Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

As Expected

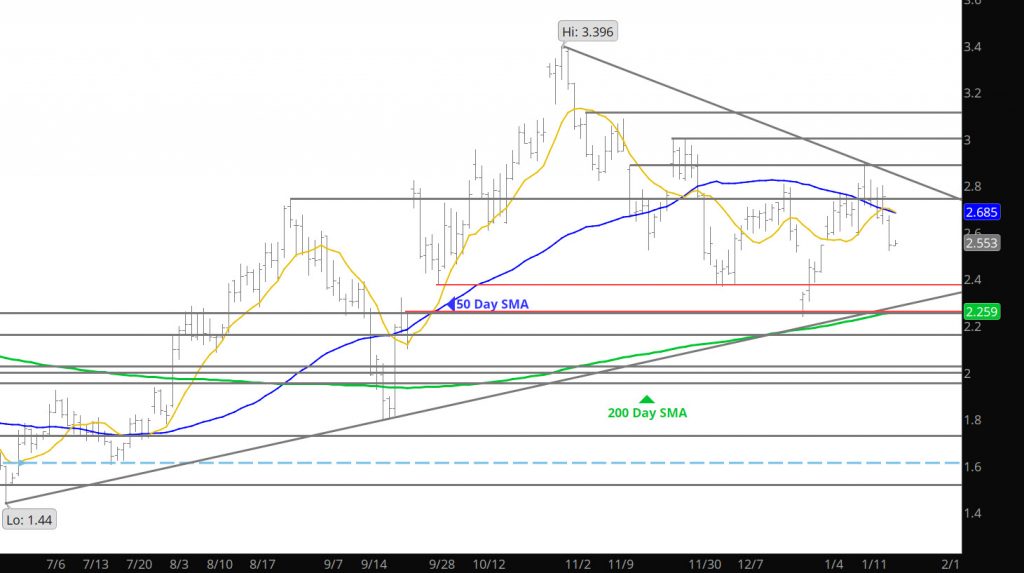

Not sure what happened to the distribution via email yesterday but the Weekly section in the web was spot on to the expected test of support provided by the early month gap that remains. Even-though prices rebounded off of the test, expect additional tests again today with more traders available.

Support: $2.566, $2.373, $2.255-$2.176

Minor Support:$2.547, $2.483, $2.162

Major Resistance: $2.74-$2.789, $2.89, $2.98-$3.05,

Minor Resistance: $2.806

Sunday Opens Weaker

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Round and Round We Go

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Just Chugging Nowhere’s

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Rally Hits Serious(?) Resistance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Reversal — Now a Test of Resistance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Trade (Daily Basis) Defines Little

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Quiet For a Storage Report

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation ?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.