Category: Daily Call

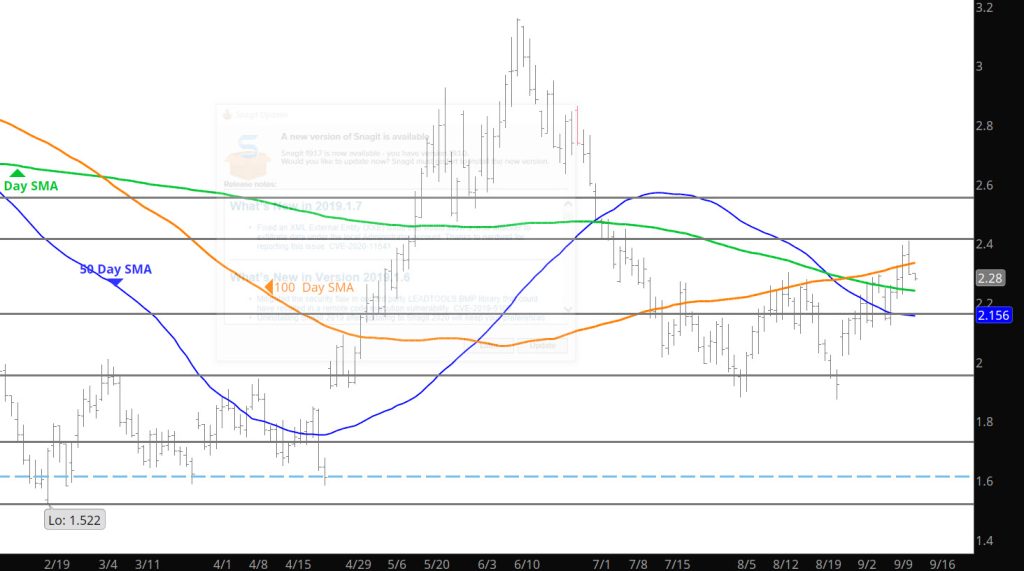

Struggles

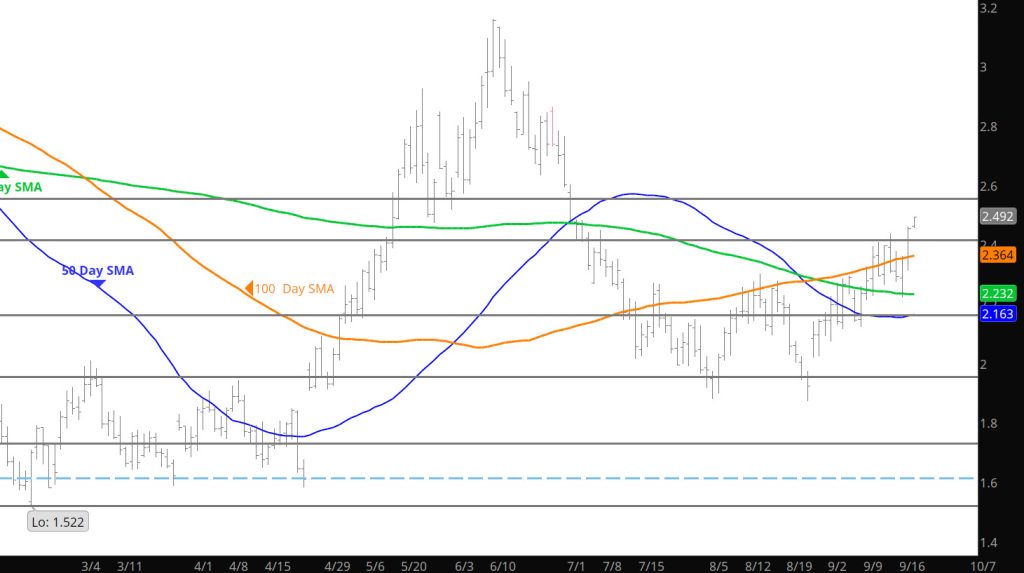

Breaking Resistance Takes Commitment

Daily Continuous

It seems that there just is not the commitment to send prices above the resistance yet. On the other side of trade, the lack of pounding prices lower is also a significant missing ingredient. Here we sit in a range trade game.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $1.856,$1.89-$1.856

Major Resistance:$2.18, $2.25-$2.310, $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16

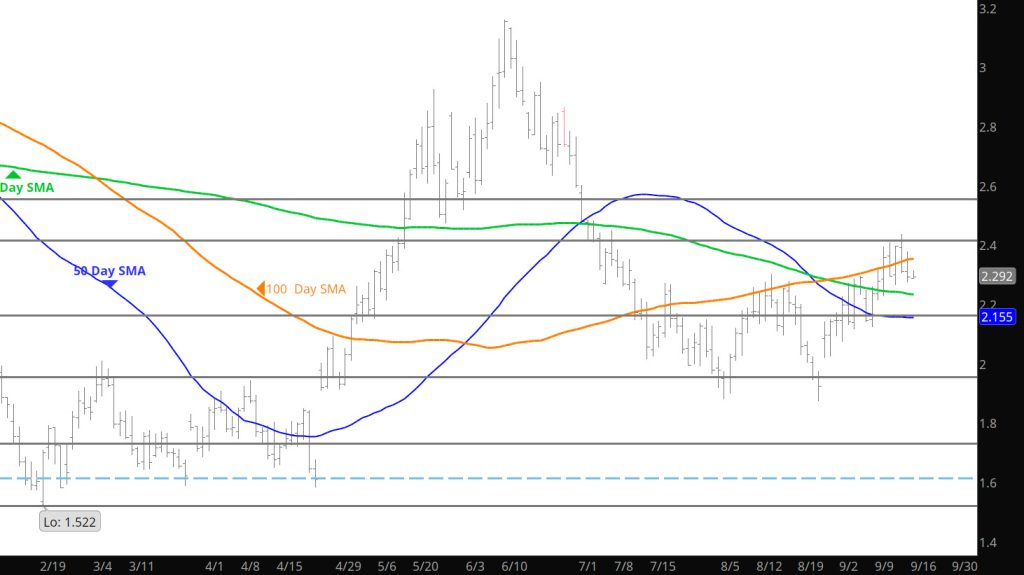

Daily Close At the Highs

Day By Day Verdict For Futures

Daily Continuous

Last week showed some resilience as a higher high and higher lows printed. Go into some of the technical analysis in the Weekly area but suffice to say higher highs and higher lows are supportive to a positive trend movement. The next week or so will provide more information to digest. This can be indicative of a trend bias change –stay tuned.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $1.856,$1.89-$1.856

Major Resistance:$2.18, $2.25-$2.310, $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16

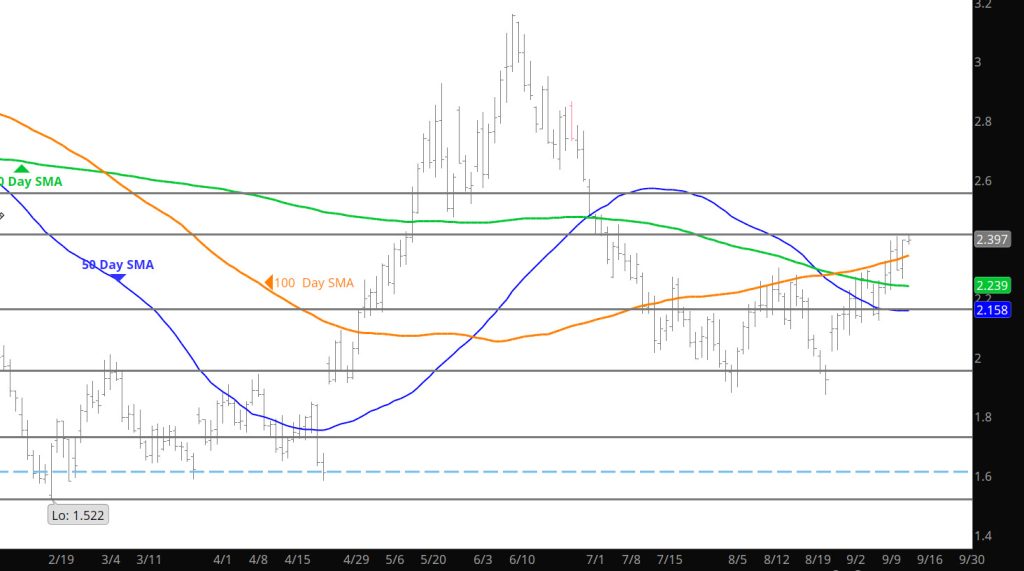

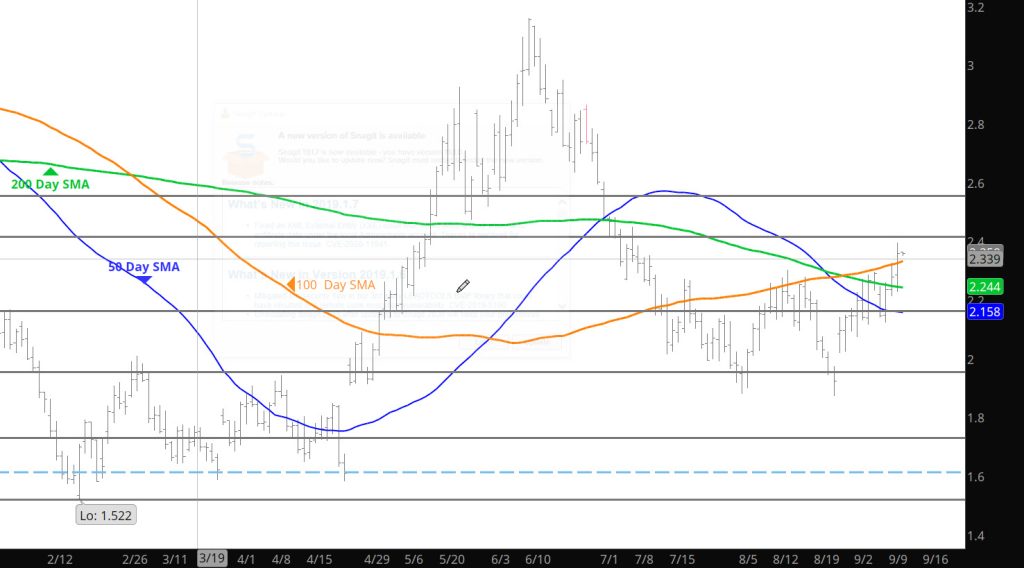

A Break Above Resistance

Daily Continuous

Didn’t see that coming this week- spoke about the YoYo in the market behavior but the string was snapped and price closed above the intermediate term resistance. Looking at the chart above, notice there was a similar breakout in both July and August only to give the gains immediately. Is this one different — tomorrow and Monday trade will define. Would not load up long quite yet but as the Weekly suggested the bias may be changing.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $2.18, $2.26, $1.89-$1.856

Major Resistance:$2.310, $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16

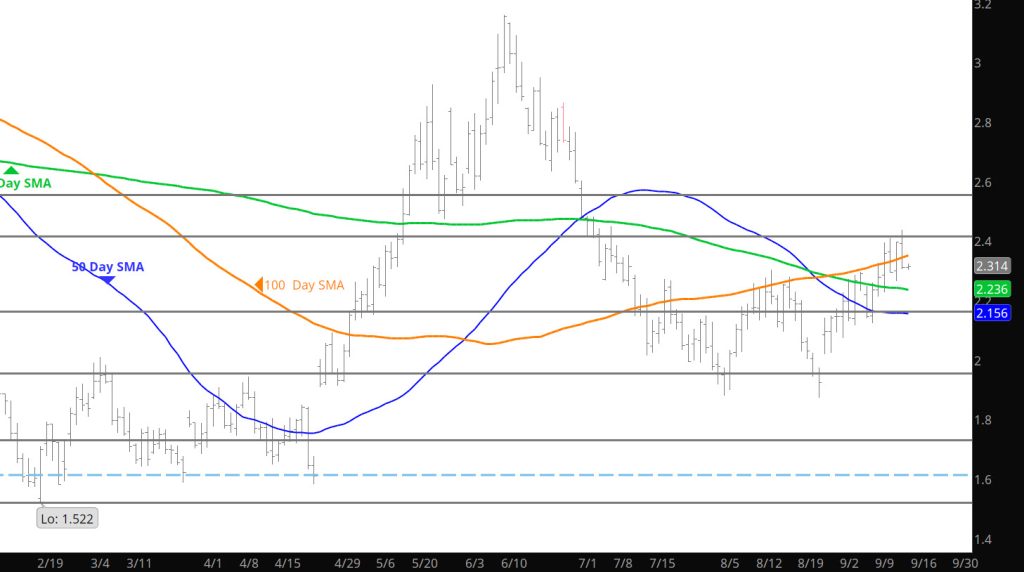

YO YO

Daily Continuous

Watching this market is like playing with a YO-YO up and down limited to the length of the string– in this case it is the price range. Up to the resistance fail then down to the support. Not much to look for until the storage report.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $1.856,$1.89-$1.856

Major Resistance:$2.18, $2.25-$2.310, $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16

The Middle

Daily Continuous

As suggested prices declined to the middle of the range yesterday– kinda boring unless you selling premium with puts to the downside. Only other way to trade this market is picking support or resistance for a dime gain.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $1.856,$1.89-$1.856

Major Resistance:$2.18, $2.25-$2.310, $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16

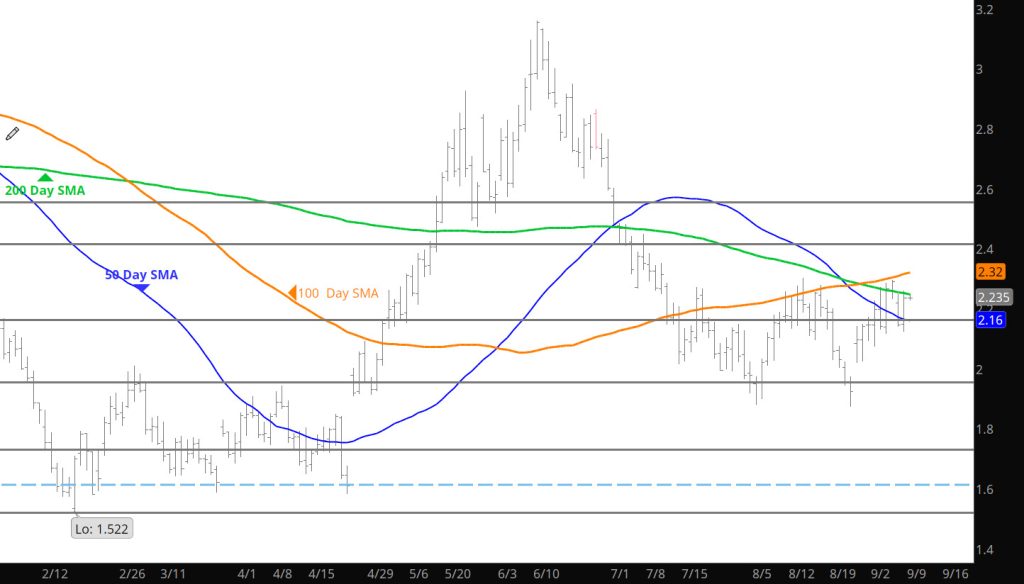

Would Suggest Continue Trading Range

Daily Continuous

Go into the changes starting to develop in the market in the Weekly but for the Daily trade I would suggest to continue trading the range that has developed in the October chart and the Continuous. The range was expanded slightly on the high side last week but continues to hold on declines.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $1.856,$1.89-$1.856

Major Resistance:$2.18, $2.25-$2.310, $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16

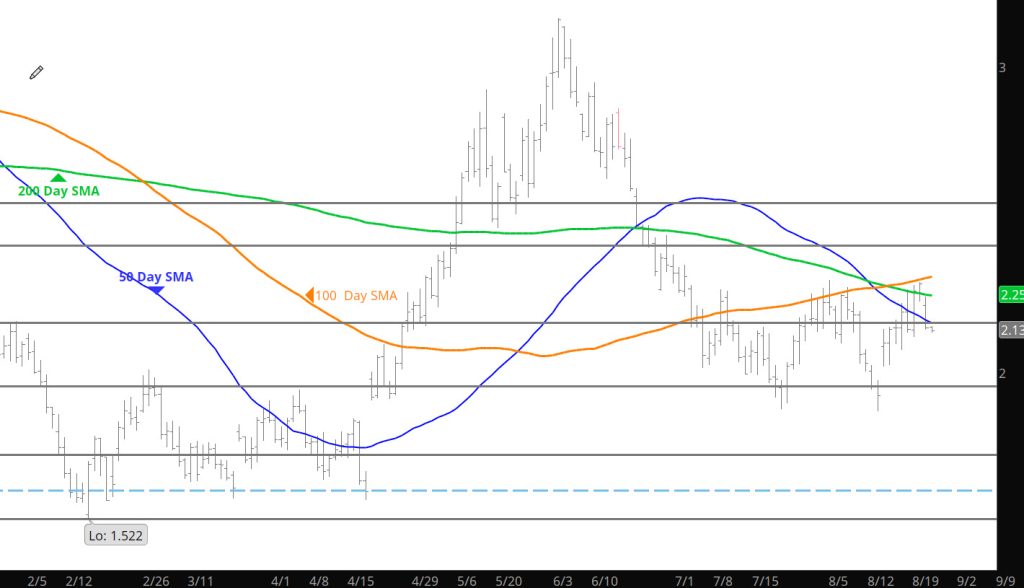

Hmm– Its Early But a Shift May Be Coming

Weekly Continuous

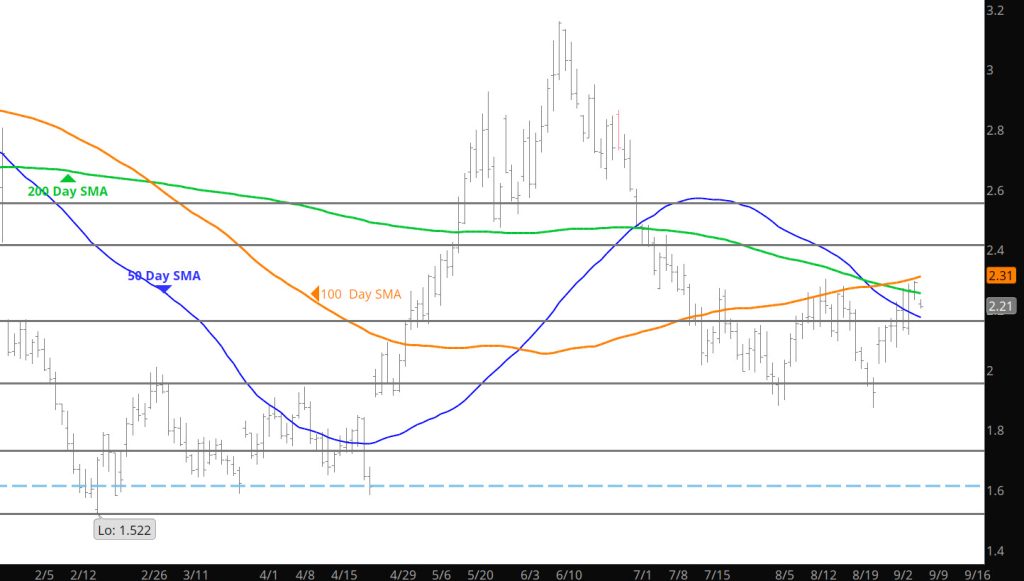

Twice during the holiday shortened week expected post – Labor Day seasonal pressure appeared to begin to weigh on the prompt, both times (Tuesday and Thursday) October traded an “outside” day reversal higher with increasing volume. This suggests that weakness was being aggressively bought. Before the end of the trading week October was testing the calendar August high ($2.301). That high along with a late July high ($2.270) defined the upper boundary of a daily trading range that has confined successive prompts since mid – July and testing its own 50 – day SMA (currently $2.298 and falling). The close was $.148 above October’s pre – holiday close and less that $.02 below the week’s high the highest weekly close since 07/12 (the fifth of eight down weeks following the June Q2).

As previously discussed, prompt gas has traditionally felt seasonal pressure following the holiday but there is no special magic about the next few days after Labor Day. While sellers are usually in control, price strength has occasionally suggested that the late summer price negative seasonal tendency has already been satisfied.

With that said, while they are not all that common there have been a few years when prompt gas rallied through Labor Day only to trade a mid – month high and then forfeit those “counter seasonal” gains. ’19 and ’21 are the most recent examples. In the former prompt October rallied hard after trading through the August high…peaked at 2.700 on 9/17 then declined through expiration. In ’21 the rally high was on 09/15 at 5.650. Over the next five days the prompt gave up nearly a dollar before finding support.

Mentioned for the last few weeks three challenges for the gas market have been discussed. One of those challenges is unique to the downtrend from the January high and the construction of both the Q1/Q2 and Q3 trading ranges; the other two are long – term historically consistent seasonal’s. Two of the three have been satisfied with the average/above average declines from the Q2 high and then from a mid/late August high. The leaves only the tendency of expiring contracts to decline as their tenures as prompt near an end. As written here multiple times, failure of an expiring contract to be “amply offered” into expiration will be an indication that the character of the gas market is changing/has changed and will be a strong signal that higher prices are on the way. IF the traditional rally toward a Q4/Q1 high began with September’s expiration decline to test the July low, October will pass that test. Keep that thought in the back of your mind over the coming weeks.

The consensus of technical indicators improved a little last week and built on that improvement during the previous week. Support from improving market internals (volume and open interest), daily and weekly closes over several moving averages along with the daily closing momentum divergence mentioned last week (the daily RSI, a VERY sensitive “leading” indicator that never confirmed the July expiration lower low) left the consensus neutral for the first time since indicator deterioration began before the early June Q2 high .

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $1.856,$1.89-$1.856

Major Resistance:$2.18, $2.25-$2.310, $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16