Author: Willis Bennett

Weakness On the Weekly Close

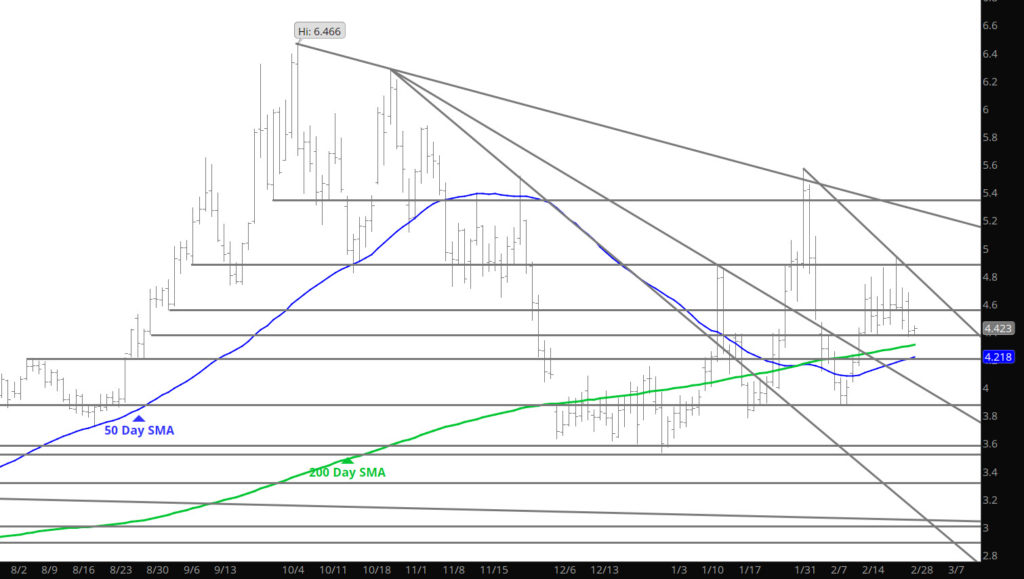

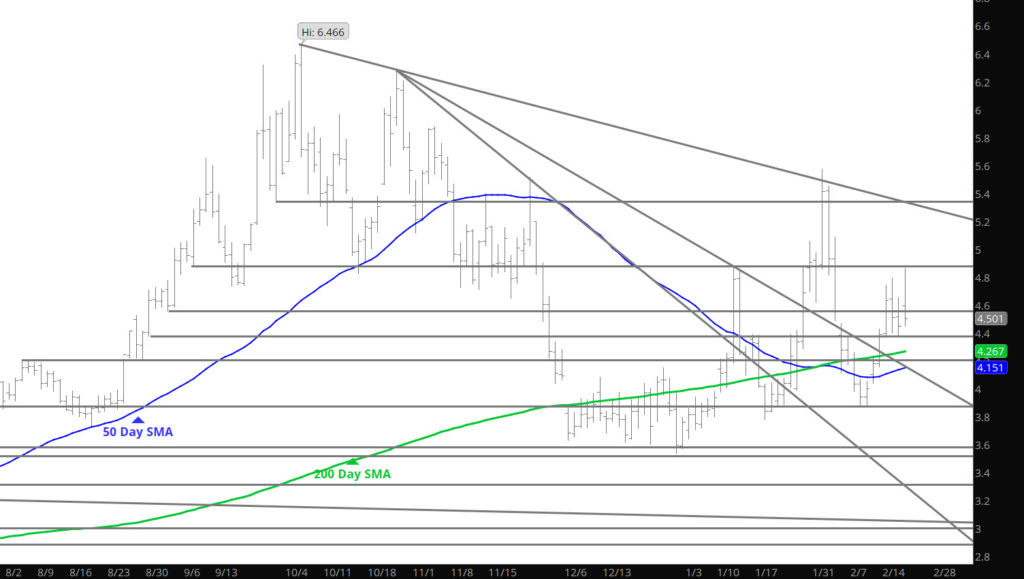

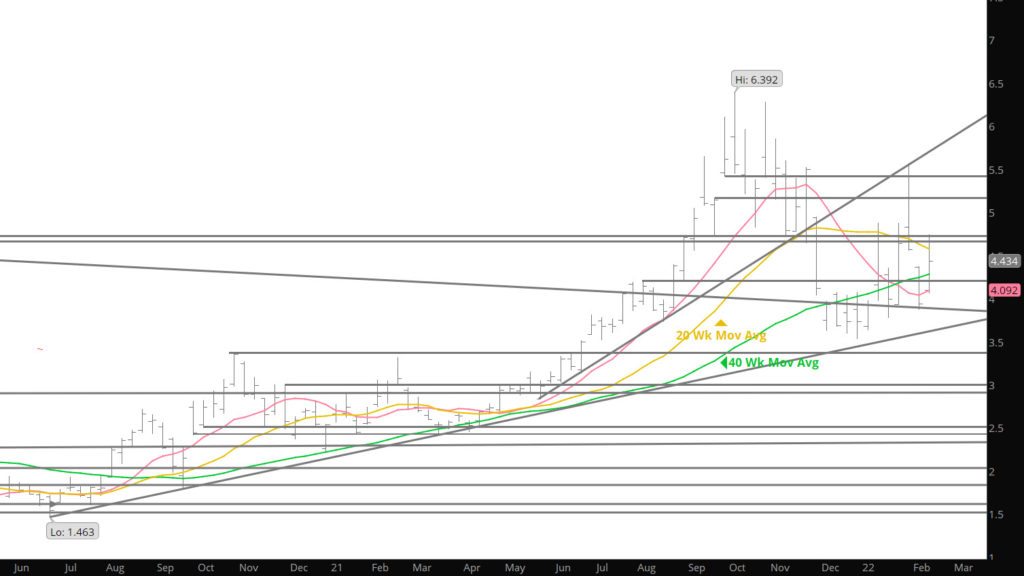

After following the expiring March contract up during the normal (trend for the last year) expiration strength, the April contract gave up much of its gains by the end of Friday. I would expect the declines to continue this week but events in Europe may create an external impact.

Major Support:$4.38, $4.26, $3.972, $3.734, $3.63, $3.584-$3.522

Minor Support: $4.48

Major Resistance:$4.664, $4.735, $4.825 $4.879, $5.088

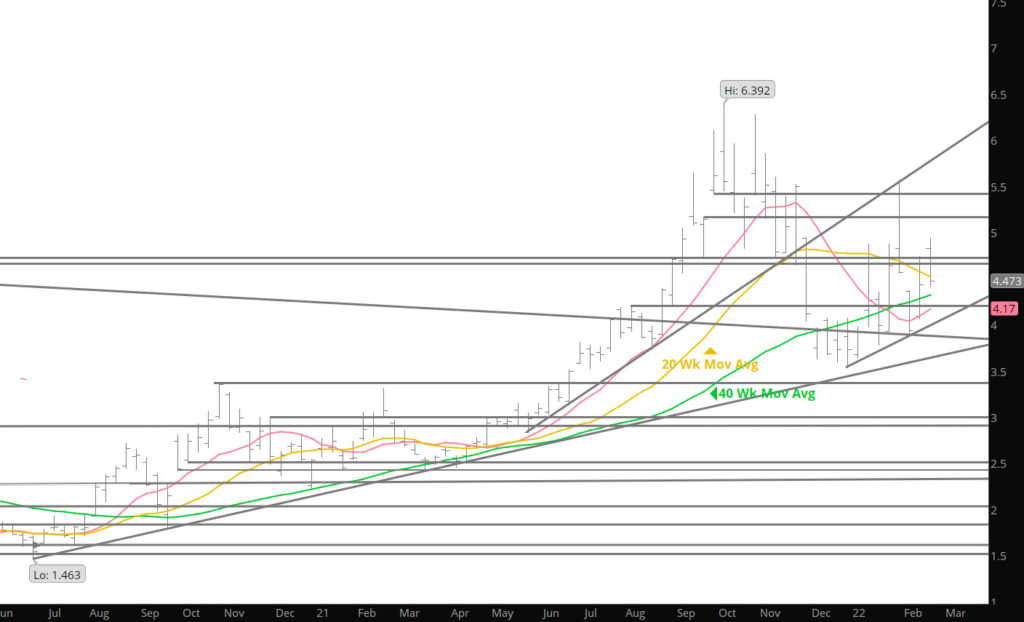

Does April Follow Recent Trends

Expiration Trend Continues

If You Prefer Holding Gains — Sit on Hands

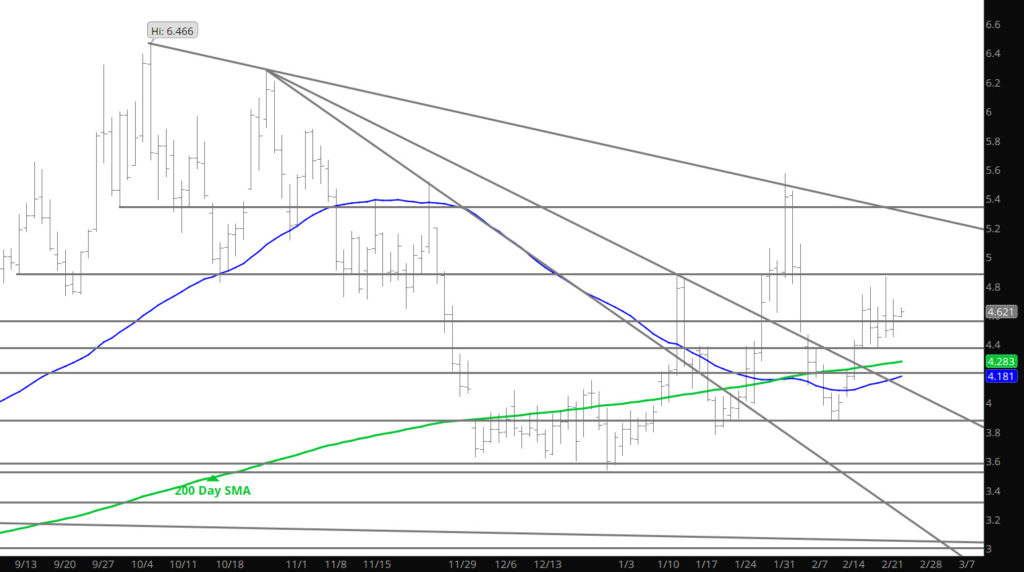

What Happens Next

Expiration Find Strength

March Expires — Think Prices Run?

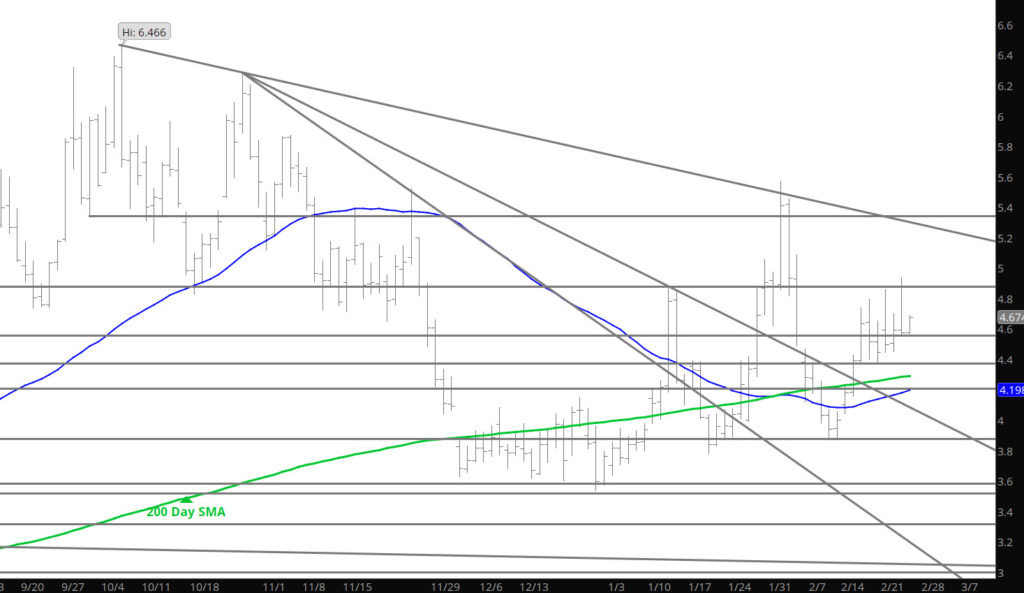

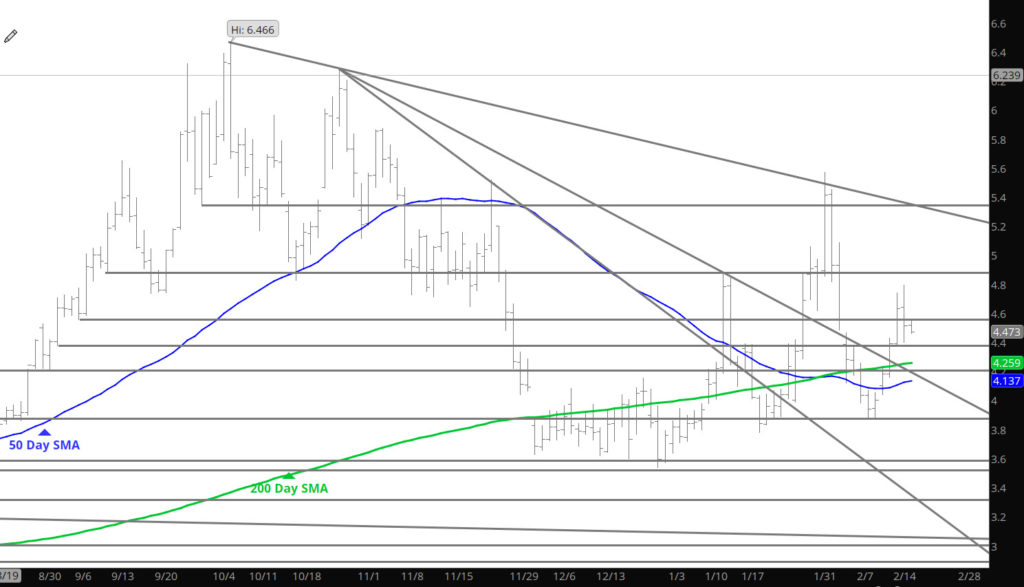

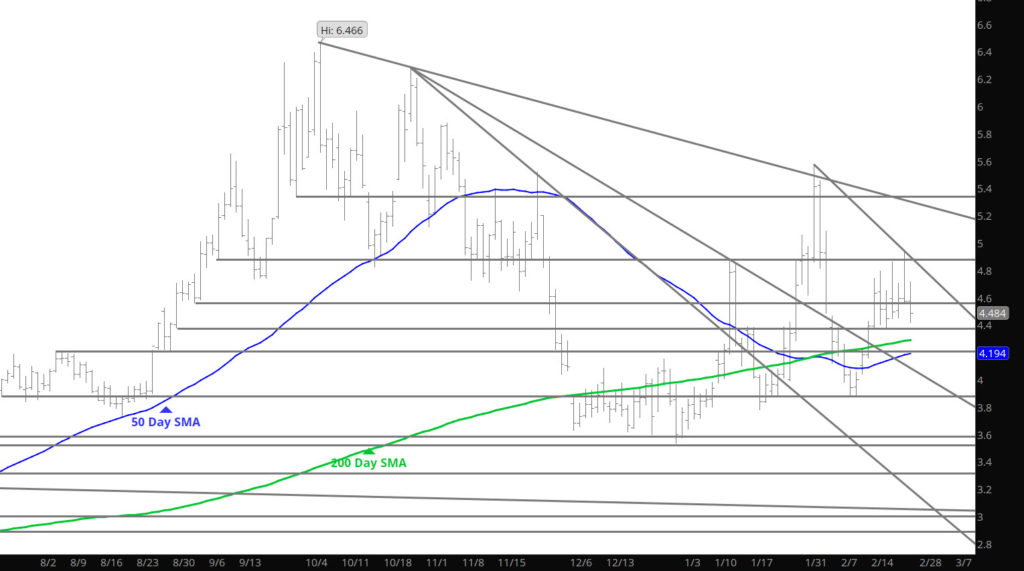

Well– in the light trade of Monday and Sunday night prices already rallied so I guess there is little surprise in the headline. Address the upcoming rally in the Weekly section, and you should reflect on the headline accordingly, but recent history suggests that prices will continue on the run. Perhaps not with the bizarre price run of the last day.

Major Support:$4.38, $4.26, $3.972, $3.734, $3.63, $3.584-$3.522

Minor Support: $4.48

Major Resistance:$4.664, $4.735, $4.825 $4.879, $5.088