Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

A Second Test

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation Commences

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Behavior and Technical Data Support Additional Gains

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

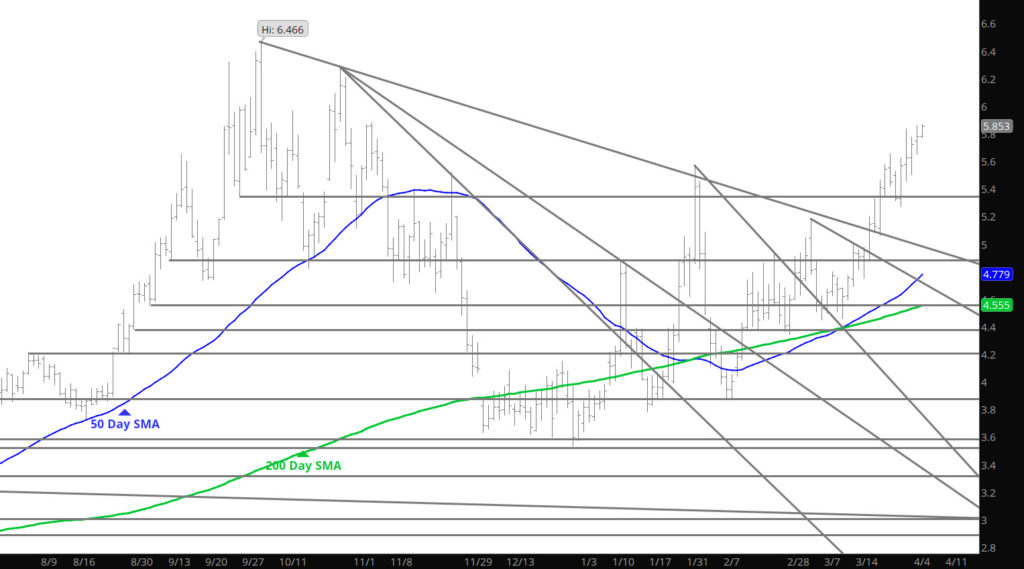

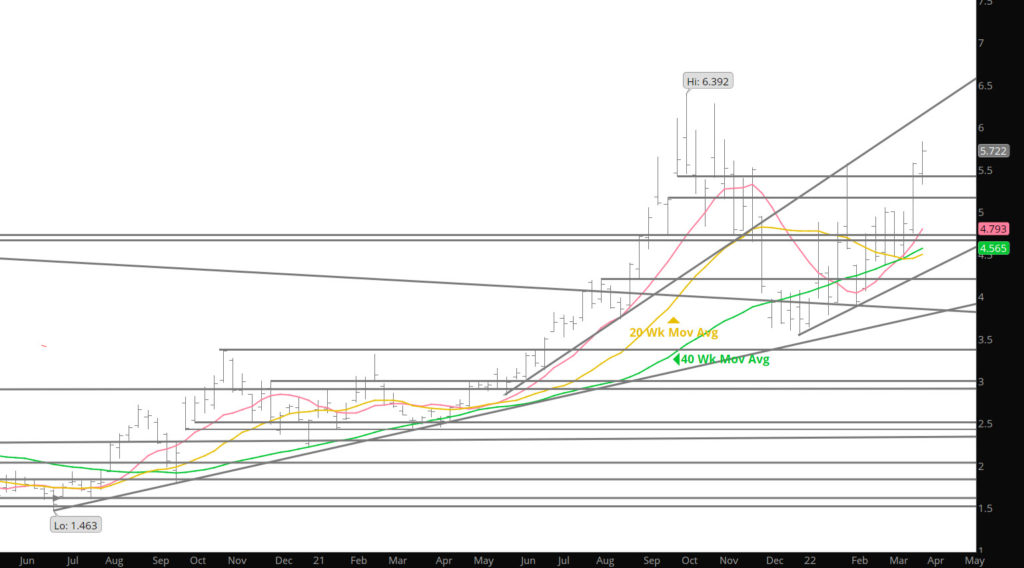

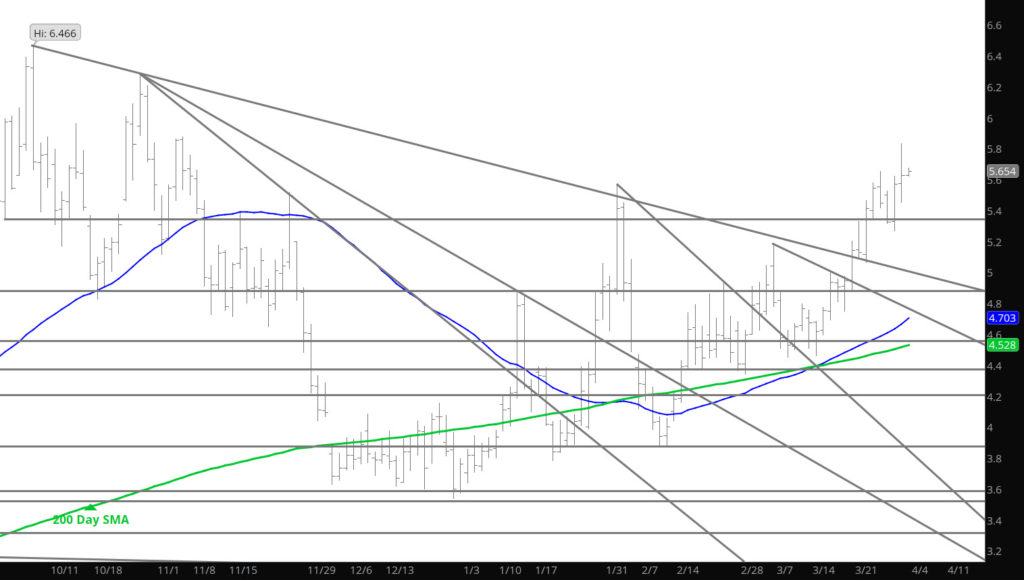

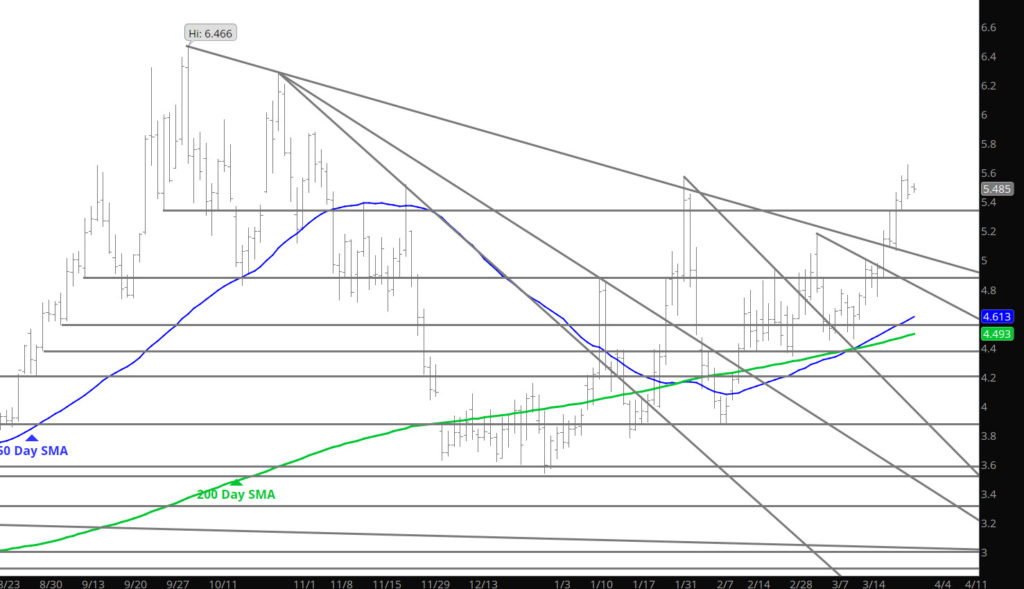

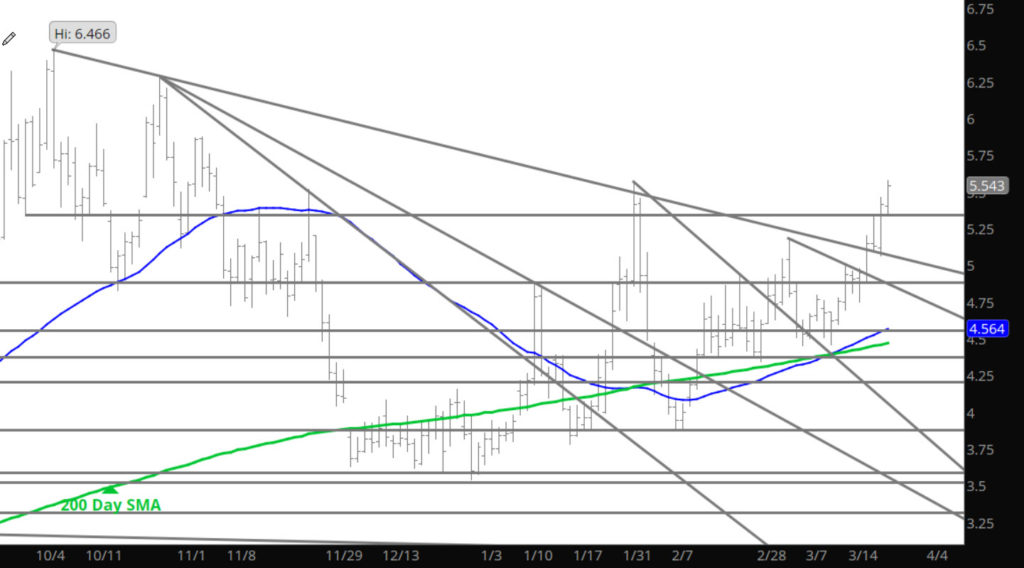

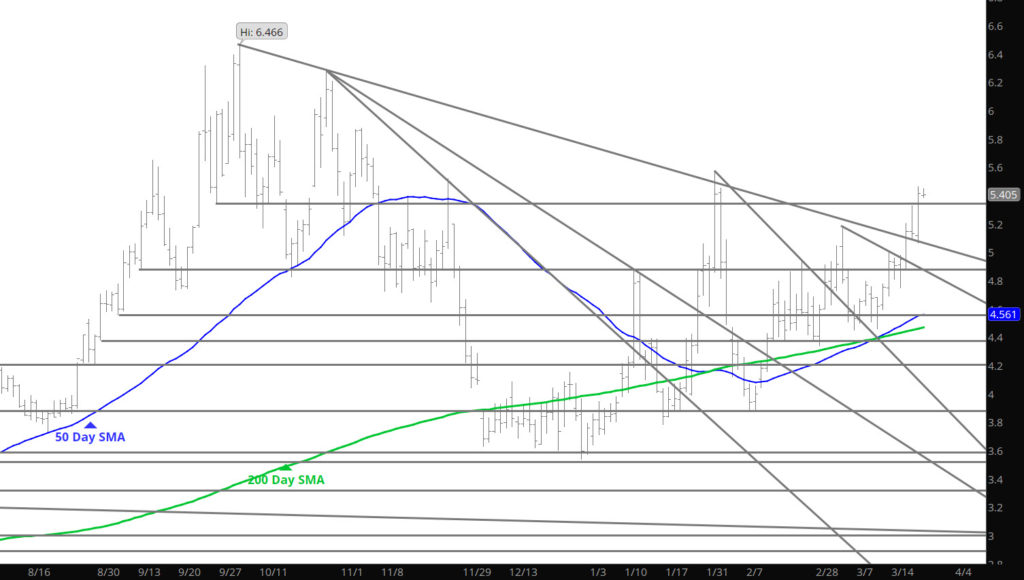

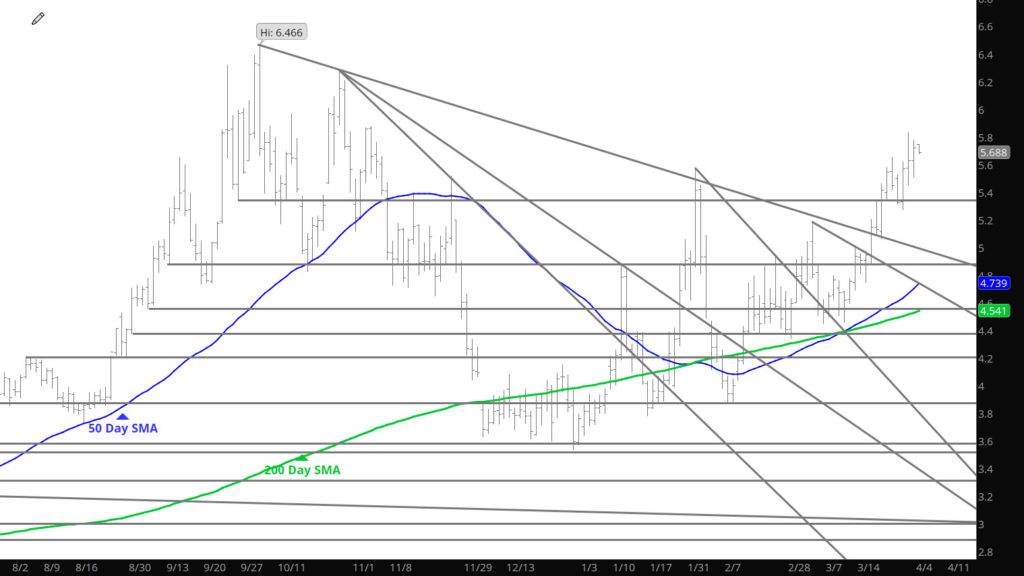

Additional Gains May Occur But Running into Serious Resistance Areas

For a Sunday night, price action was subdued. Wrote about the tendencies of intra-month movements recently in the Weekly section and would advise a read. Daily movement may support some additional gains but they are likely to be shallow versus last months gains on various days. This are between $5.70 and $6.00 needs some probing by the bulls, while any decline back below $5.40 will find buyers. April may turn into a range bound month as the market further defines summer injections and the impact from the war.

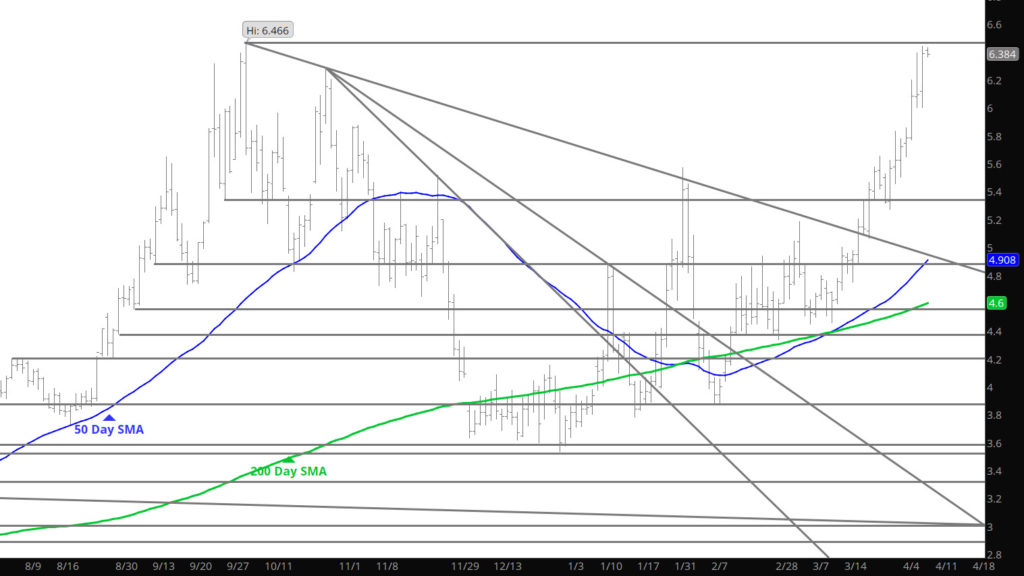

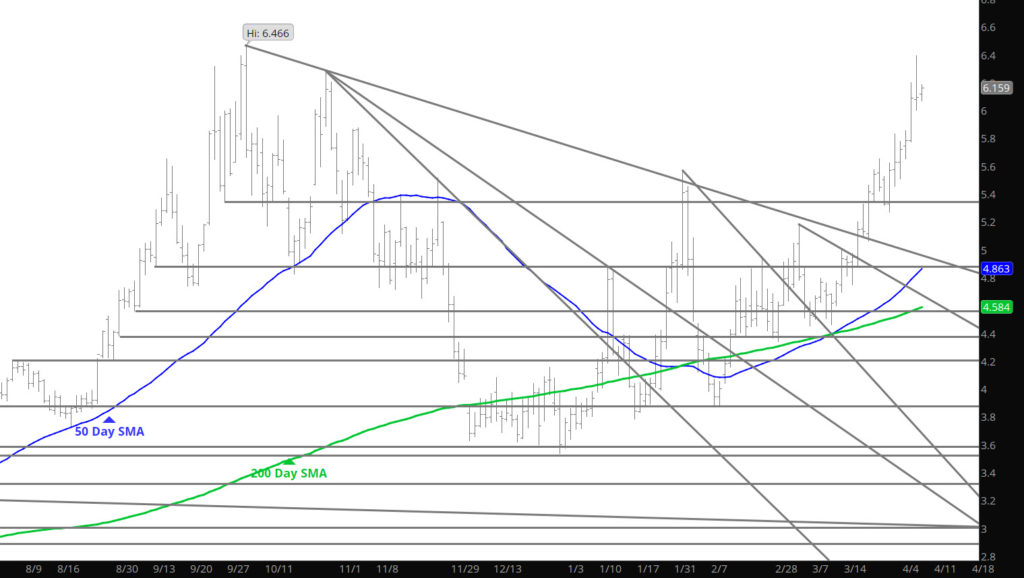

Major Support:$5.27-$5.199, $5.001, $4.40-$4.26, $4.187, $3.972, $3.734, $3.63, $3.584-$3.522

Minor Support: $5.063, $5.04, $4.88, $4.60-$4.557

Major Resistance: $5.65, $5.83, $5.97, $6.24

Rally Continues But Shows Weakness At the Close

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Declining Expiration Met With Buying

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

After Last Week– Does The Rally Resume

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

What a Trend

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

13th Consecutive Rally into Monthly Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.