Category: Daily Call

Prices Run To May Expiration

Expect Some Further Weakness But???

Memorial Day Weakness Continues

Weakness Into Bearish Report —- Again

Pardon my sarcasm but for the last few weeks the Wednesday trade has been weak on low volume to set up for the storage report (which I hear, is going to be bearish — again). The question remains, do folks sell into the report only to run out of sellers? From a technical trade perspective continue to trade the range and sell the rallies (prices in the high $1.80’s and above), OH and buy the dips (low $1.60’s and below). History suggests weakness into, or just after, the holiday while the higher daily volume following the gaining price days.

Major Support: $1.611-$1.59, $1.555-$1.519

Minor Support: $1.649

Major Resistance: $1.82-$1.849, $1.873, $1.90

Minor Resistance: $2.029

Trade Consolidates Monday’s Gaines

Unexpected Pop

Minor Bounce Off of Support Test

Prices Find Support

Trend Line Violation Opens Door For Declines

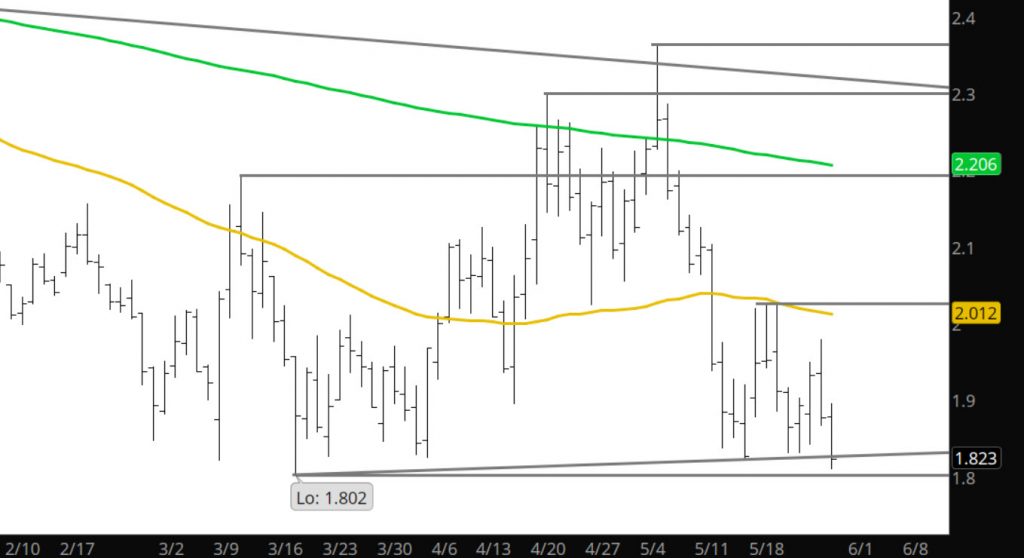

Once the trend line in the Weekly (see Web) and the spot June, the trap door was open, and some liquidation occurred. We may be similar in trade to 2016 which had an uncommonly early May Q2 high, but with the volume being rather anemic for this type of activity do not believe the high is in so close to the establishment of the Q1 low (just six weeks earlier). The trade does look like it wants to go down and test the expiration range low from the May expiration at $1.59. Would expect the area between the March low of the June contract ($1.649) and the previous mentioned low, to find some buying interest.

Major Support: $1.649-$1.611-$1.59, $1.555-$1.519

Minor Support:

Major Resistance: $1.82-$1.849, $1.873, $1.90

Minor Resistance: $2.029