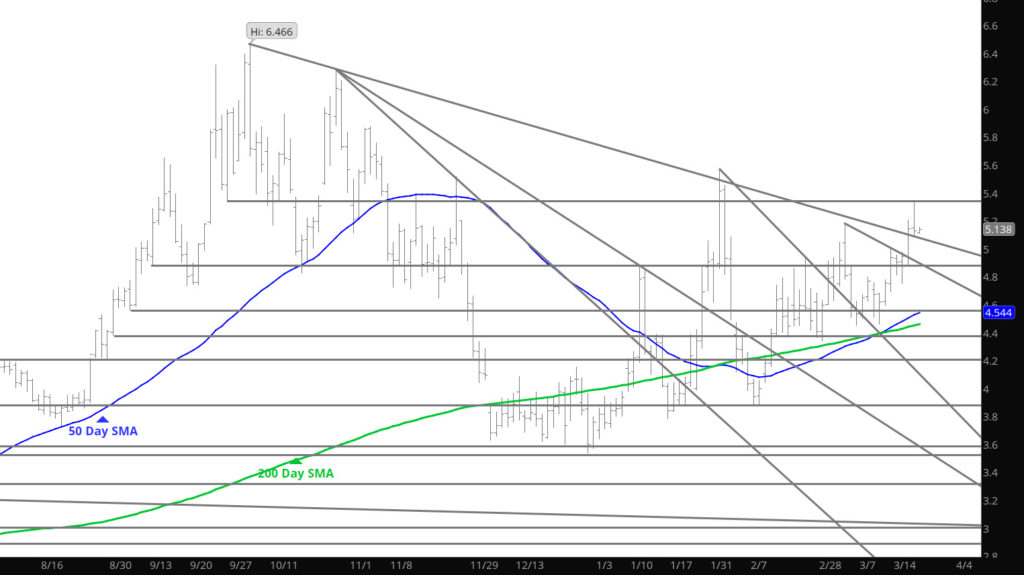

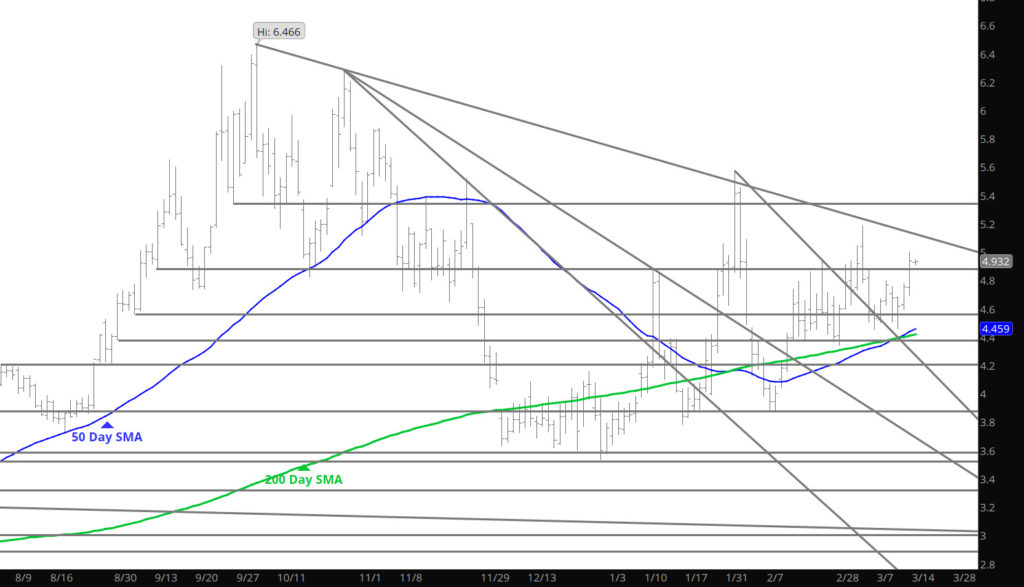

A Close Above $5.00

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

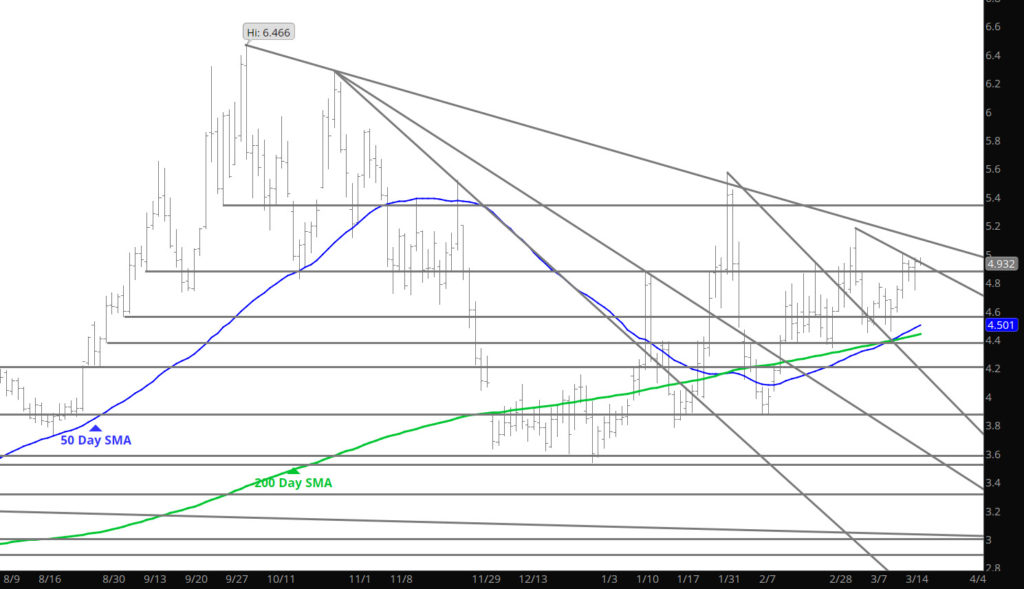

Early Declines Find Buying

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

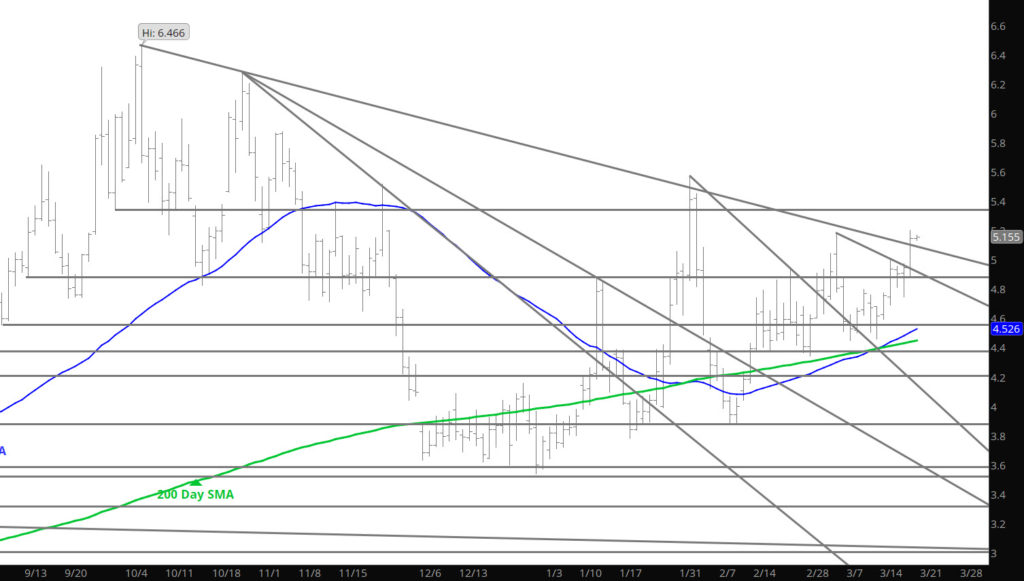

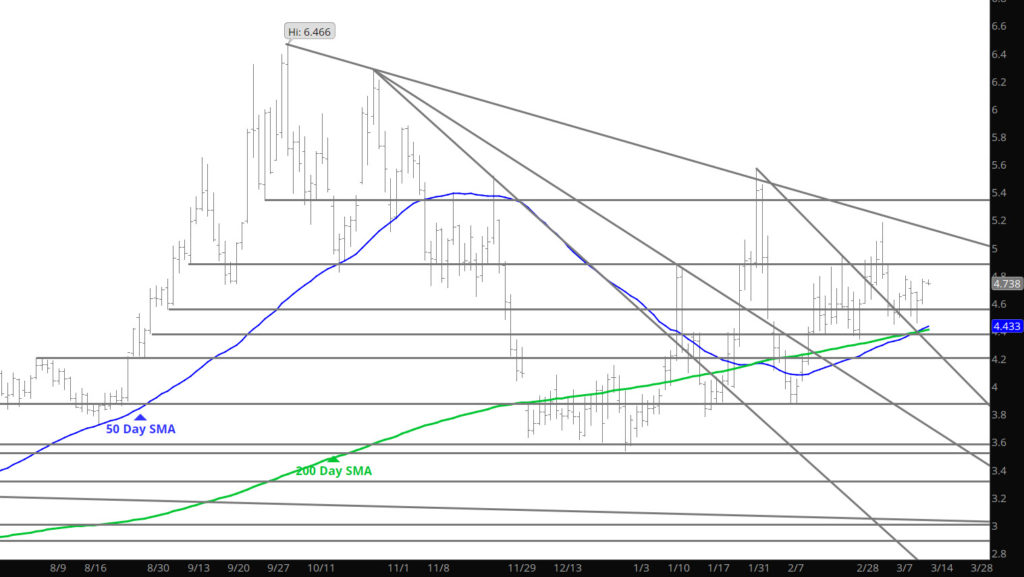

Rejection At $5.00 — So Far

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

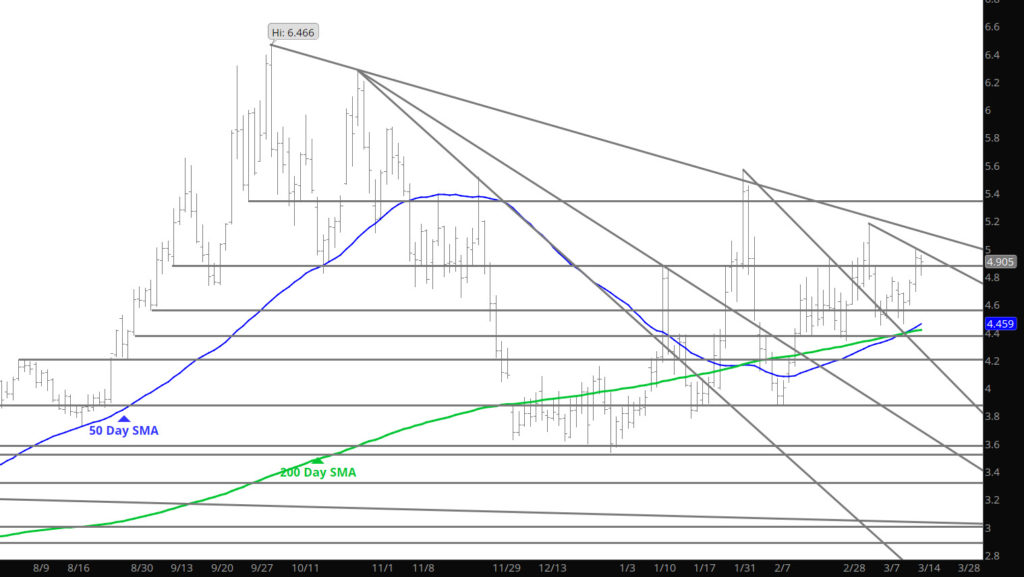

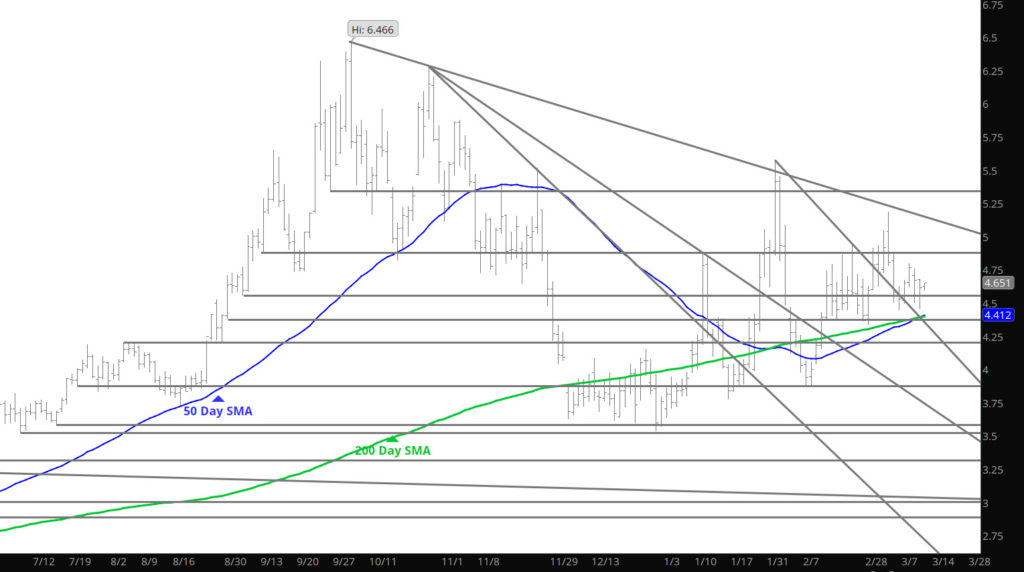

Is It a Higher Weekly High

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

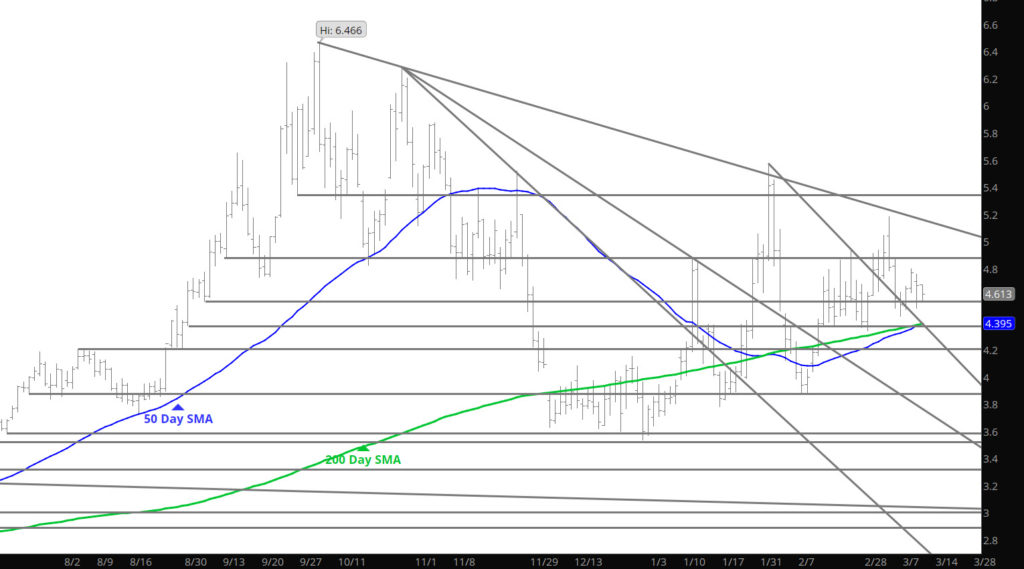

Bounce to High End of Mini-Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Near Term Support Tested

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Work Recent Mini-Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Change of Pace

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Declines Ran Out of Steam

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.