Category: Daily Call

Good Effort But No Cigar

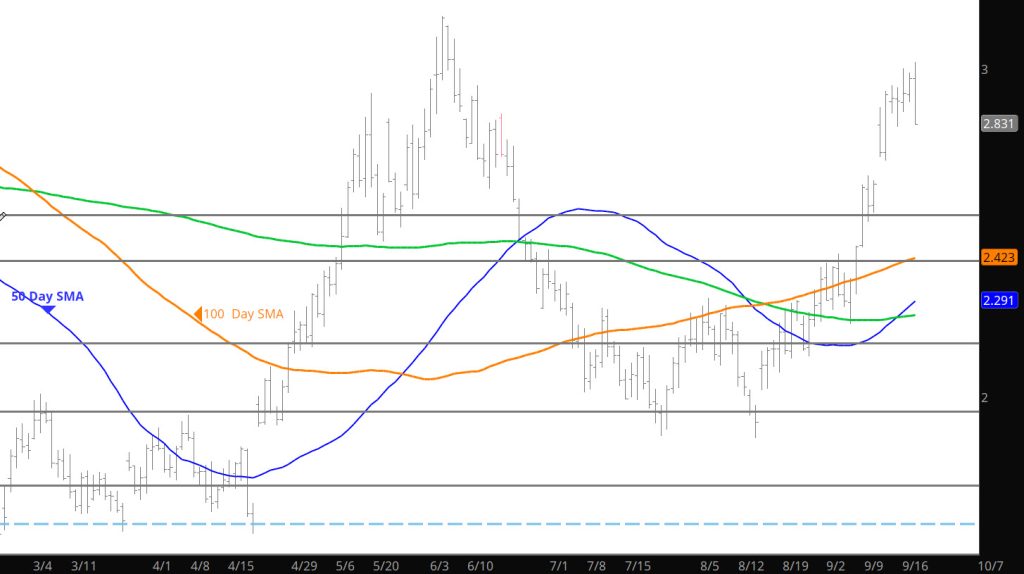

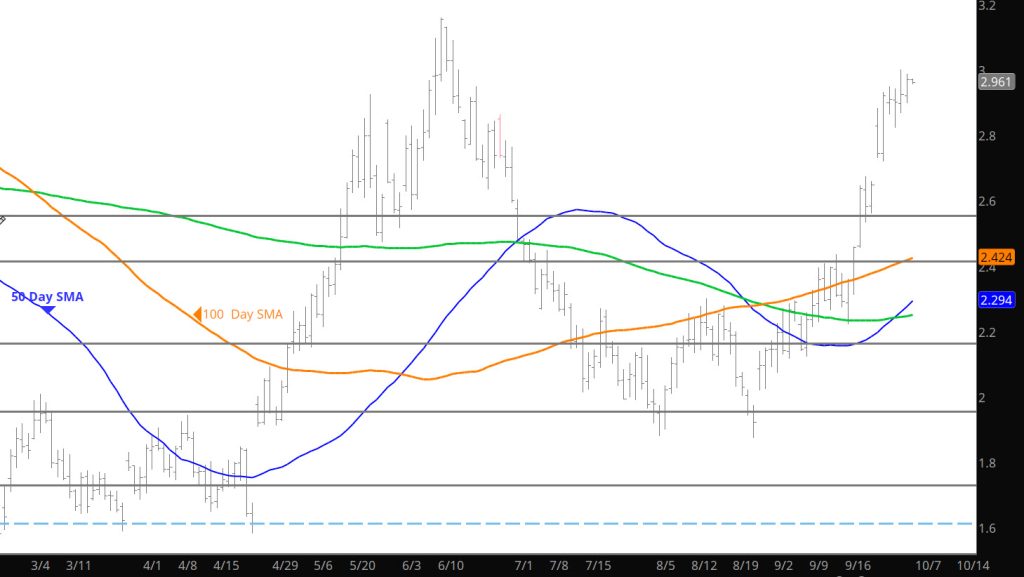

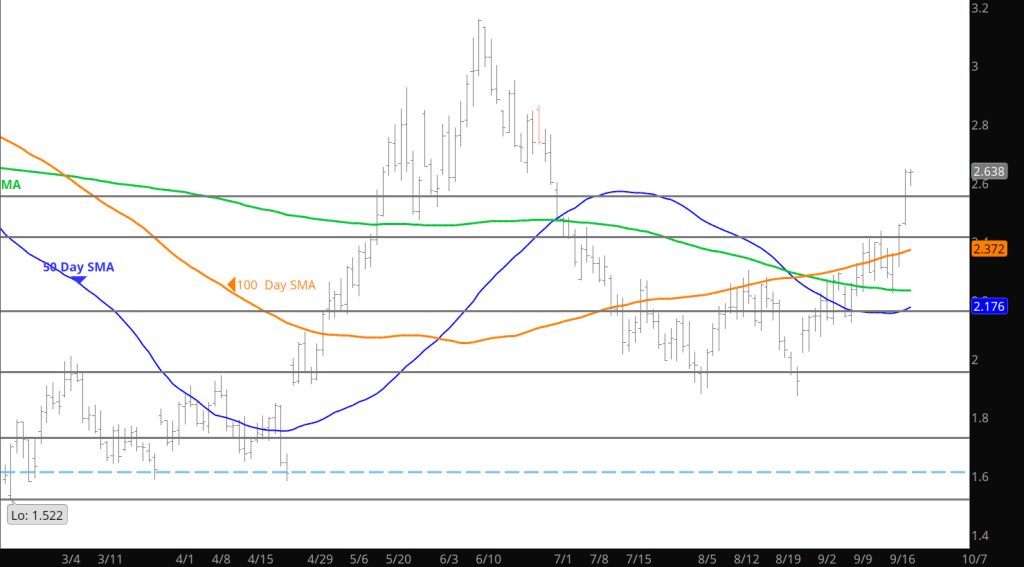

Daily Continuous

The bulls tried to set up for a break out above $3.00 only to fail after the data release. Not sure how the data was interpreted as bearish to kill the gains but that fundamental information is over my pay grade. The key from my perspective is the market did not “collapse” but rather held the recent range. Take that as additional confirmation that the bias has changed. Play the suggested ranges from earlier in the week.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $2.62, $2.507-$2.44, $1.856,$1.89-$1.856

Major Resistance: $3.00, $3.16

Solid Range Developing

Nothing Different

Tight Consolidation Day

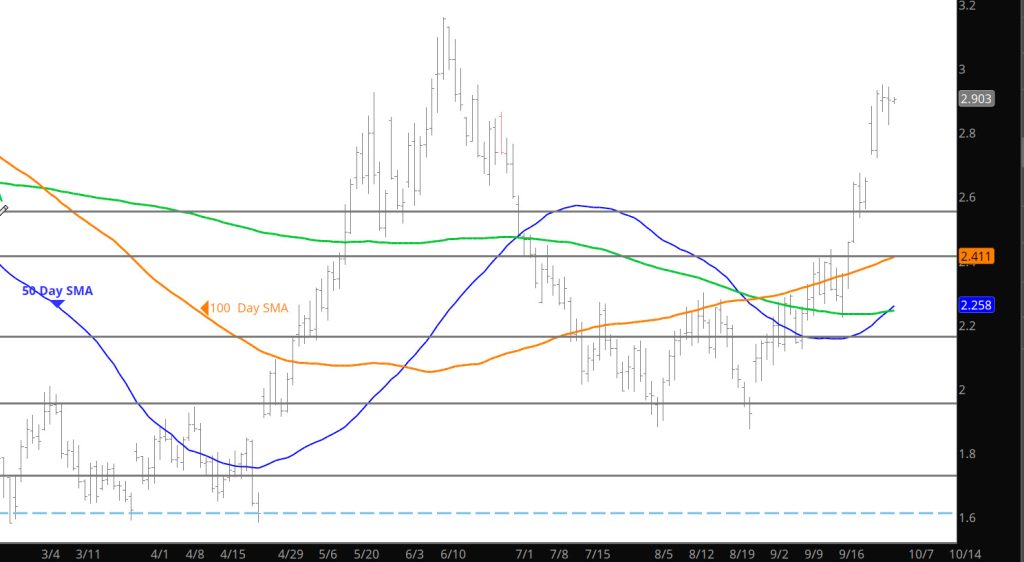

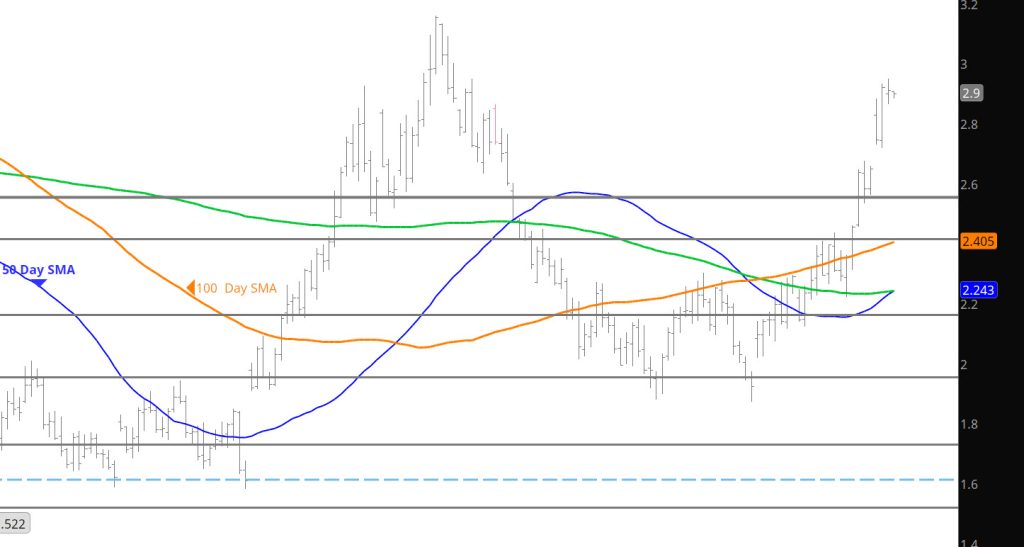

Daily Continuous

Trying to set a base for the next step higher (should it be the result) prices paused and “consolidated” the recent gains (from expiration or what ever) and now seem to be in a consolidation process. From here, would suggest buying dips on the declines and selling over the $3.10 zone.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $2.507-$2.44, $1.856,$1.89-$1.856

Major Resistance:$2.618, $3.00, $3.16

New Bias Needs to Create New Range

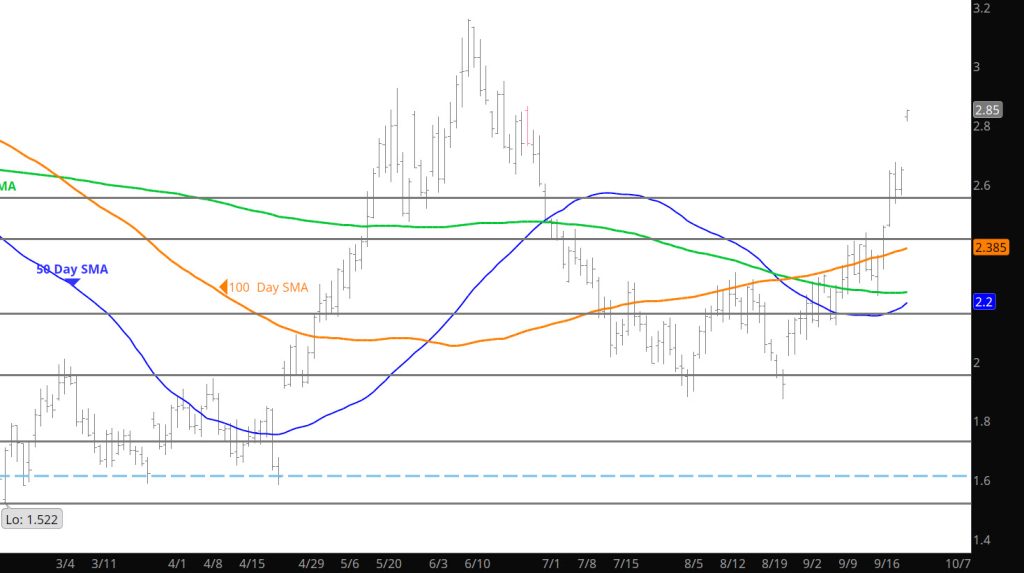

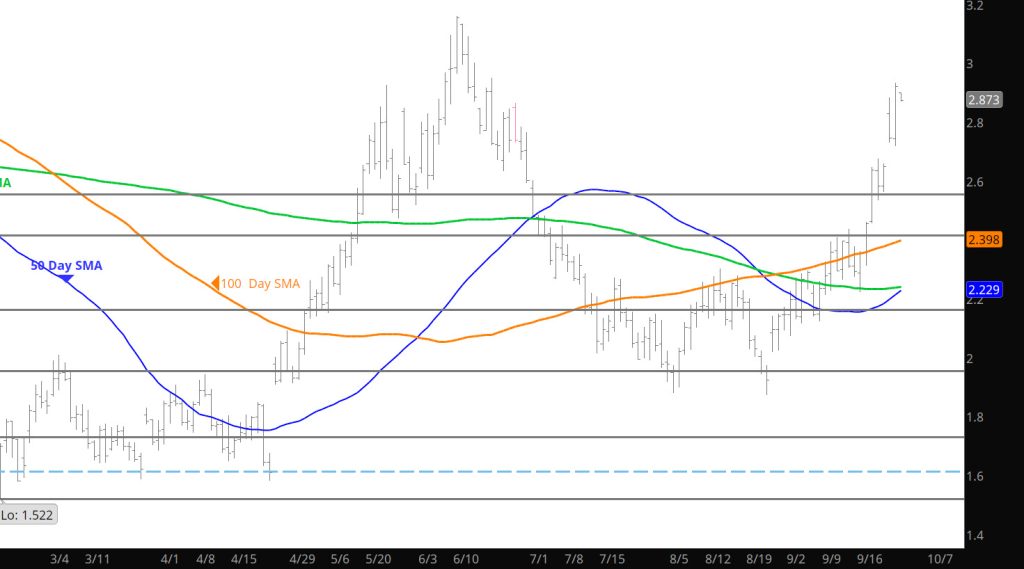

Daily Continuous

The market seems to be changing it’s bias after the expiration last week. Would treat this change with caution until there is solid confirmation of the next and new range.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support :$2.62, $2.507-$2.44, $1.856,$1.89-$1.856

Major Resistance:$3.00, $3.16

Jury Is Out

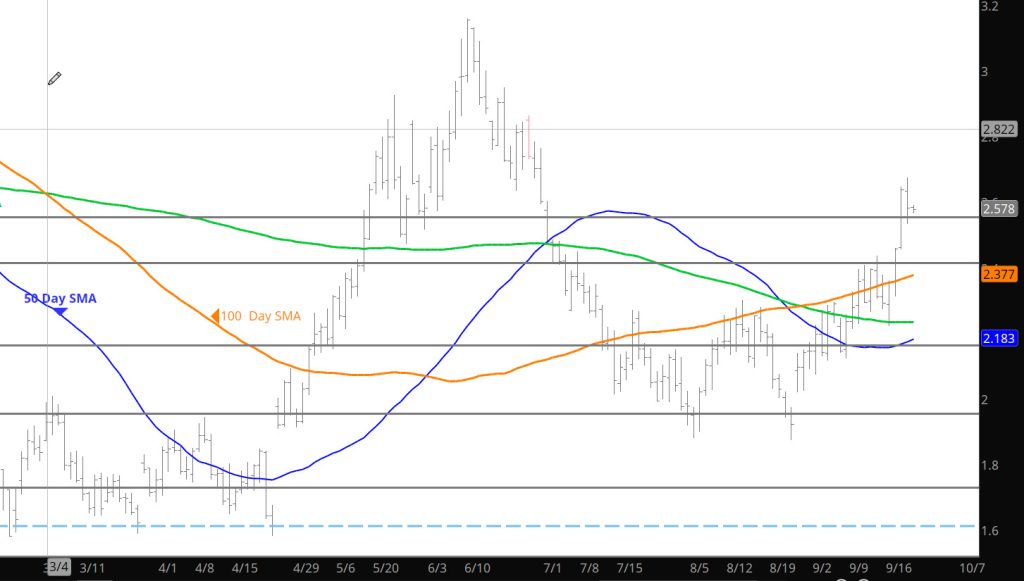

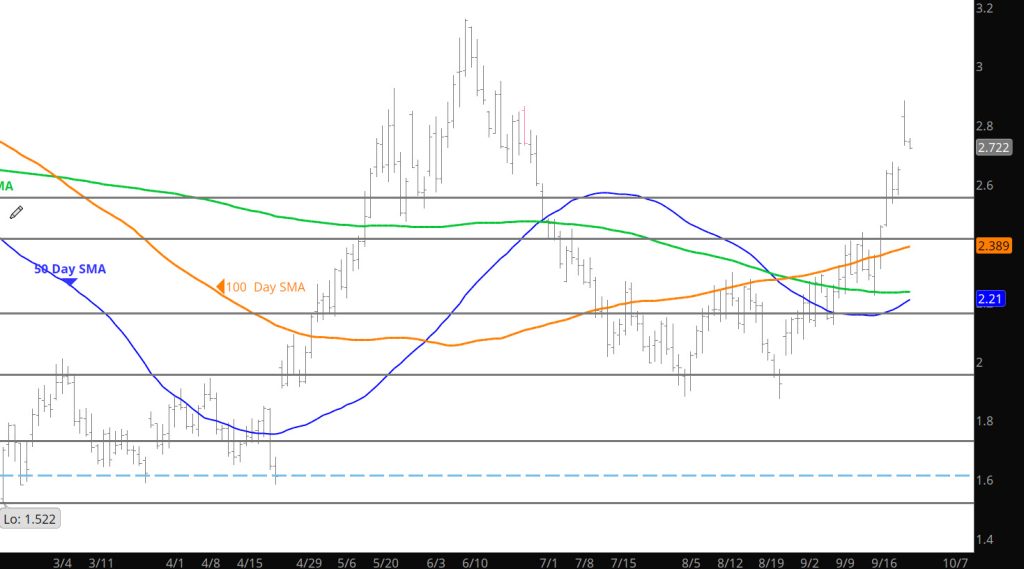

Daily Continuous

While prices were up and down during yesterday’s expiration, I am going to state that the expiration process was well supported, thereby breaking the trend of the previous expiration’s of 2024 which were all well offered during the process. What does this mean?—The bearish bias (all through this year) is starting to take some hits. The first target is the gap remaining from the premium awarded the Nov contract (even though some of that gap was closed during yesterday’s decline). This will be the first test of a confirmation of a bullish bias change.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $2.507-$2.44, $1.856,$1.89-$1.856

Major Resistance:$2.618, $3.00, $3.16

November Maintains $.20 Premium

Some Firming

Next Three Days Are Key

Daily Continuous

Mentioned in the Weekly section: … eight contract months that have gone to settlement so far in ’24 three have traded pre expiration highs on or after the 22nd. May fell hard during its last three days, August for five straight days the others had variations of weakness and timing, Once it became evident that expiring contracts were being “amply offered”…five of the eight have traded contract lows on the day they went to settlement. Have mentioned it before that, a change in that pattern would indicate a change in the character of the gas market. This week we will find out whether that change has occurred.

How do you say the rubber will be meeting the road this week. Be interesting to watch after the gains of yesterday.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $1.856,$1.89-$1.856

Major Resistance:$2.18, $2.25-$2.310, $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16