Author: Willis Bennett

Whiplash

Nov Comes Down More Then Oct

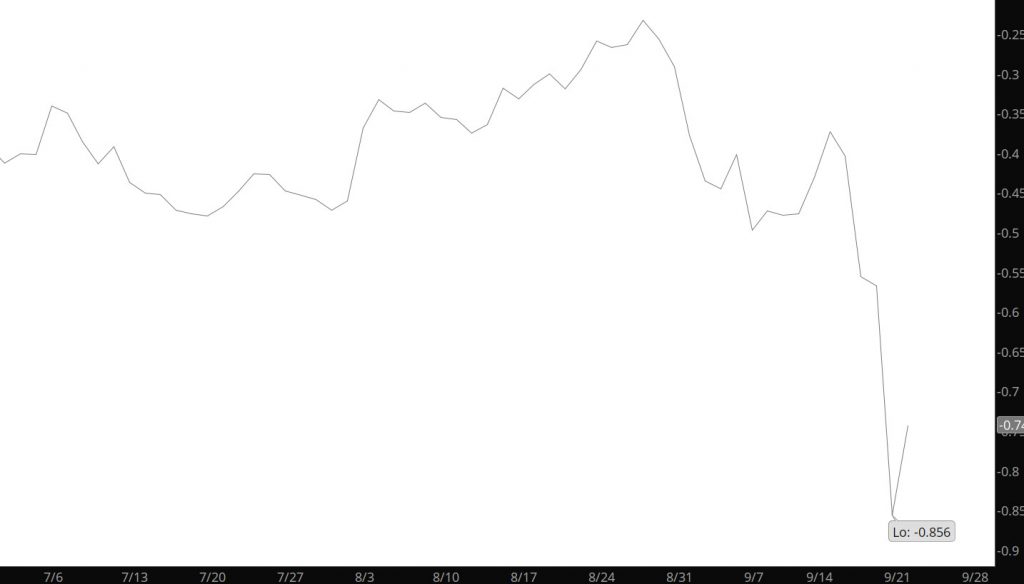

For the first time in a while the differed contracts lost significantly to the prompt and brought some reality to the recent price action. Perhaps this is the first step in the correction bringing prompt closer to the second month, yesterday brought the Nov contract back after trading to an $.85 premium. Unfortunately, if you look at the Dec / Nov spread– it too is at an extreme wide margin. Mentioned yesterday, the prompt Oct contract is a “no touch” depending on your risk profile— perhaps the Nov contract brings opportunity (short term) from the bear side.

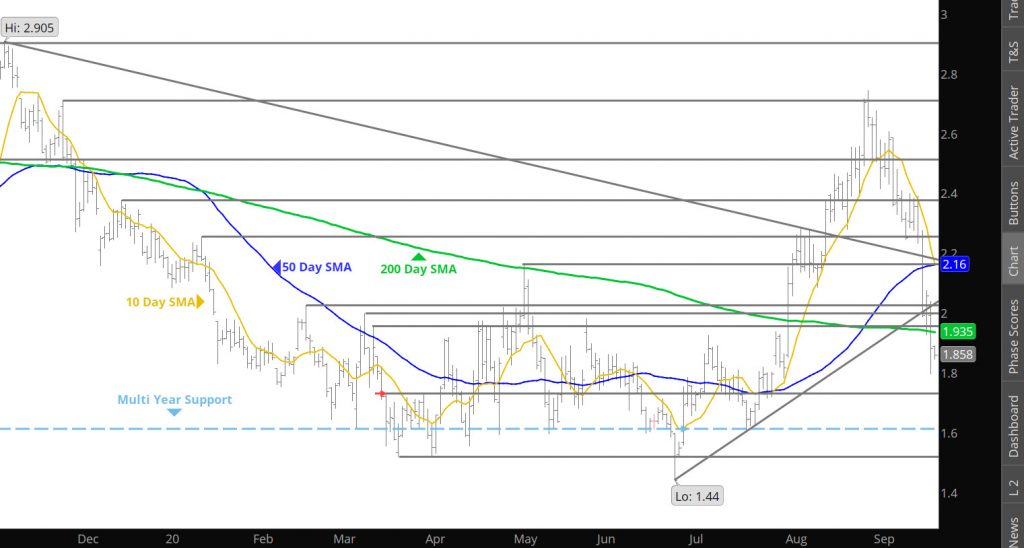

Major Support: $1.864-$1.852, $1.768-$1.70

Minor Support:

Major Resistance: $ 2.162-$2.18, $2.275

Minor Resistance:$1.964-$2.008

Forget Support From Moving Averages

New Week, Old Market — Expect Tests of Support

Prices Return to the Mean

The Summer Bullishness Has Officially Joined Elvis

Storm Brings No Movement

Sunday’s Run Hits a Wall

Prices started strong on Sunday as the market opened, continued to rally (up $2.399) but then melted down during the trade day, closing near the lows. Not the confirming signal for additional gains bulls may have wanted. Today, prices should extend the trend from the closing action of yesterday. How far the declines may take prices is unknown as the support zones (numerous) commence just below last Friday’s lows.