Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Quiet Going Into Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

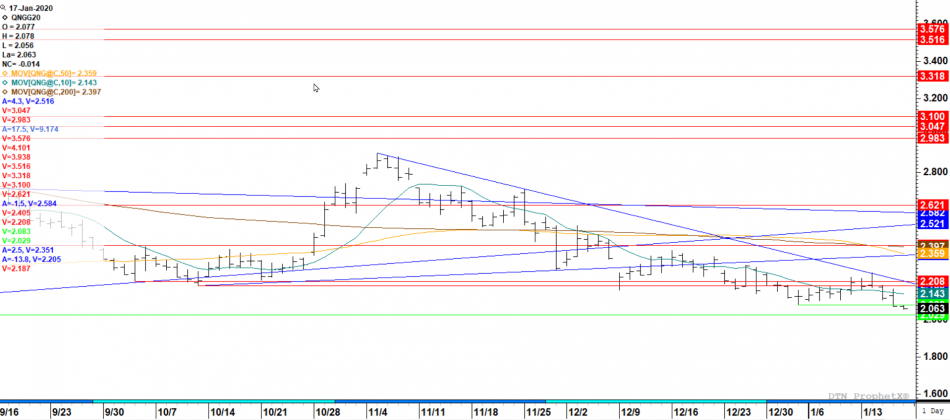

Tried the Gap Again

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

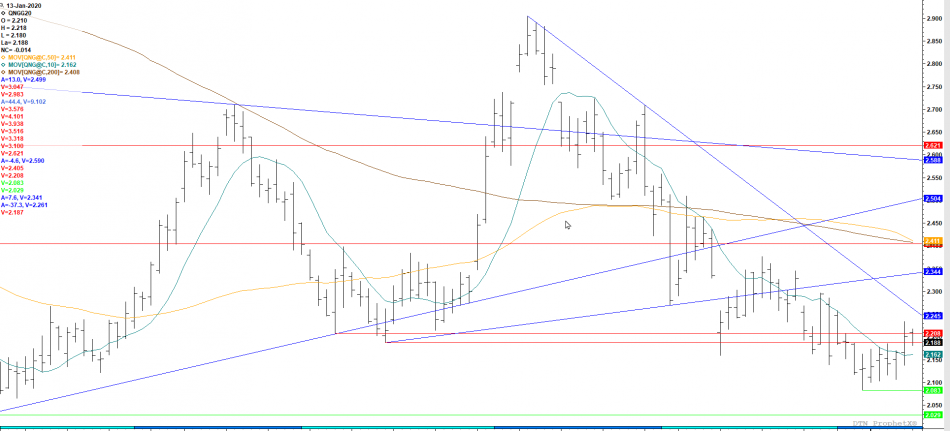

Almost Got the Gap

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

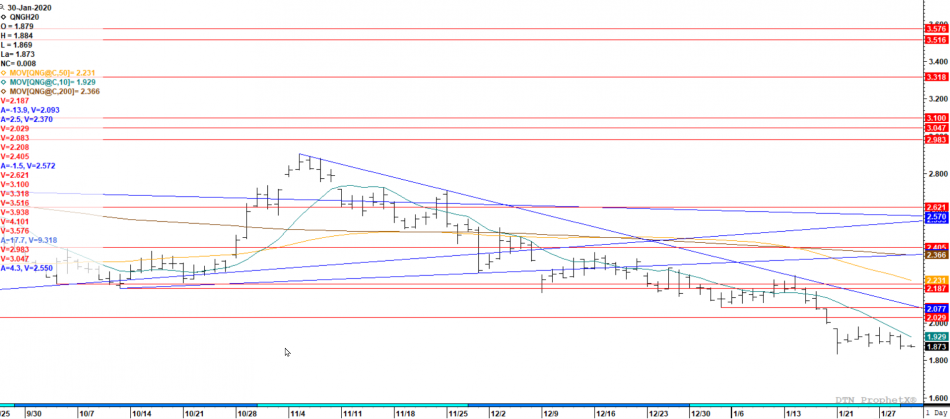

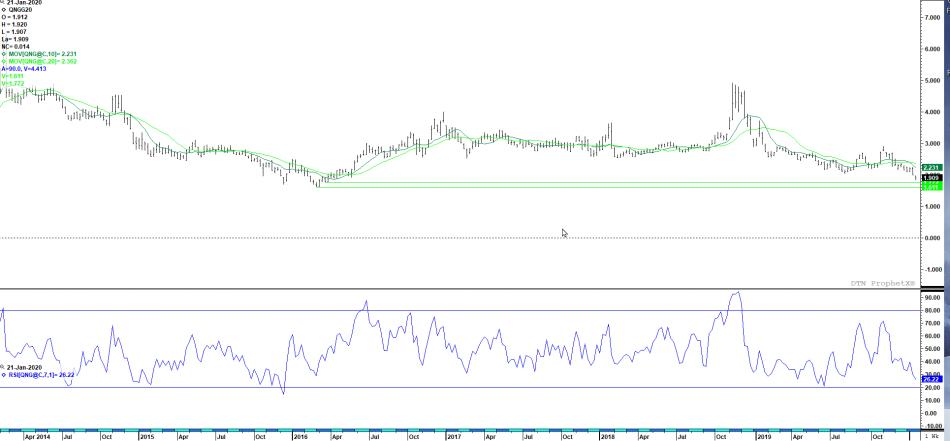

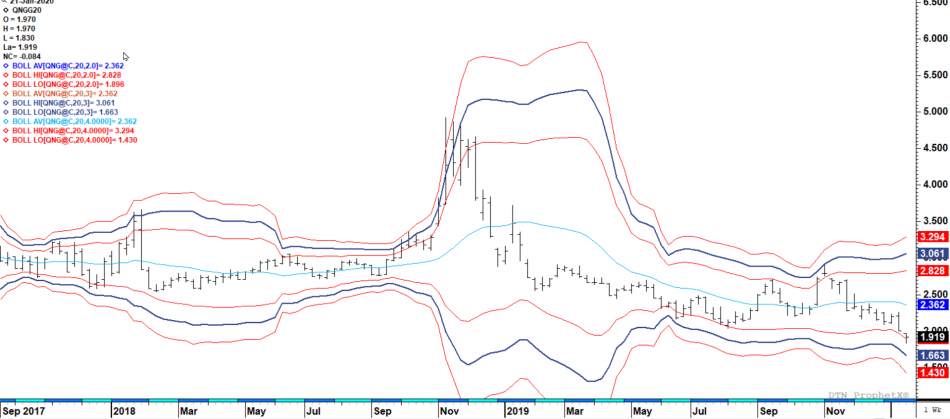

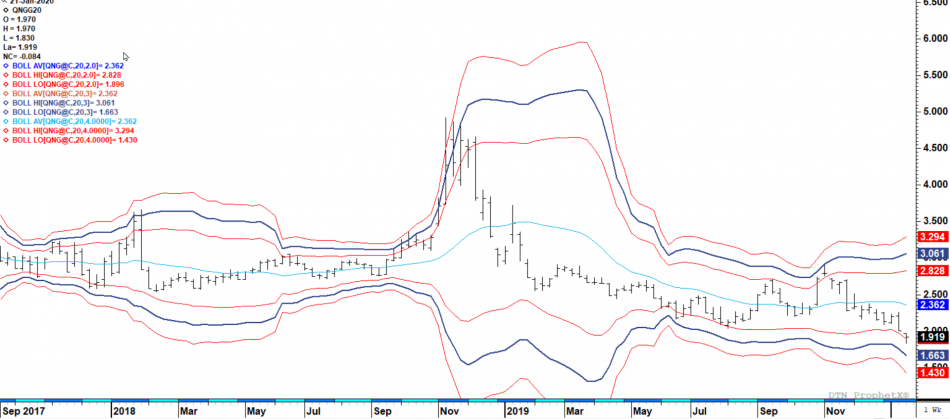

Chasing Lows From 2016

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Same As Yesterday

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

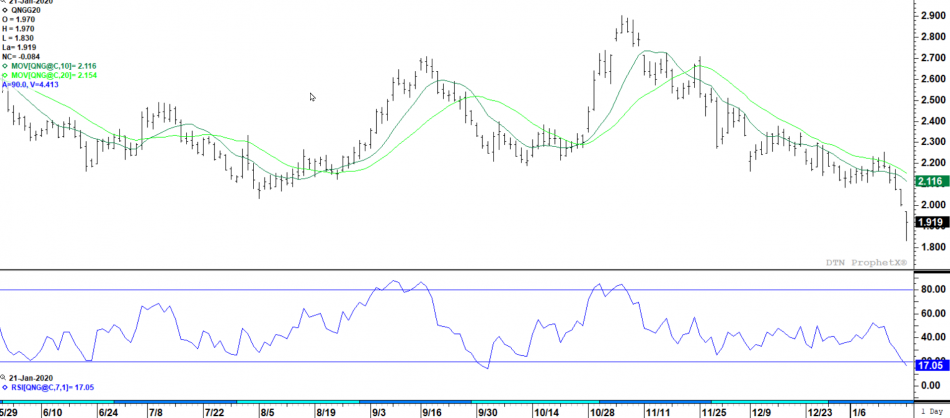

Close Below $2.00 — 2016 Test Coming

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

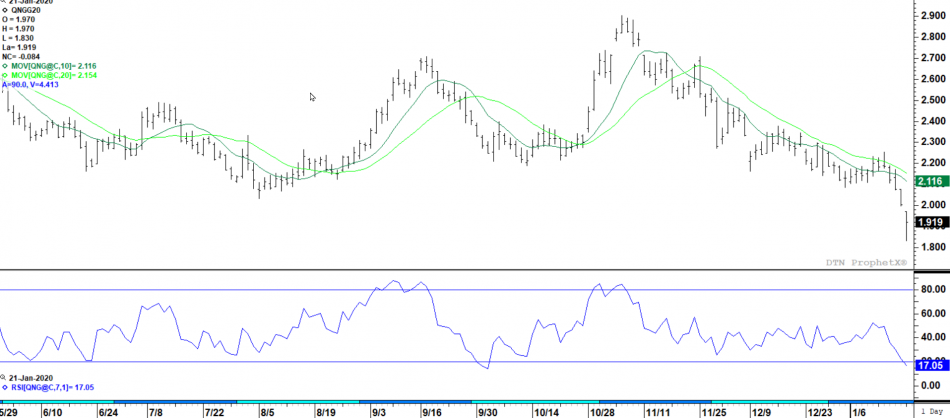

Might Get the Long Awaited Test of August Lows

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Test of Support Happens Again

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Not Much Change

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.