Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Whoa – Where That Come From

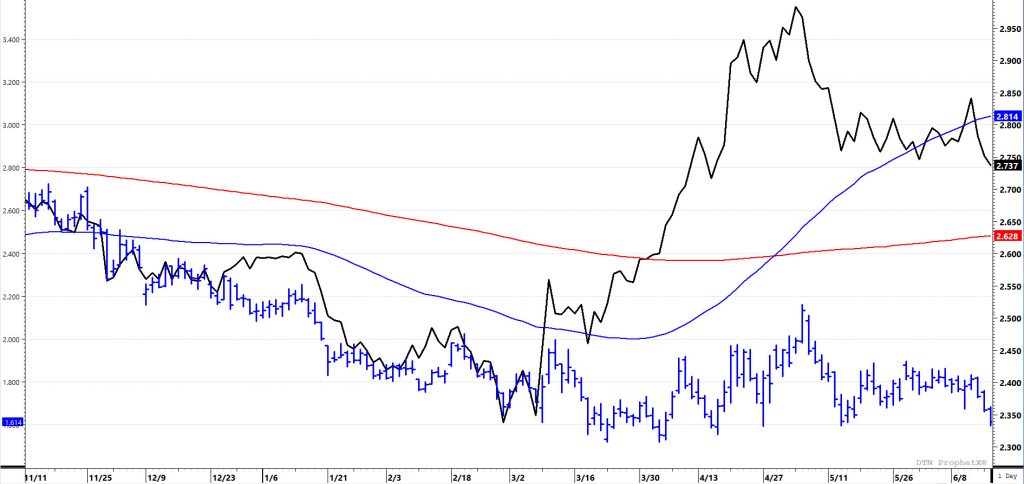

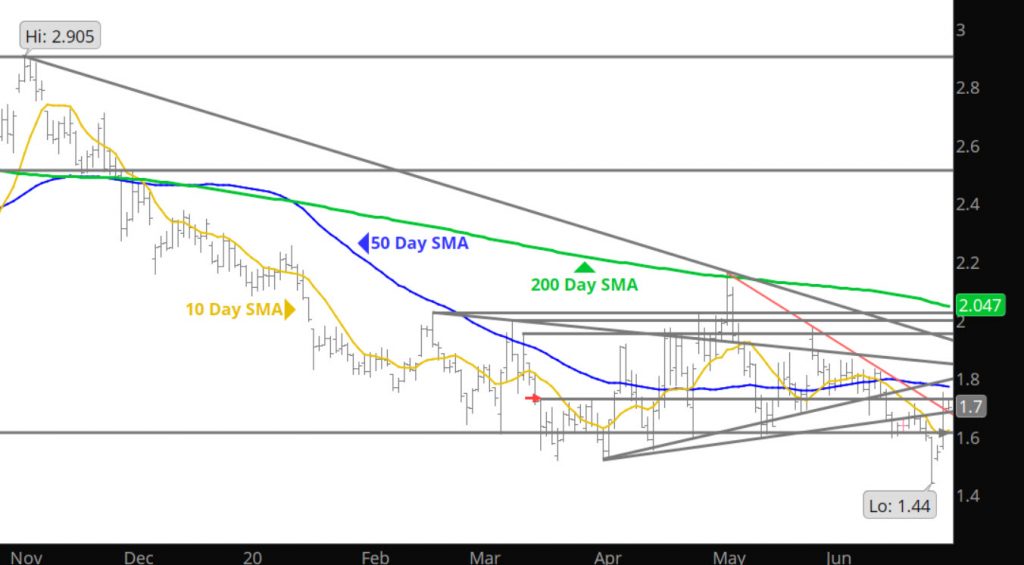

Did not expect that reaction to the close last week. Was thinking more of a retest of the premium afforded the August contract, but clearly the market thought other wise. Now we sit in the middle of the range that has held prices for an extended period of time. Technical indications of an over-sold market have relaxed on the run. Continue to expect short term rallies as the Managed Money long positions increased last week through June 23rd while there was a reduction in short positions.

Major Support: $1.484-$1.44, $1.336

Minor Support: $1.527

Major Resistance: $1.595, $1.611-1.642

Minor Resistance: $1.722, $1.864-$1.896

Sunday Trade Brings A Bounce

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Slide into Options Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Wake Me When We Get There

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Certainly Not In a Hurry

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Expect Range to Hold Through Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Testing the Low Side is Becoming Fashionable

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Down Draft Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Decline to Trend Line Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.