Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Declines Start Consolidation

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

My Apologies No New Brilliance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

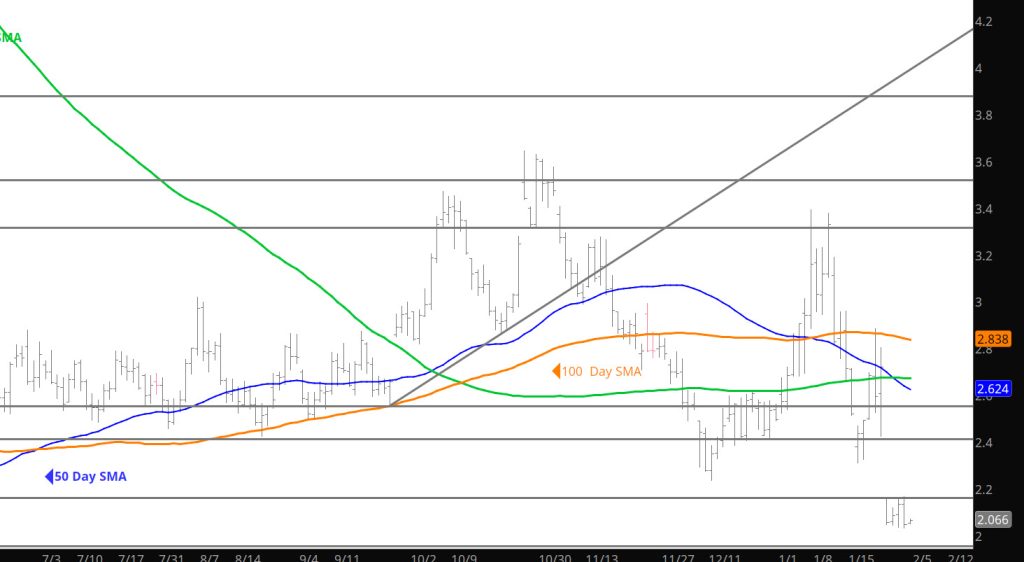

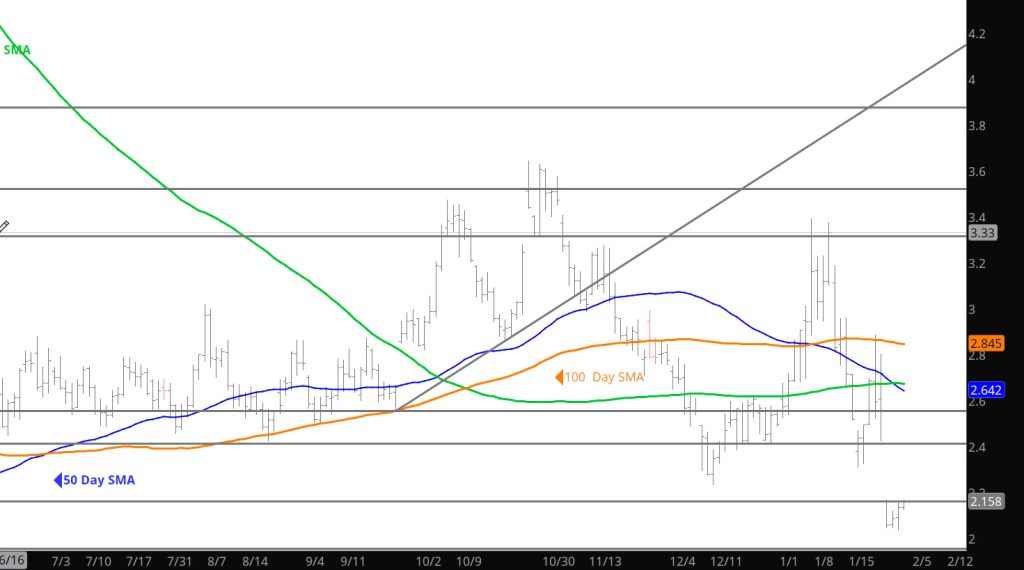

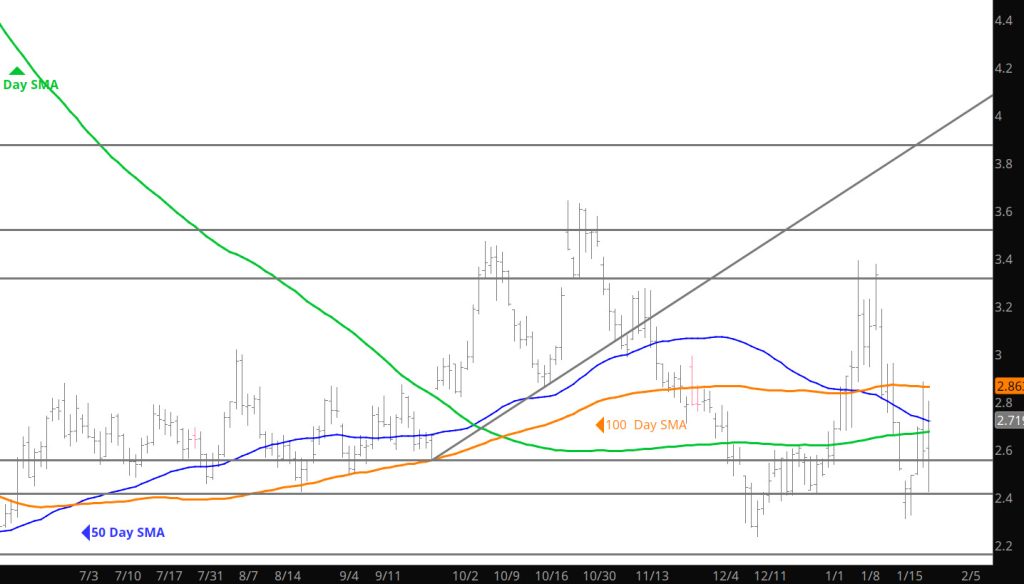

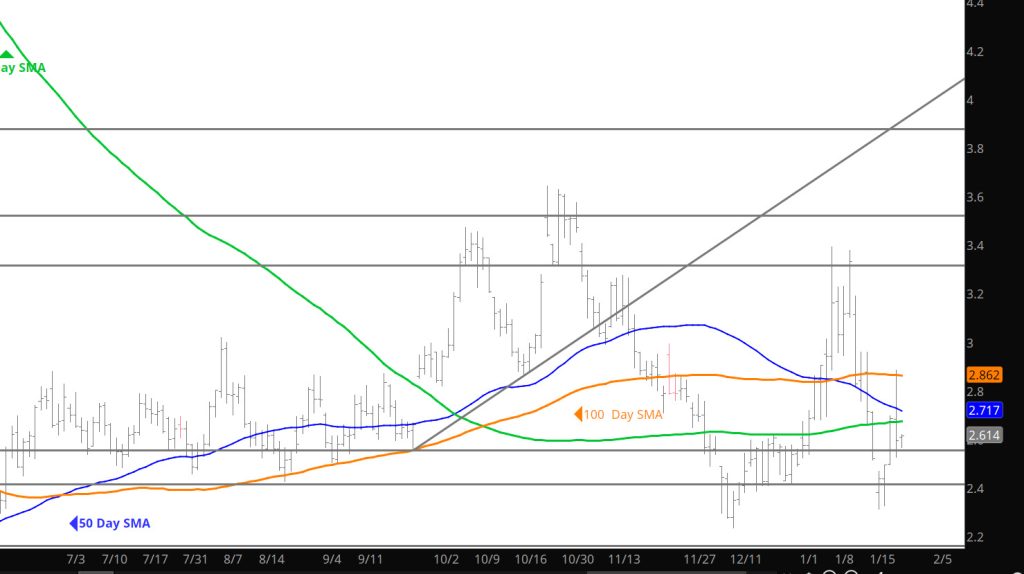

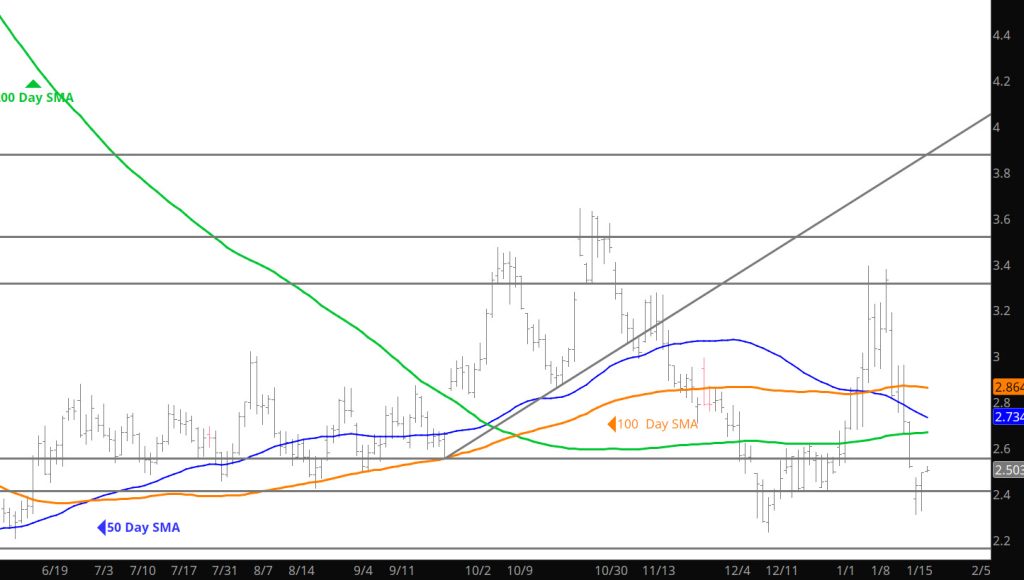

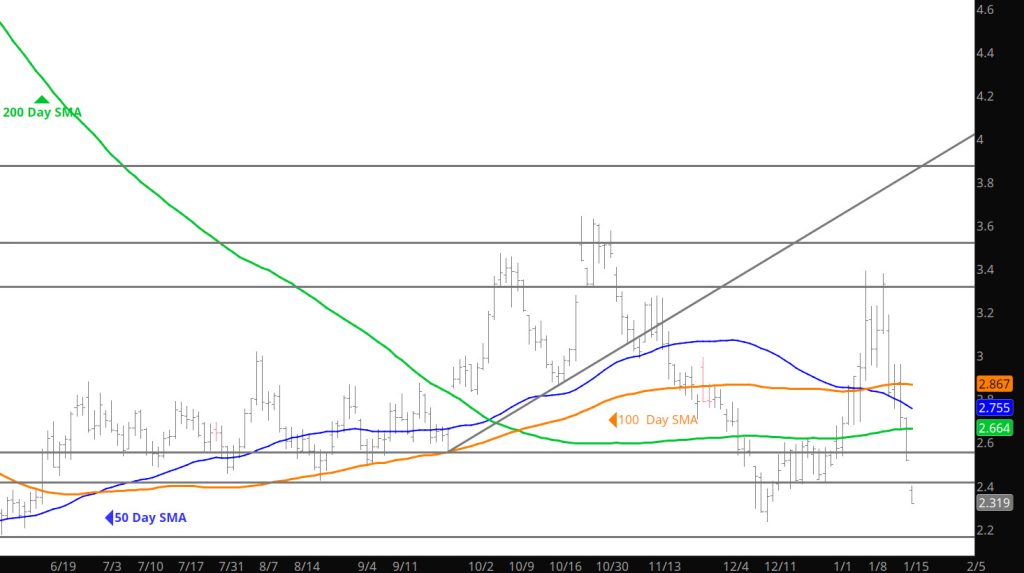

Seems to Test 2023 Support

Daily Continuous

Understand the large gap from last Friday to yesterday was inclusive of the discount that March maintains to the Feb expiration– So all I can theorize is this bear market wants to test the numerous support zones mention in the Weekly area and then see what happens. Good luck picking your low.

Major Support:, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support :

Major Resistance $2.45, $2.56, $2.64, $3.00, $3.16, $3.48, $3.536, 3.59, $3.65

What To Do?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Gap Closed During Consolidation

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

As Thought

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Gap Lower — Too Aggressive

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Look Out Below

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.