Author: Willis Bennett

Solid Bounce Tests Resistance

Extension Downward

Break Down

Brutal Break Lower

Light Consolidation

Awaited Test of Support Occurs

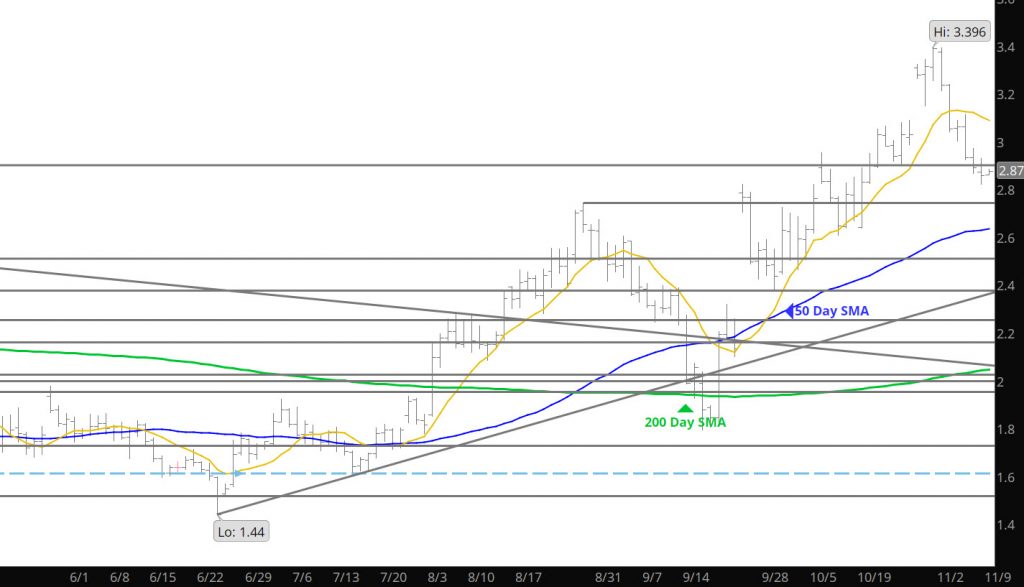

Discussed here for the last couple of weeks, regardless of the Nov expiration and price break above $3.047 (old gap from 2019) it was likely that the December spot contract was going to test this area. That event occurred yesterday. Whether or not there is an extension downward, remains unclear but if price don’t today they are missing a great opportunity.

Major Support: $3.047-$2.98, $2.907, $2.822

Minor Support:$2.84

Major Resistance: $3.151, $3.24, $3.361-$3.370, $3.423, $3.516

Slight Softening

Bullish Close to the Week

Crossroads

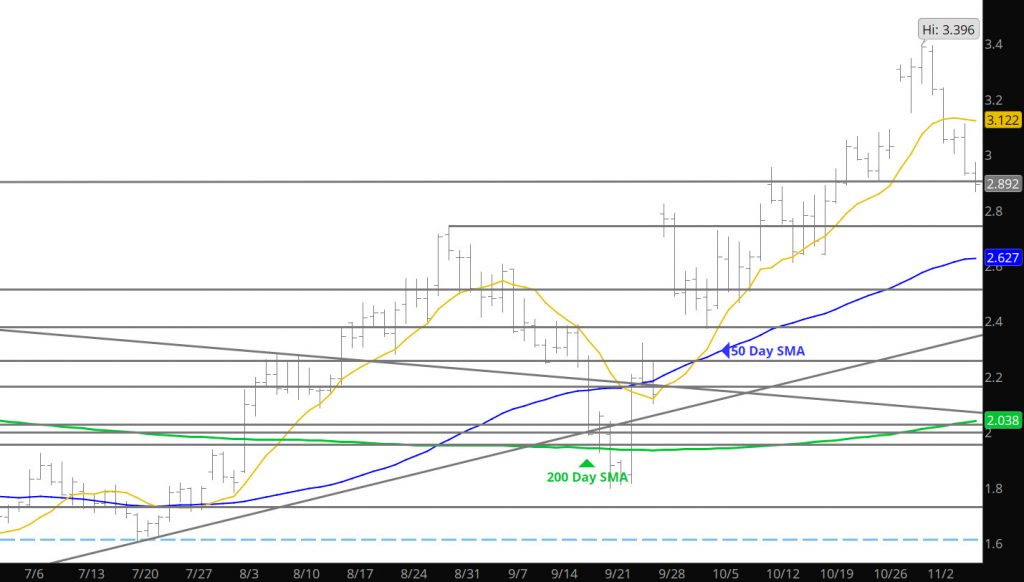

The market has created a short term decision on extend the gains higher or consolidating some of the gains from Thursday and Friday’s dramatic move. That move started to challenge the high for the Dec contract (break it in late day light trade) and has all the elements to break above the old highs and set new high. Only problem with the bullish configuration is the over-bought condition of the market, the RSI on both the daily and weekly charts is extended into the extreme levels and the Bollinger Band study is beyond 2 standard deviations on the high side – confirming the over bought status. This market is at a crossroads of setting additional highs this week or consolidating the gains achieved with the Dec contract.

Major Support: $3.19, $3.101-$3.091, $3.047, $2.907, $2.822

Minor Support:$3.151, $2.98, $2.84

Major Resistance: $3.361-$3.370, $3.423, $3.516