Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

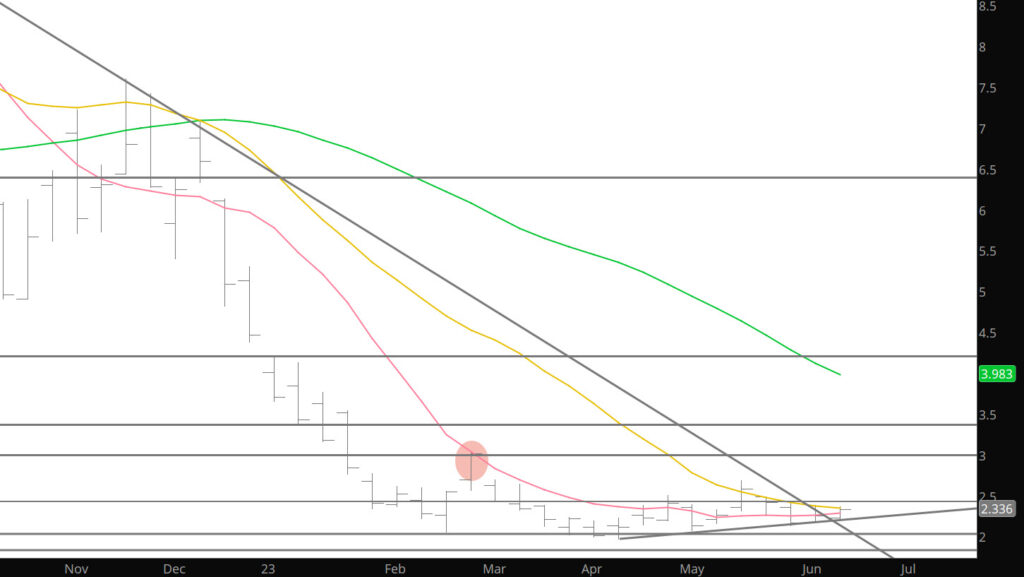

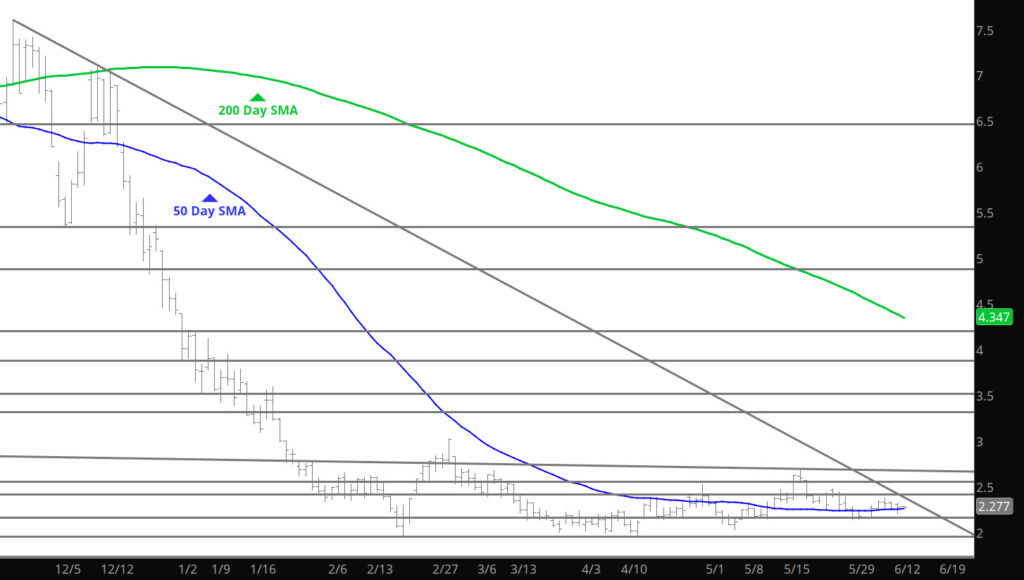

Bias Change Confirmed

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation Confirmed

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Range Starts To Develop

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Test Break Out Zone

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Bias Change

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Short Covering Rally Occurs

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

No Change

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Daily Close Above Declining Trend Line

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Trend Lines Hold

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.