Category: Daily Call

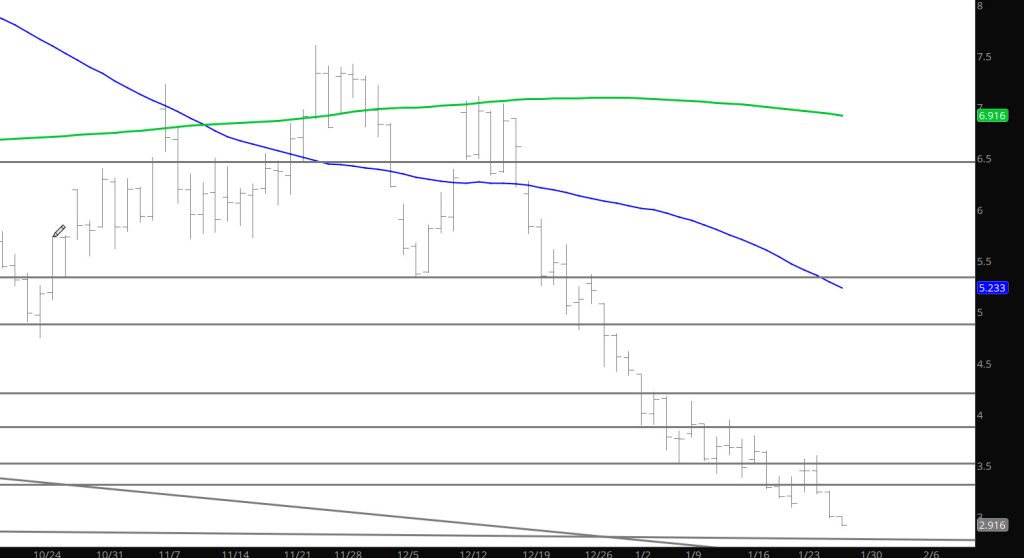

Over-sold Reaching History

Discuss some of the historic aspects of the declines since last fall in the Weekly section. Not going into here as well– just here to say — not sure from where but there will be a short covering rally coming up that will challenge the over-bought correction experiences from last summer and last fall. Careful through here.

Major Support: $2.533, $2.422, $2.238

Minor Support:

Major Resistance$3.536, 3.595, $3.63, $3.789, $4.128, $4.22-$4.39, $4.75-$4.825, $4.948

Headed to $1.00

Don’t Listen To Technical Issues — Keep Selling

A Quiet Day

What a quiet day for natural gas yesterday, guess the bears ran into some issues is sending prices down further. Not much to say about the technical side from yesterday.

Major Support: $2.761, 2.68, $2.533, $2.422, $2.238

Minor Support:

Major Resistance$3.536, 3.595, $3.63, $3.789, $4.128, $4.22-$4.39, $4.75-$4.825, $4.948

Rally During Expiration

Feb Contract Going Into Free Fall

Prices just continue to press lower — which is great for some — for me I cleared my shorts on the failure of the rally on Monday. Left a few chips on the table — but I sleep well. Got no clue where this is going to decline down to but, as mentioned yesterday, lots of folks are on one side of this boat and I am not one of them. Will be out of internet service tomorrow so there will be no Daily for Friday.

Major Support: $3.18-$3.09, $3.00

Minor Support:

Major Resistance$3.536 –$3.63, $3.789, $4.22-$4.39, $4.75-$4.825, $4.948, $5.056