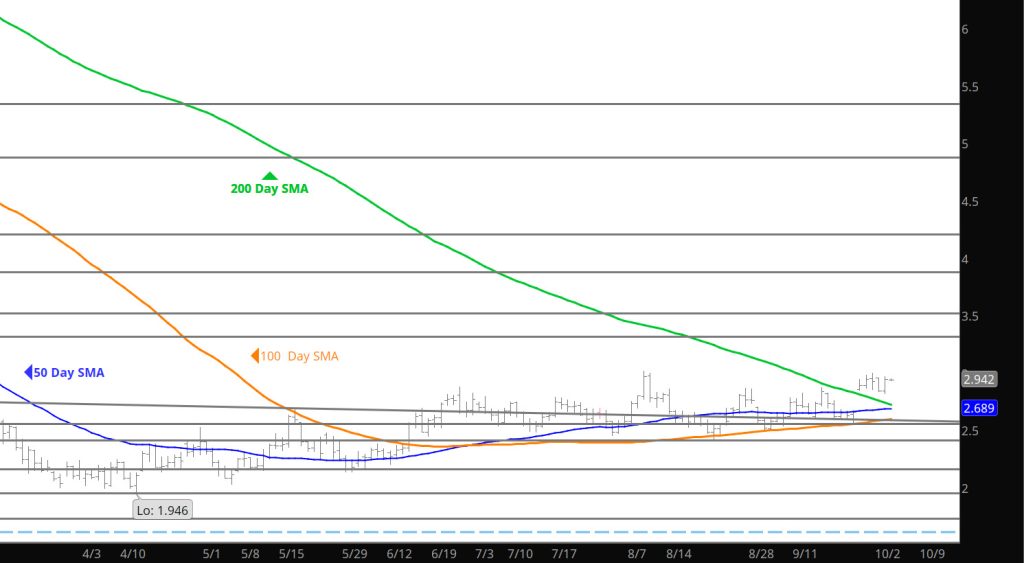

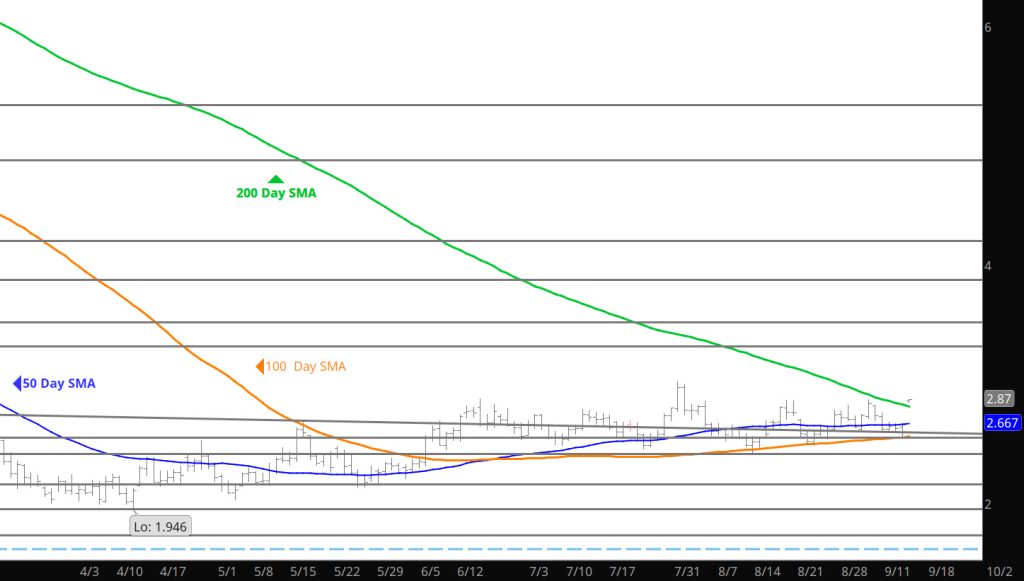

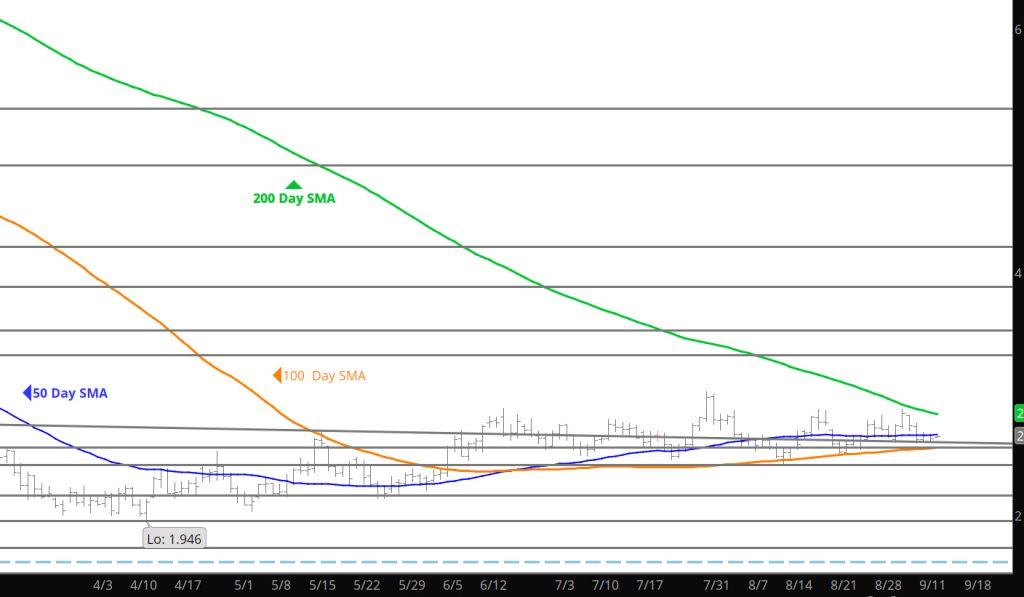

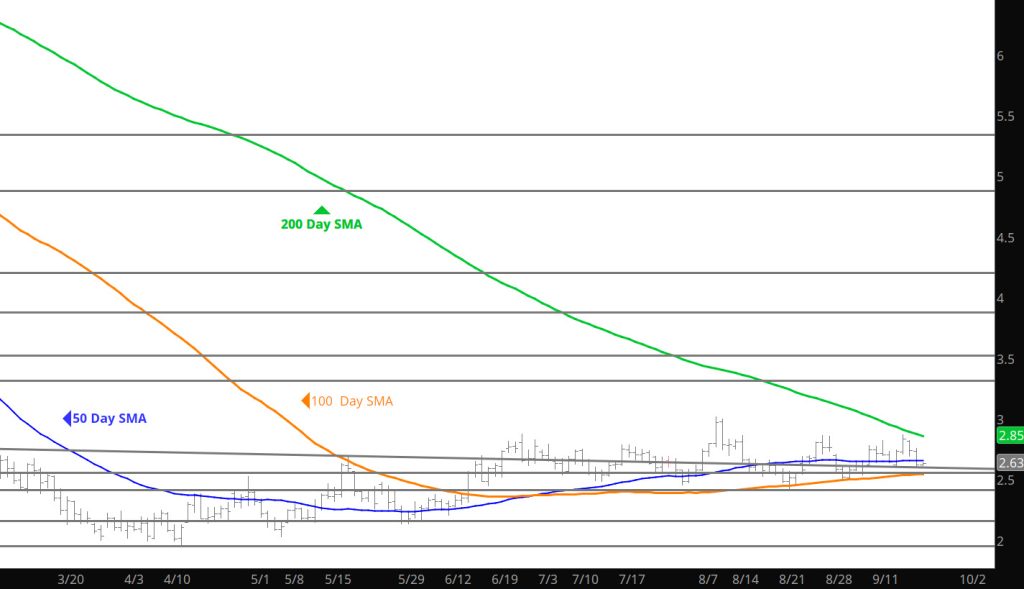

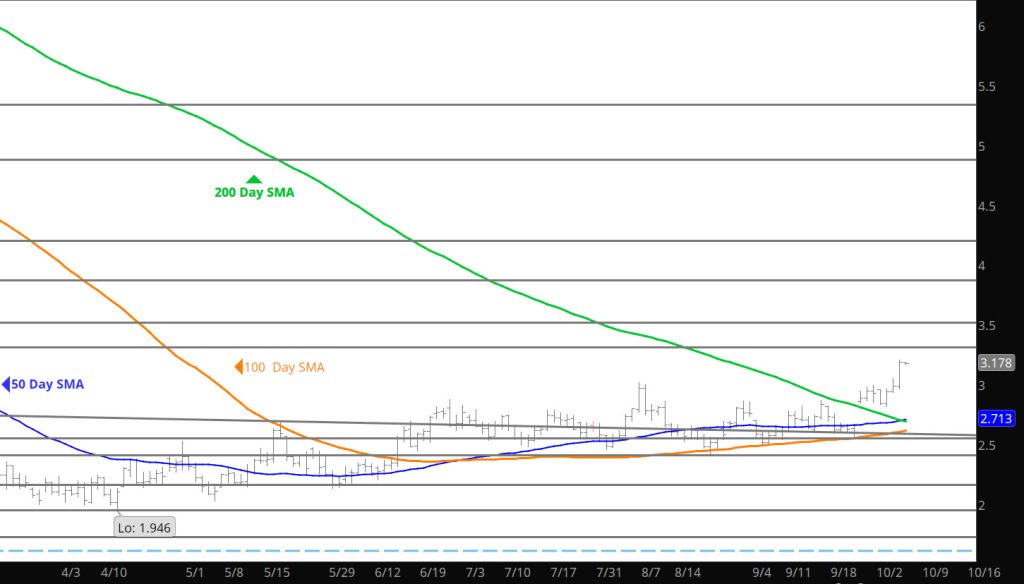

Daily Continuous

My apologies for missing publishing yesterday — did not set up the server properly– but you missed nothing as my diatribe just spoke about the failure of the move on Wednesday by closing under the key resistance area (after stopping me out on the run). Said the same thing going into the storage report that the selling around $3.00 had a close and low risk opportunity and yesterday proved that it was low risk. The one element that the market provided was the potential confirmation of a bias change with a high volume (daily) directional bias change. It is now imperative for the market to finally confirm this be holding most of the gains through the weekly close.

Major Support: $2.47, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $2.84, $2.38-$2.26, $2.17

Major Resistance $3.24, $3.536, 3.59