Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Keeps Trying

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Is Market Setting Up For Breakout

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Expiration — You Know the History

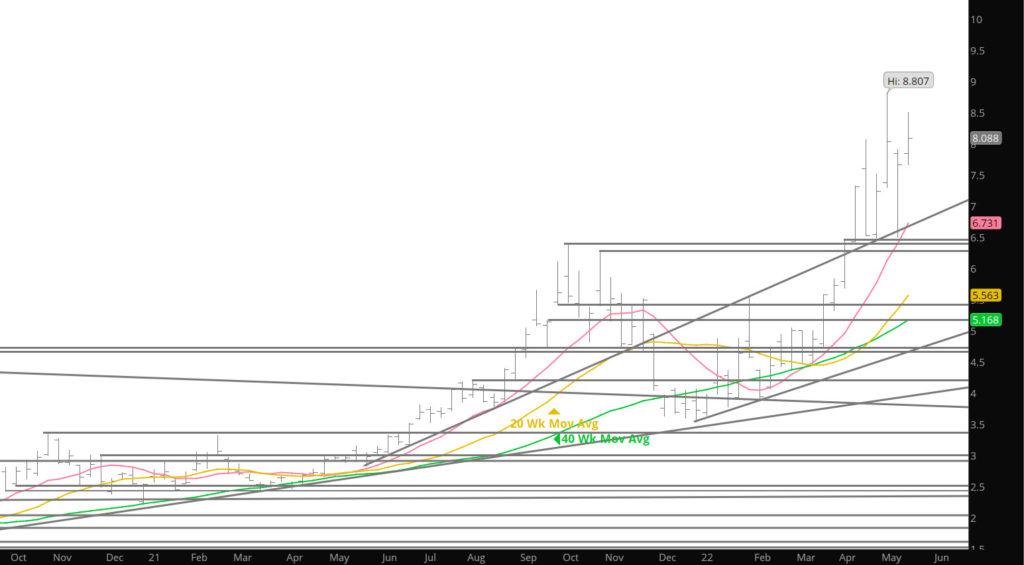

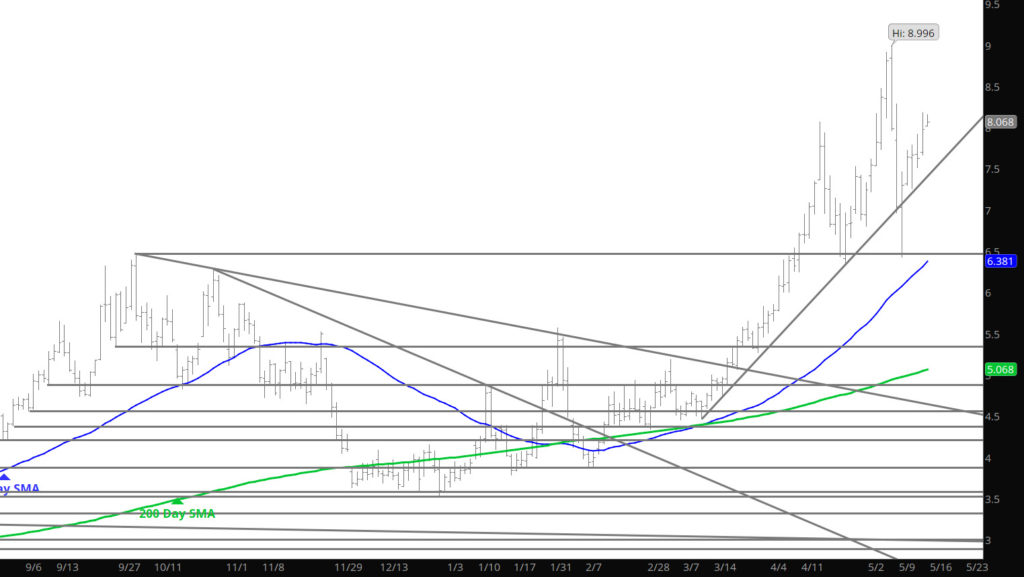

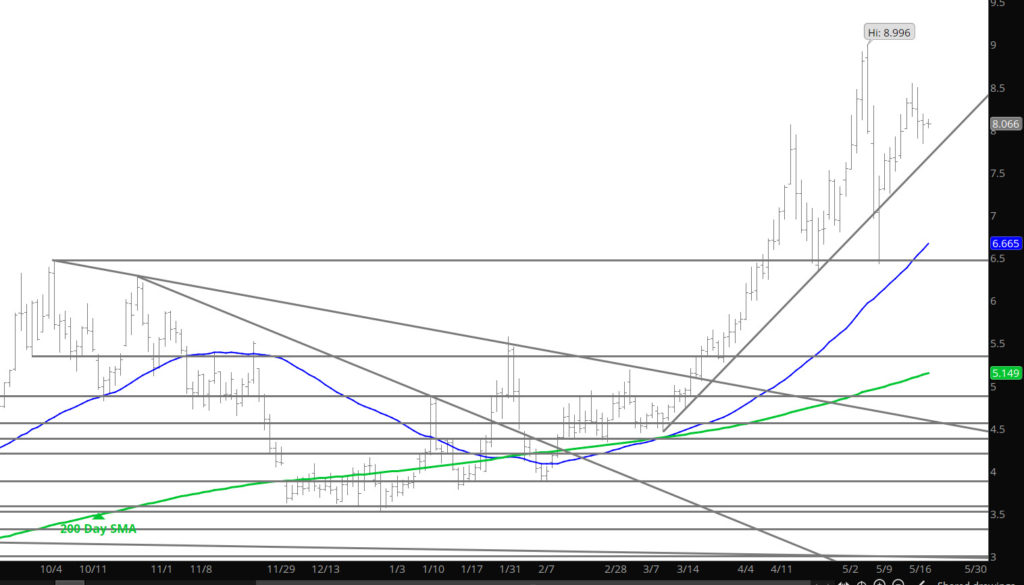

The Sunday night trade was subtle and quiet — what gives. We are headed into expiration of the June contract and we all know what the trend of expiration’s over the last 15 months, perhaps the contract will have a brief extension of the declines from last week, but read the Weekly for more details, as the declines may be limited.

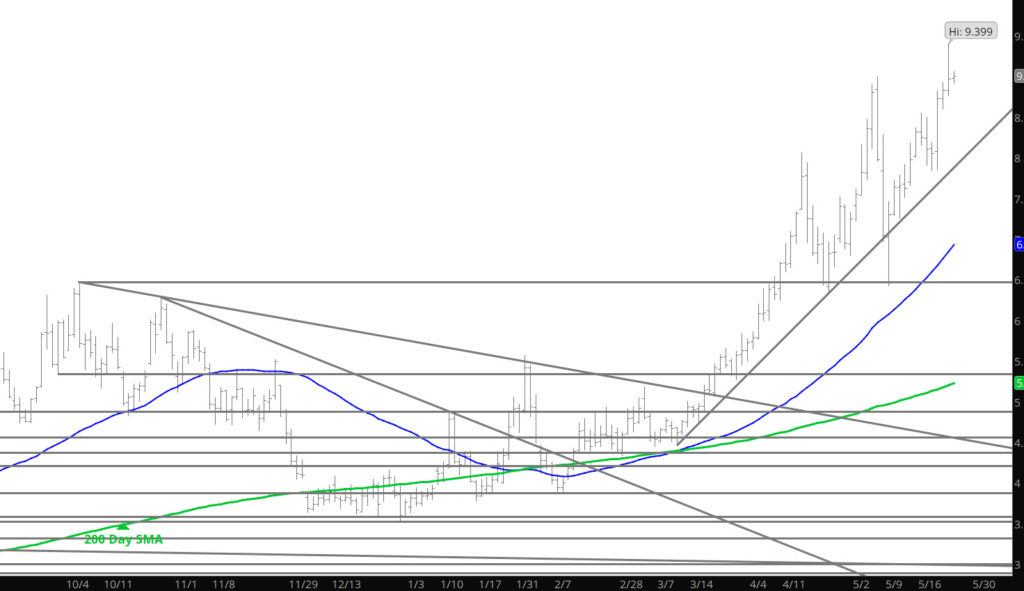

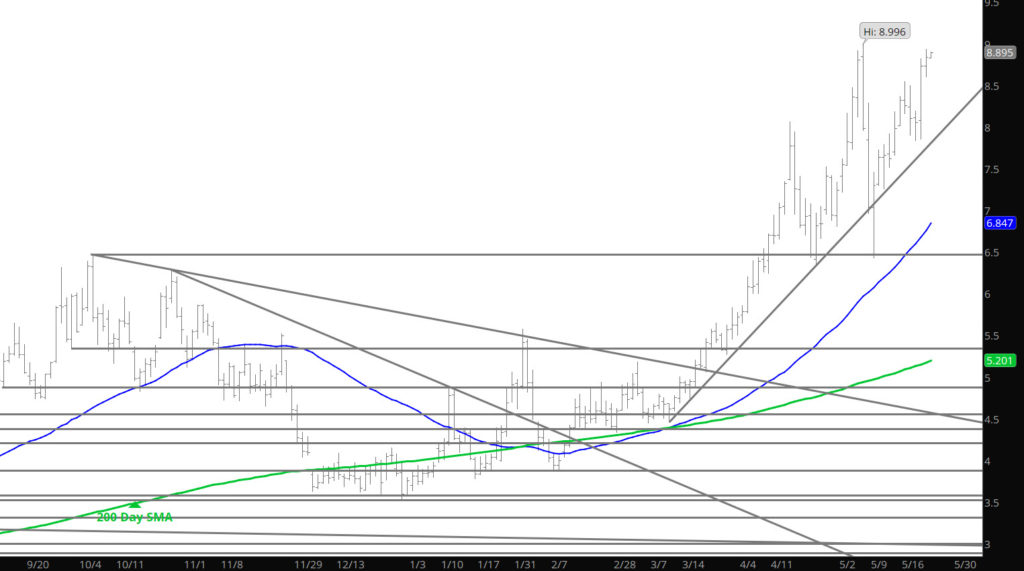

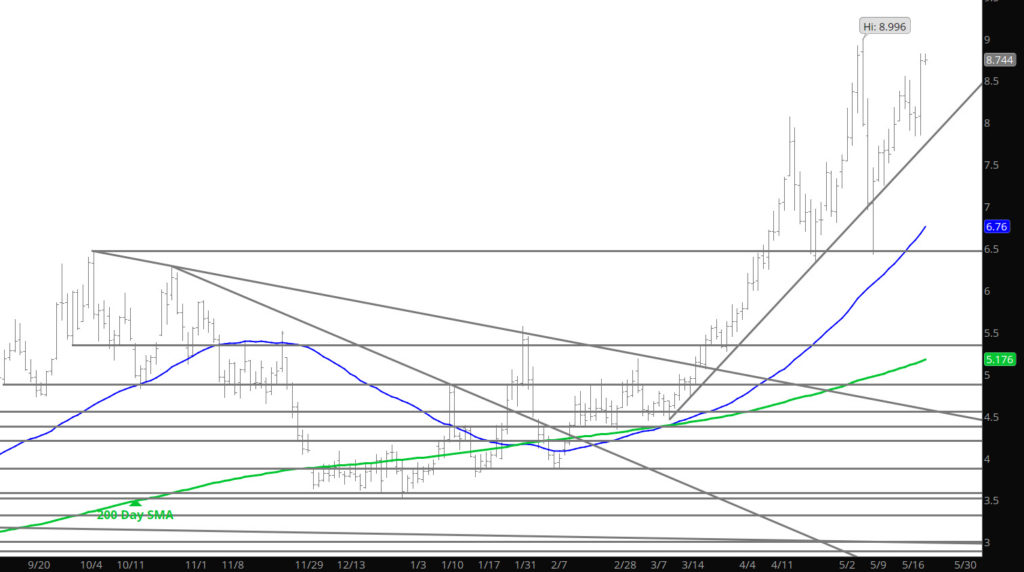

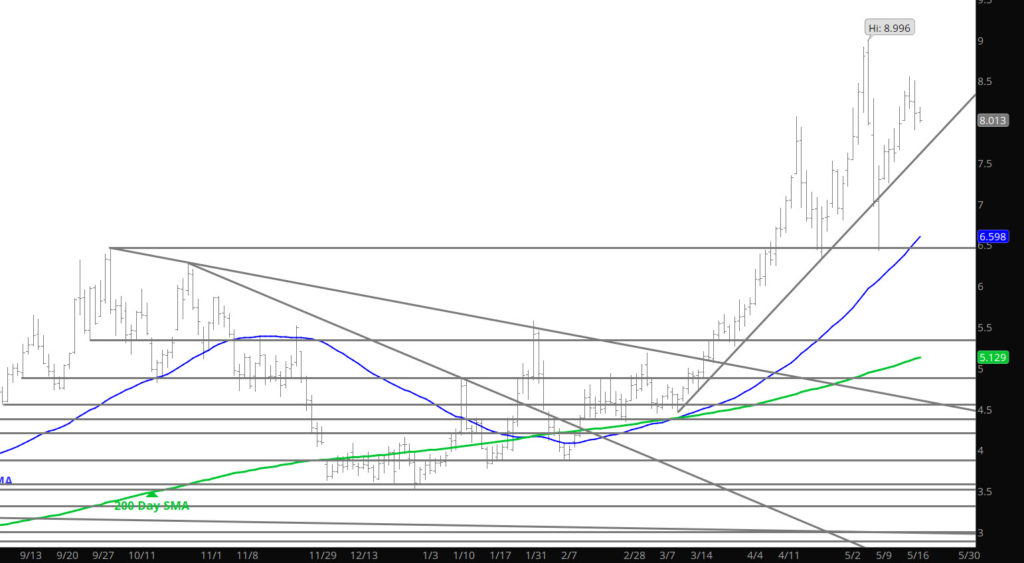

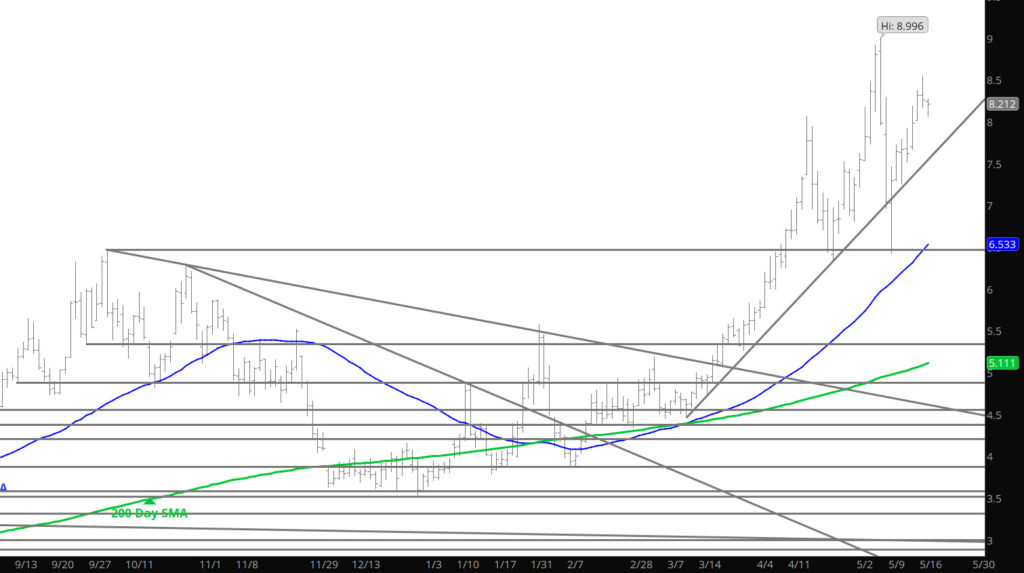

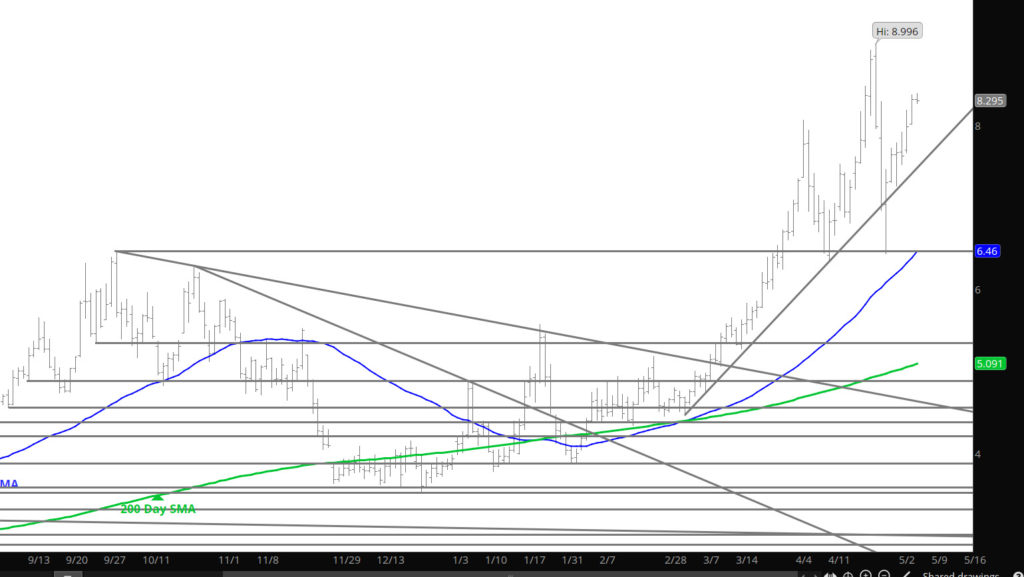

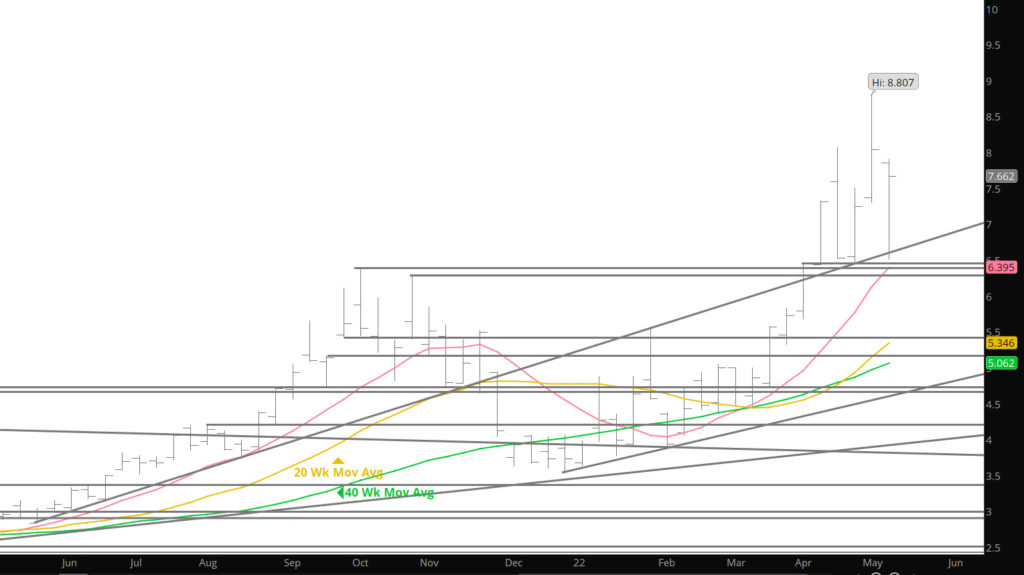

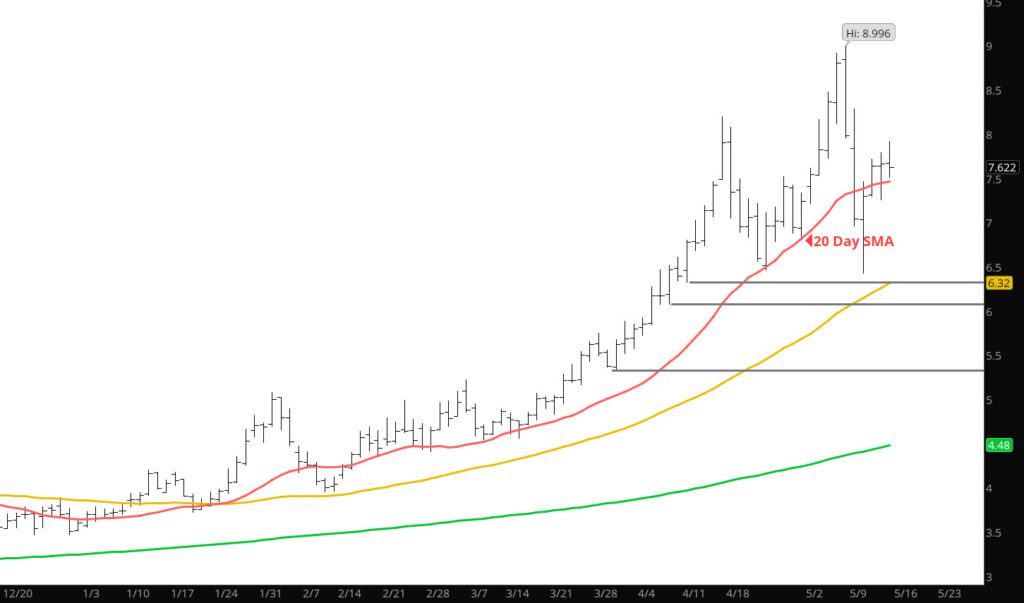

Major Support:$7.663, $7.50., $7.00-$6.855, $6.411-$6.392, $6.247-$6.278, $5.27-$5.199, $5.001, $4.40-$4.26, $4.187

Minor Support: $7.722- $7.69, $6.00, $5.063, $5.04, $4.88, $4.60-$4.557

Major Resistance: $8.197, $8.287, $8.52 $9.60

EOM We All Know the History

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

What’s Happening

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Enjoy

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Grinding Higher

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Silliness Turns Serious

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Divergence Developing and History

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.