Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Base Building Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Holiday Trade Takes Prices Lower

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Likely A New Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Break Out Somewhat Tempered

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Solid Test Now What

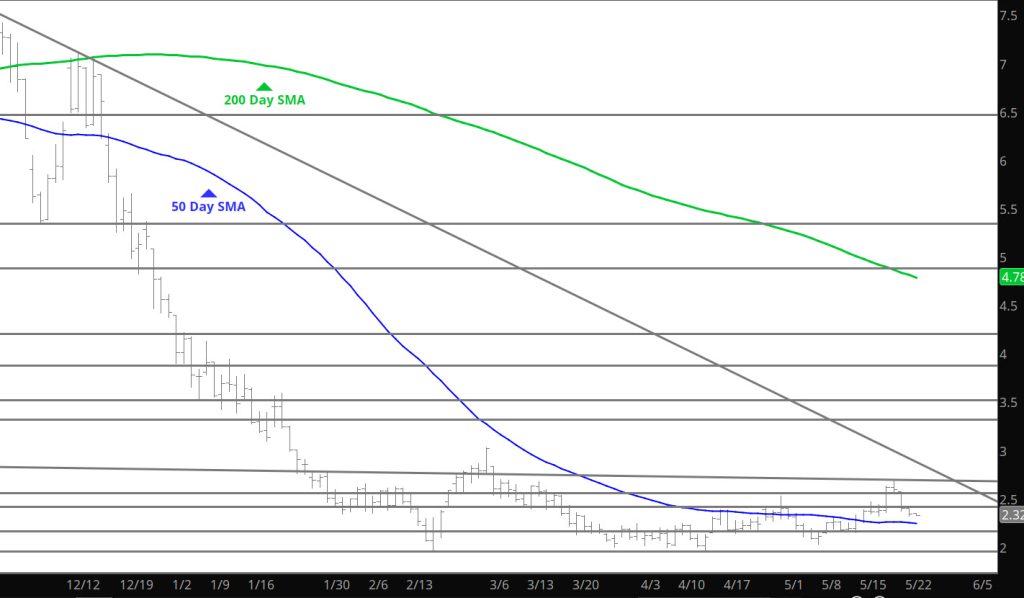

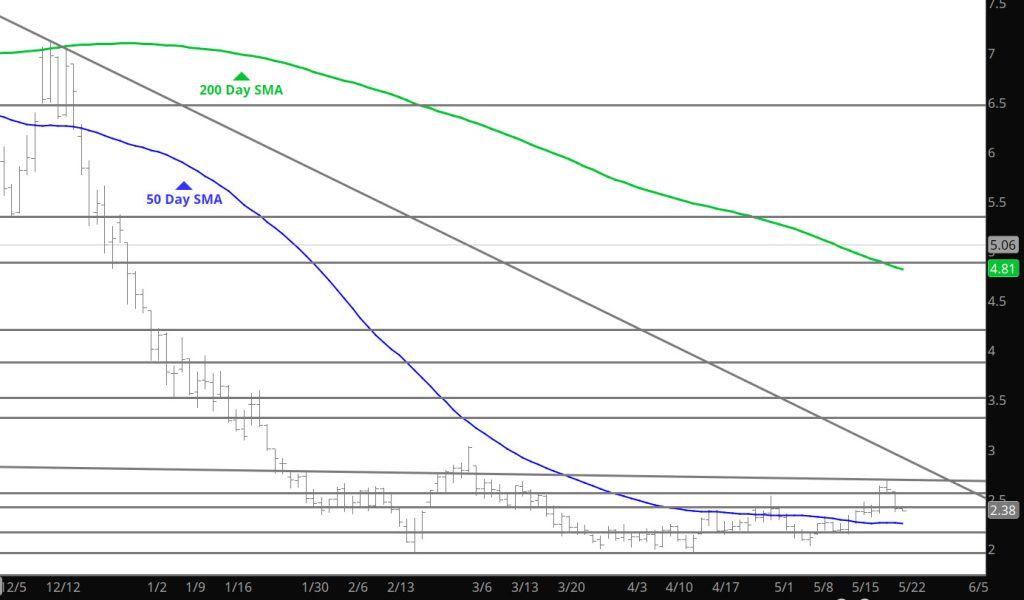

Wanted to see the decline and test now need to see and extension below support or do buyers start to show their heads.

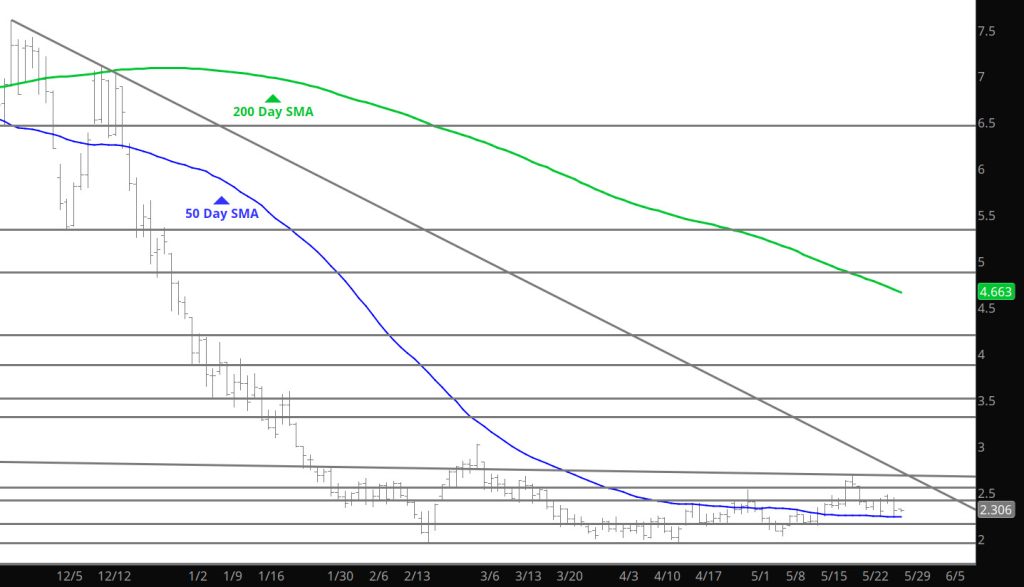

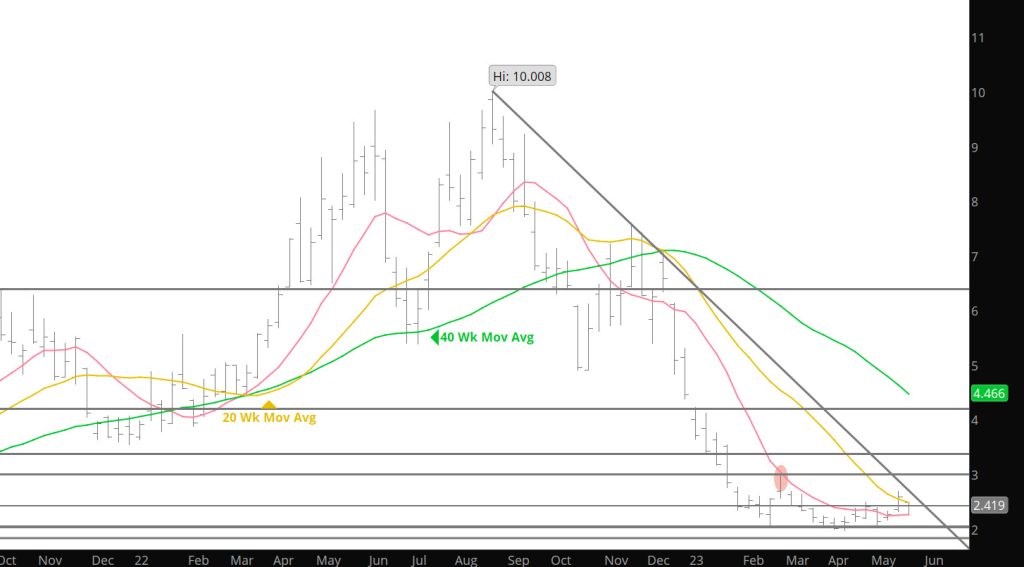

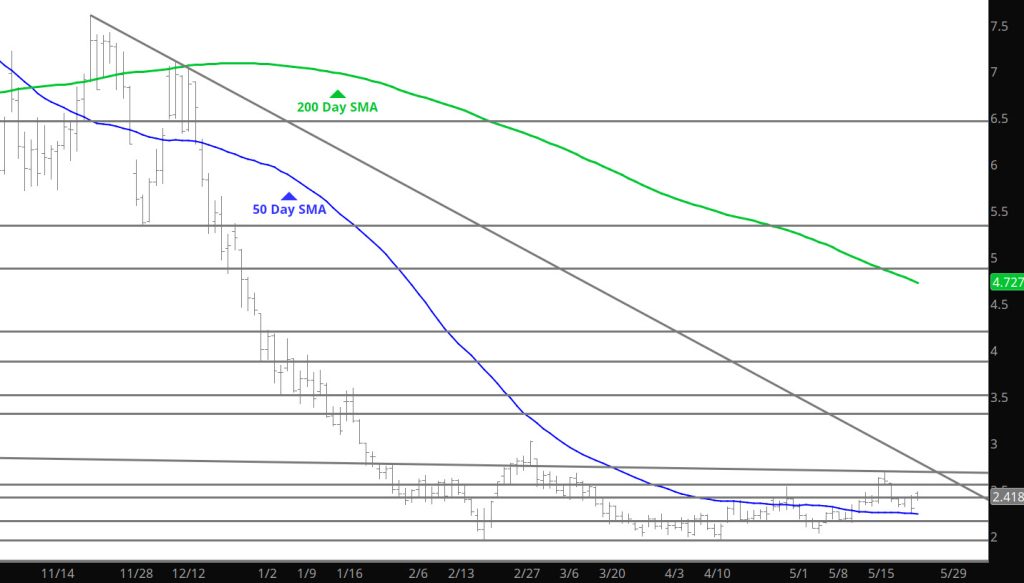

Major Support: $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support: $2.50, $2.36

Major Resistance $2.543-$2.604, $2.836, $3.00, $3.536, 3.595

Want To See Some Support Tests

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

A Breakout For the Bulls

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Break Out to the Upside

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Nothing New

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.