Daily Continuous

Wrote in the Weekly my hesitation to print a Daily yesterday and I suggest you read it. Some asked last week when this run would end and I mentioned that it depends on when the shorts are done covering and the forecasts moderate. Guess the shorts weren’t done until later in the day and the weather is still potentially have an impact on price. Not from the Feb standpoint — but the March price. Not sure where Feb is going to settle but odds are it will be at a significant premium to March and that will be where any forecast implication will be felt. Through all that volatility in Feb, March stayed “calm”

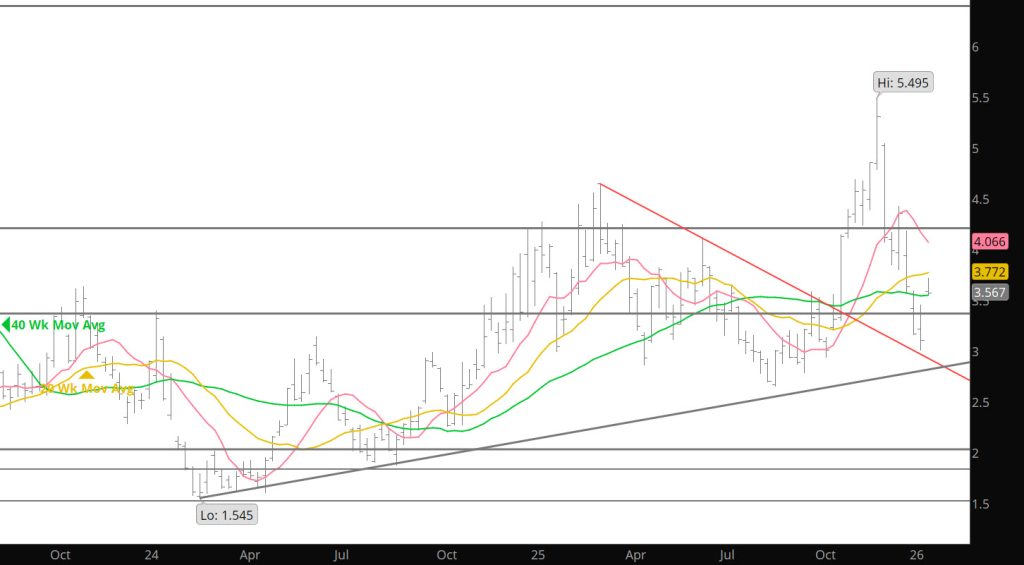

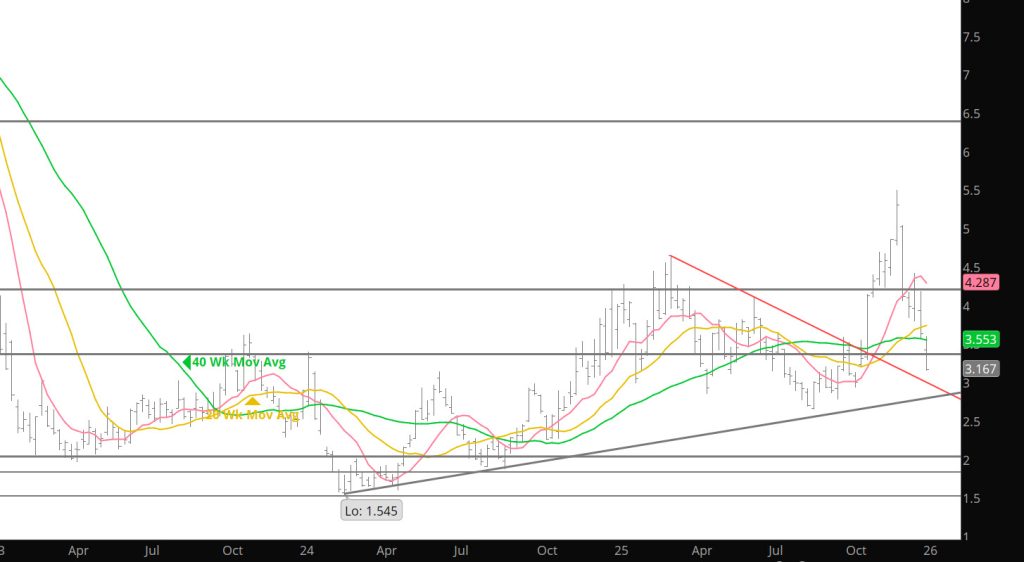

Major Support: $3.554, $3.374, $3.16-$3.148, $3.136-$3.024, $2.93

Minor Support/Resistance :

Major Resistance: $3.787-$3.831, $4.063, $4.086, $4.593, $5.333, $5.496