Author: Willis Bennett

Tardy and Range

Yesterday turned out to be a good day to suffer a stomach issue as the market just churned lower and now this morning seems to be looking to set the low end of the range. My apologies for not emailing the Daily and the tardy post, but I am still not in my game plan.

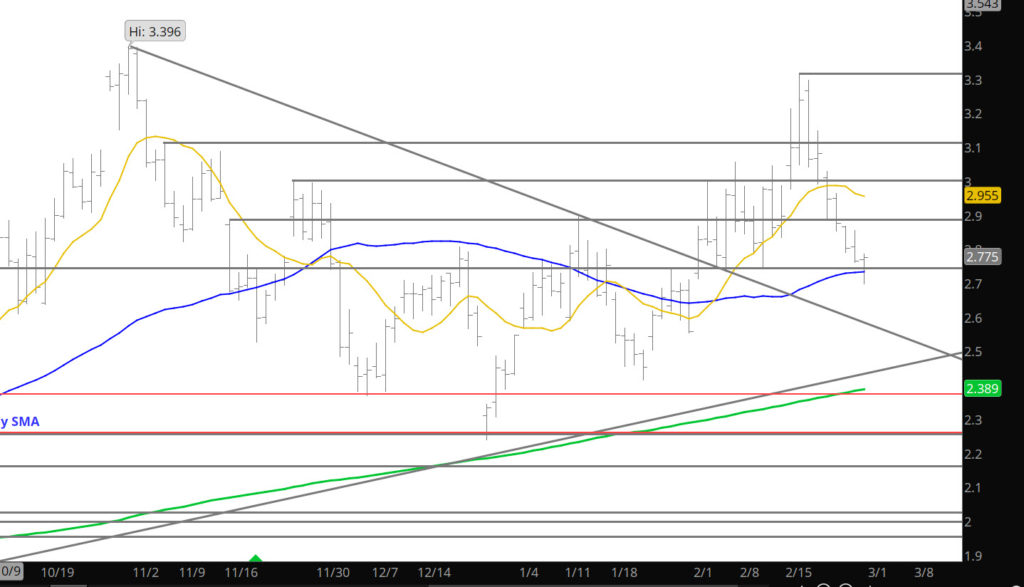

Support:$2.764, $2.74, $2.65, $2.373–$2.356,$2.255-$2.176

Minor Support: $2.71, $2.60-$2.554,$2.483, $2.162

Major Resistance: $2.94, $2.98-$3.05, $3.082, $3.316-$$3.396, $3.486

Minor Resistance:$2.85

Patience is Required

Range Is Working

March Settlement – Highest of Q1

Declines Continue Through the Week

April Starts Quietly

Subtle Expiration Declines

The expiration was lower (continuing the trend) and now the new prompt (April) faces an immediate challenge of the recent declining trend vs what is likely to be a near record storage release after the weather of last week. It may be an interesting struggle as the range of withdrawals is fairly wide.

Support:$2.834, $2.74, $2.373–$2.356,$2.255-$2.176

Minor Support: $2.806, $2.71, $2.60-$2.554,$2.483, $2.162

Major Resistance: $2.98-$3.05, $3.082, $3.316-$$3.396, $3.486

Minor Resistance:$3.172

Gas Remains in “Comfort Zone”

Prices continued to the downside yesterday and into the comfort area that held trade during the calendar February. The very small gap from Feb 1st at $2.712 is likely the low for the month- therefore- expect prices to stay with in the majority of the range for February (either side of $2.82). It seems that the April contract, though a little weaker, is also staying within the comfort zone.

Support:$2.834, $2.74, $2.373–$2.356,$2.255-$2.176

Minor Support: $2.806, $2.71, $2.60-$2.554,$2.483, $2.162

Major Resistance: $2.98-$3.05, $3.082, $3.316-$$3.396, $3.486

Minor Resistance:$3.172