Author: Willis Bennett

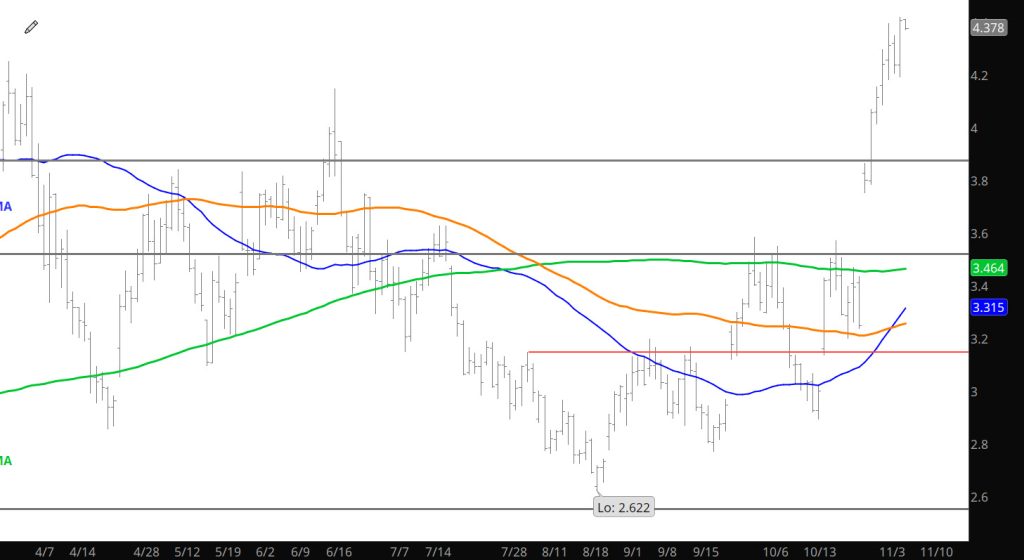

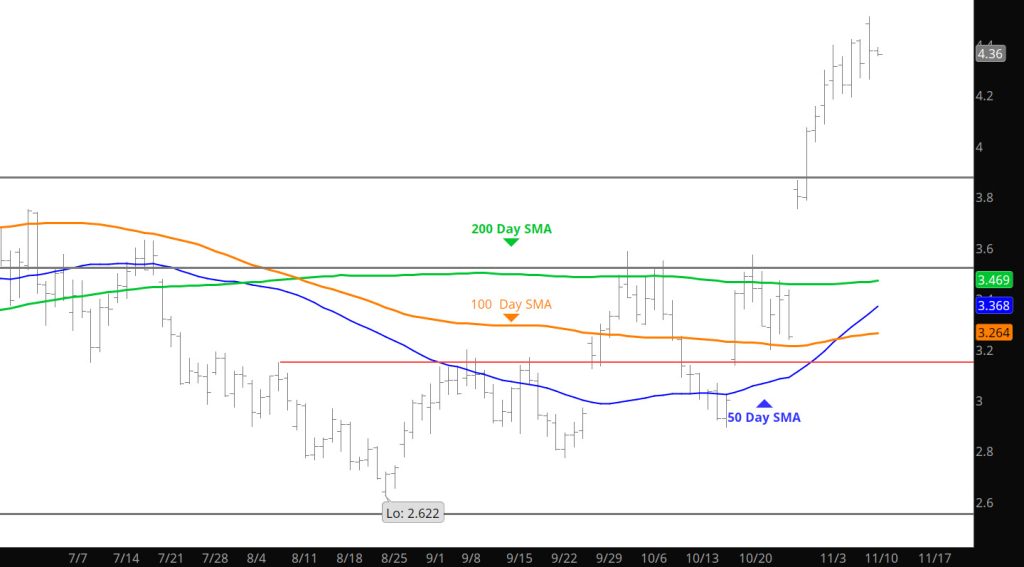

That’s a Solid Test and Rebound

Daily Continuous

Prices seem to want to test the high side of the Nov contract range that has been developing. Positions should hold until existing weather moves on and the storage report is released– watch for a retracement back to the early month lows ($4.20-$4.00).

Major Support: $4.21-$4.139,$4.122,$4.055,

Minor Support : $3.942, $3.75,$3.65

Major Resistance: $4.394, $4.461-$4.475, $4.49-$4.55, $4.901,

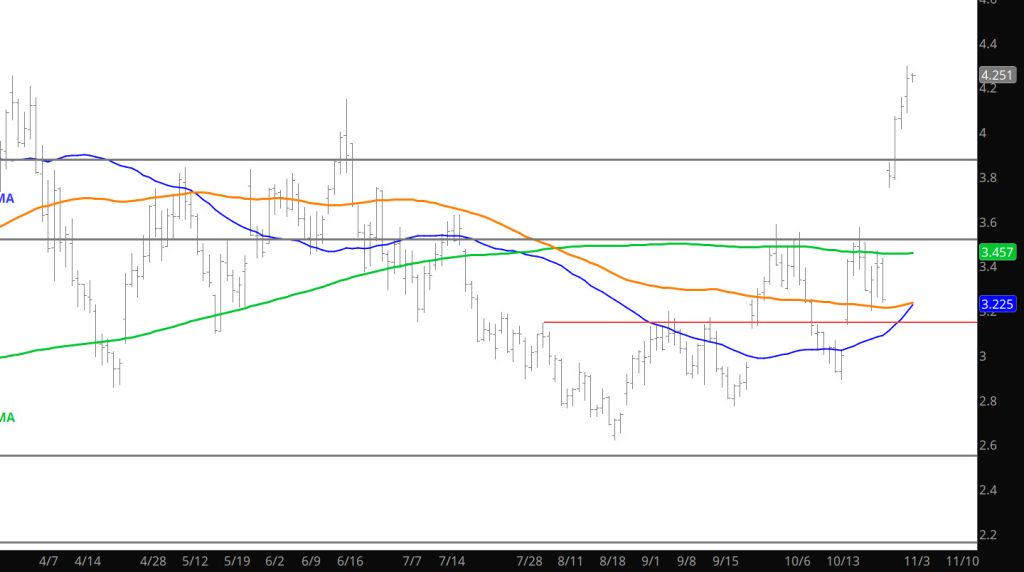

Early Strength Retraces Gains

Daily Continuous

Early strength mentioned in yesterday’s Daily evaporated quickly as the full market opened and forces prices down. Expected, per the Weekly and Daily sections, weakness was expected from the over bought level of the market. Not convinced that the retracement is finished– if you are buying be patient–if you are selling be opportunistic.

Major Support: $4.21-$4.139,$4.122,$4.055,

Minor Support : $3.942, $3.75,$3.65

Major Resistance: $4.394, $4.461-$4.475, $$4.901,

Short Covering Fuels Some of Run

Sunday Trade Starts Strong

Tight Range Continues

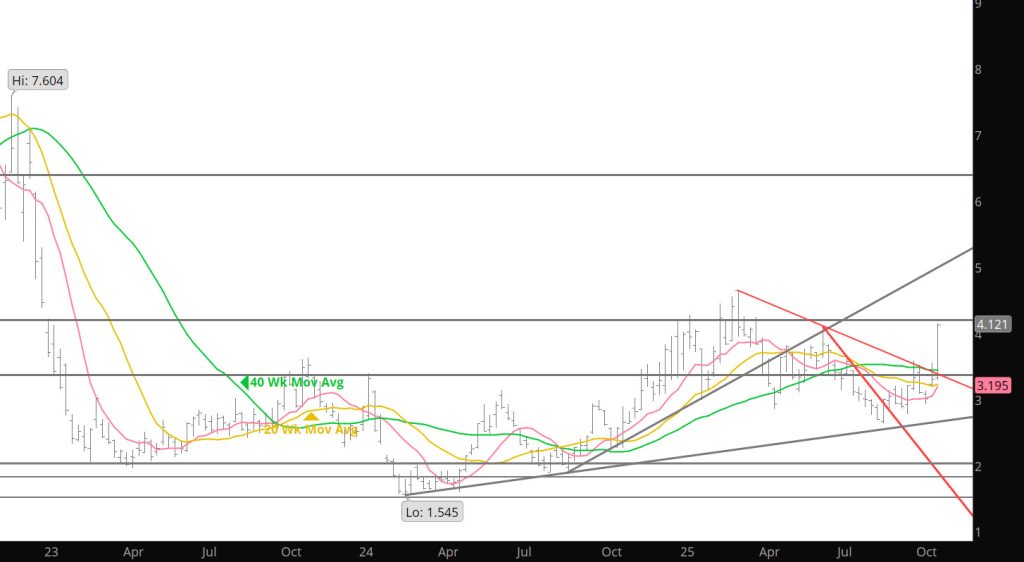

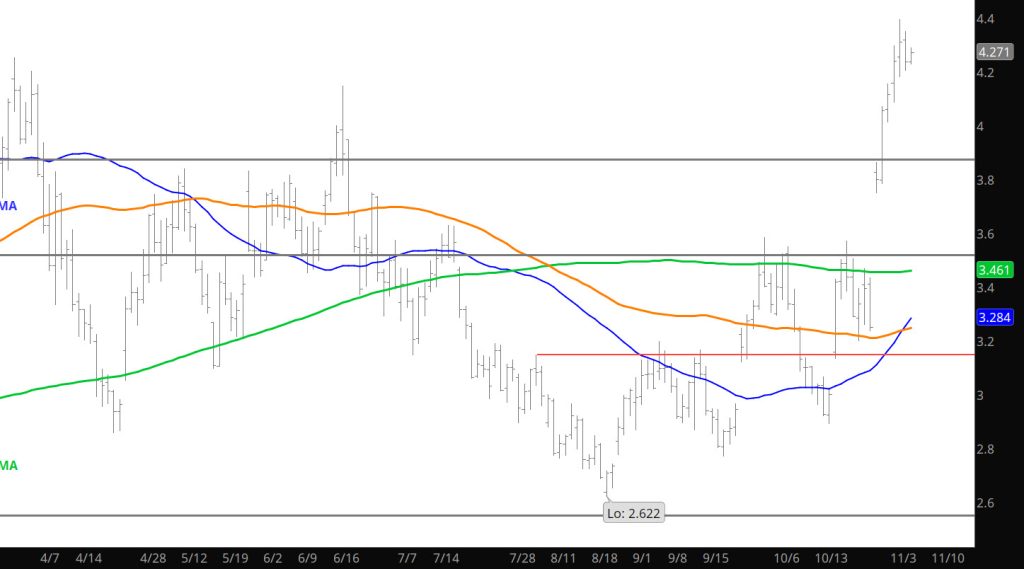

Looks Like Some Calmness With Consolidation

Daily Continuous

Price action is holding firm with some tight daily ranges which signals a lack of commitment from the masses. Today may provide additional information on the the near term bias. While the break above $4.00 provided some income in the last week, the storage report will determine the future action in the next week.

Major Support: $3.06, $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support : $4.16, $4.08, $3.16

Major Resistance: $4.373, $4.461,