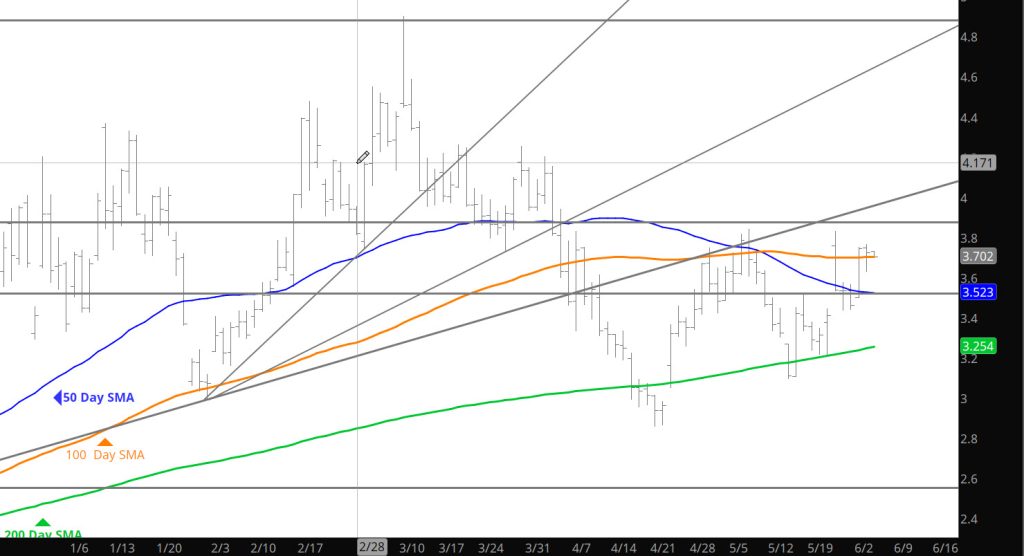

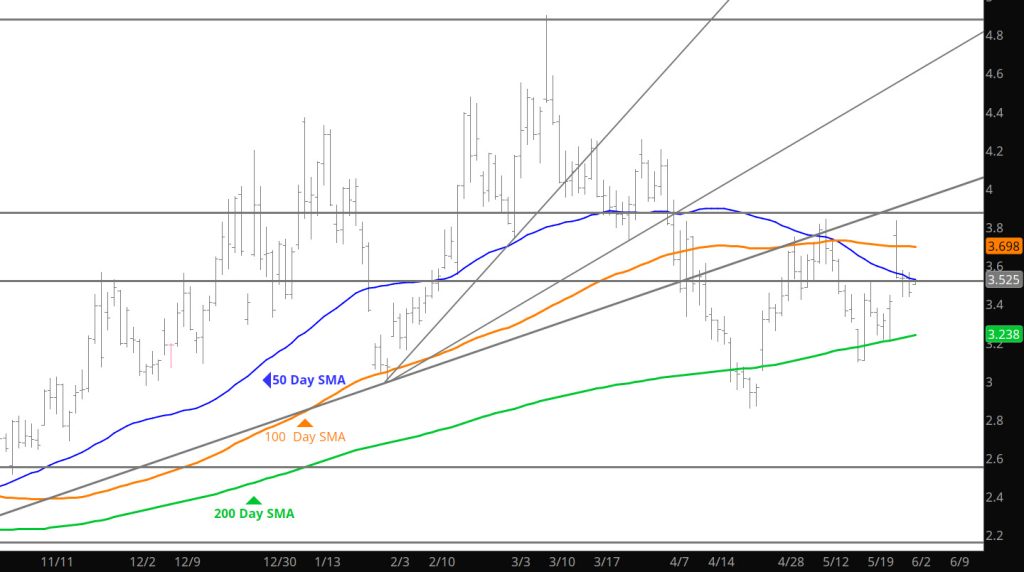

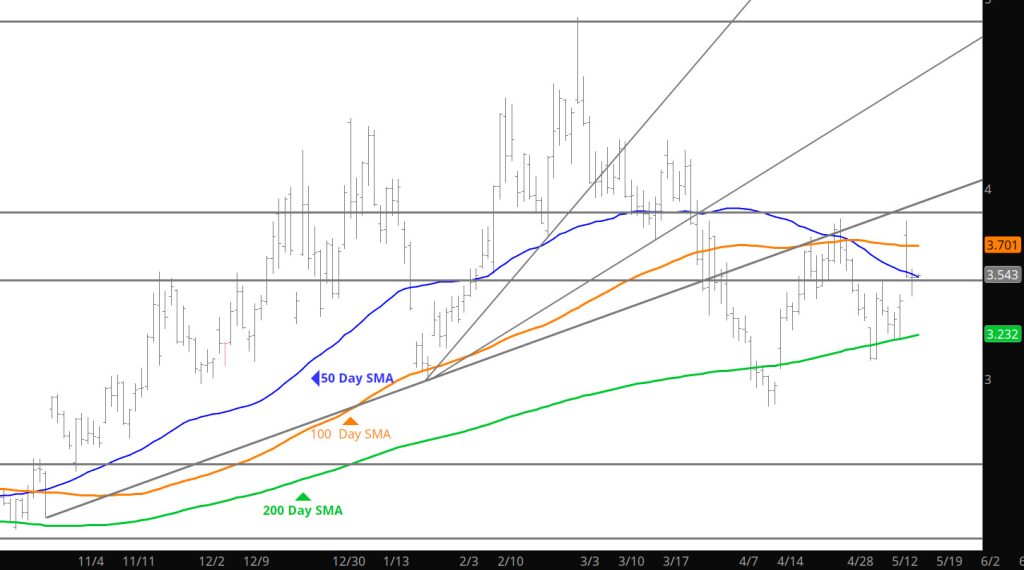

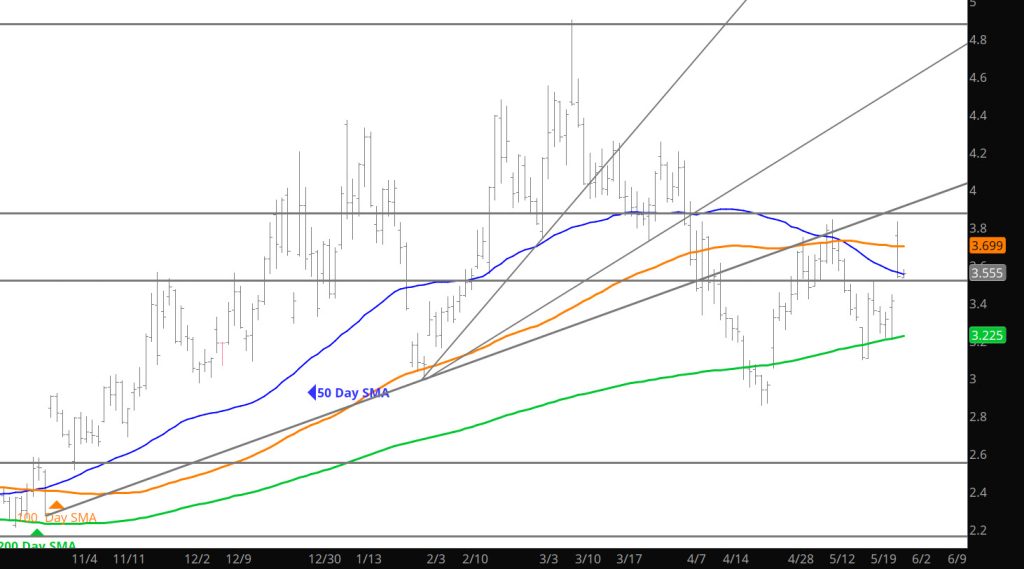

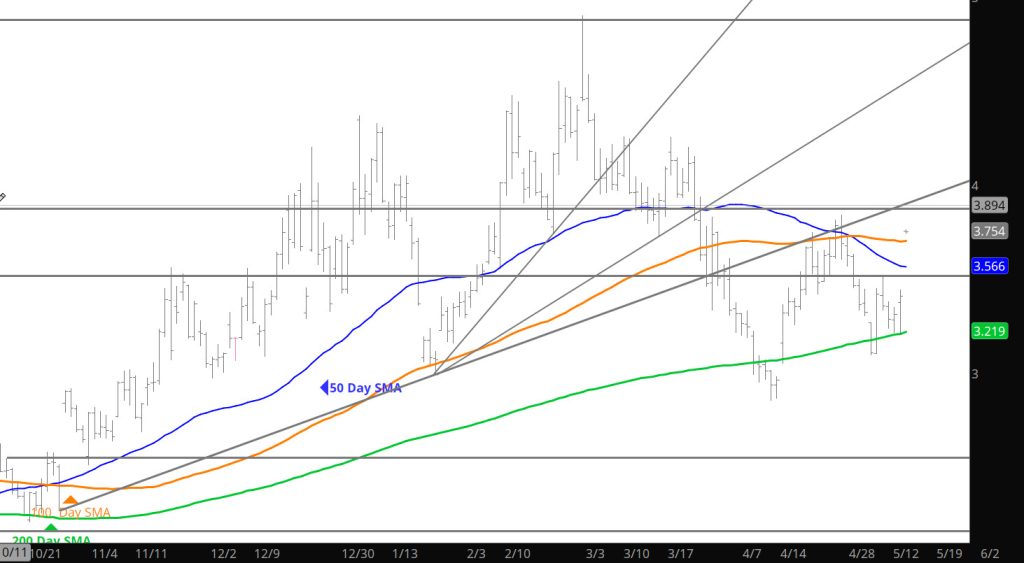

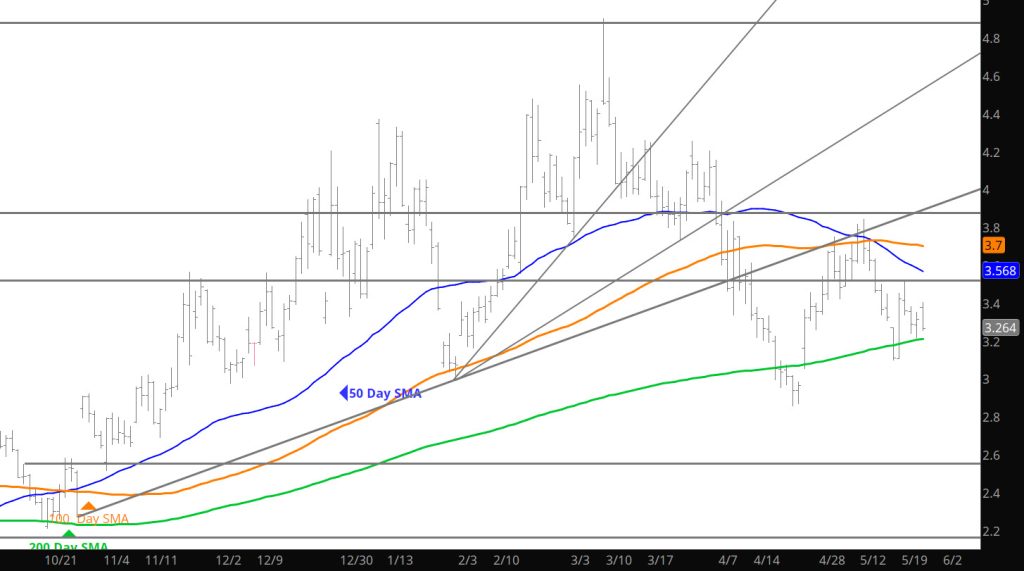

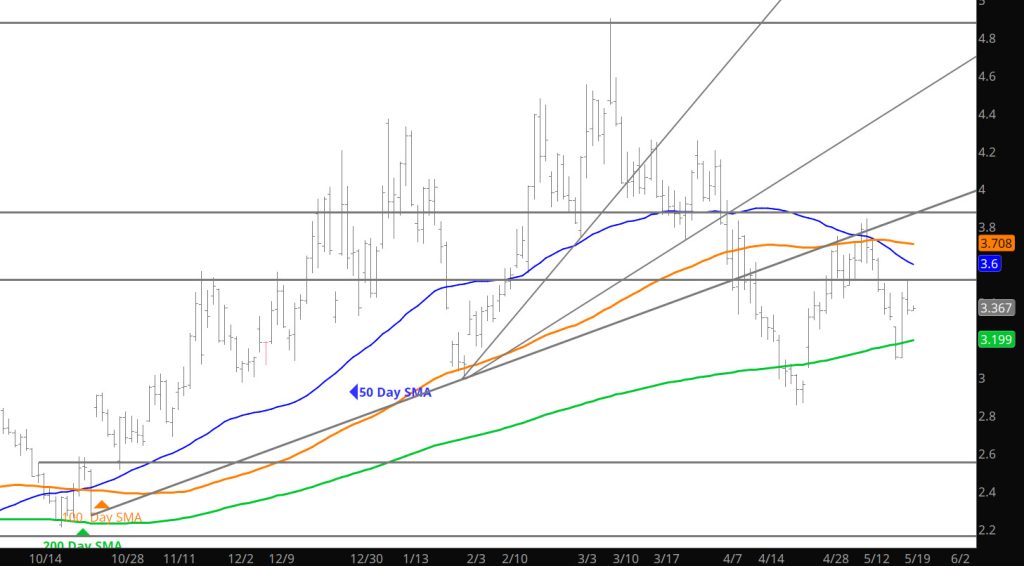

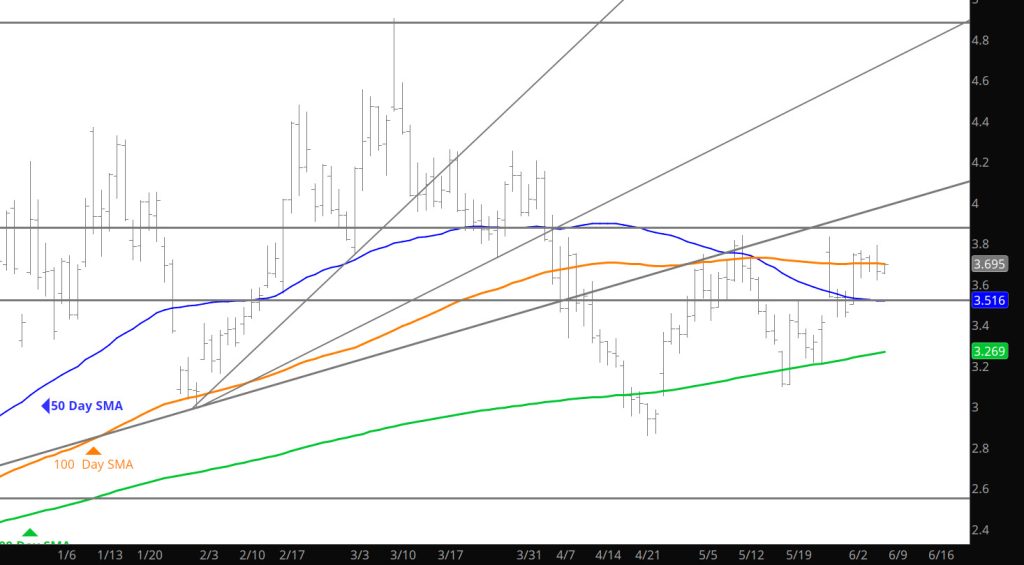

Daily Continuous

The market got a bearish storage release, sending prices down, but didn’t pressure the low side of the range before it got a footing and held the declines. Still in the range.

Major Support: $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :$3.30-$3.26

Major Resistance:$3.46, $3.628, $3.86, $4.168, $4.461, $4.501,