Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

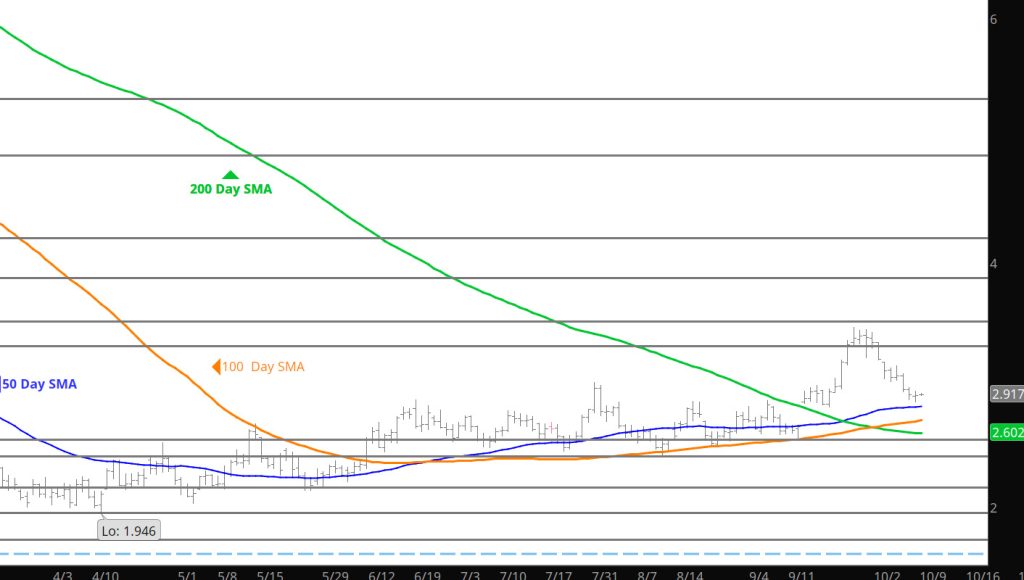

Has the Low Side of Dec’s Range Been Defined?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

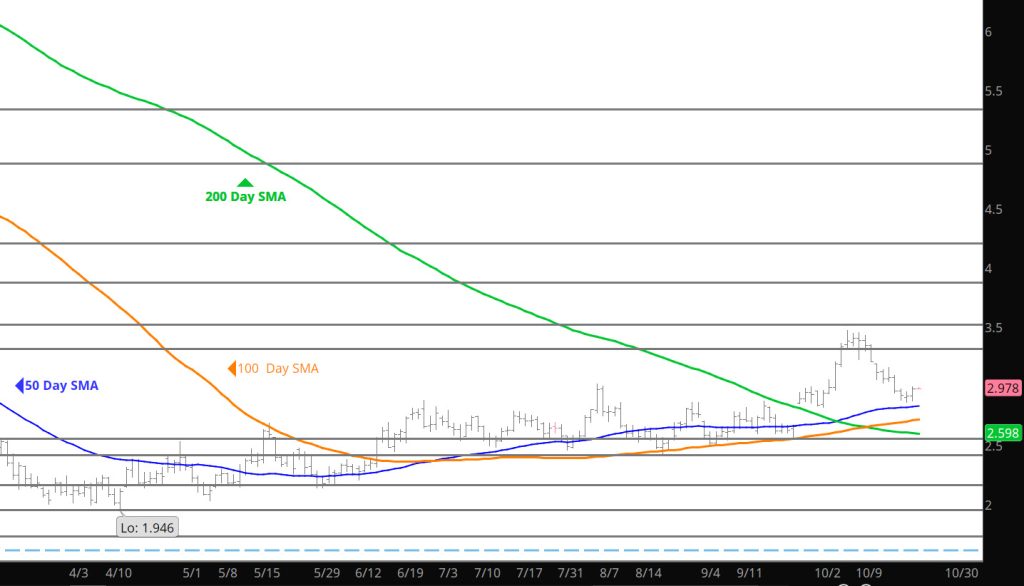

Expected Declines

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

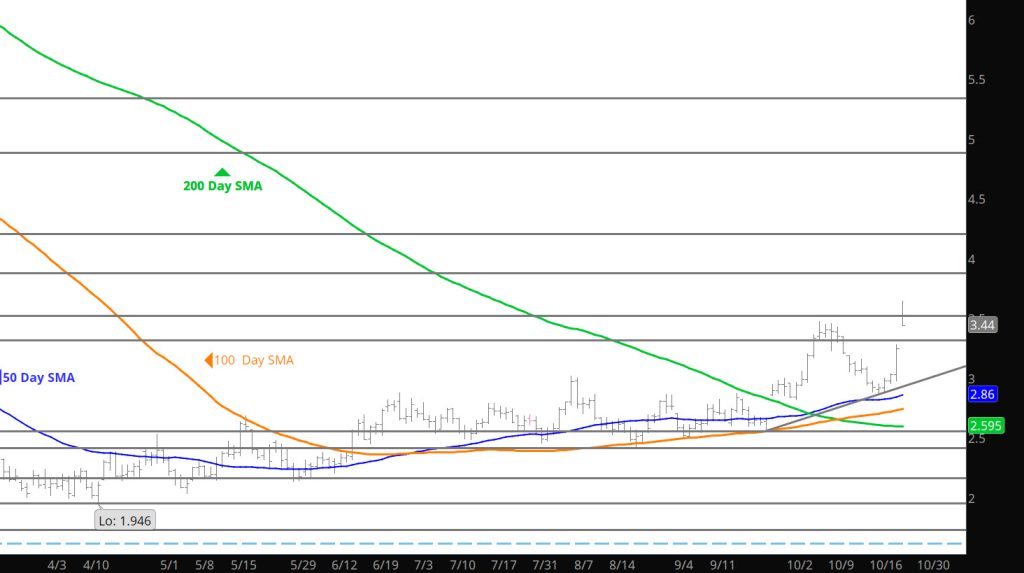

Dec Takes Over As Prompt

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Storage Report Provides Volatility

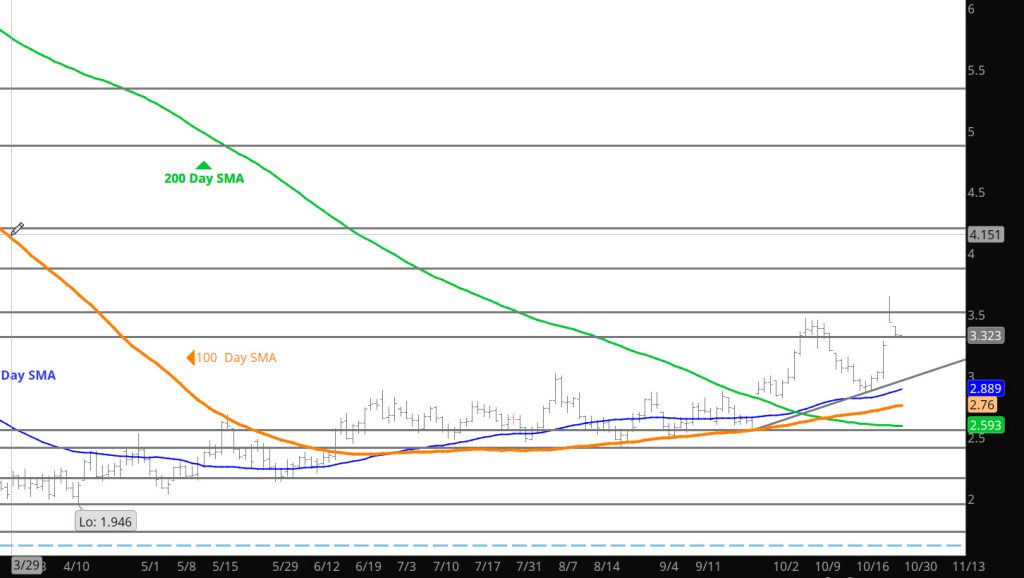

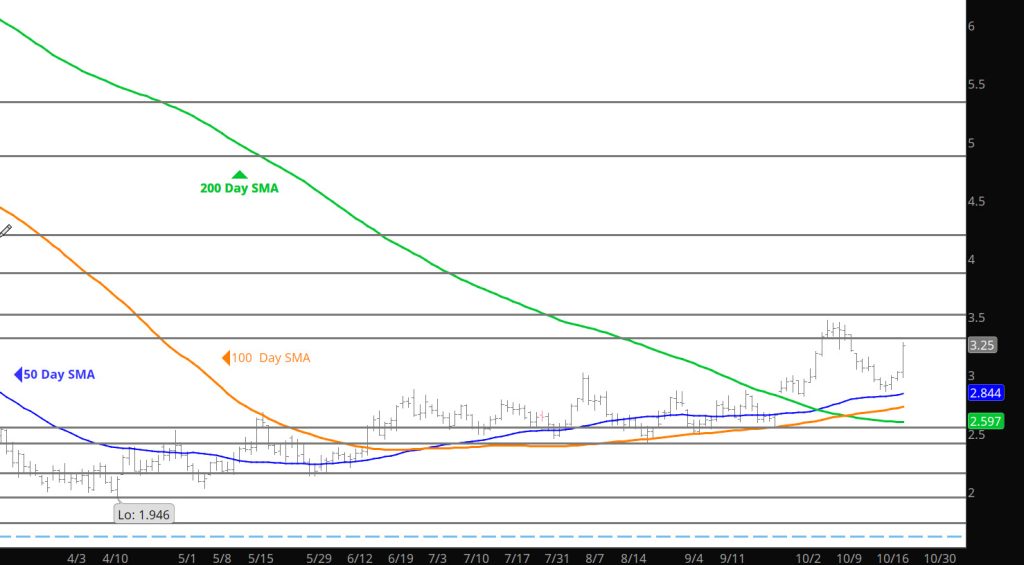

Daily Continuous

I suggested earlier in the week that the range trade issue might need the storage report to provide bias. What was surprising, was the bearish report providing the reason for a bullish run? Not sure what that is all about but if you are waiting to buy — be cautious as the Dec contract did not rally equal to the Nov run and the difference between Dec and Nov declined to a low of $.25 (the lowest of the year) suggesting that the move in Nov is not an indication of upcoming winter prices. That will get further definition as the Dec takes over as prompt.

Major Support: $2.82-$2.78, $2.74, $2.608, $2.47, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $2.84, $2.38-$2.26, $2.17

Major Resistance $3.185, $3.42-$3.48, $3.536, 3.59

Just Can’t Muster the Commitment

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation At Low End of Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Starting To Evaluate Length

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Break Out Support Zone Breached

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Shrinking Range Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.