Author: Willis Bennett

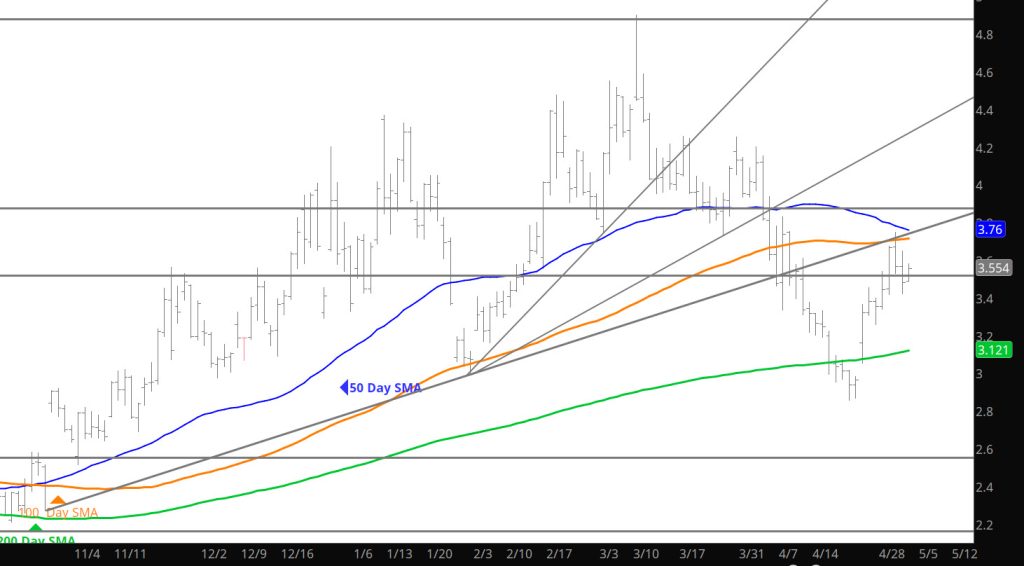

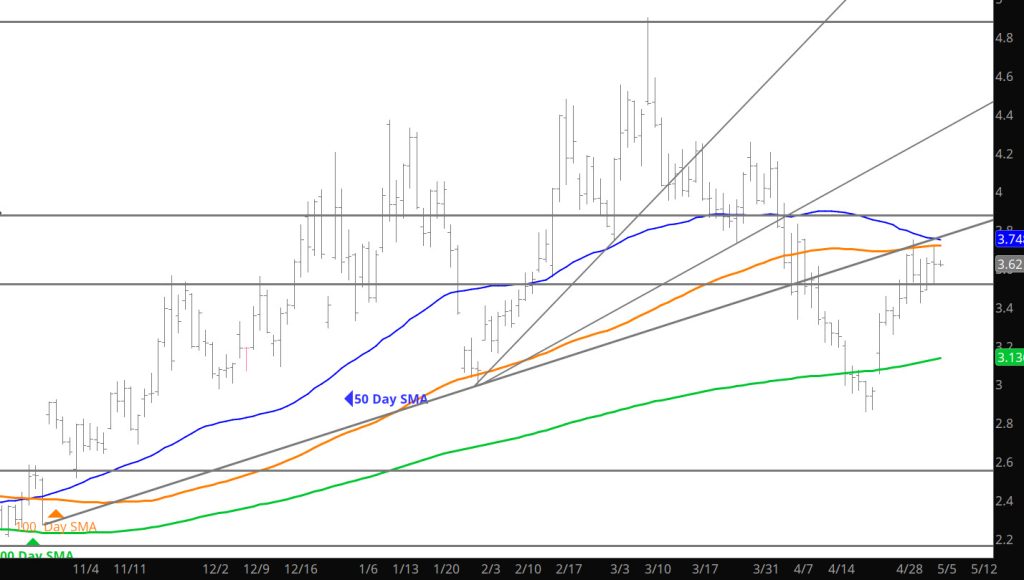

Expect Additional Weakness

Storage Release Confirms Declines

Daily Continuous

The slightly bearish storage data confirmed the near-term bias of declining prices. The Weekly close will be important for the near term price action but remember, we are still in a range for prices — just testing the low end of the range.

Major Support: $3.26, $2.97, $2.727, $2.648,

Minor Support :$3.423

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03

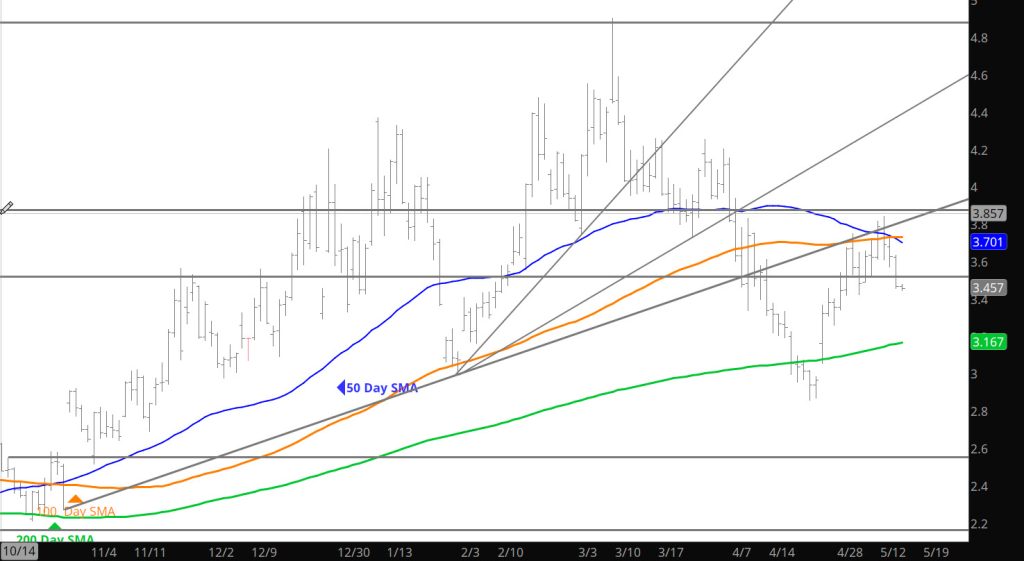

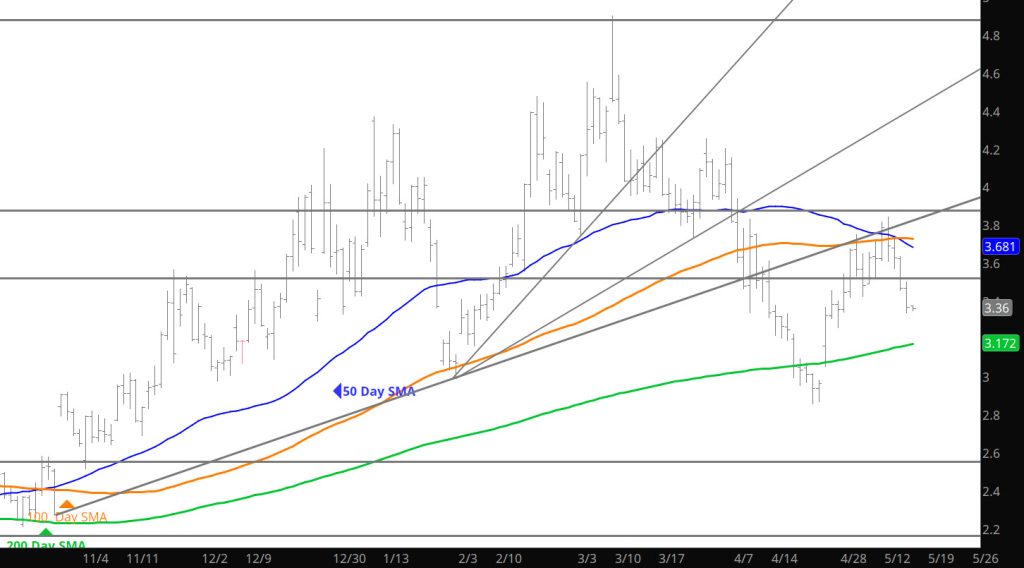

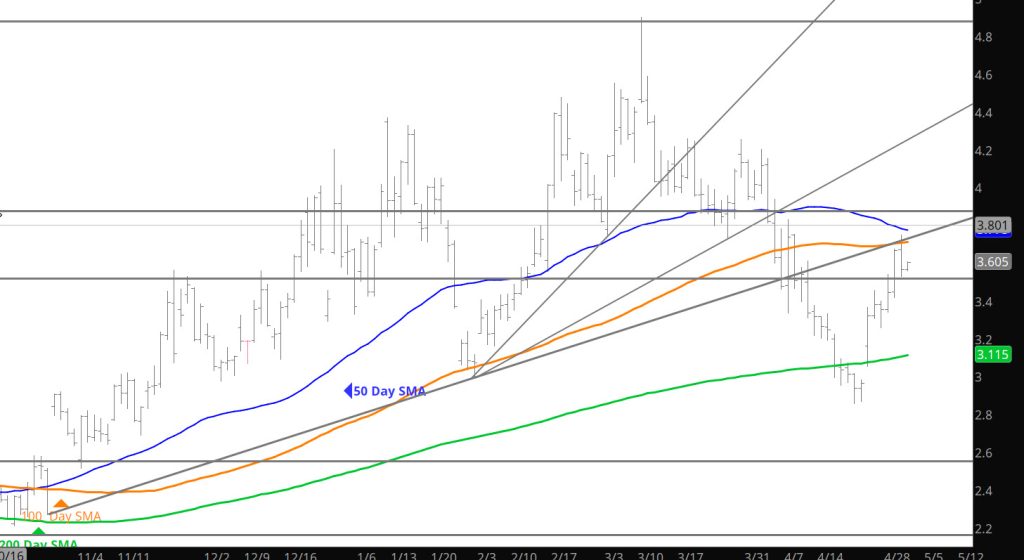

Lows From Early May Challenged

Failure At Highs — Consolidation Continues

Daily Continuation

Price action rallied to a higher high only to feel the affect of altitude and retreated back into the comfort zone of the range for June gas. I would think that gas may make another run to the highs but it will need to close above the Moving averages converging just above yesterday’s close (see Daily Chart above) to catch some possible momentum.

Major Support: $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03

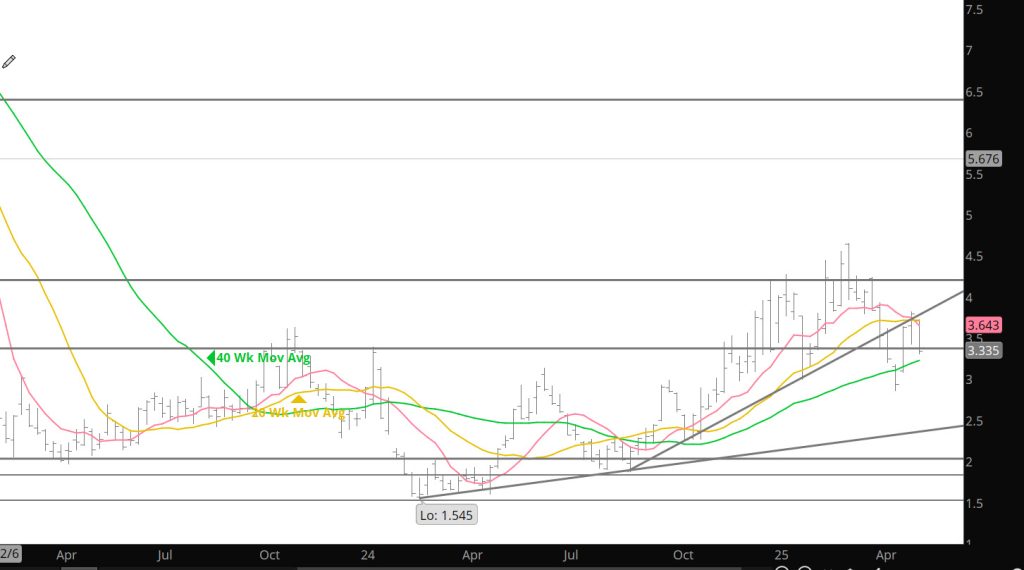

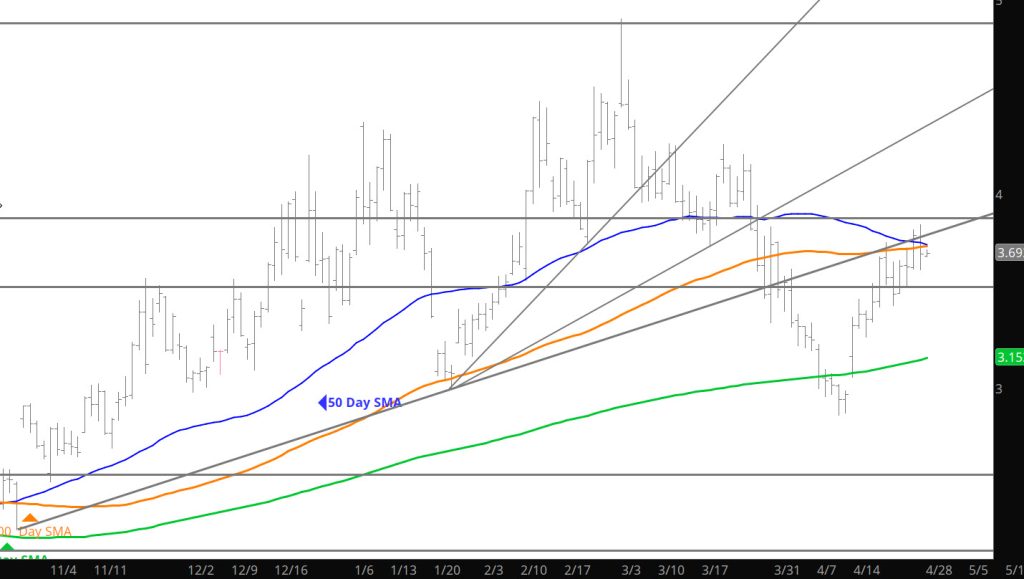

Bullish End of Week

Daily Continuous

Discuss the price action in 2025 compared to previous years in the Weekly section, last week’s high close was a bullish indicator but consistent with history. Now, the issue is the continuance of the bias or failure at resistance, early Sunday night trade gives no insight.

Major Support: $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03

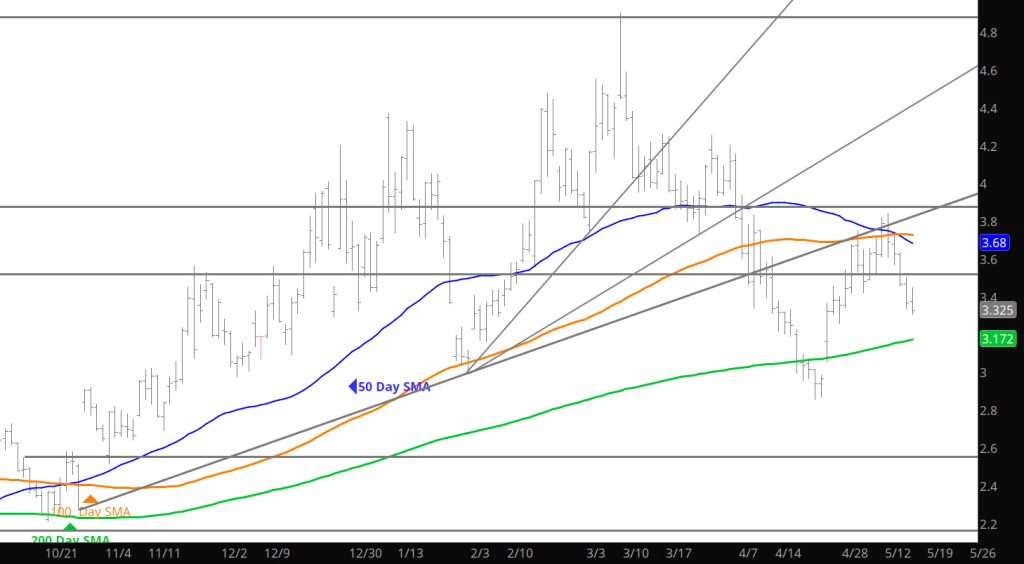

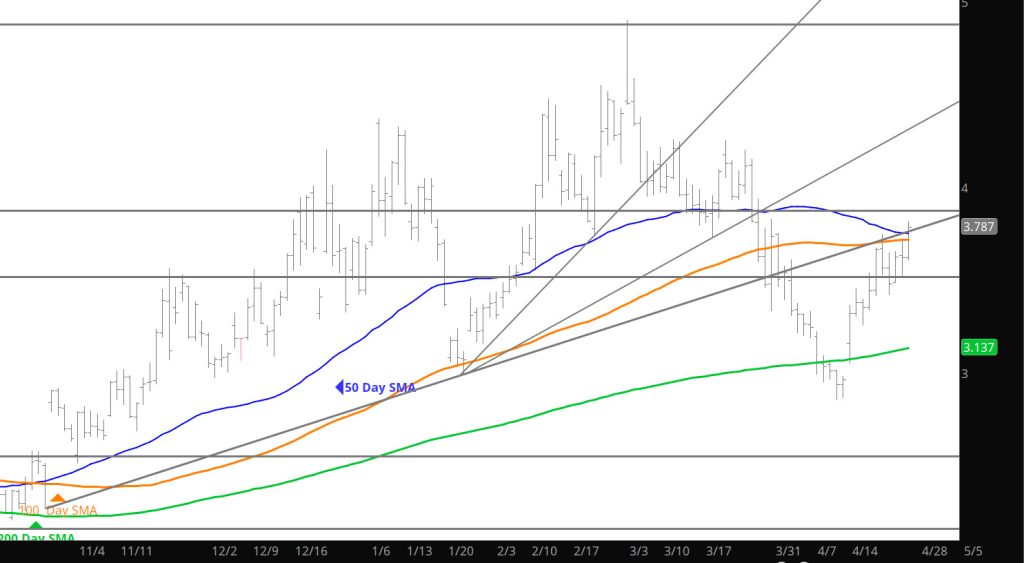

Challenge the High Side –Failure

Daily Continuous

Prices challenged the high side of the range before the storage release and then relaxed to decline into the “range”. I would expect similar trade to- day with the potential for additional weakness.

Major Support: $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03

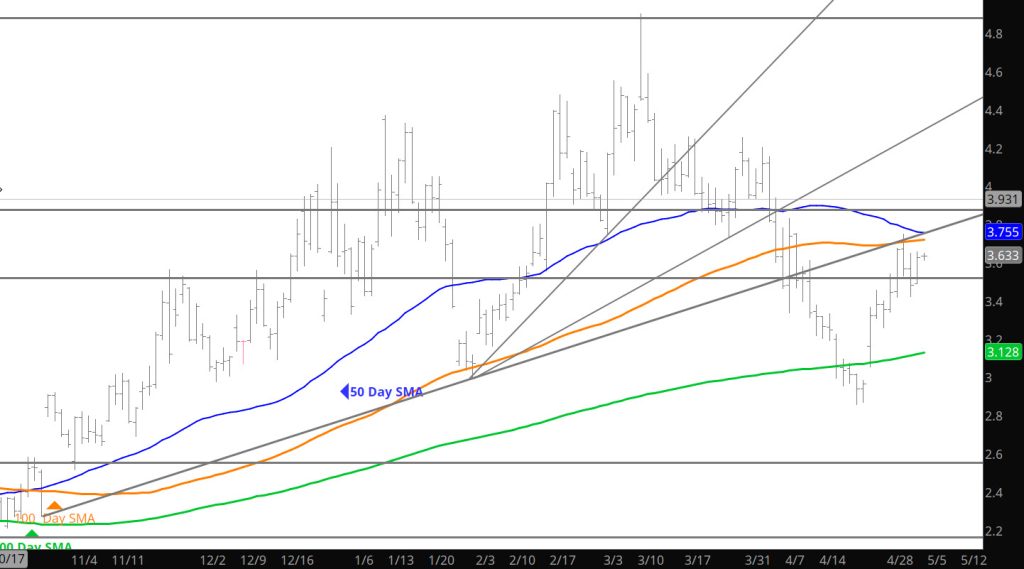

Lets Go Top Side

Can’t Say Much During This Range Period

Range Testing Continues

Daily Continuation

Not a lot to add to the heading as the market is testing and establishing a range for near term price action– would play the further sides of support or resistance to avoid being chopped by the potential action.

Major Support: $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03