Category: Daily Call

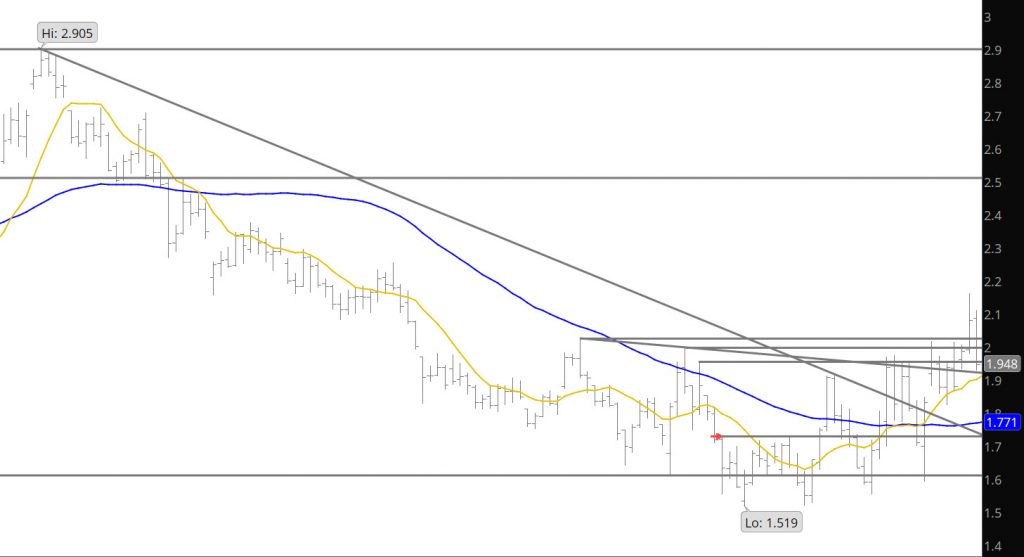

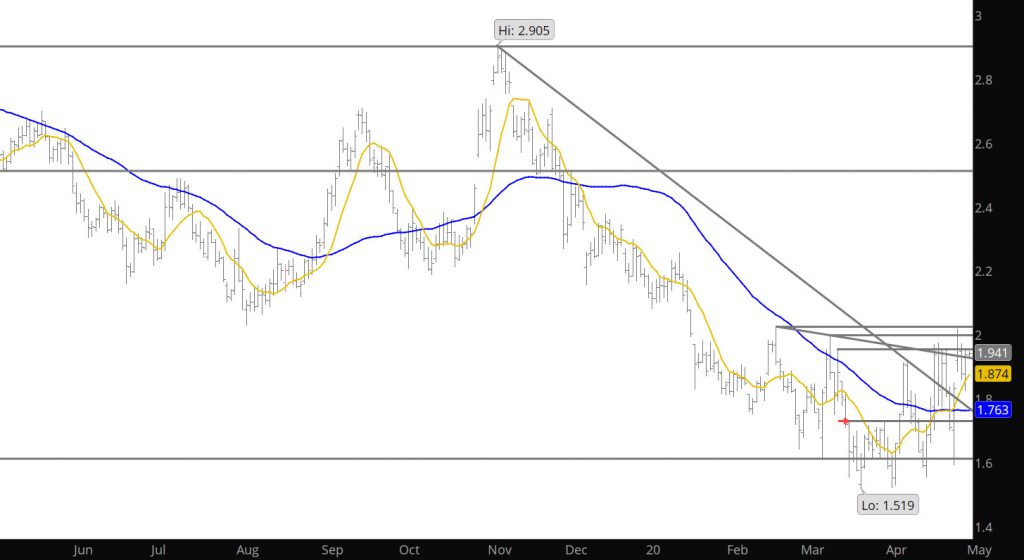

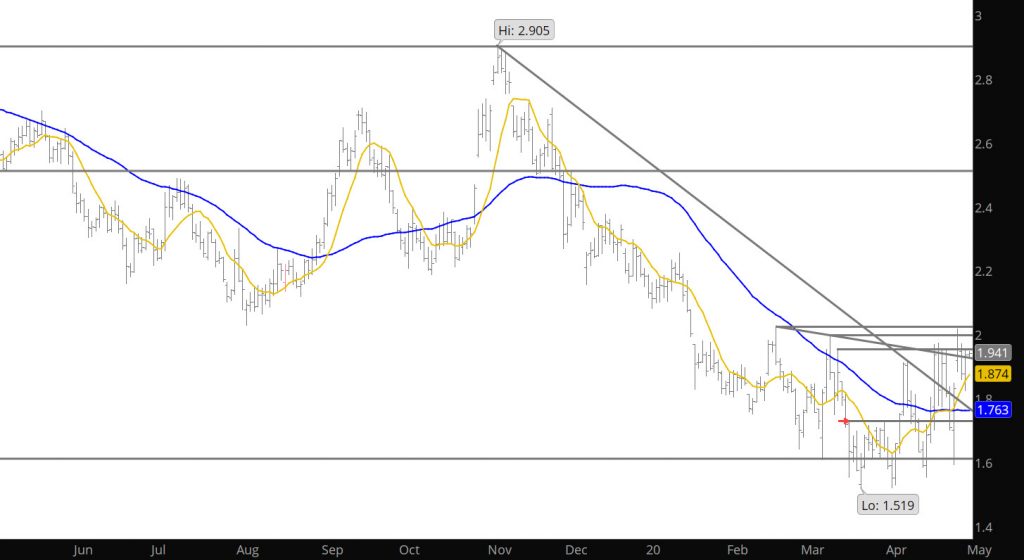

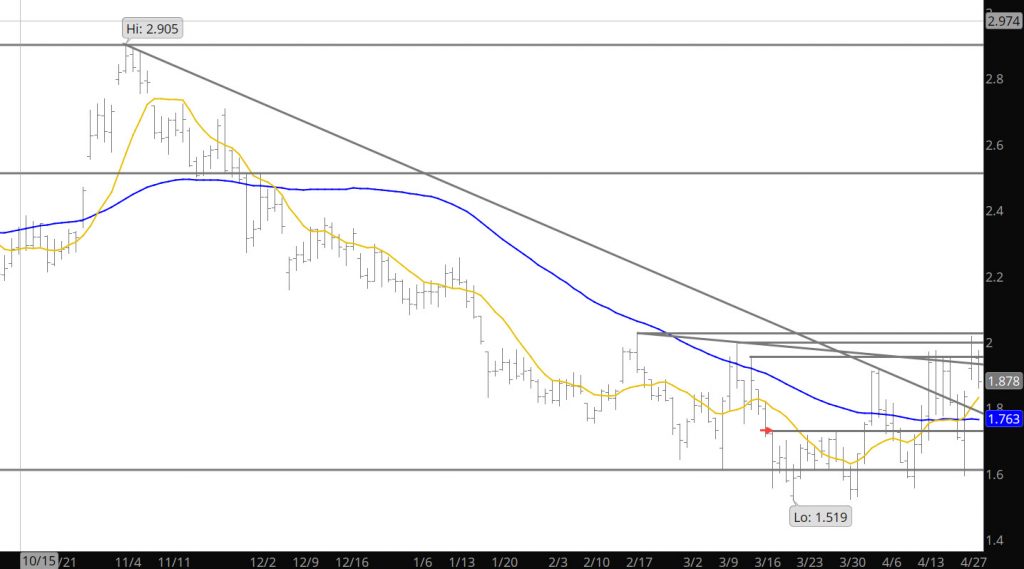

Extension Downward –Testing Trend Line Support

Additional Declines – No Dip Buyers Yet

Not surprising to find additional declines post the storage report. The volume the last two day has been lighter on the declines than the short covering run early in the week, which should be expected. Perhaps the market is testing support and consolidating the gains made earlier in the week, but in reality the prompt is where it was post May expiration. Lots of volatility and no clear directional bias.

Major Support: $1.82, $1.611, $1.555-$1.519

Minor Support: $1.794, $1.78-$1.765

Major Resistance: $2.062,$2.08-$2.102–$2.108,$2.139-$2.16, $2.255

Minor Resistance:

Short Covering Rallies Promote Volatility

Expected Break Out Occurs

Break Out Upon Us

Higher Weekly Close

Prices Rebound and Look to Test Resistance

Shocking –Weakness on First Day

Expiration Within Expectations

Just a reminder — this will be the last week that the Daily will arrive in your email unless you subscribe to the website. Effective May 1, you will have to subscribe to the website to receive the Daily. This market seems to be forming a bias change and ecomenergy will be leading the analysis during the transition.

The May contract expired at the high end of my expectations discussed on Monday ($1.61-$1.833) at $1.794. This was after two days of $.22 and $.25 daily ranges — whats that all about. My thoughts were that prices in June prompt would try to close with May’s prices but it is at the high end of the range that has held resistance for an extended period of time. Perhaps prices will collapse down into the support zone from May and April, or as the differed price action has indicated, future strength will control the market. The expiration of May at the high end and the strong differential to June needs to be addressed near term.

Major Support: $1.611, $1.555-$1.519

Minor Support: $1.78-$1.765

Major Resistance: $1.993-$2.025, $2.062,$2.08-$2.102

Minor Resistance: $1.968