Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

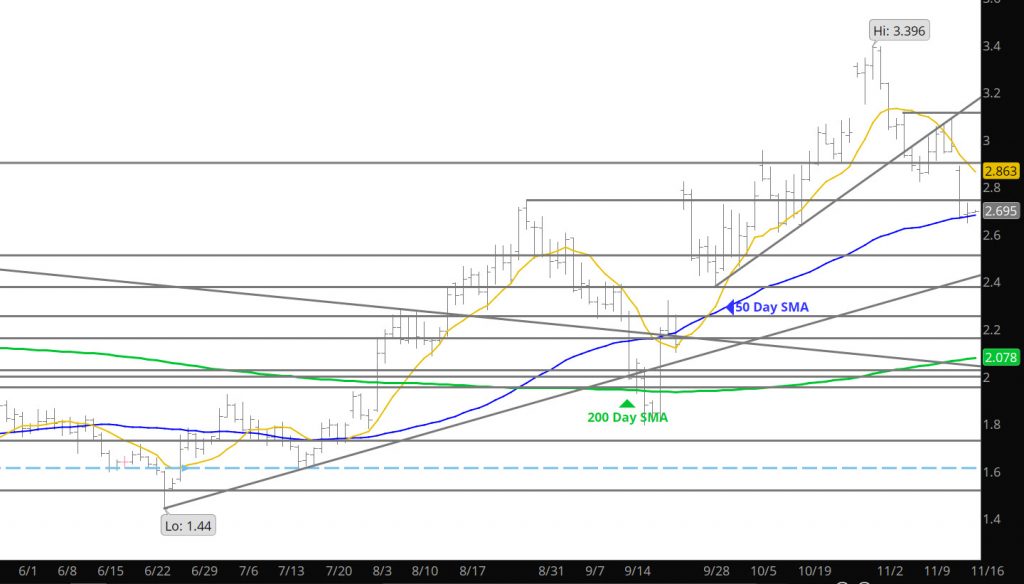

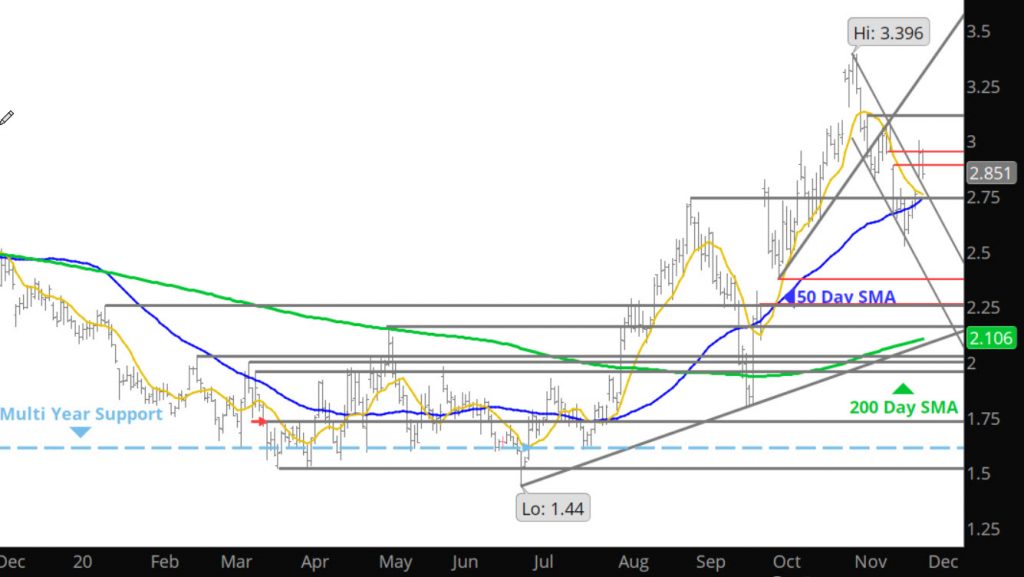

Mini-Range Consolidation Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Yesterday’s Call All Wet

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Short Term Declines Should Continue

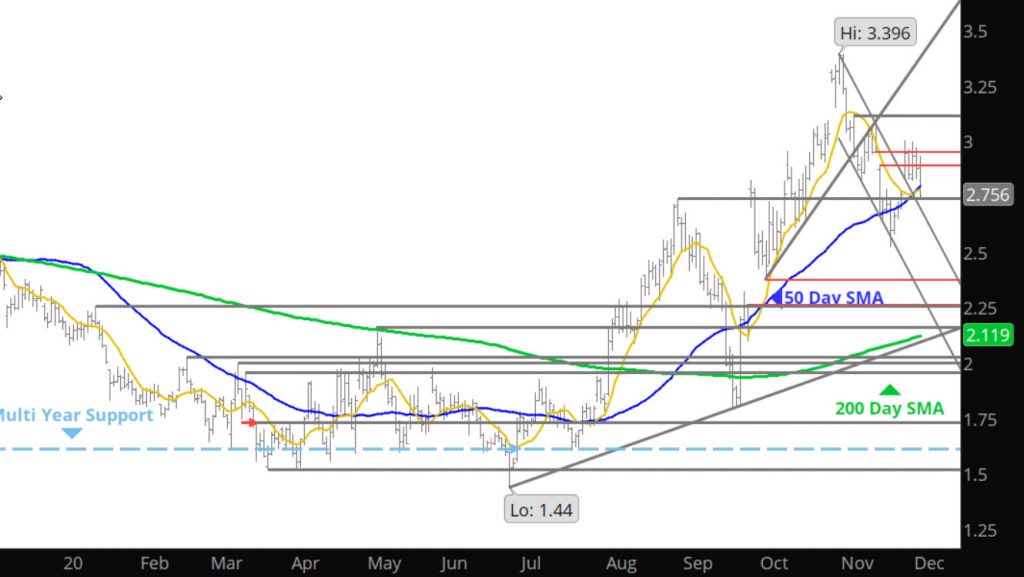

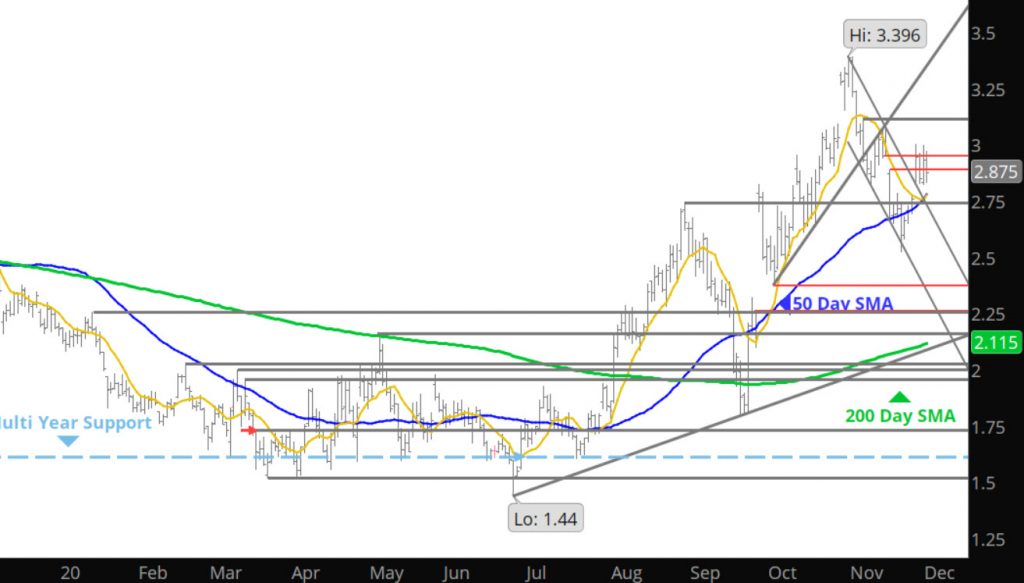

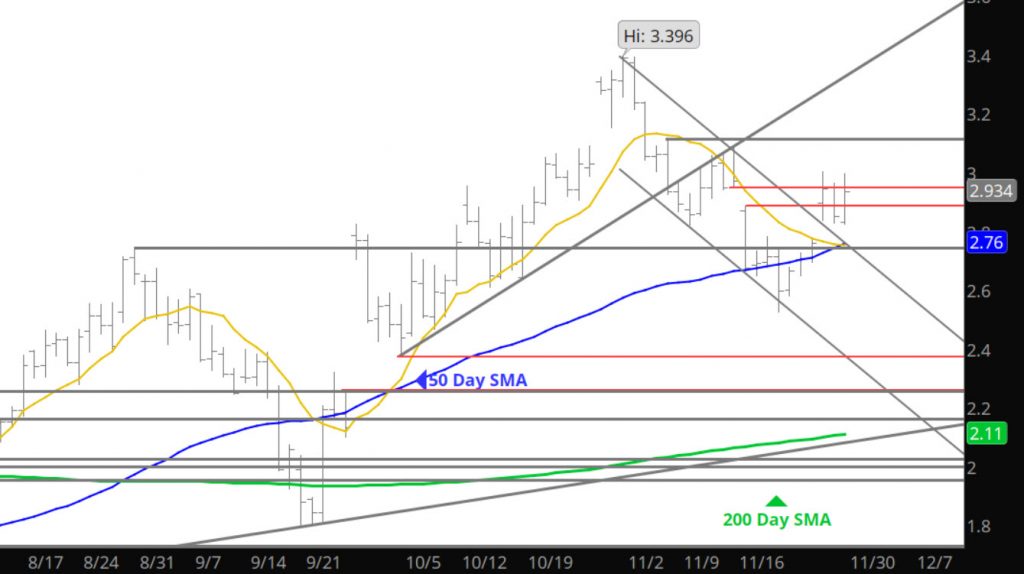

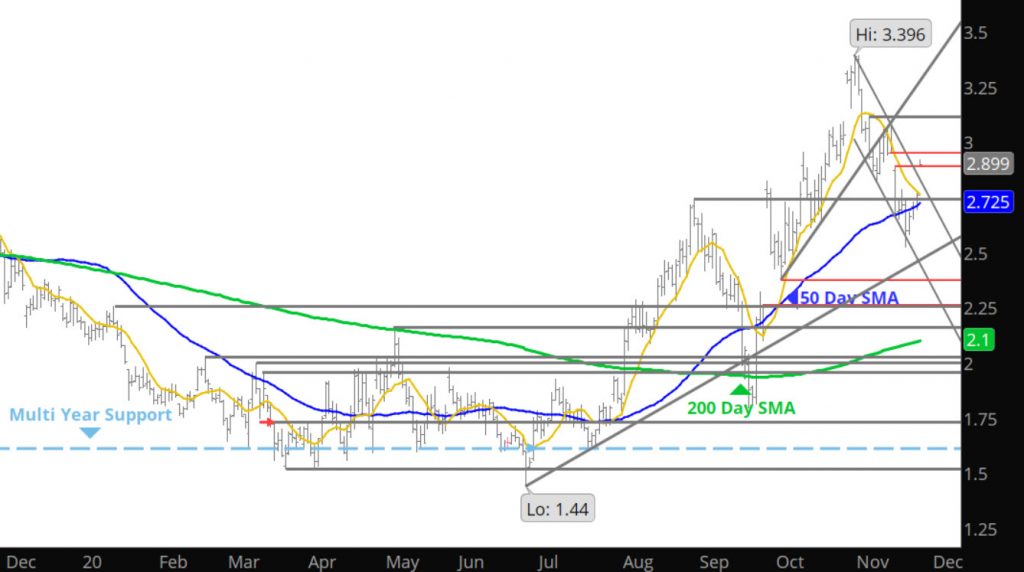

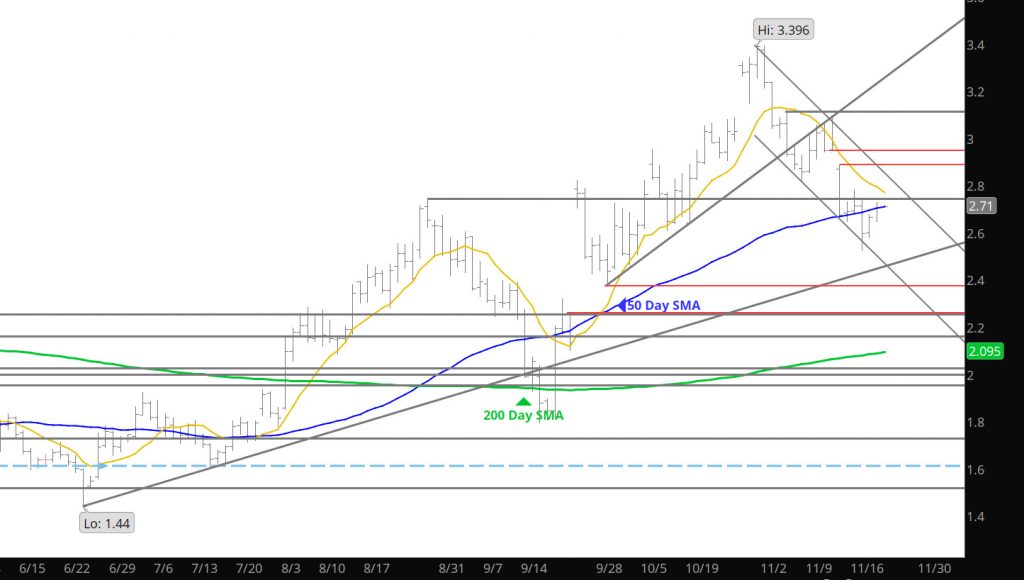

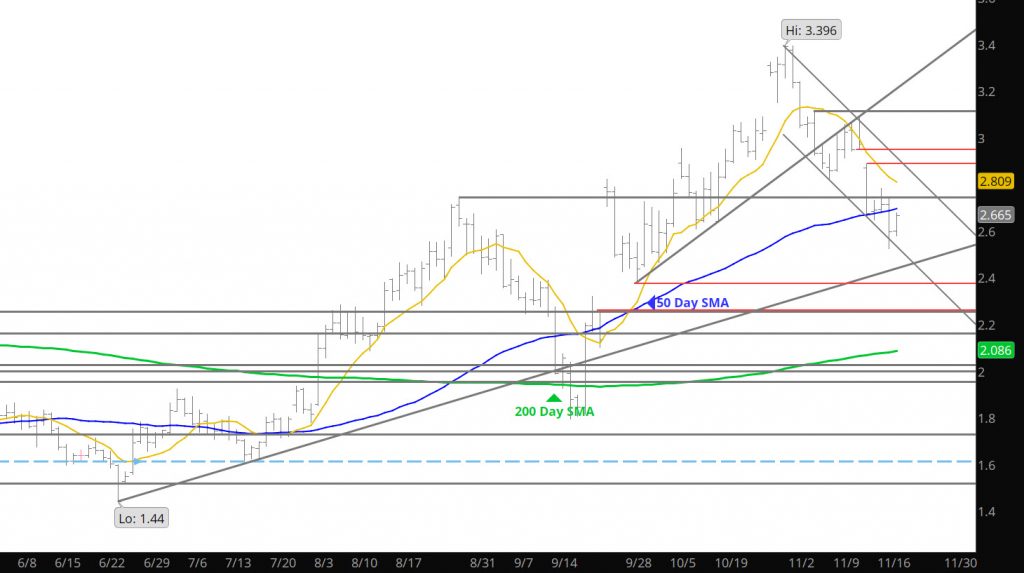

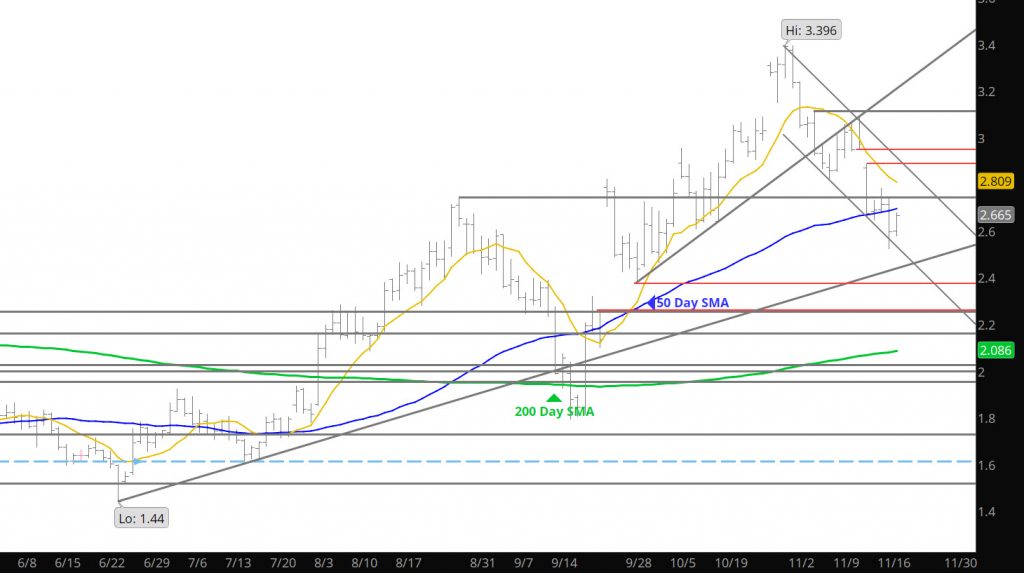

As discussed in the Weekly section — the market has developed a negative bias to trade. Before you play that side (read the Weekly Section for longer term positions) look for low risk areas to pursue length in the long term price arena. Look for movements within the recent range ($3.00-$2.70) in the next day or so and look to the market to define longer term impacts.

Major Support: $2.61- $2.621, $2.425,$2.373

Minor Support:

Major Resistance:$2.82-$2.853, $2.887, $2.98-$3.05, $3.091, $3.151, $3.24,

Minor Resistance:

Gains Continue After Last Week’s Selling

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Garner Some Support Into Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Declines Slow on Friday

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Brutal Reversal

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Decline Occurs In Advance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

What Did You Expect

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.