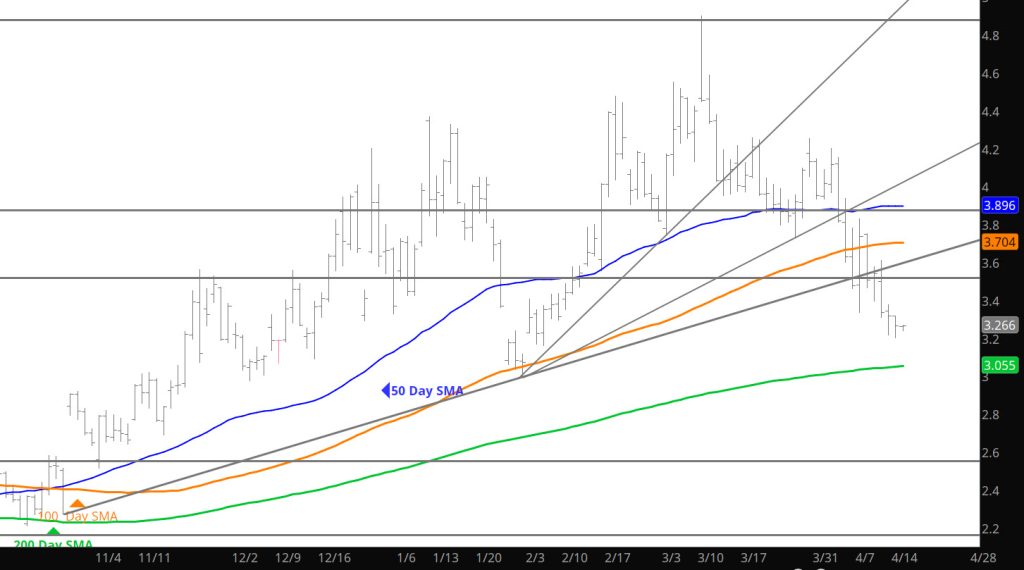

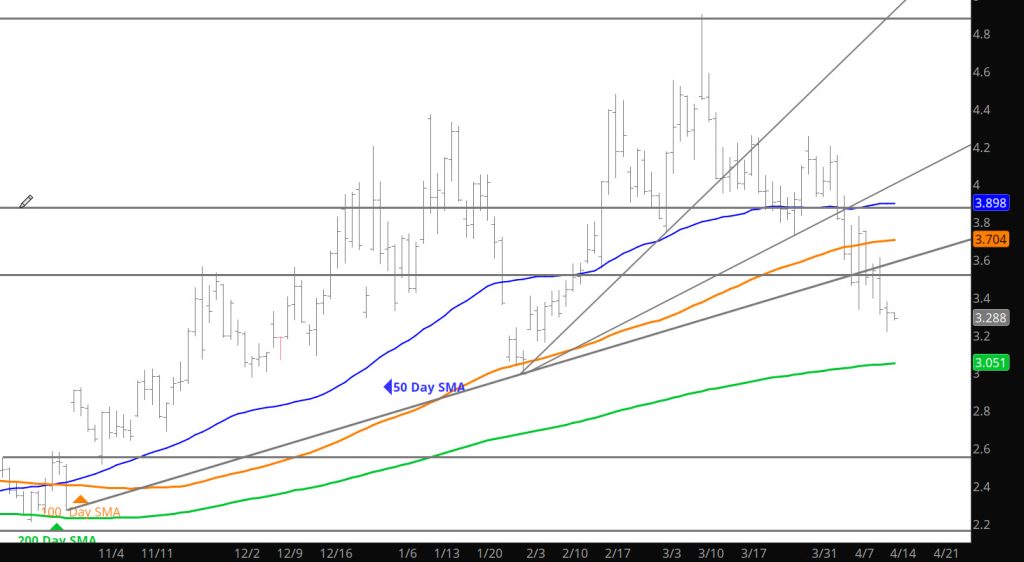

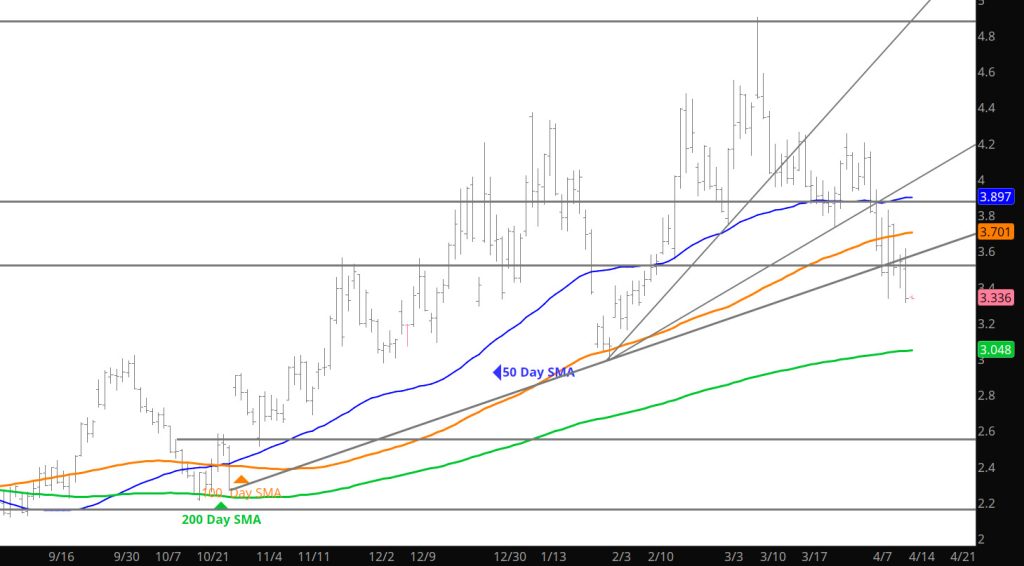

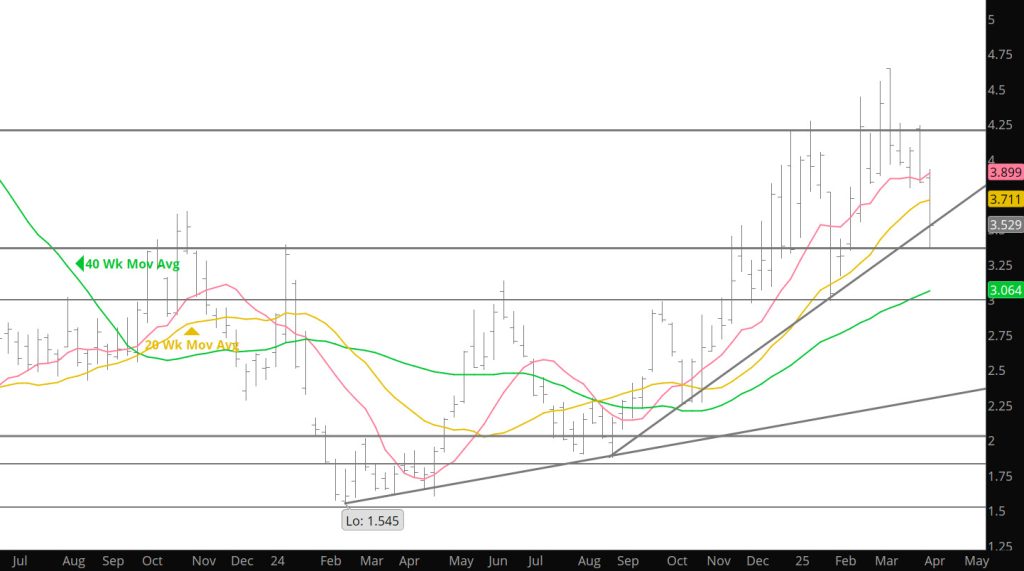

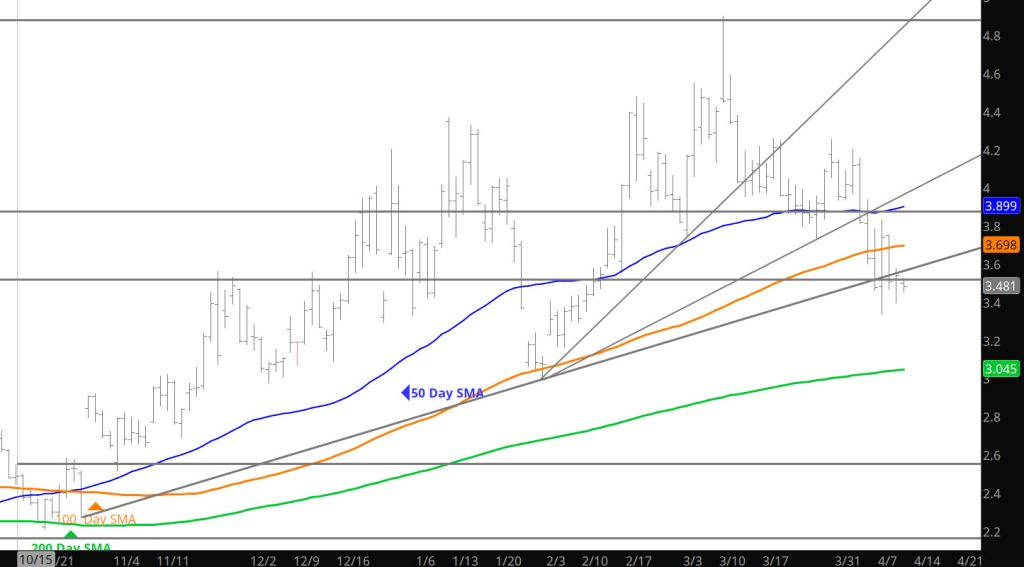

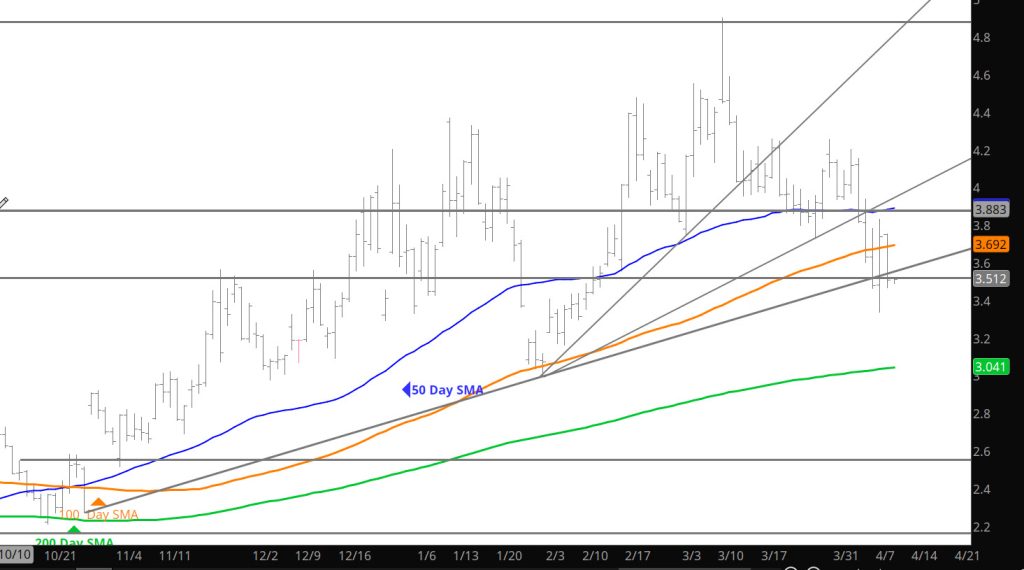

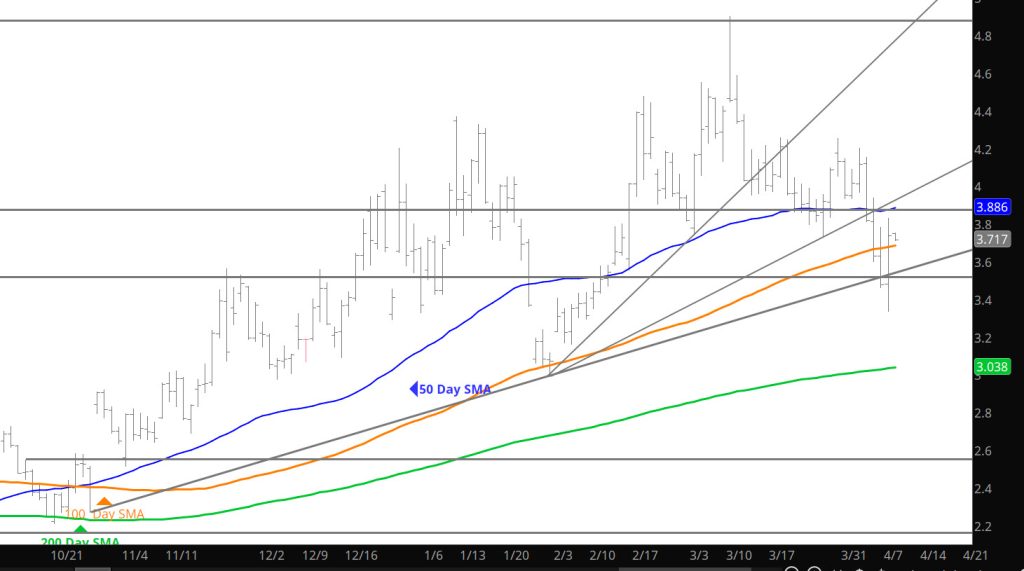

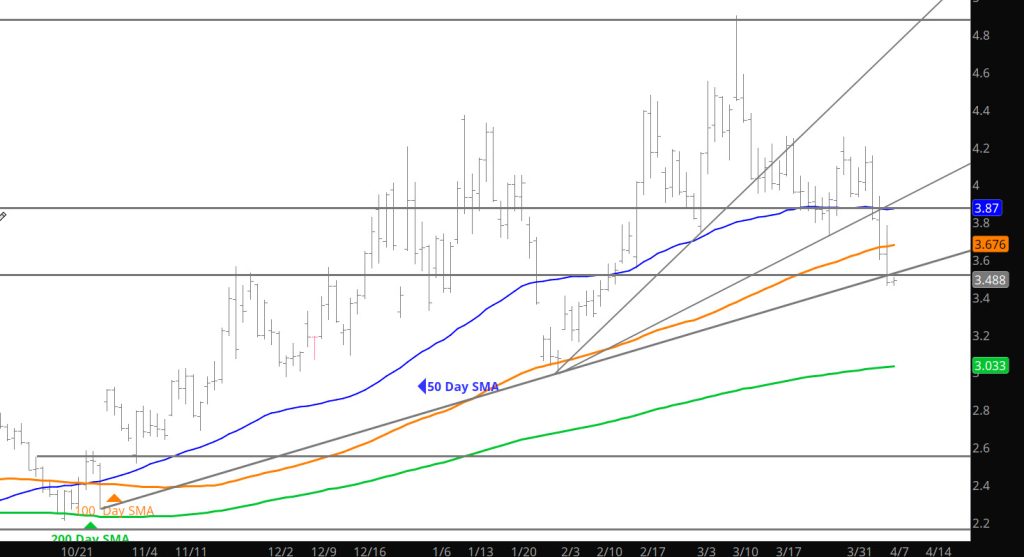

Weekly Continuous

Due to an Easter celebrations — the Weekly and Daily sections of the website will be short in length. Last week provided little resolve to the previous week’s dilemma regarding bias but it was interesting to watch a lower low each of the trade days (technically a negative bias) but the open interest continued to decline each day (non-supportive of a bearish bias). Discussed here several times that volume is the energy that drives price trends and having declining volume levels last week sends a warning flag. There was not break down in prices but rather what I would characterize as a slow melt. At the end on Thursday (Friday – market was closed) there had been little resolution as to the bias for this upcoming week. The market did seem to hint at testing the $3.168-$3.11 gap in the Daily Continuous, but even if it opens down in the gap on Sunday night — the trend has been over the last few weeks, that what ever direction is established in Sunday night trade — the Monday full trading day reverses. Caution is advised.

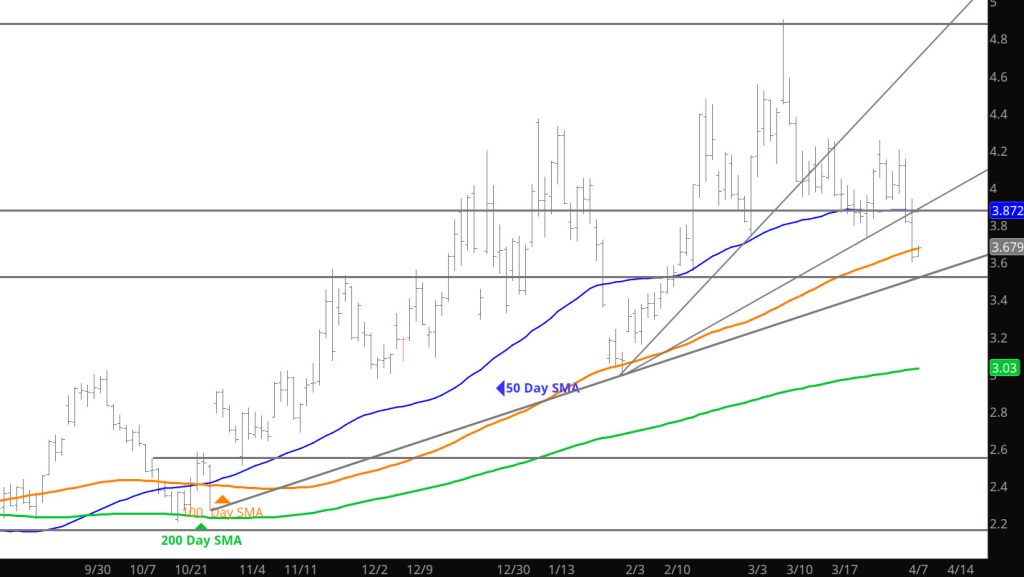

Major Support: $3.336, $3.16-$3.11-$2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03