Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Range Range Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Storage Report Does Nothing

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

OOPS– Declines Didn’t Extend This Time

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

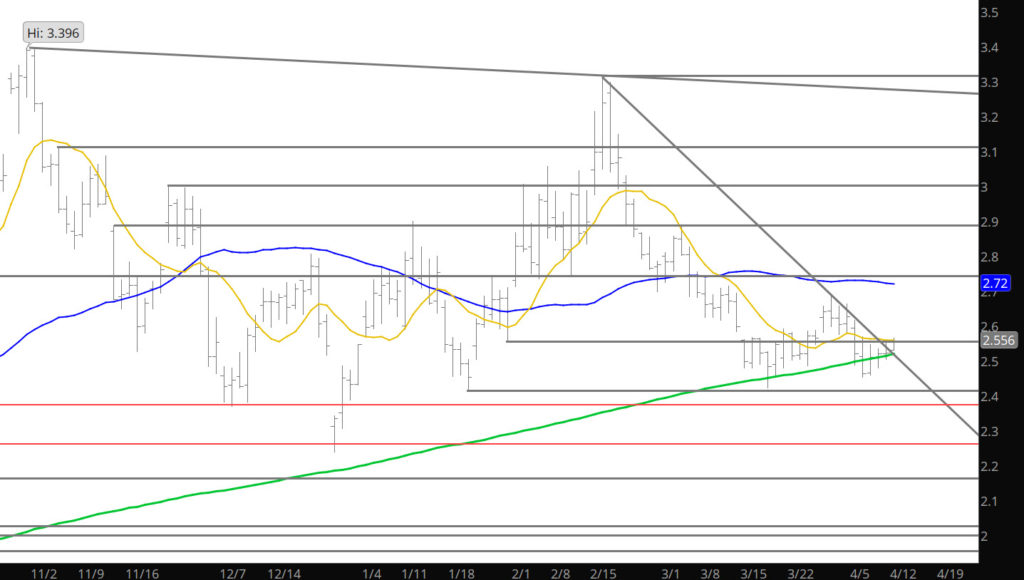

Possible Breakdown

Finally got a probe at the close to break below the March lows. While bearish from a technical standpoint, if this decline is made of the power to rock lower it will need some daily declines testing and breaking further support zones continuing lower. Other than shorting — may think about buying the dip with stops tight.

Support: $2.422-$2.414, $2.373–$2.356,$2.255-$2.176

Minor Support: $2.483, $2.162

Major Resistance: $2.74-$2.789, $2.89, $2.98-$3.05,

Minor Resistance:$2.806

Declines to Test Support- Range Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Higher Range — Same Action

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Good Friday Observations

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Quiet Probe Lower

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation Is a Bias

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.