Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Change of Pace

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

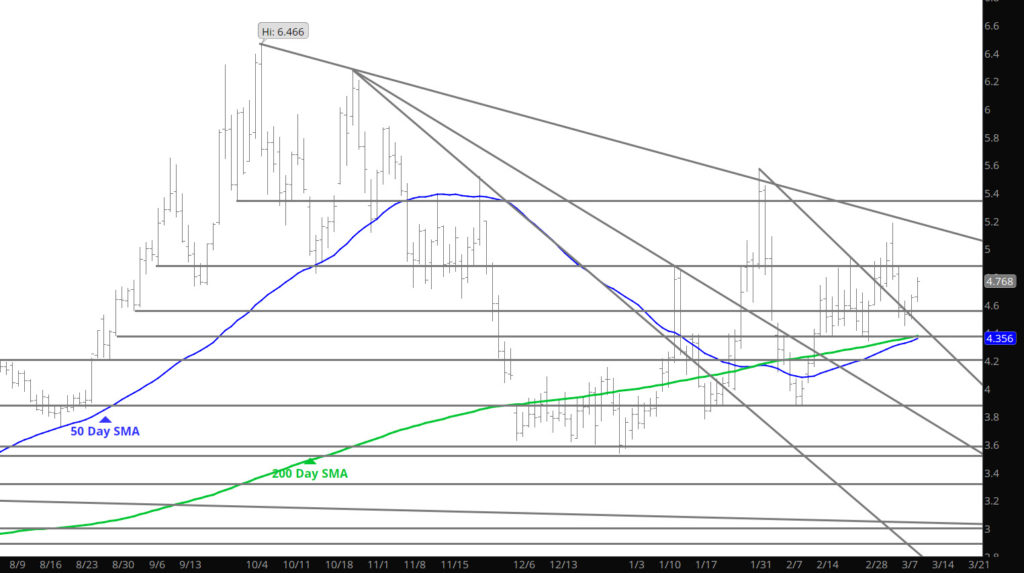

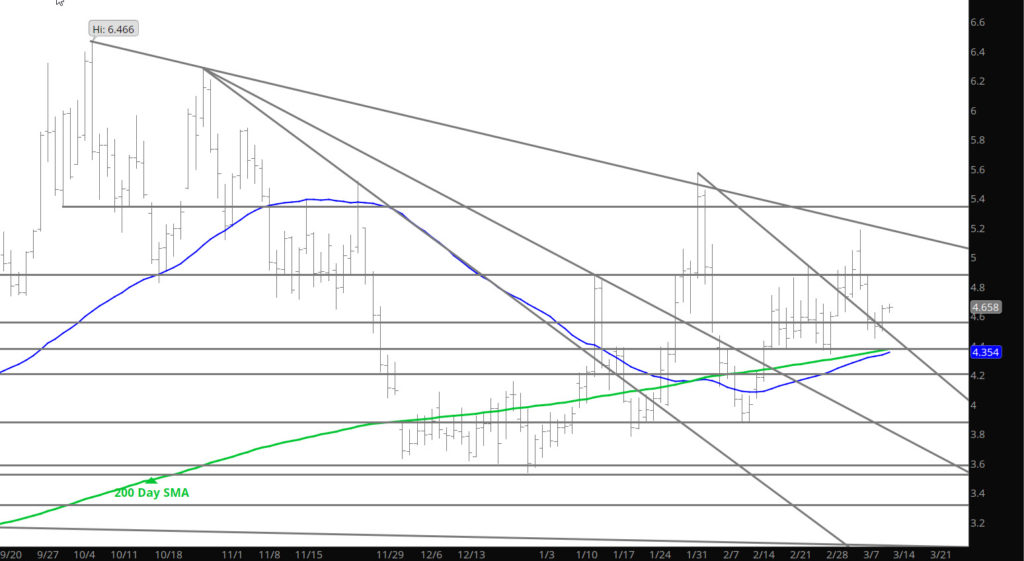

Declines Ran Out of Steam

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Declines Slow to Consolidate

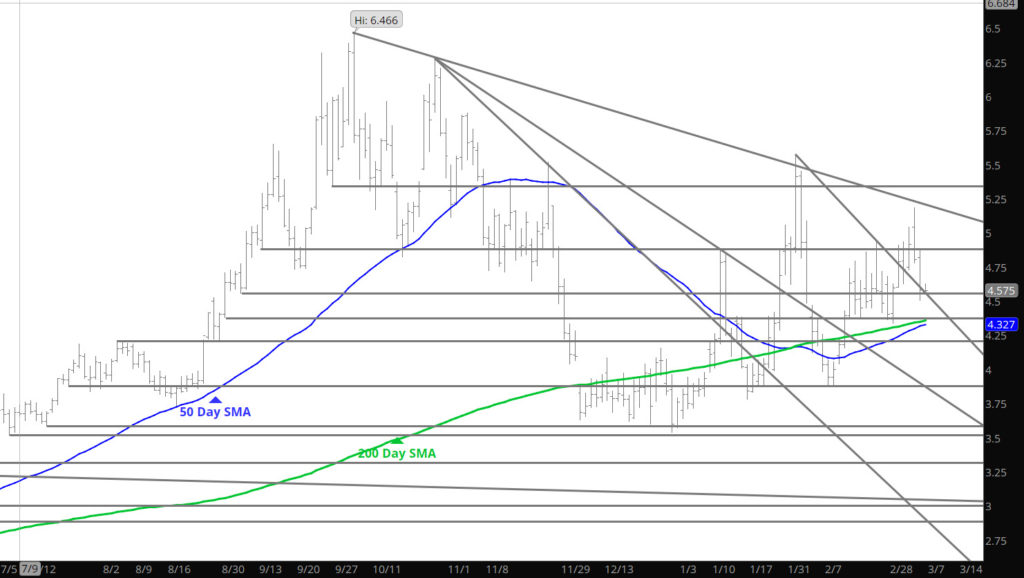

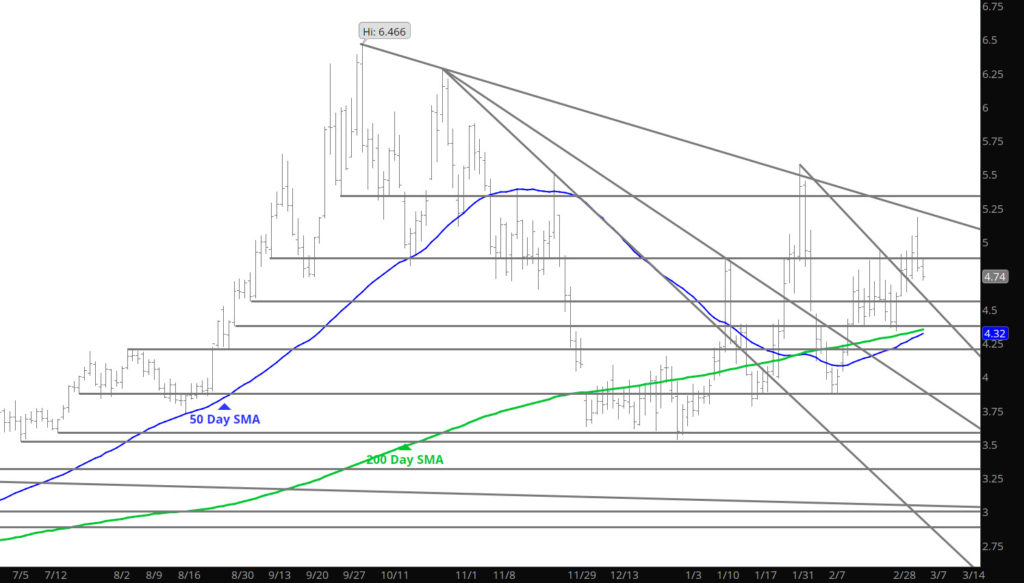

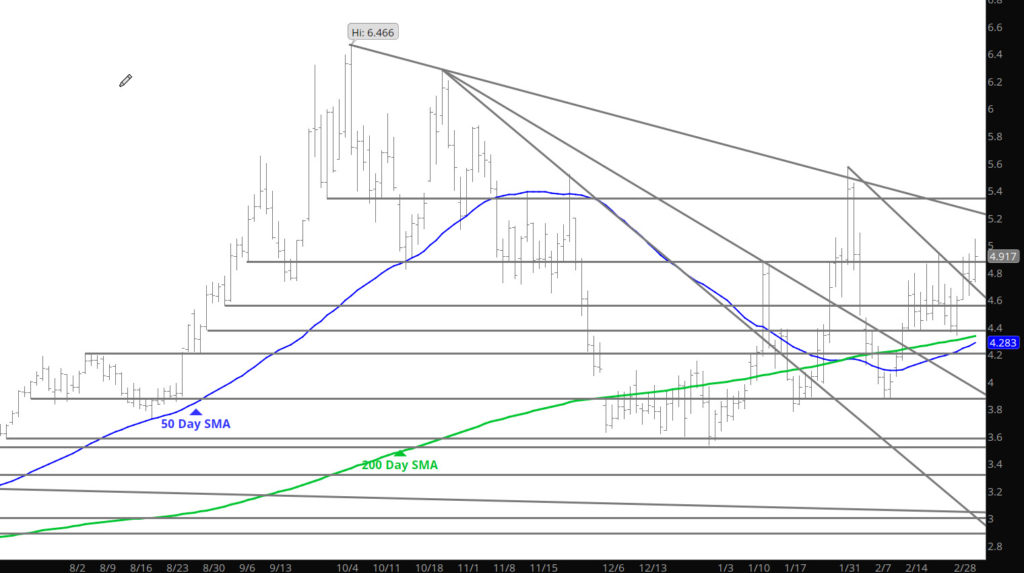

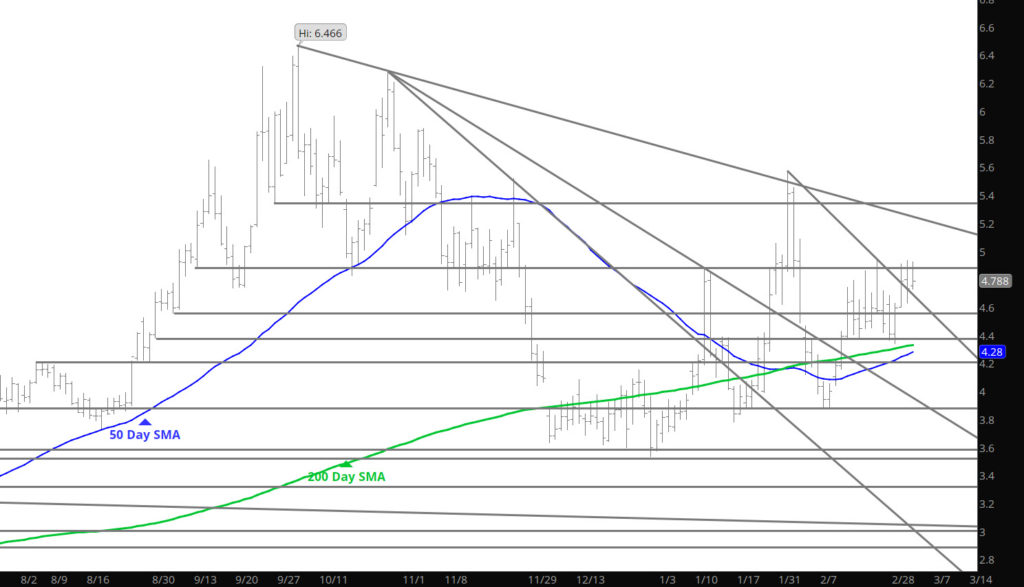

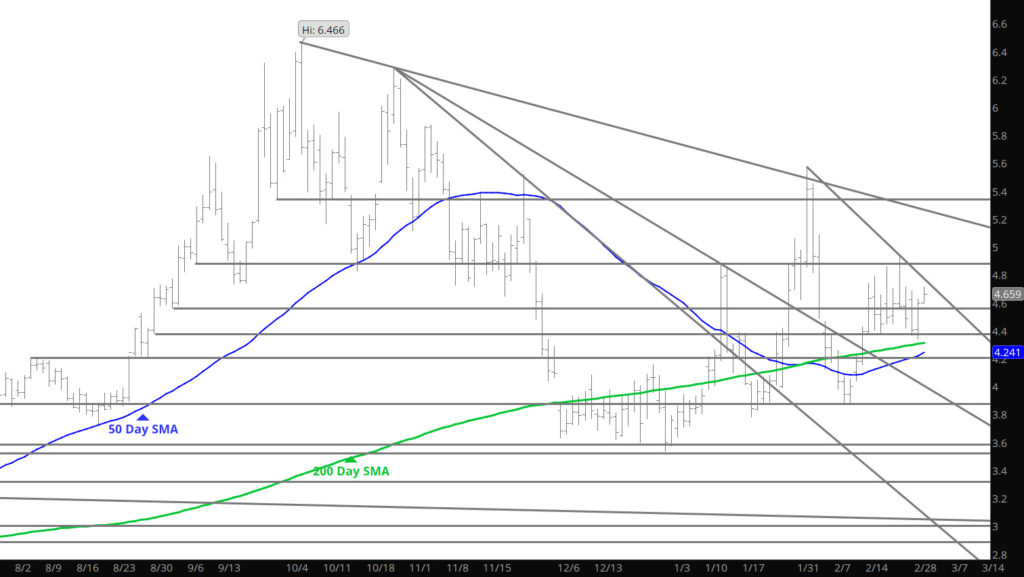

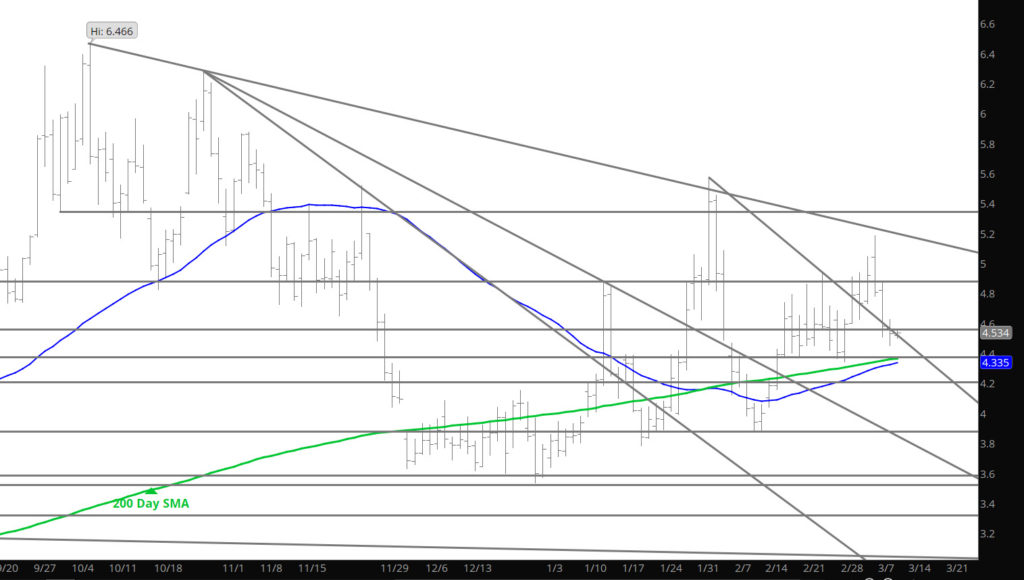

Price action slowed yesterday and while declines extended, the end of the trade day was met with more of a consolidation theme. Continue to expect a decline to test last week’s low at $4.34 (early morning light trade) but I am more interested in the $4.36-$4.40 area as that zone has held support and finding buyers for the last month.

Major Support:$4.38-$4.26, $4.187, $3.972, $3.734, $3.63, $3.584-$3.522

Minor Support: $4.60-$4.557

Major Resistance: $4.82-$4.88, $5.08

Orderly Declines Continue

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

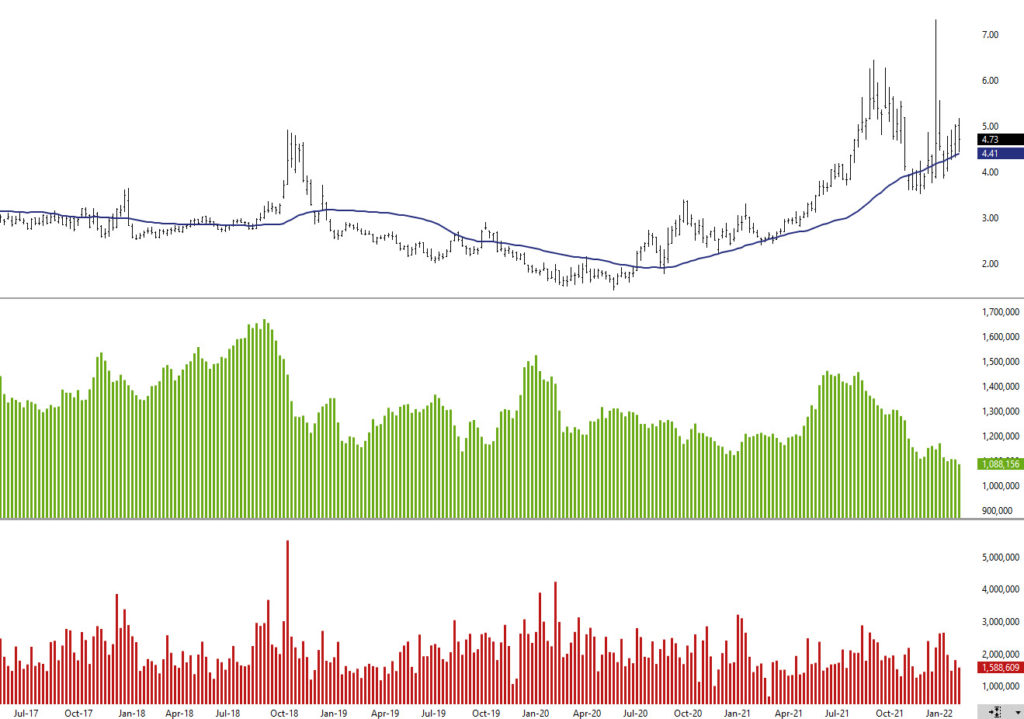

Natural Gas Does Trade on Fundamentals

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

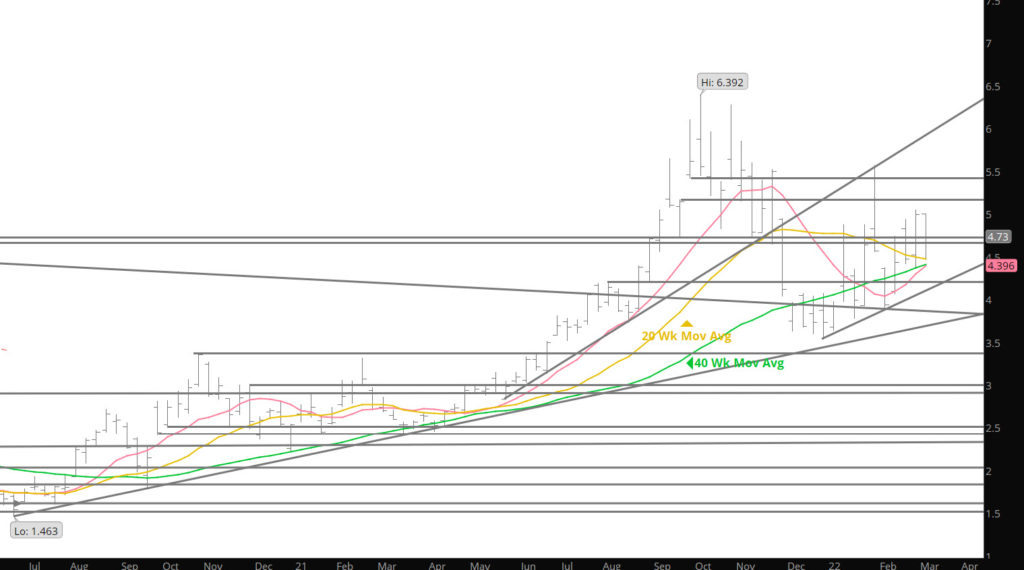

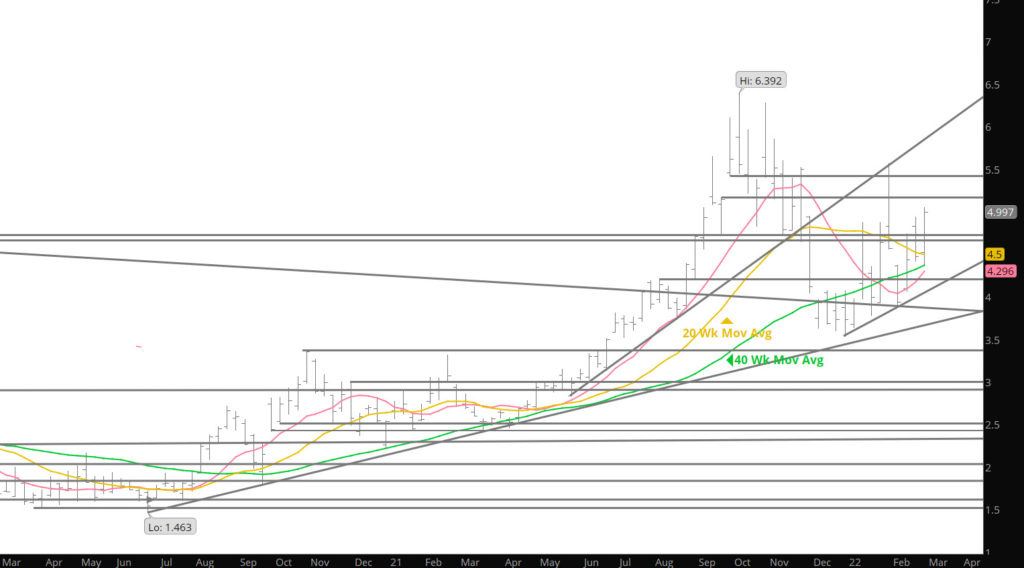

Secular Bull Market Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Sunday Night Runs Continue

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Remain In Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Market Loves Light Trade Periods

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.