Author: Willis Bennett

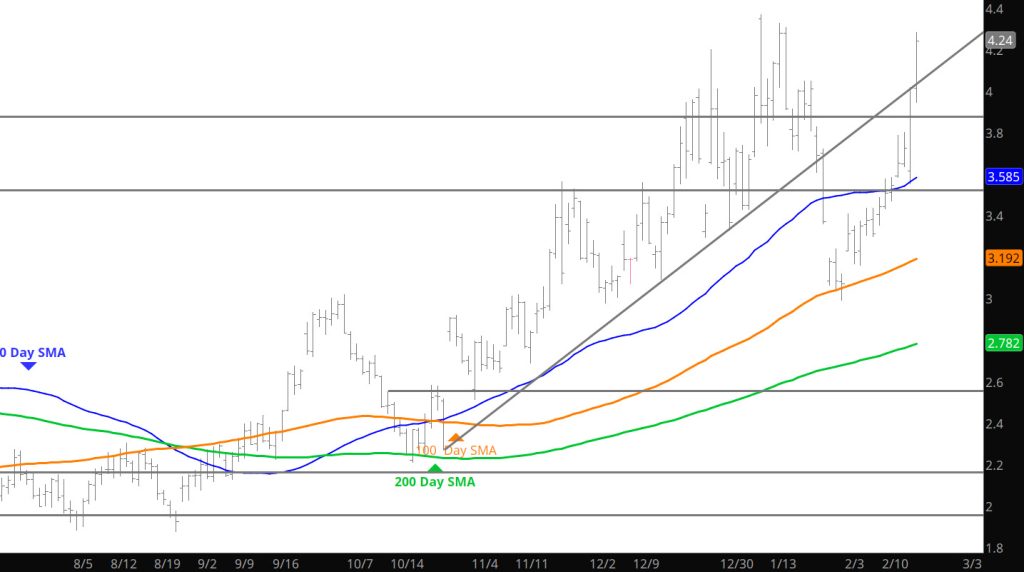

Interesting Battle On Highs

Weekly Continuous

Spoke repeatedly last week about the lack of a higher high for the March contract and the potential impact on the price run of late. Interestingly enough though, was the market closed on the highs of the Week (see chart above). In order to trade a higher high in Feb– the market will need to trade above the Jan high, and since 2009 the calendar January has been exceeded during February twice, 2014 and 2021. In the former the February high ($6.493) was not exceeded until January ’22. The 2021 February high ($3.316) was the high until the following June.

All the technical factors suggest that March will remain “inside” the range traded during January pending a retest of support presented by the December/January lows ($2.977 – $2.990). That said, the sponsorship that propelled March to an $.80/dt rally from the calendar January ending low was surprising.

On Thursday, more than a million contracts changed hands in the natural gas market with the prompt posting a daily gain of only $.063. The 50 – day SMA of volume is 600,638. A principle of technical analysis is that result must reflect effort…in my view it did not.

Over the history of natural gas trading there have not been very many days that volume was a million contracts or more, with 02/13/25 was the ninth time. All of the first eight either preceded or coincided with at least a moderately significant event. Should you be interested in the others send me an email and I will reply. It is also relatively rare for a volume spike to occur with natural gas in a definable range…and ever rarer that an increase in open interest accompanied the volume spike. A guess is that buyers were falling all over themselves to secure supplies when the collapse into and following February expiration was not extended…I think those outlooks will be corrected in the coming few days. Continue to expect the March contract closing the remainder of the gap left on 02/03 ($3. 118 – $3.161).

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.34, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461,

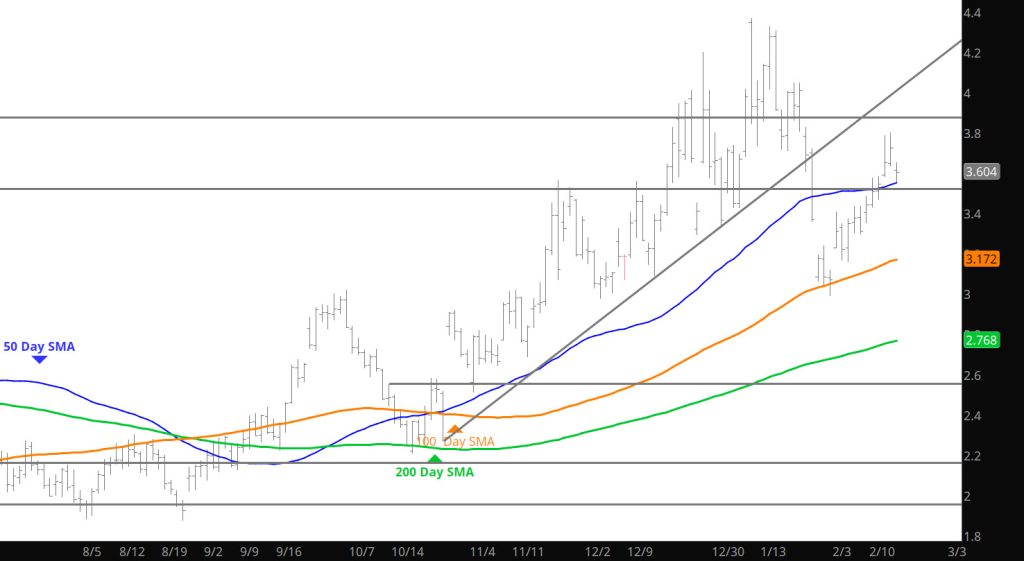

Light Volume Sends Prices Down

Daily Continuous

With the light trade on the holiday, prices retreated back down to conventional support from the 50day SMA. Went into expectations in the Weekly Section but from the Daily perspective — it’s the range controlling the trade.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.34, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461,

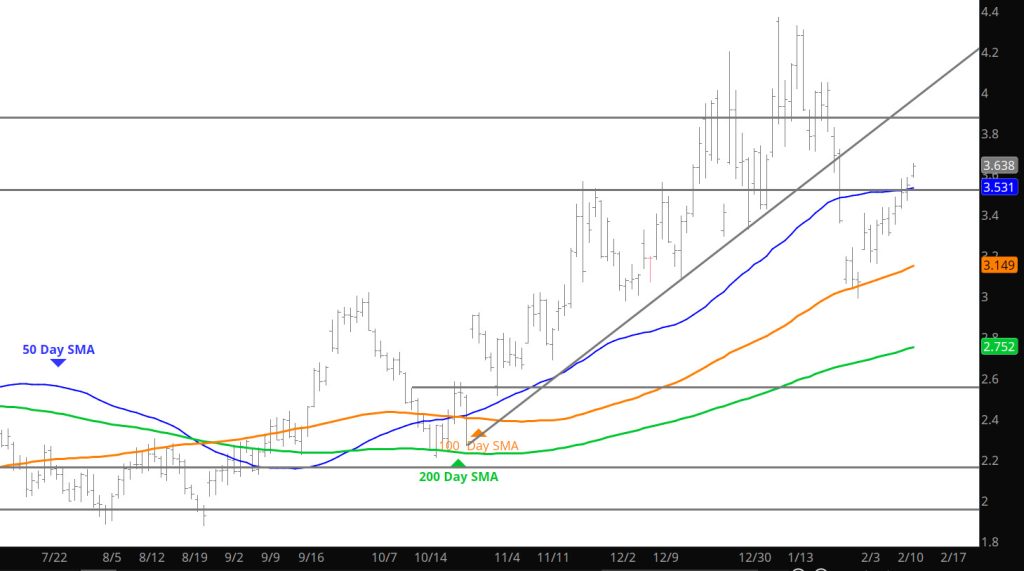

Trying to Trade a Higher High

Daily Continuous

The move continued (especially in the late day trade) trying to entice the rally to take out the $3.84 area (not a higher high- monthly) but will lead to potential trade to set a higher monthly high– today is storage which may bring the volume to set a new high.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.34, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461,

Momentum Working Against Gains

Price Gains Hold

Daily Continuous

The gains posted on Sunday night held but didn’t grow during the trade day. Prices are butting up against near term resistance — but his may also be a consolidation period to send prices higher (cold weather continues the momentum) or for the market correct to test support at $3.00 and set up the Q1 low. The answer will be in the coming seek or so as the ending inventories will provide insight as to the trader’s perspective.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.16, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.34, $3.39, $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461,

Range Trade / Is There Consolidation

Weekly Continuation

A somewhat quiet week of trade between $2.99 and just below $4. if you want to believe its the beginning of a “consolidation” period. The long – term uptrend in natural gas prices is defined by a trend line drawn from the February – March – April ’24 and the July – August lows (see above). With the caution that trend lines can be drawn with a micrometer but should be marked with chalk, the current value of the rising support is around $2.417 (Monthly chart), for calendar March the value will be $2.511 (which you might note is +/- the target mentioned above for a decline from the Q4/Q1 high that equals the 20 – years average). The lows of the last two years, which bear a striking resemblance, were constructed during February, March and April.

The intermediate term uptrend was disrupted leading into February expiration. An expanded range during which prompt gas fell from a close above $4 (01/24) to under $3 in five trading days…including a .073/dt expiration gap, led to a close for calendar January only a few cents off its low. A strikingly similar monthly bar was traded during January ’24…the total range traded a year ago was $1.355, this year $1.379. Both months inflicted substantial “technical damage” to the charts. A year ago, that damage quickly led to lower prices. March 25’s gap higher to begin February was very different but my view is that the result will be the same.

As discussed previously, March has a consistent historical tendency of trading either the high or low of its tenure as prompt by the end of its first full week. Last week I wrote to expect the expiration gap to be filled sooner rather than later and for the high of March’s tenure to be traded during the coming week . The gap was closed and March traded to a high of $2.435 before fading into the close. That recovery high, 38.2% retracement of the continuation decline from the 01/13 high and the 50 – day SMA both of which are +/- $3.500 will present substantial resistance. In the, unlikely event that March is able to trade a higher high then another test of $3 may not be in the cards, but my guess is that a violation of a rising short term trend line, will lead to that test of the December and January lows. I think that March will be offered lower.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.34, $3.39, $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461,

Sunday Excitement

Daily Continuous

Sunday trade wants to test the resistance range for prices– if you are bearish (seasonal history) then the suggestion is to look at the options. From my perspective there are likely additional declines coming so I will choose patience for now.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.34, $3.39, $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461,