Author: Willis Bennett

Range Expanded

Test of Support — Not Yet

Churn, Churn to the Downside

New Week Look for Weakness

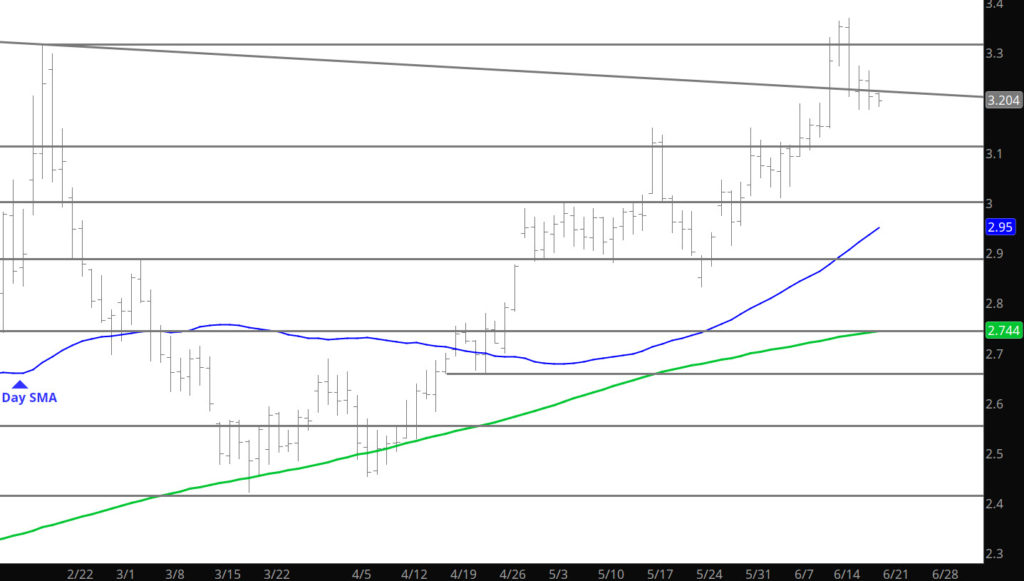

Having issues loading charts on this internet connection — was going to load the Daily and mention that after last week’s reversal — see Weekly section– the July contract has likely posted the high side of its expiration range. The market now should define the low side of the range.

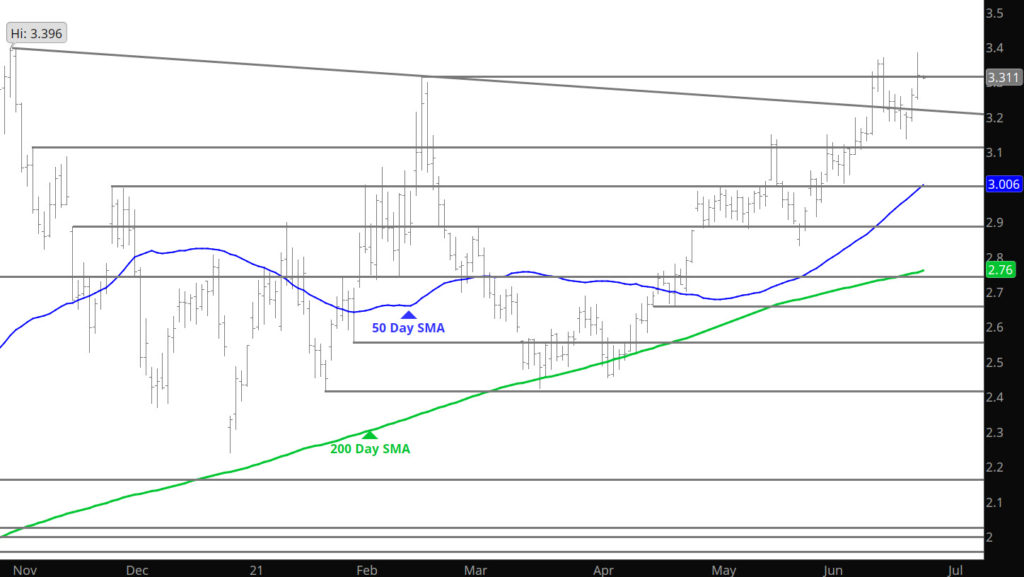

Major Support: $3.198, $3.12, $3.00 $2.914-$2.886, $2.78, $2.71-$2.70

Minor Support: $2.694

Major Resistance: $3.321-$3.33, $3.369-$3.396, $3.482

July Contract Rally Has Work to Do

No Surprise

Folks Know About Storage Adjustment

A lot of you fundamental traders have been alerting me to the big working gas reclassification coming in the report today. Trust me — if I know about some fundamental related issue — the world knows about it. It will be interesting to see how the market trades around it — my inclination is to approach with caution — failed at the highs lets see how the market defines support after digesting the PG&E “adjustment”. Question for you conspiracy folks against gas utilities– do you think there is a possibility that the utility (or its storage management division) bought some PGE basis prior to the announcement — say for the last quarter? Just asking.

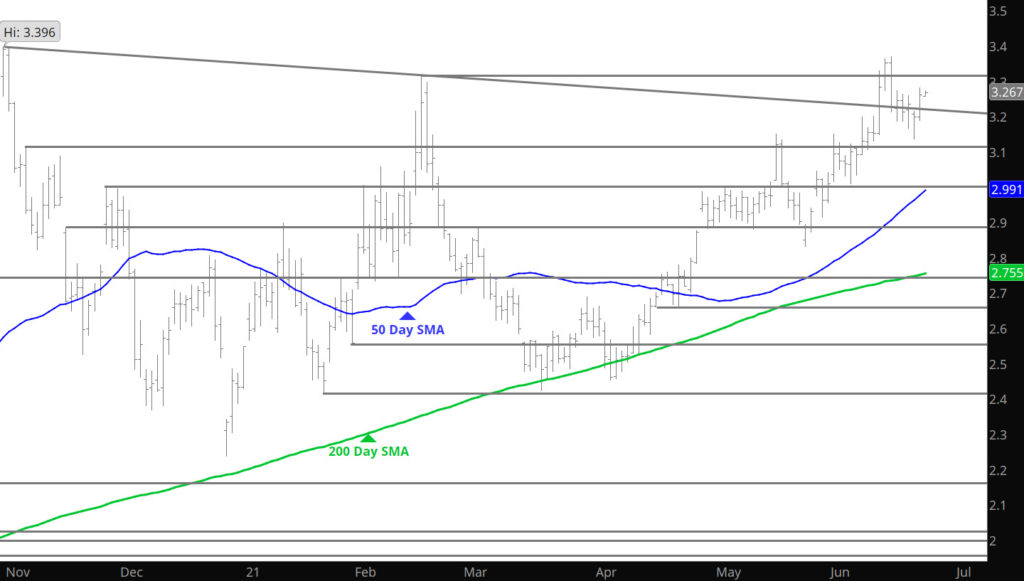

Major Support: $3.198, $3.12, $3.00 $2.914-$2.886, $2.78, $2.71-$2.70

Minor Support: $2.694

Major Resistance: $3.321-$3.33, $3.396, $3.482