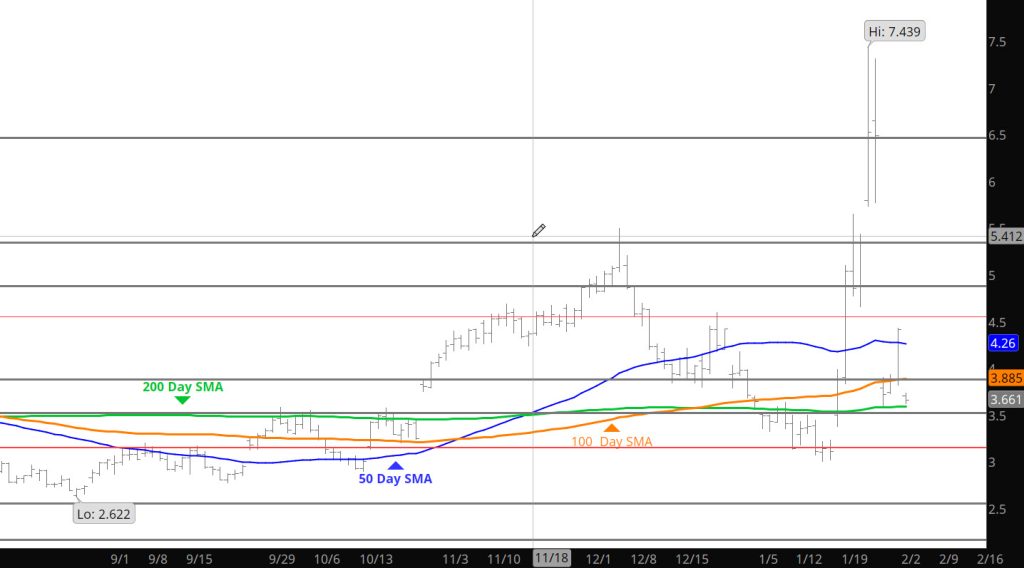

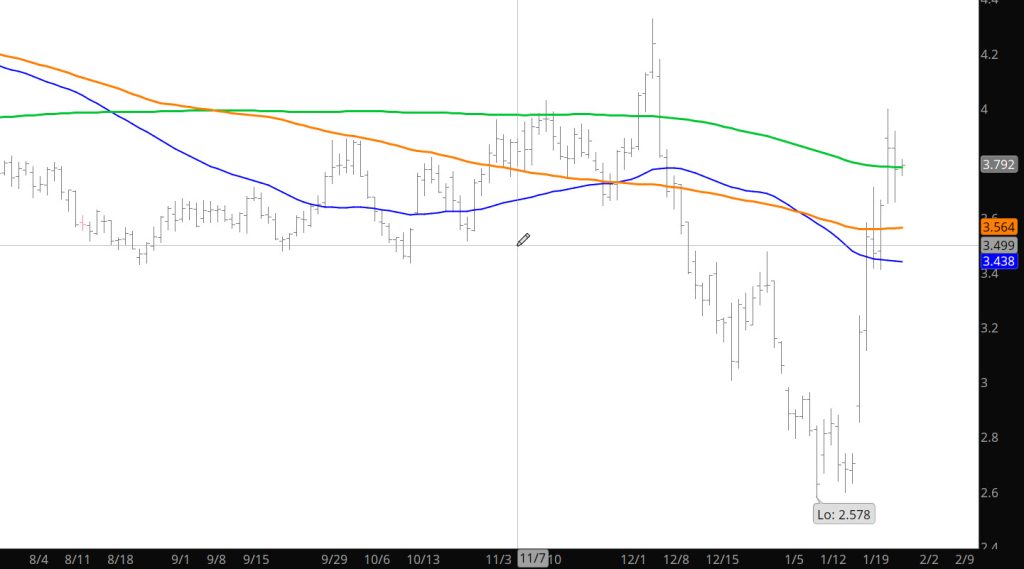

Daily Continuous

Mentioned yesterday that a range would start to develop and was confirmed in the trade. Will likely take some sort of fundamental event to bring any volatility back to the gas market.

Major Support: $3.374, $3.16-$3.148, $3.136-$3.024, $2.93

Minor Support/Resistance :

Major Resistance: $3.787-$3.831, $4.063, $4.086, $4.593, $5.333, $5.496