Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Week of Range Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation and Doubt

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Gain a Bid in Late Morning Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Solid Bounce Tests Resistance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Extension Downward

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Brutal Break Lower

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Light Consolidation

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

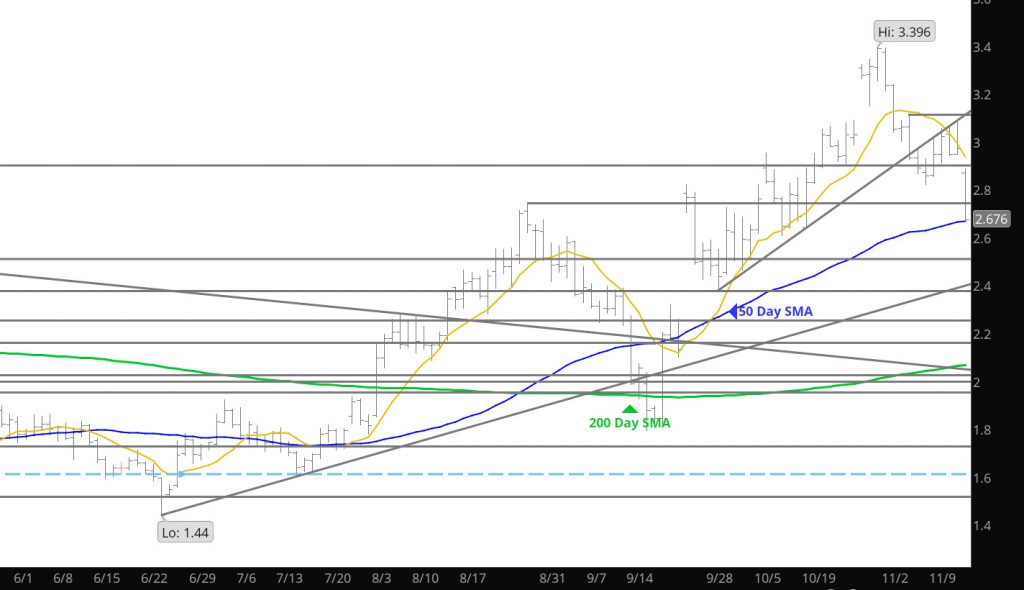

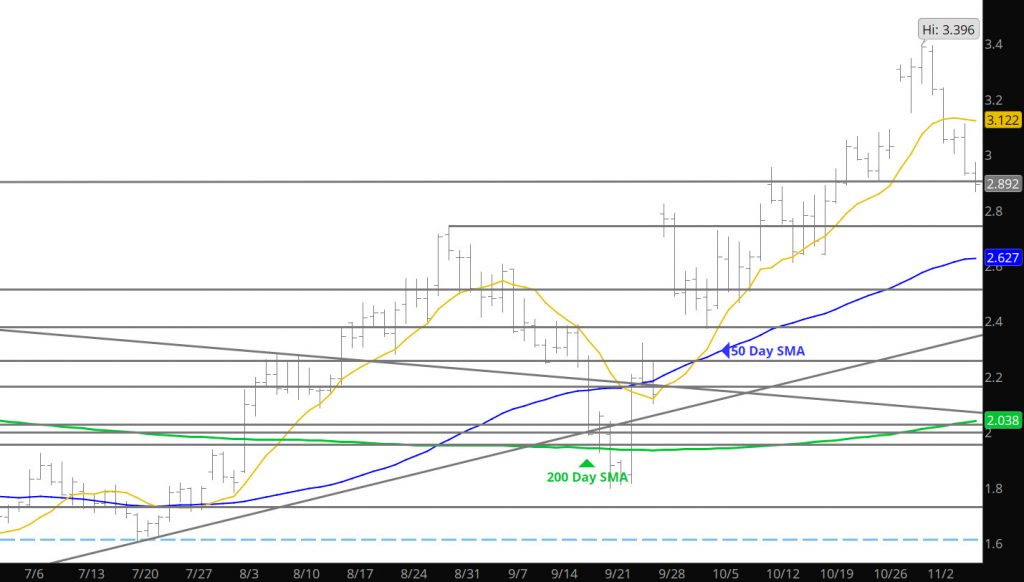

Awaited Test of Support Occurs

Discussed here for the last couple of weeks, regardless of the Nov expiration and price break above $3.047 (old gap from 2019) it was likely that the December spot contract was going to test this area. That event occurred yesterday. Whether or not there is an extension downward, remains unclear but if price don’t today they are missing a great opportunity.

Major Support: $3.047-$2.98, $2.907, $2.822

Minor Support:$2.84

Major Resistance: $3.151, $3.24, $3.361-$3.370, $3.423, $3.516

Slight Softening

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.