Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

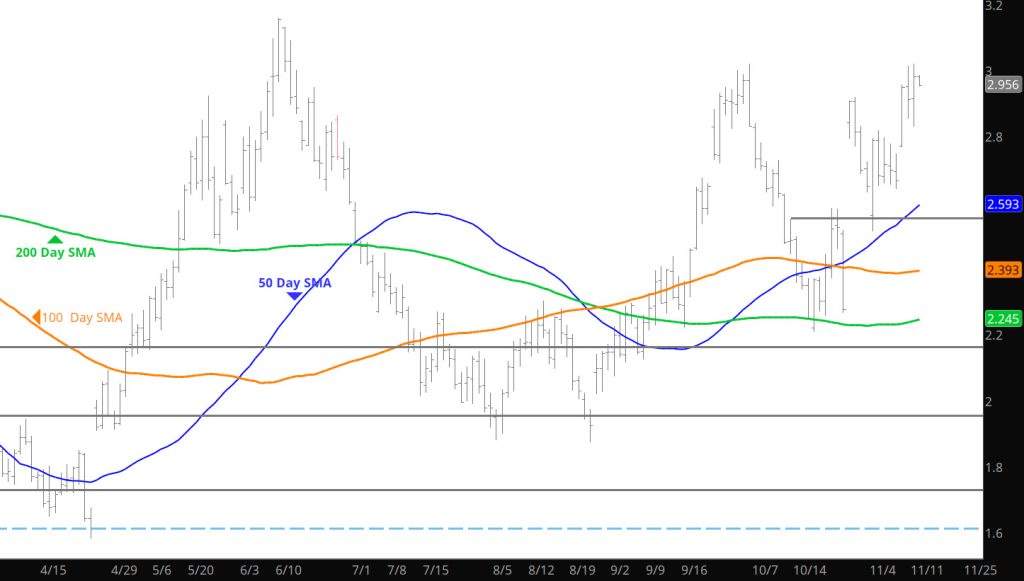

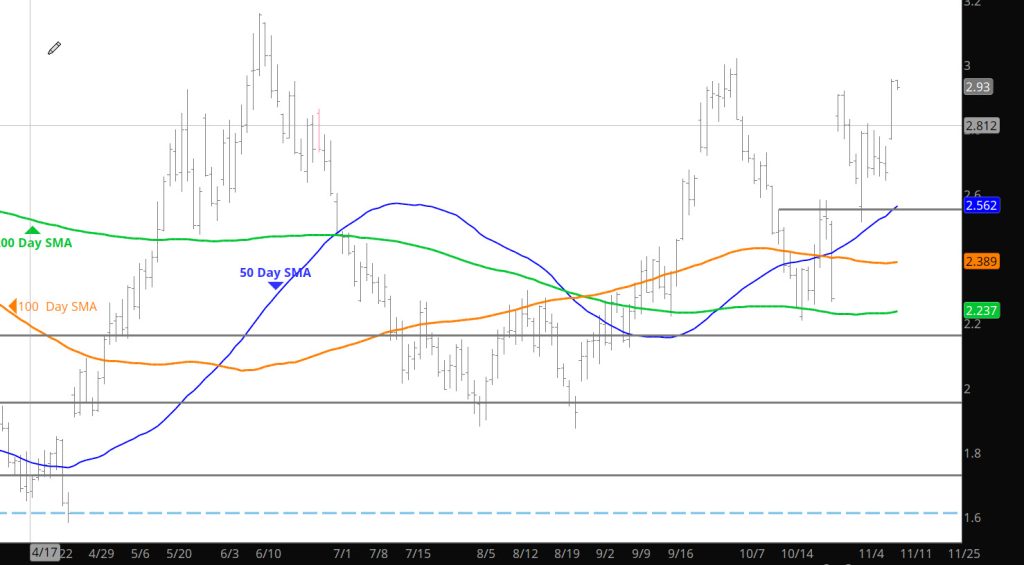

Prices Remain Up Against Resistance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Quite A Bounce

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

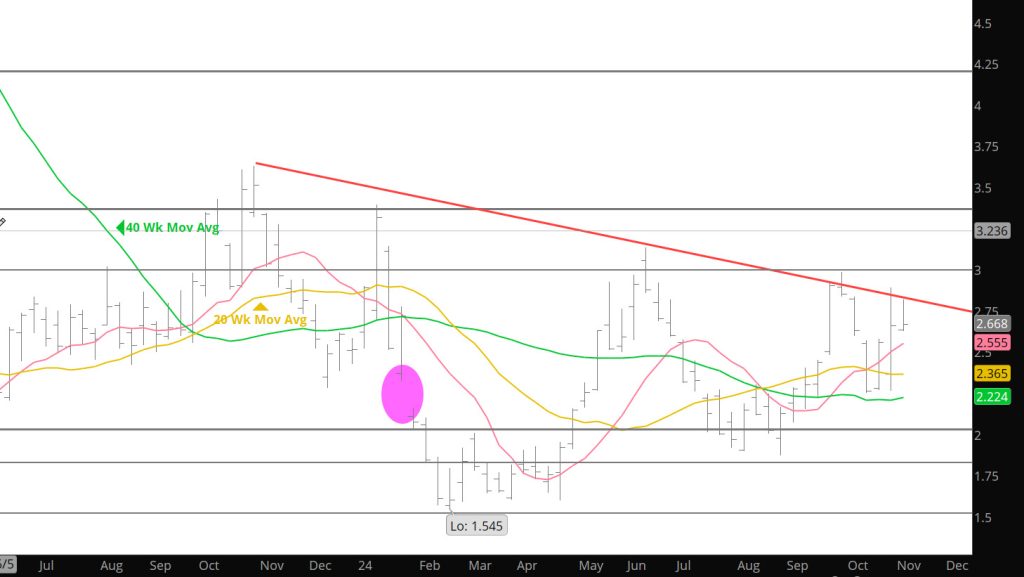

History May Bring Range to a Conclusion

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

A Salute to Our Veterans

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

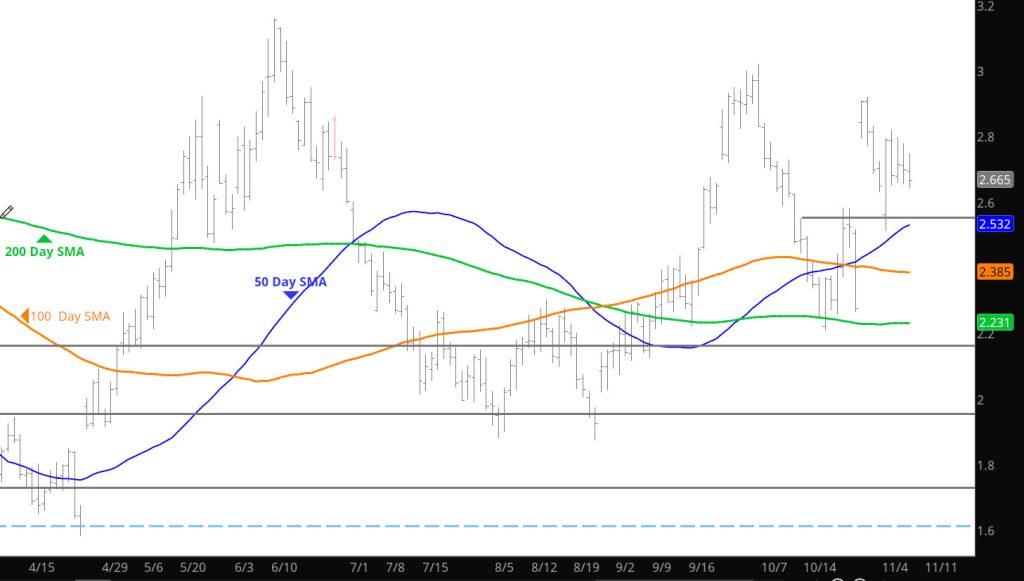

Dec Continues in the Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Dec Testing the Low End of Range

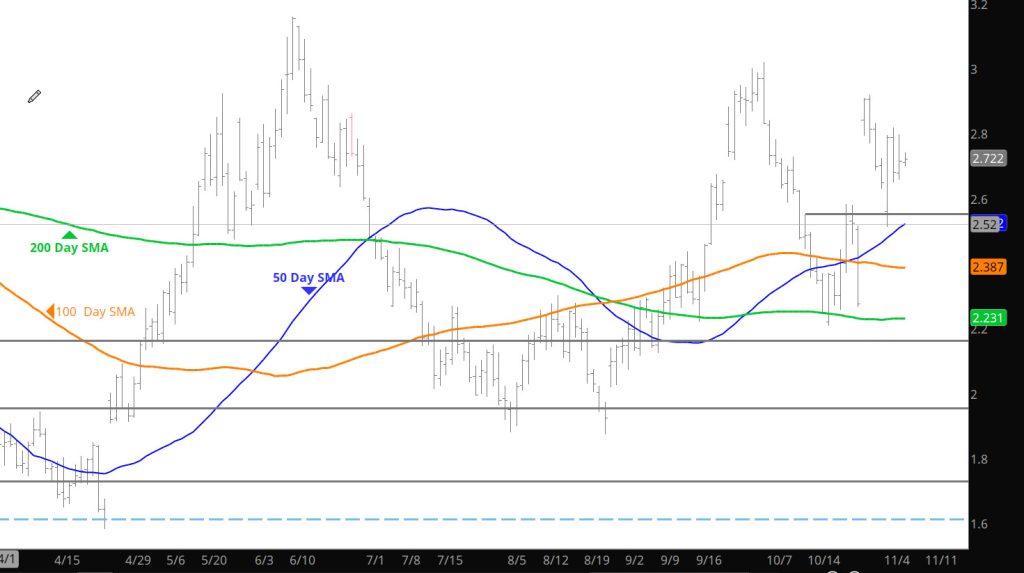

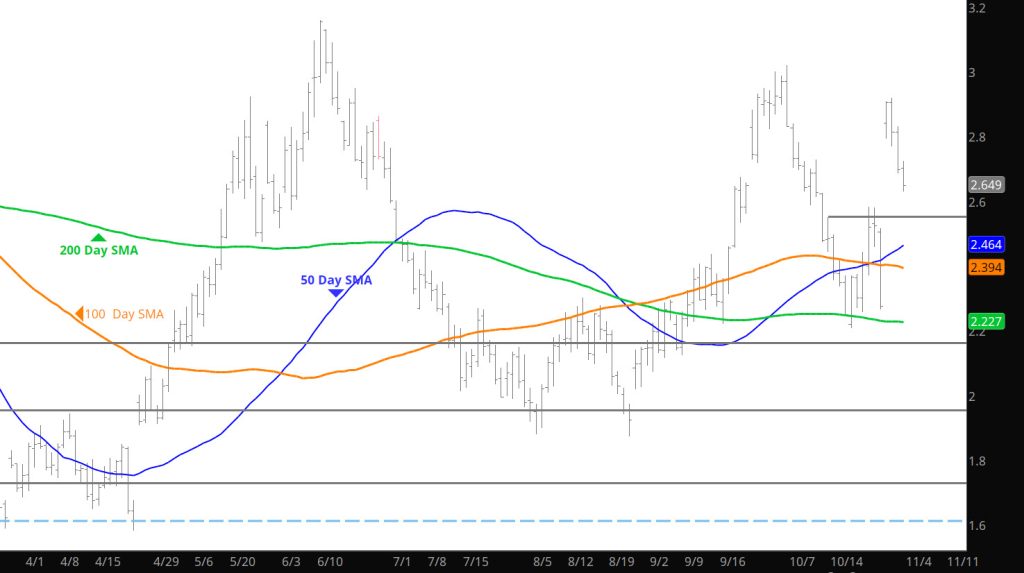

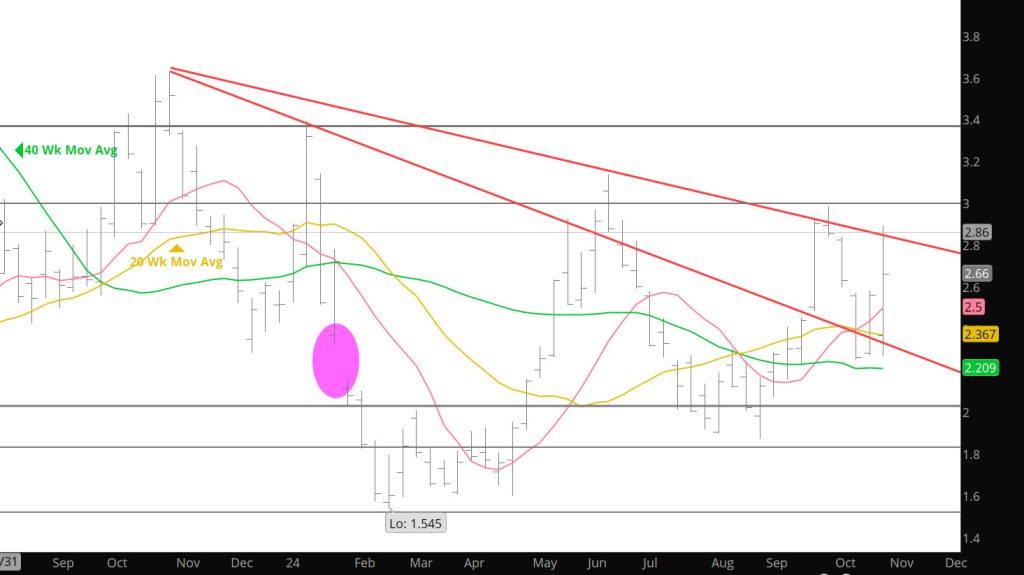

Daily Continuous

Declines wanted to test the low side of the range that the December contract seems to be wanting develop and confirm.

Major Support:,$2.648, $2.39, $2.35, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $1.856,$1.89-$1.856

Major Resistance: $2.727-$2.784, $3.00, $3.16

Gap Closed

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Lows for Dec Contract Not Registered

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Weakness To Continue

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.