Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Seen This Movie Before

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Expect More of the Range Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Some Positive Technical Developments

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Middle of the Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Boring

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Headed North

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Range / Consolidation Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Down to April Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

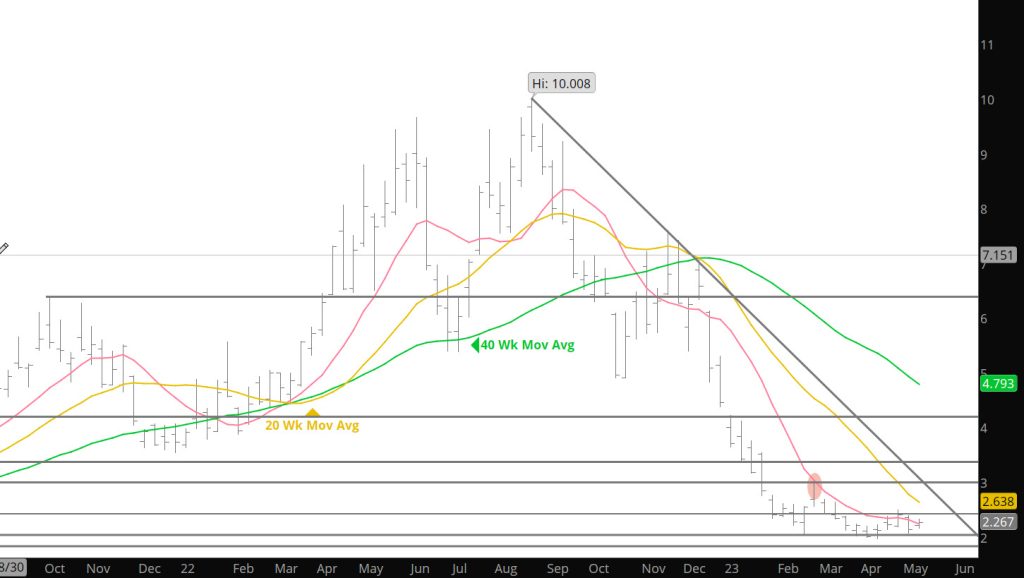

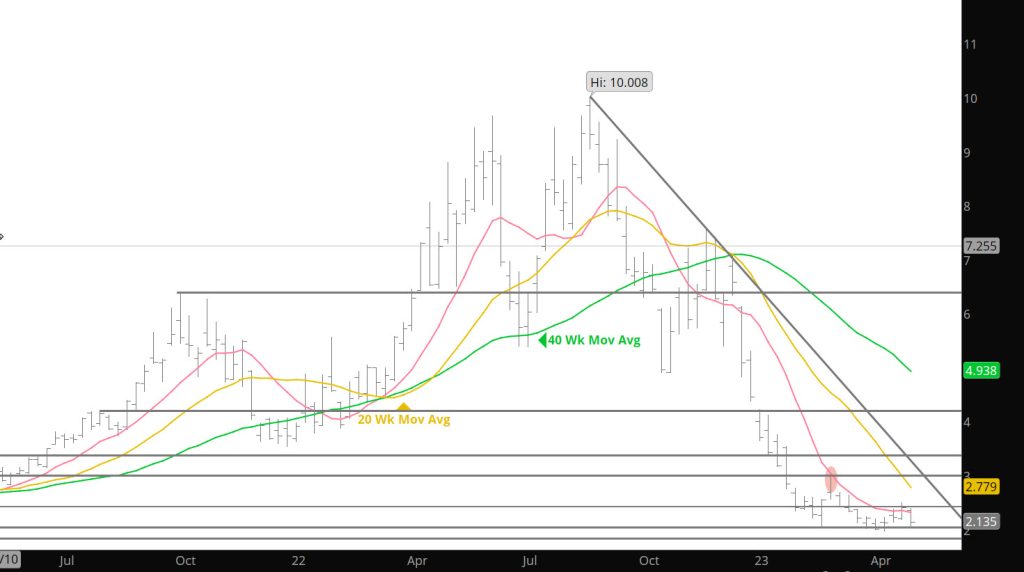

Important Period for Near Term Prices

Good to see the declines continue to test last month’s lows and now the question remains what about $2.00. Been here twice before and further declines will be interesting to watch. Folks in the press attribute the declines to production and recession fears. Not sure about the latter but according to the EIA report yesterday — Dry gas production continues to be strong. Recession issues will be offset by the power demand that was sighted in the Weekly Summary of the Storage report yesterday. We are at the low end of the range– trade accordingly.

Major Support: $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support:

Major Resistance $2.543-$2.604, $2.836, $3.00, $3.536, 3.595