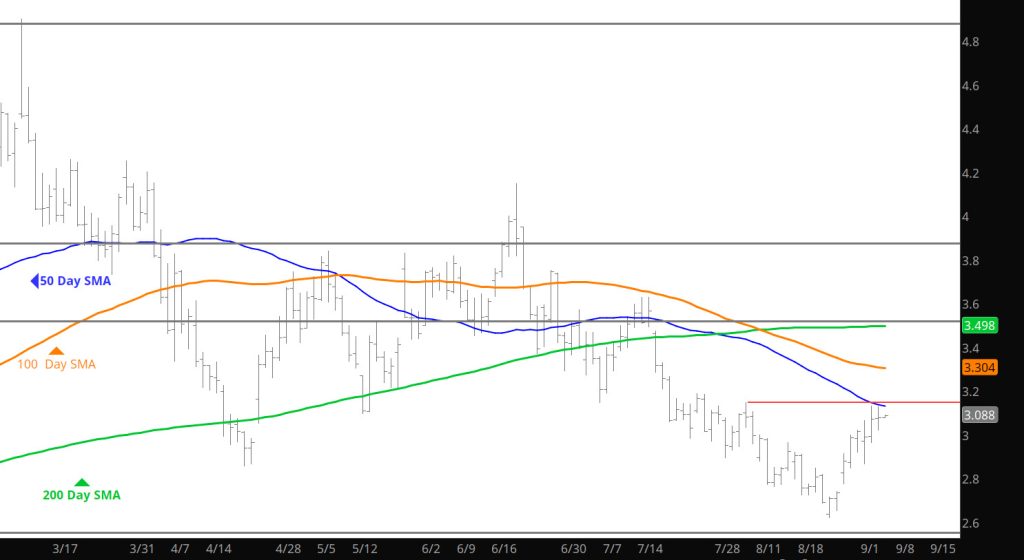

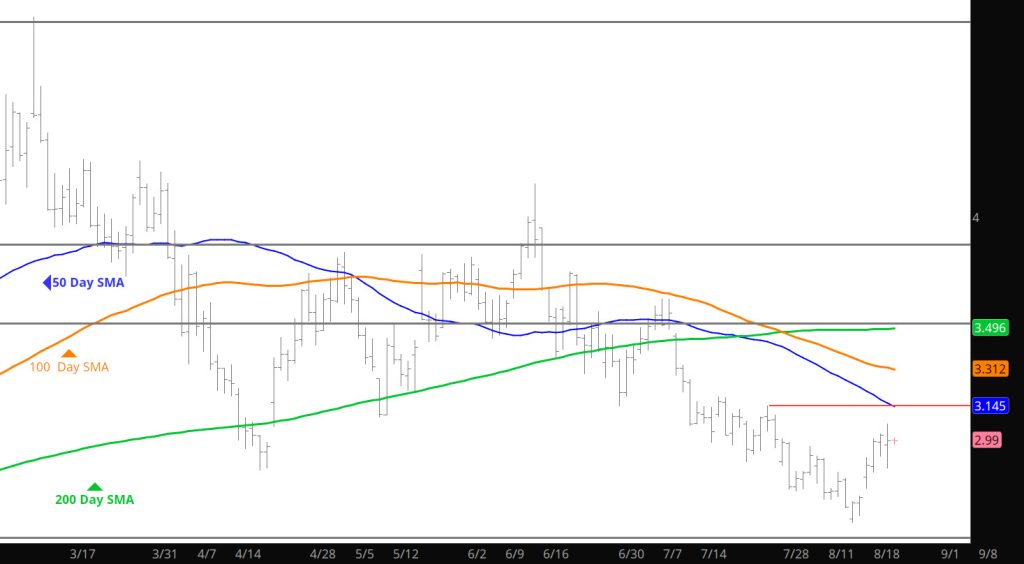

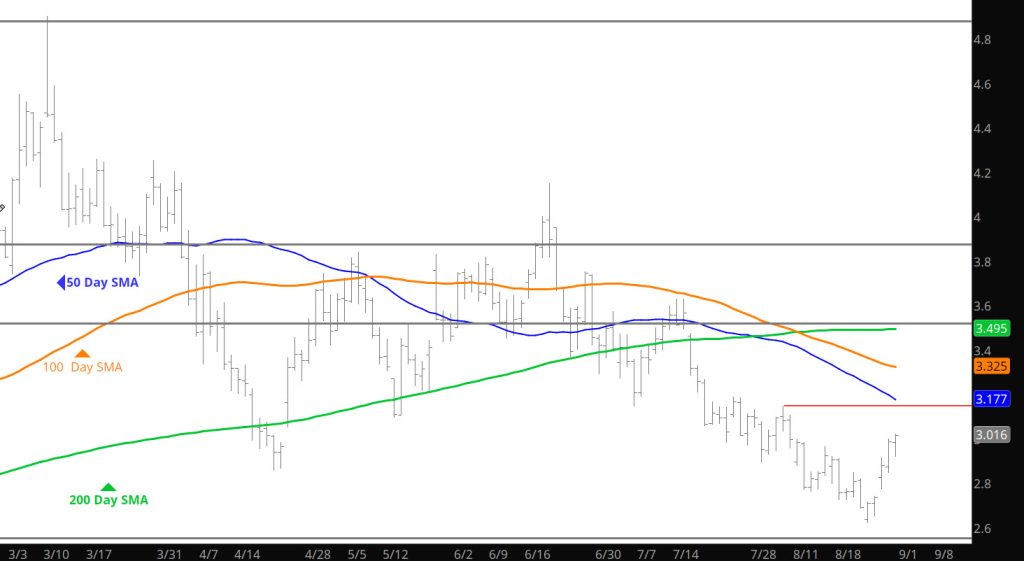

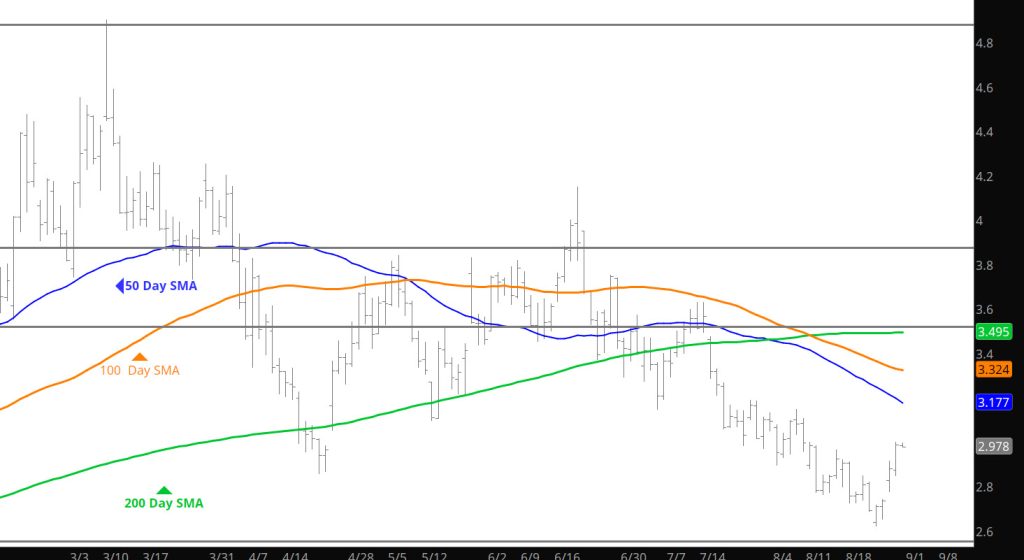

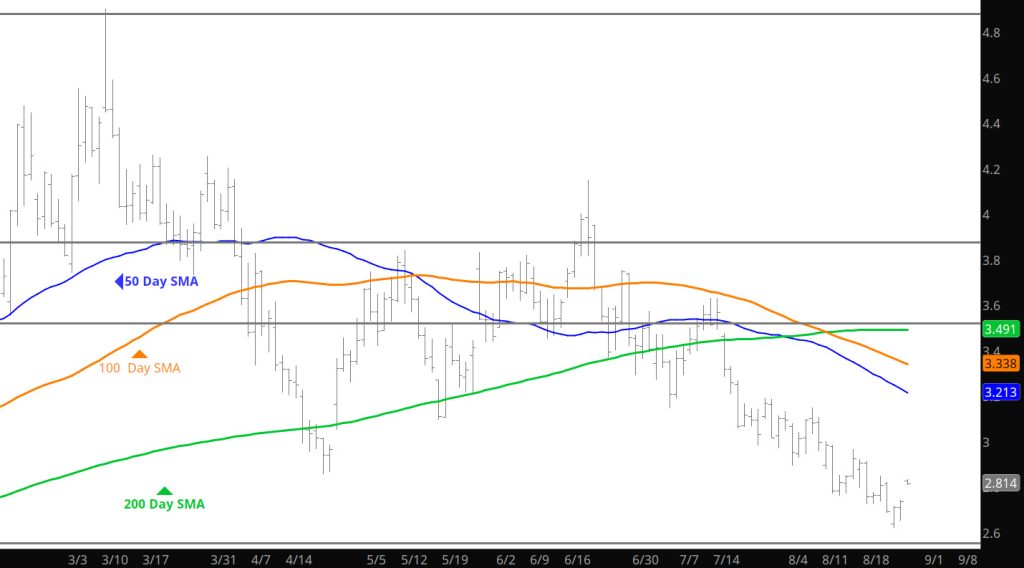

Daily Continuous

Not sure if there will be more volatility today as prices and volume seemed wired in a tight range. Stick to selling premium in this type of environment.

Major Support: $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support :

Major Resistance: $3.061, $3.16, $3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,