Category: Daily Call

Neither Event Occurred

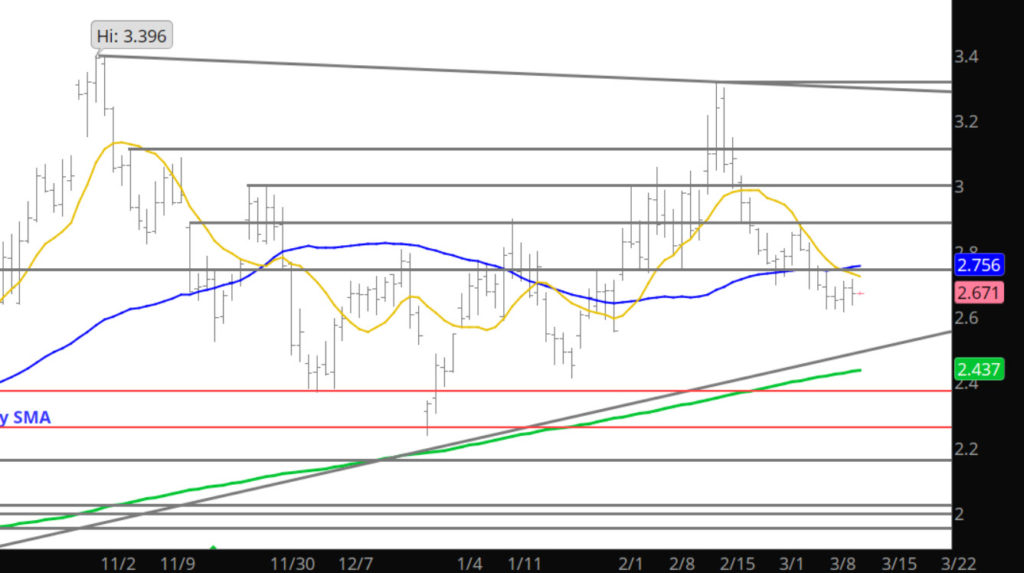

Does the Gap Close

Well yesterday proved inconclusive to direction but today is a storage release may give the market the volatility to break out or extend the breakdown. If the gap ($2.566-$2.584) closes, from the first of the week, and prices get into the $2.60’s there are not a lot of resistance areas for a dime higher. To the downside there are areas of support around $2.44 down to $2.37.

Support: $2.422-$2.414, $2.373–$2.356,$2.255-$2.176

Minor Support: $2.483, $2.162

Major Resistance: $2.74-$2.789, $2.89, $2.98-$3.05,

Minor Resistance:$2.806

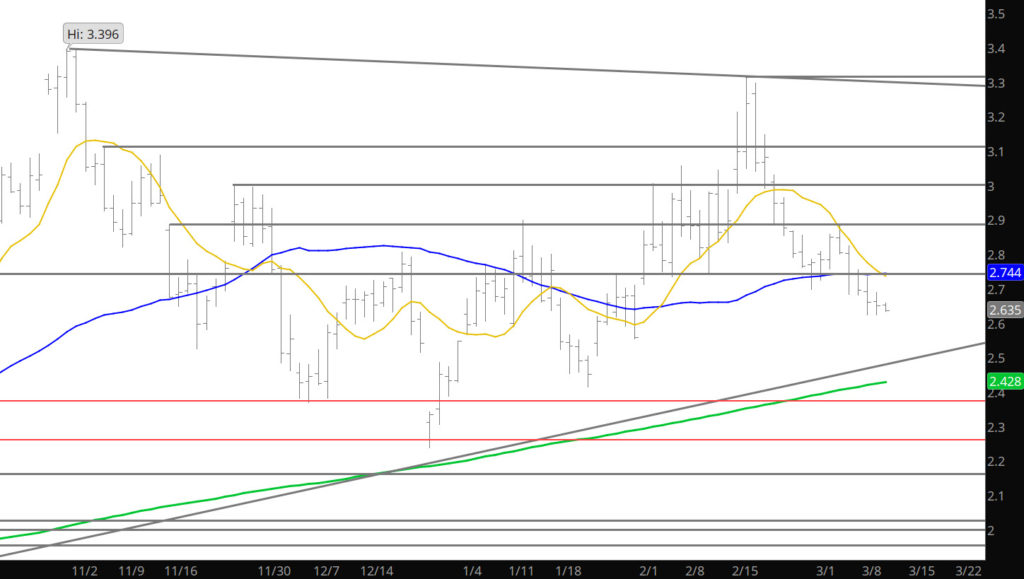

Initial Test of Support

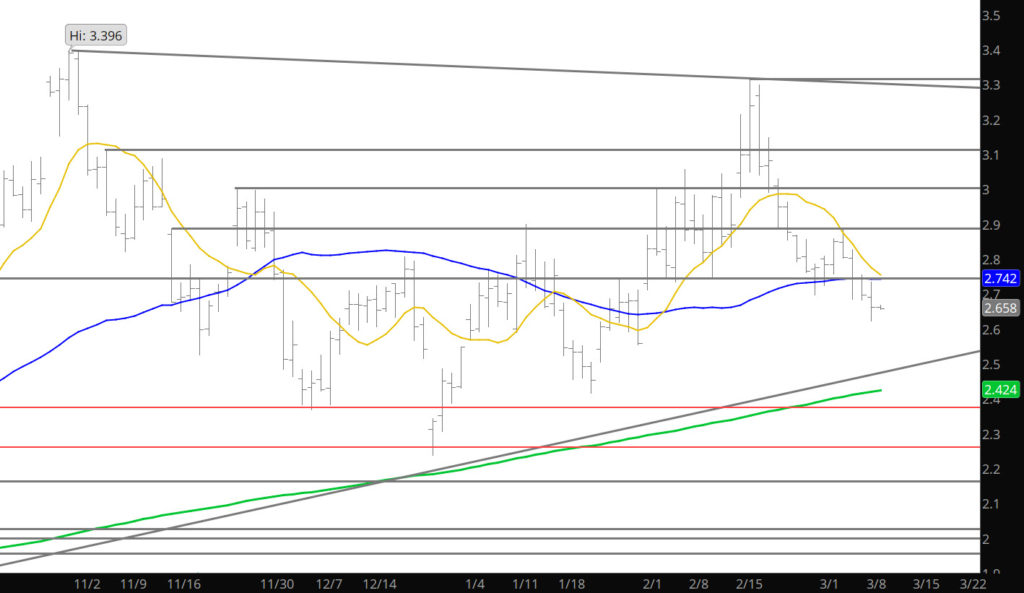

Break Down Continues

Gas Storage – Does Nothing to Prices

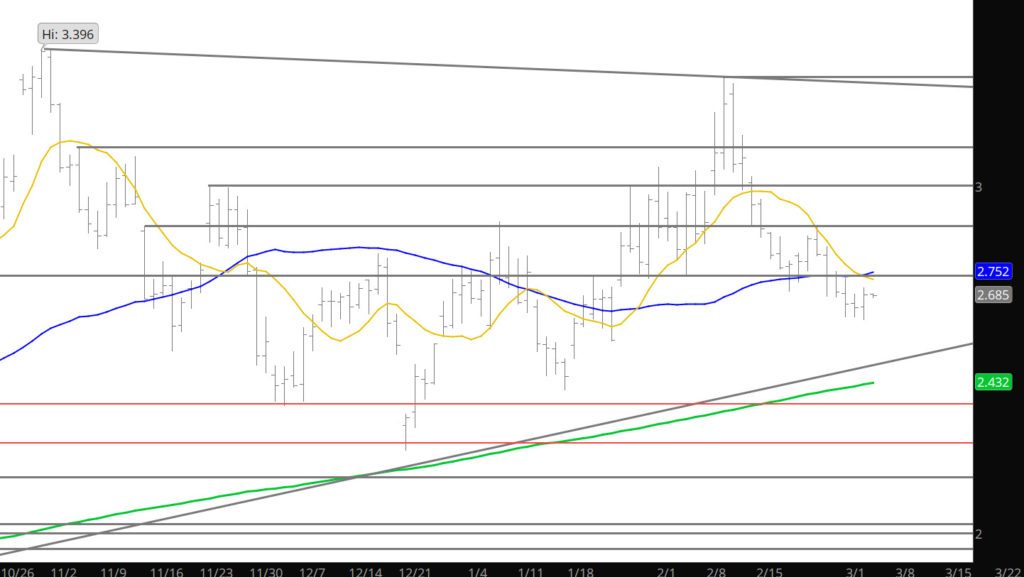

Near Term Support Holds

The market provided three tries to break into $2.50’s and failed. Yesterday, it garnered some interest in seeking the high side of the range. Did not hear of any fundamental reason for the gain so I will leave the analysis to if support holds — time to check resistance. Not sure how aggressive this run will be on the heels of the storage report (which has now lost relevance) but may proved some volume for the contract.

Support: $2.61, $2.54, $2.373–$2.356,$2.255-$2.176

Minor Support: $2.483, $2.162

Major Resistance: $2.74-$2.789, $2.89, $2.98-$3.05,

Minor Resistance:$2.806