Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

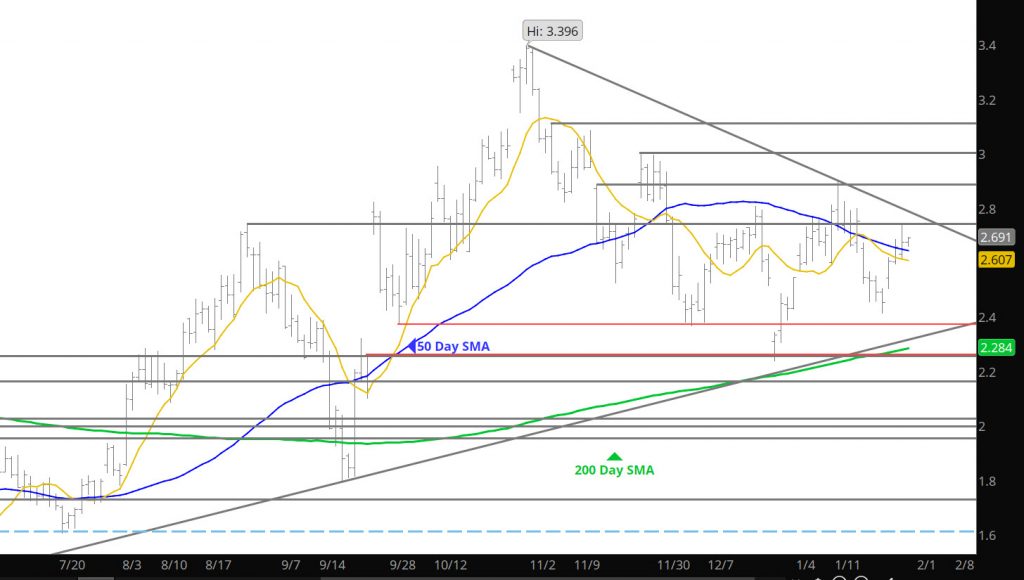

Some Consolidation

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

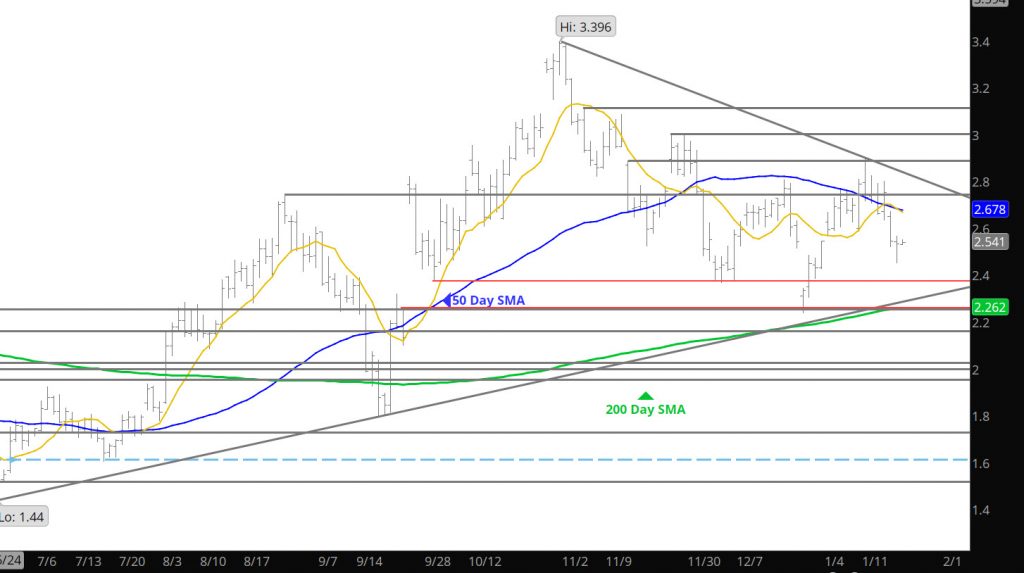

Sunday Strength Maintains

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

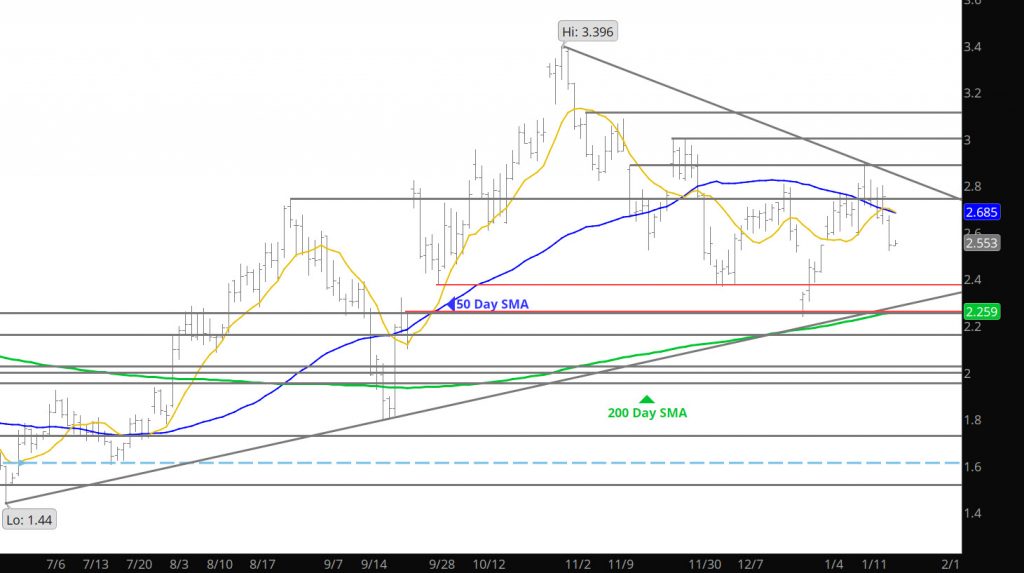

Declines Test Intermediate Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Market Digests Losses

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Reverse Off of Low Extension

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Gap Closes

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

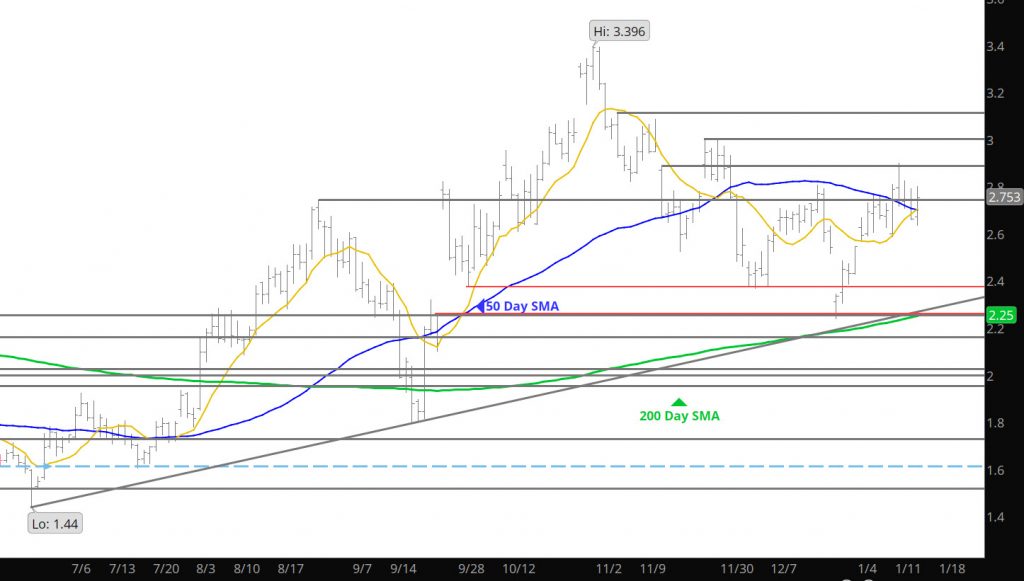

As Expected

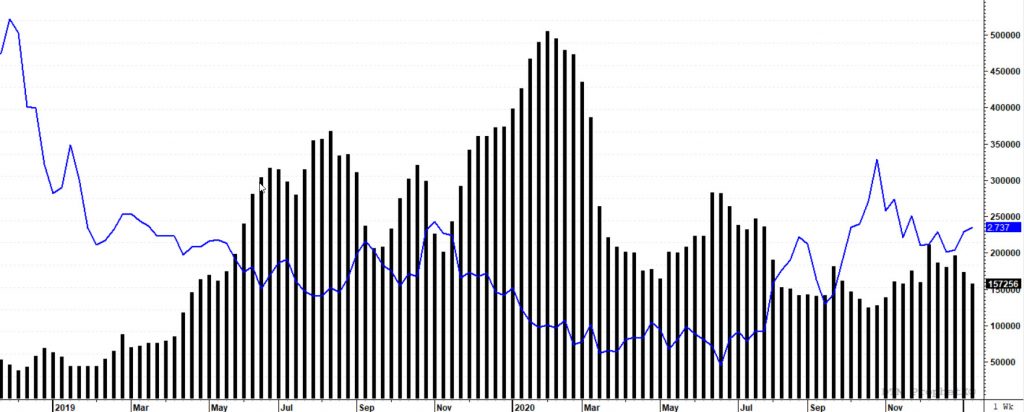

Not sure what happened to the distribution via email yesterday but the Weekly section in the web was spot on to the expected test of support provided by the early month gap that remains. Even-though prices rebounded off of the test, expect additional tests again today with more traders available.

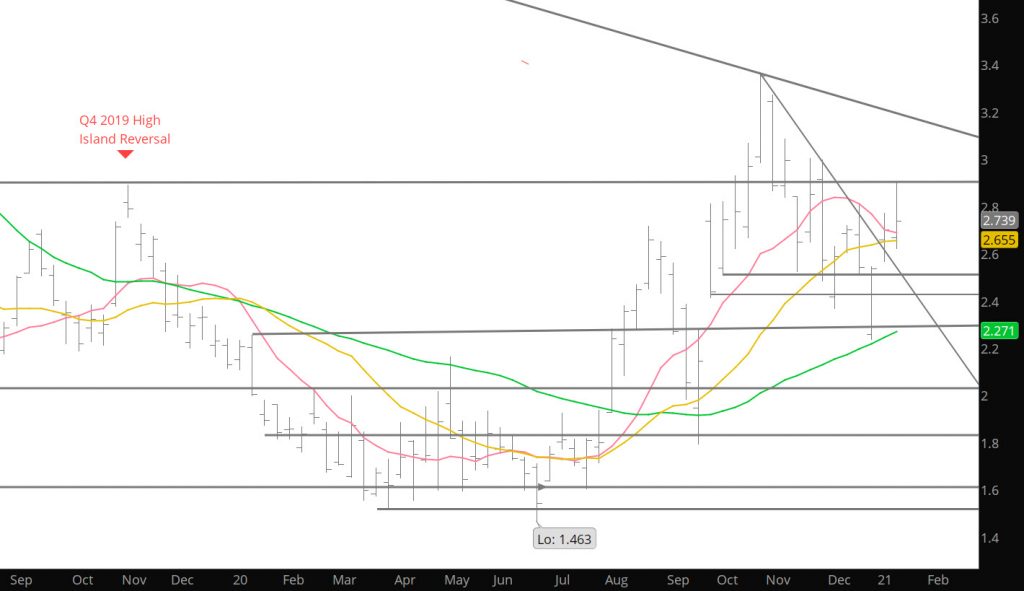

Support: $2.566, $2.373, $2.255-$2.176

Minor Support:$2.547, $2.483, $2.162

Major Resistance: $2.74-$2.789, $2.89, $2.98-$3.05,

Minor Resistance: $2.806

Sunday Opens Weaker

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Higher High — Quiet Week

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.