Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Strong Start- Weak Close

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Strong Close — Gap Up Open

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Diseased Animal Bounce?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Break Down Into Gap

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Big Gap Down

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

We Crawl Into High $2.70’s

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Expected Lighter Trade Commences

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Holiday Trade Coming, Likely Light and Volatile

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

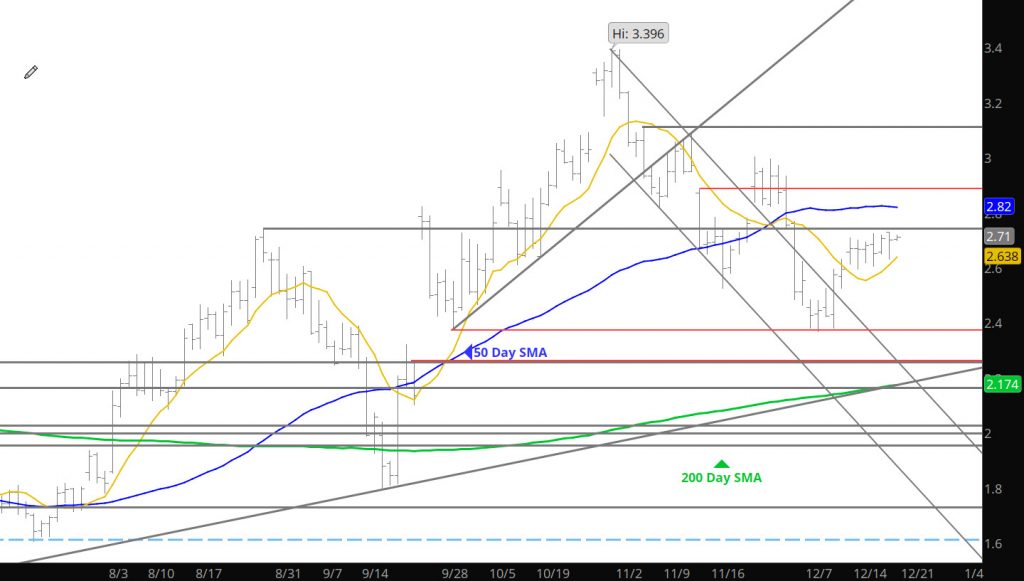

Chop In the 60’s

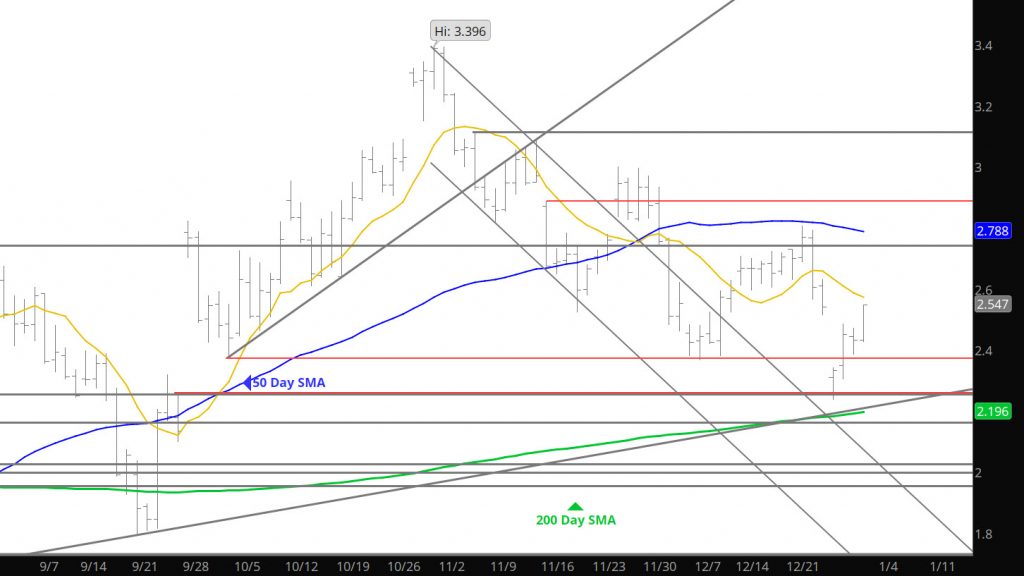

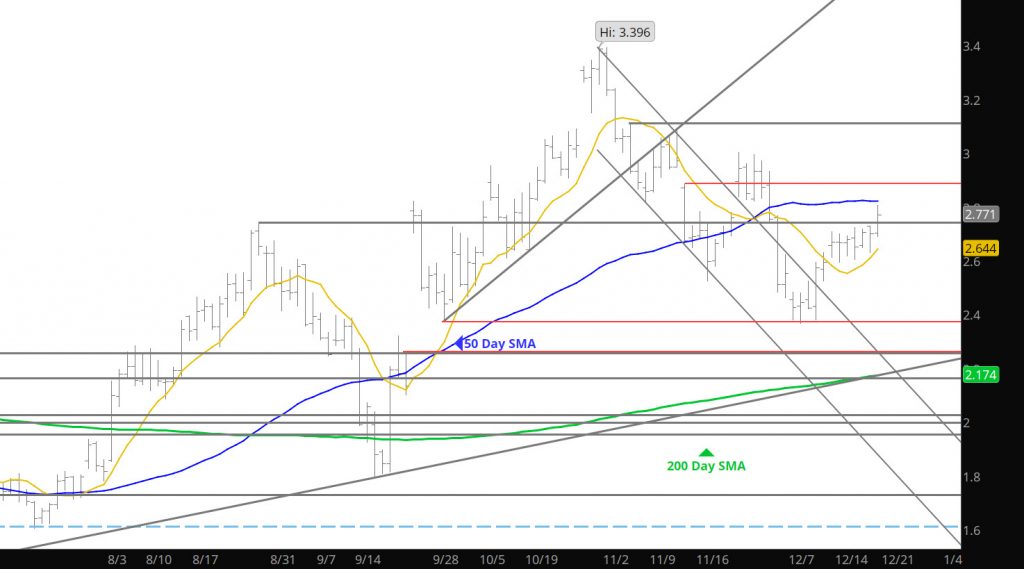

Not much to say except that prices are chopping around between $2.60 and $2.70. Is this a consolidation pattern that will lead to a break out or break down? You tell me! Last week had big volume on the declines and rebound with open interest loosing ground– I am as confused as the market is. Two weeks ago I wrote about all the comments I hear about the winter being “over” and the seasonal high is in– OK — why is it so stubborn to give up the ghost and land below $2.50? If you are long keep the stops in place (the 20 Week or last weeks close) if you are short your key is this week’s high.

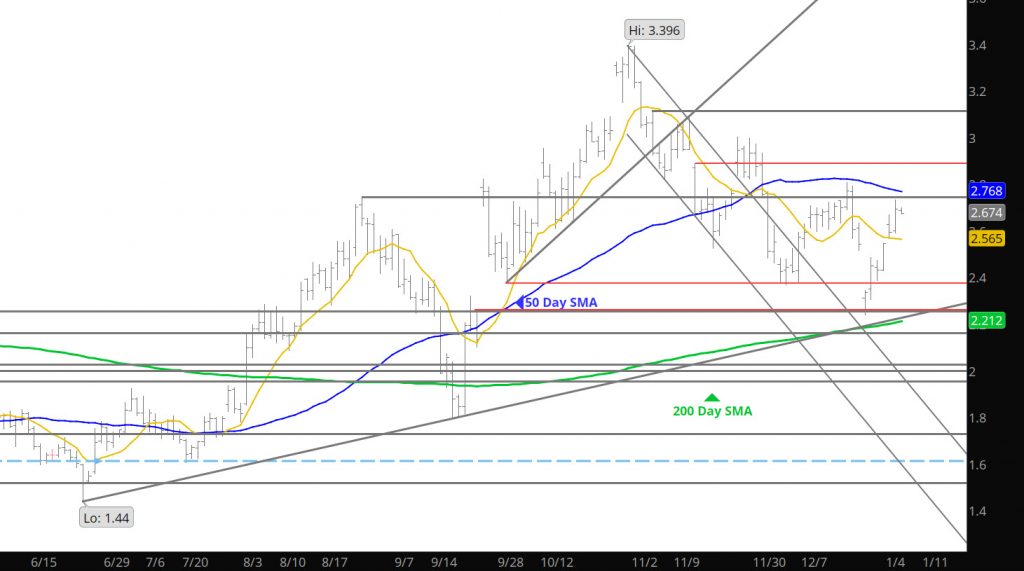

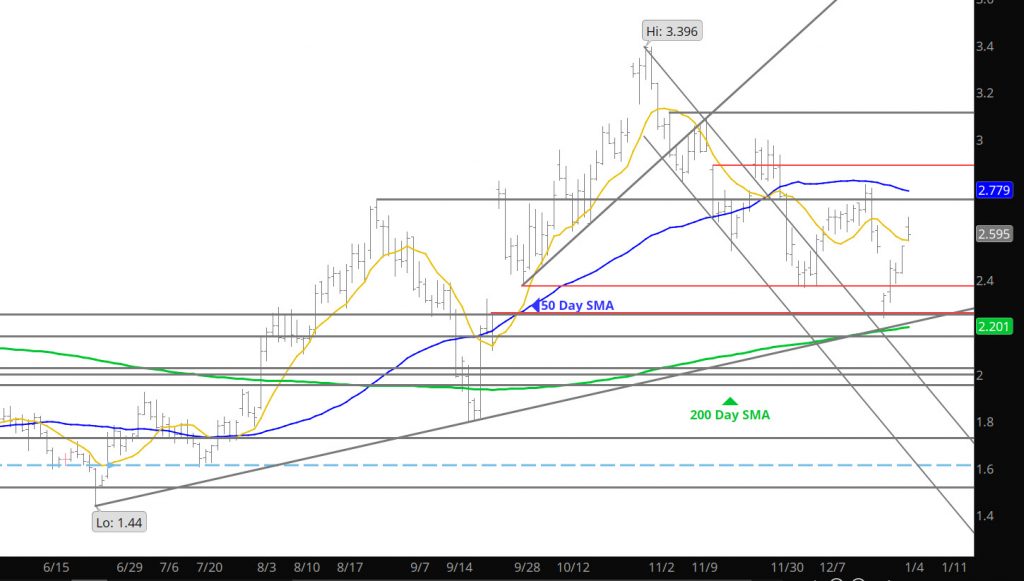

Support: $2.425,$2.373, $2.255-$2.176

Minor Support: $2.596, $2.162

Major Resistance: $$2.74-$2.789, $2.98-$3.05,

Minor Resistance: $2.649, $2.798