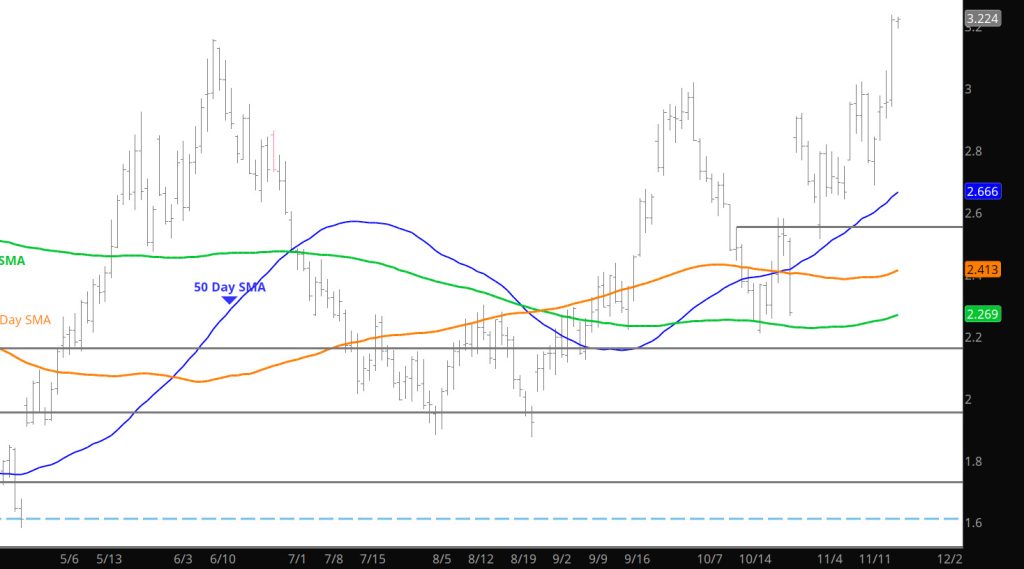

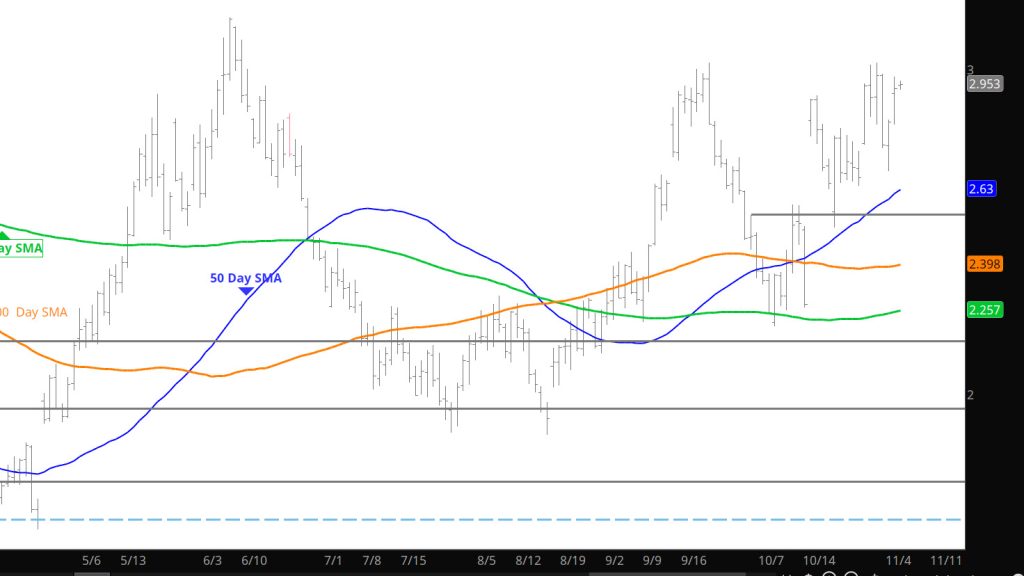

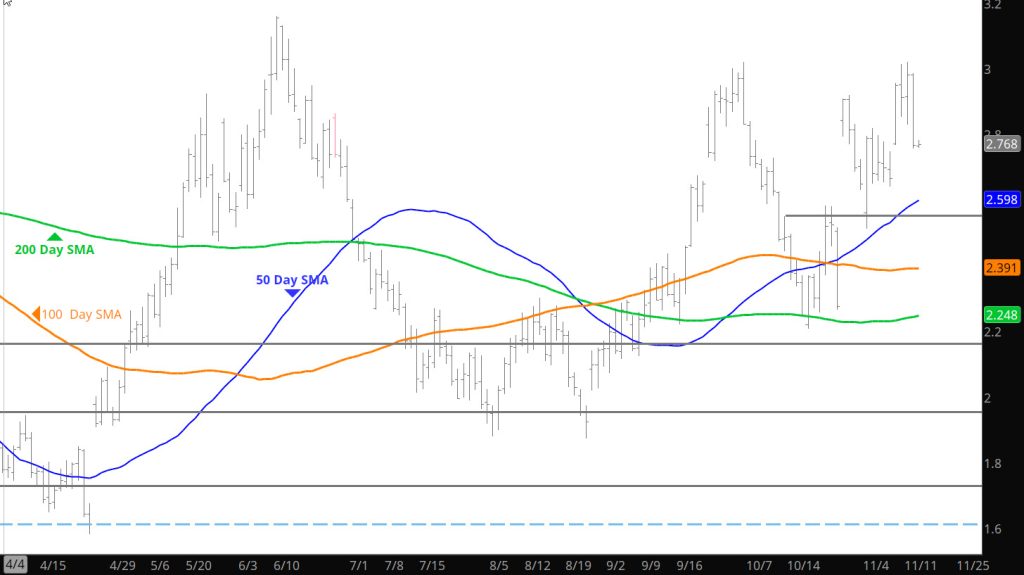

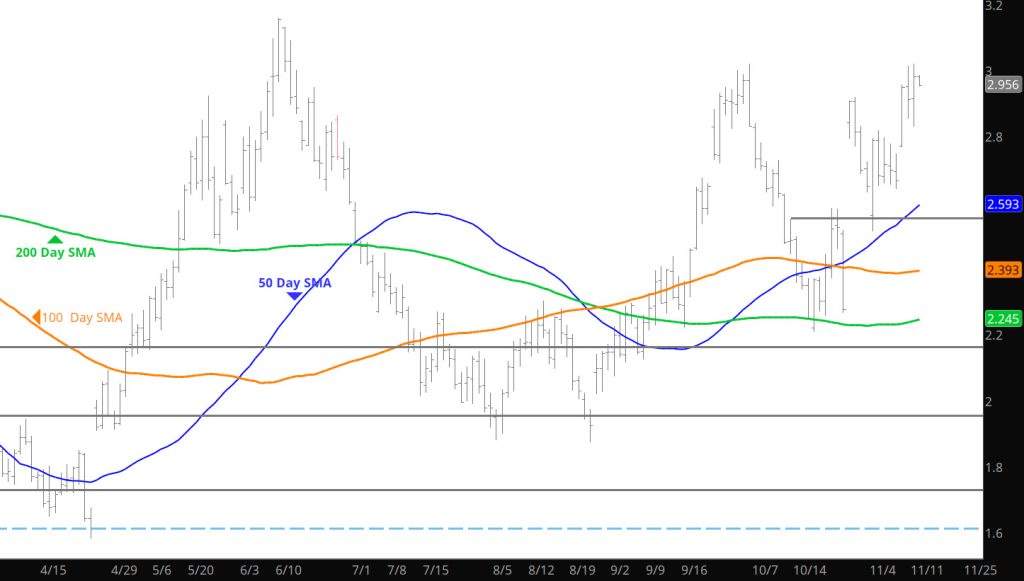

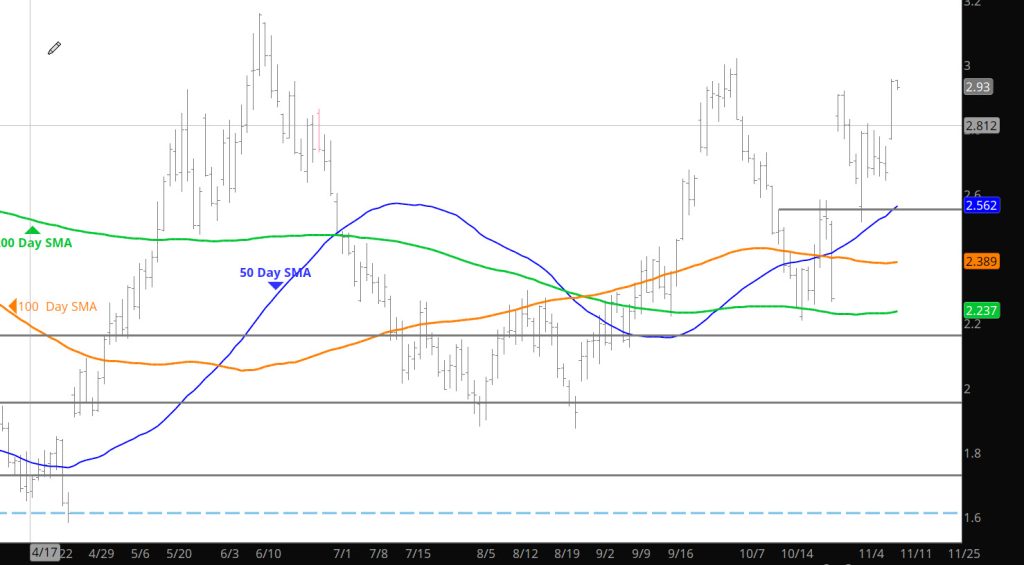

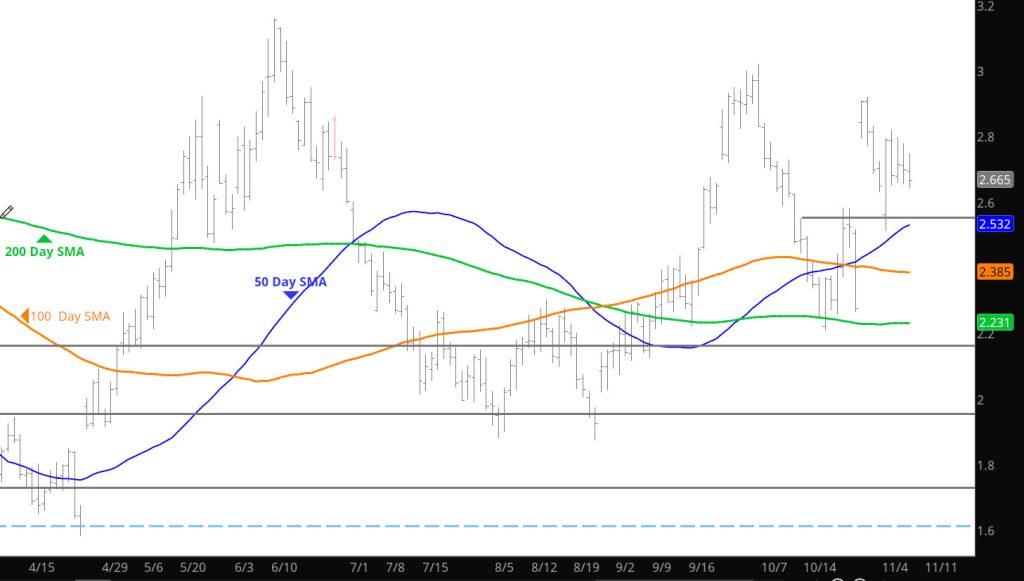

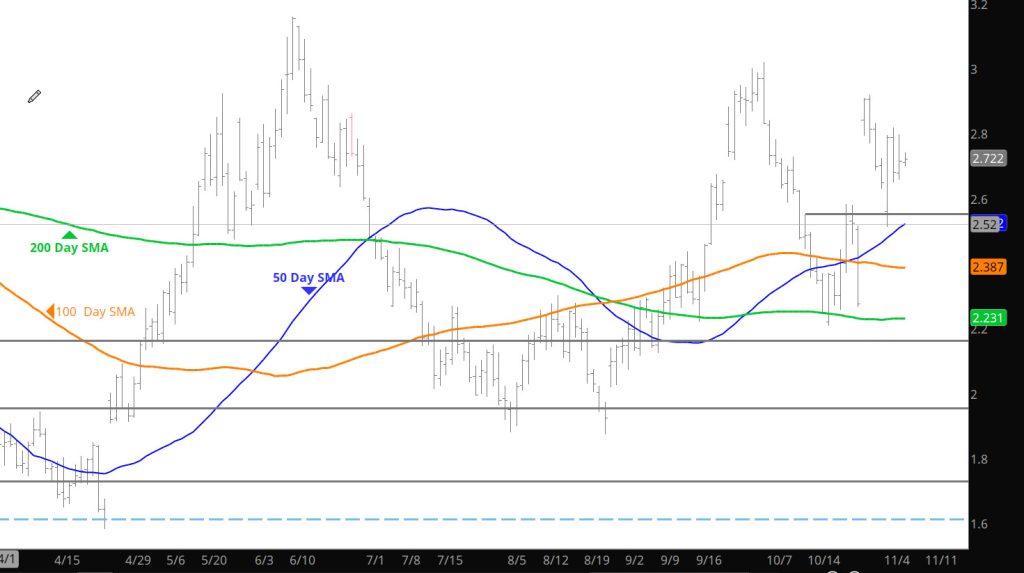

Daily Continuous

The break out continued as prices rallied before the storage report release. The trade (post storage) was quiet and declined late in the trade day. That action was likely due to late coming bulls taking profit on earlier positions. I was more interested in the buying (granted after market) in the light late day that sent prices back up to the $3.40’s. As suspected the gains made on Wednesday was generated from short covering (open interest declined on Wed) and I would expect slightly more bears were forced to cover, after a somewhat bullish report, produced little action. As long as this week’s support levels are tested and hold– then there is likely a bias conversion going on.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.16, $3.00, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.307 $3.392, $3.487