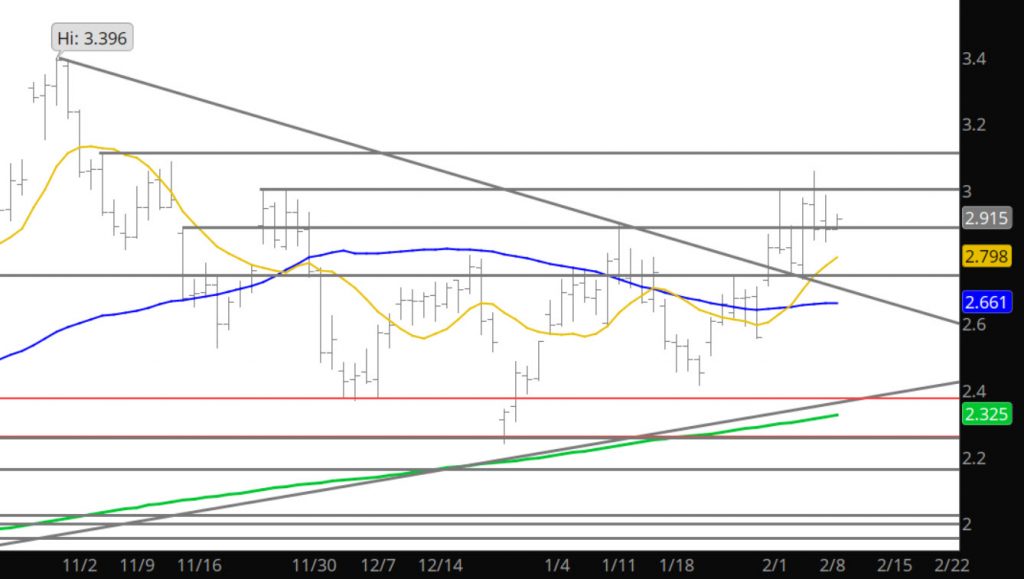

Not much to report on yesterday’s action with prices staying close to the opening after a brief run to $2.985. This is an interesting trade as the weather forecasts are showing frigid cold coming (so I have heard) and extending longer in time than folks thought, yet prices are relatively calm. This frigid February may take the storage surplus (over the 5 year average) out to the wood shed. Again, I have no idea how you fundamental folks trade, but I have to believe that prices have not baked in the results of the upcoming period of weather.

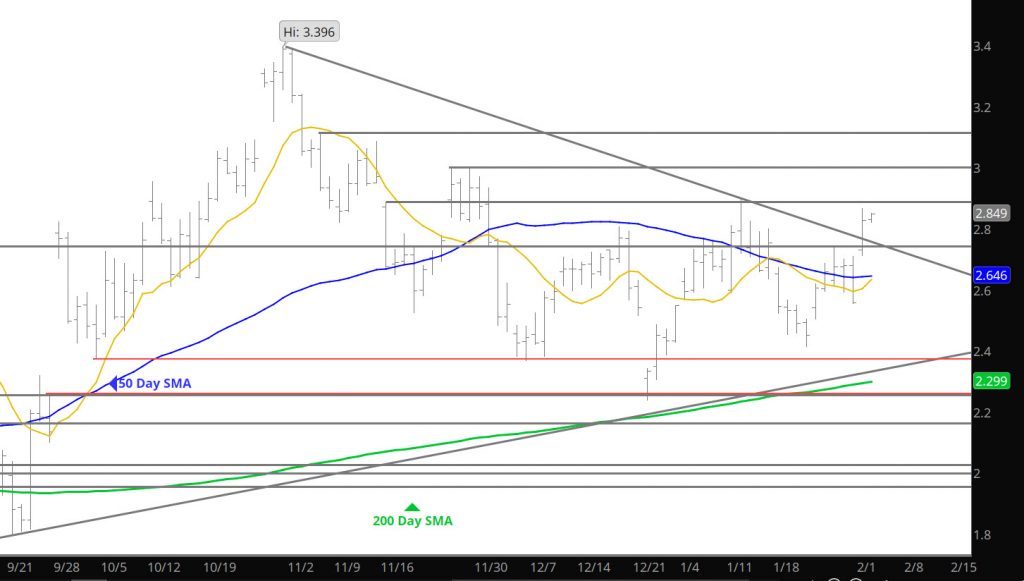

Support: $2.373–$2.356,$2.255-$2.176

Minor Support:$2.806, $2.71, $2.60-$2.554,$2.483, $2.162

Major Resistance: $2.92-$2.997, $2.98-$3.05,

Minor Resistance: