Author: Willis Bennett

Interesting Day of Trade

Prices Continue Higher

Support Tested

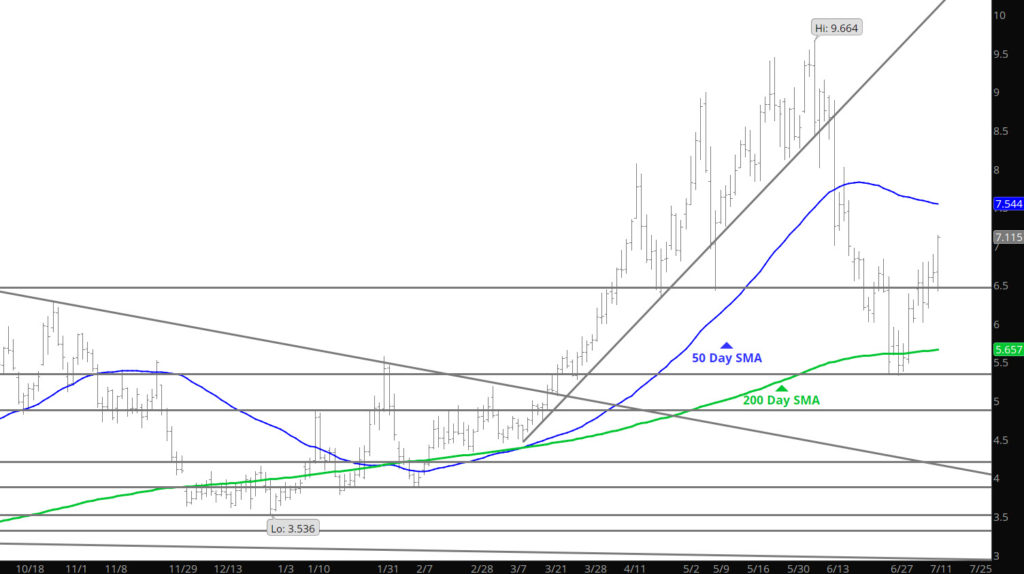

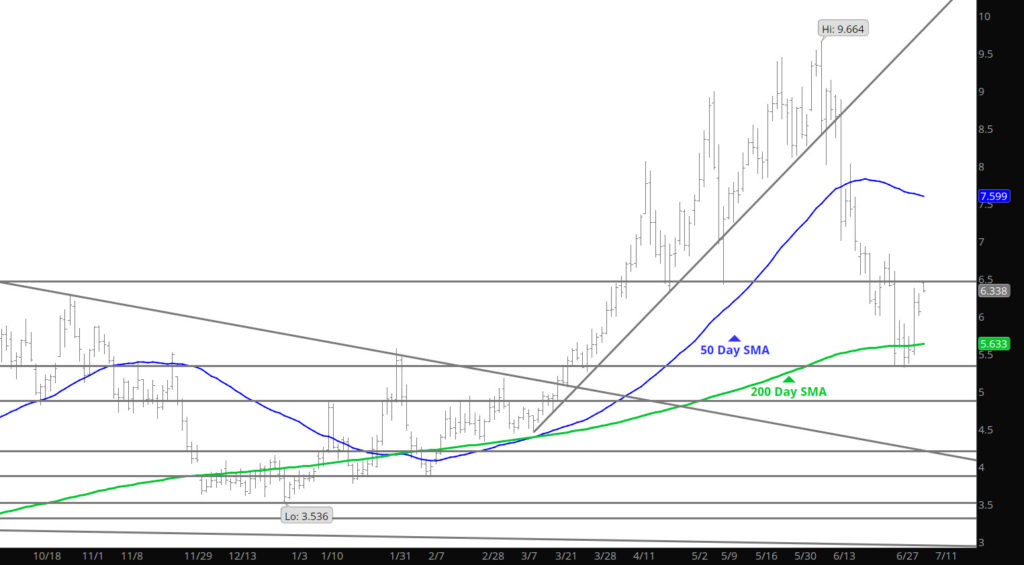

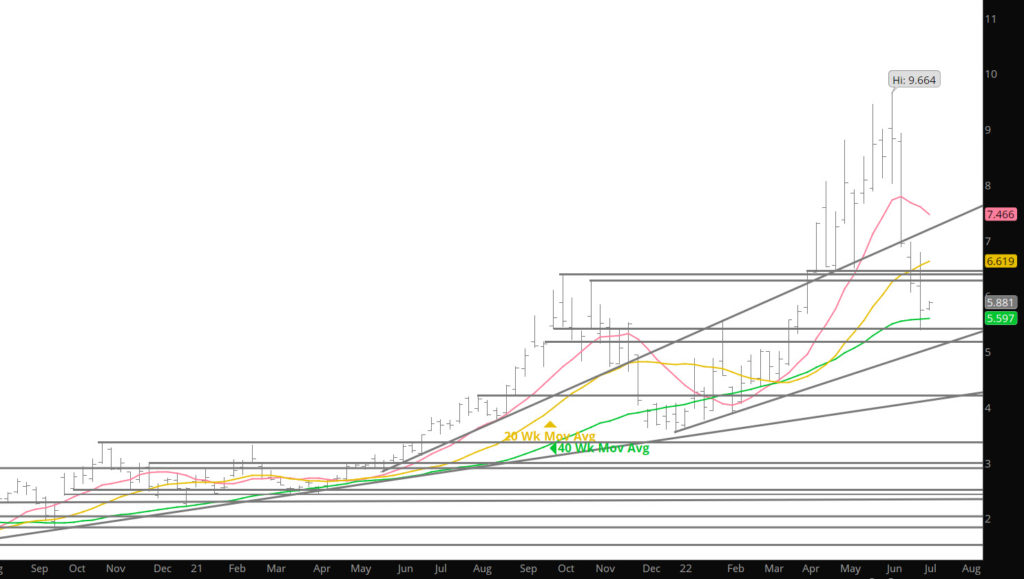

Prices did not rally quite as high as expected but the run failed (as expected) and immediately fell to test support at $6.00. That area has now held in the last three declines trying to break below. Accordingly, this price action should be respected as an area where buyers come in. As discussed previously, the market may be setting up a summer trading range (basically between $5.50 and $7.00) for prompt until the summer heat gets defined and the LNG plant issue becomes clearer. Until then play the market you are given.

Major Support:$6.02, $5.623, $5.59-5.572, $5.06

Minor Support: $5.548, $5.40-$5.45

Major Resistance: $6.34-$6.43, $6.587, $6.638

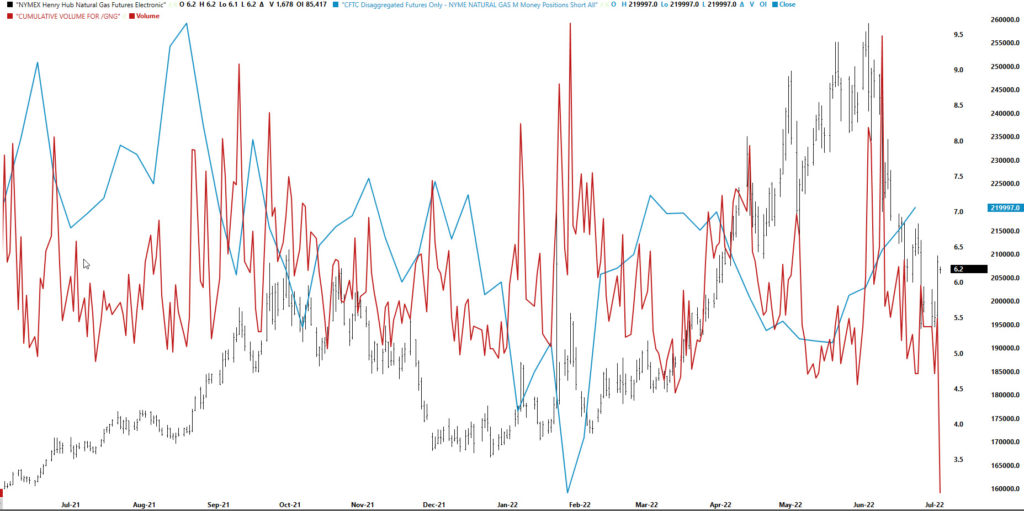

Too Many on One Side

Sunday Night Signals a Rebound

Suggested Rally Commenced

Consolidation Type Trade

An Extension Though Slight

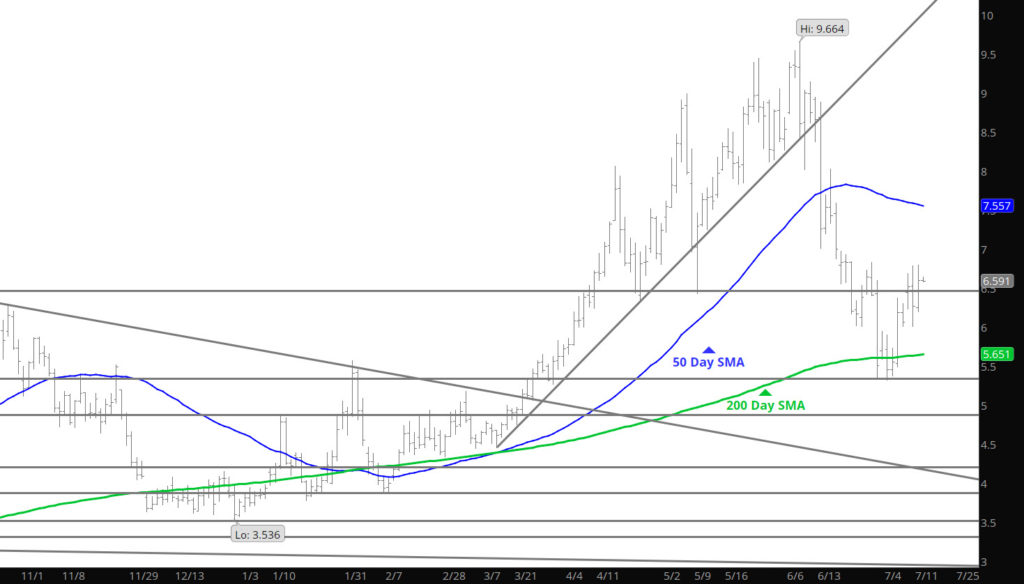

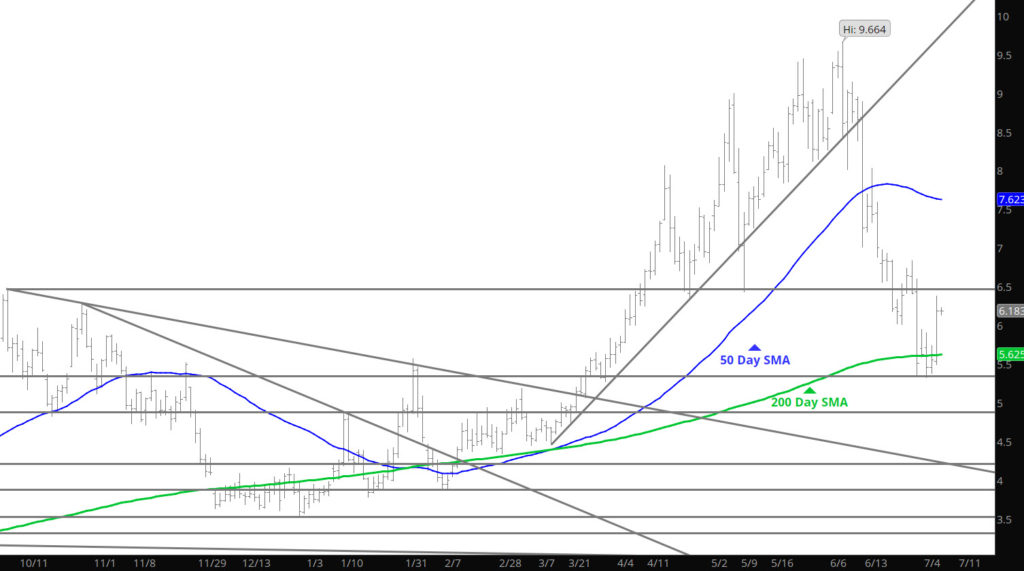

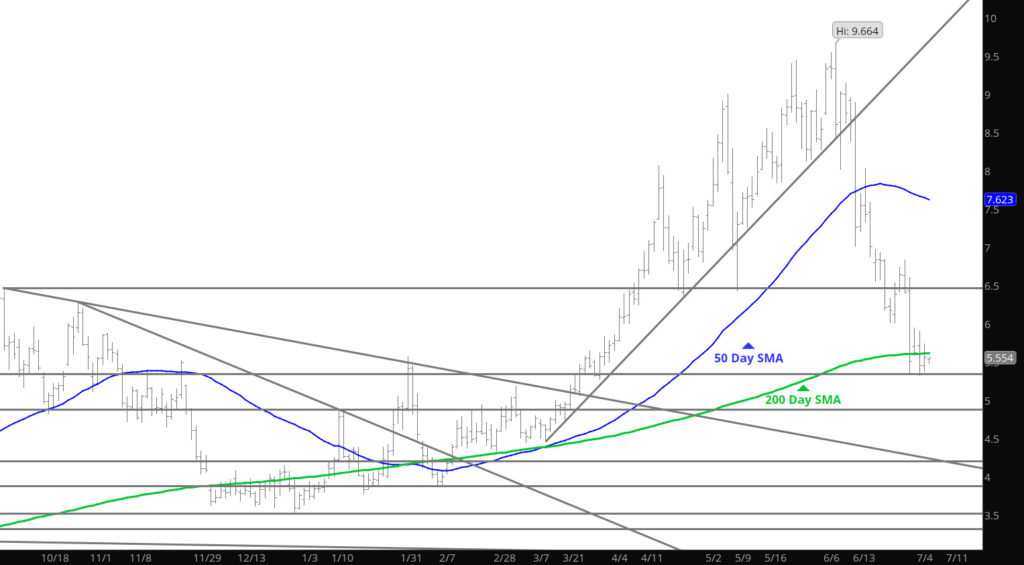

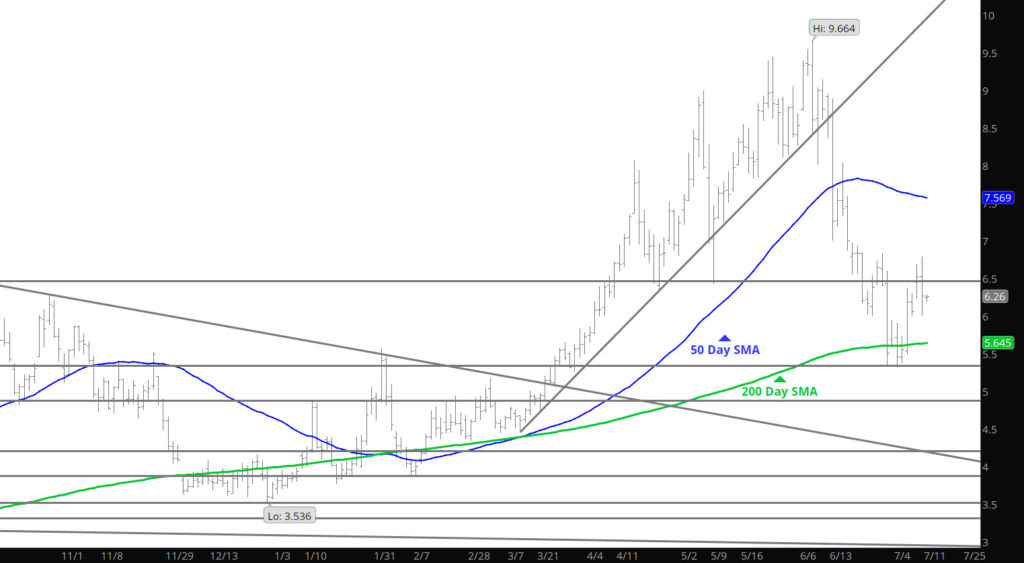

Price challenged the support from last week — just below the 200 day SMA but similar to last week, prices found support and bounced slightly upward. This is a near term support area and would not advise large buying. The market is over sold on numerous technical stand points (mostly daily in focus) and will eventually allow for a significant rally—- eventually. In the meantime it looks to be a sell any rally focus.

Major Support: $5.623, $5.59-5.572

Minor Support: $5.548, $5.40-$5.45

Major Resistance:$6.021, $6.34-$6.43, $6.587, $6.638