Expiring August booked a gain during the final days of its tenure while last week’s continuation decline to a lower weekly close produced a technically negative weekly reversal bar but with lower weekly volume. The expectation of lower offers when trading resumed Monday was fulfilled by a gap lower being quickly filled, but the stage was set for lower trade and the market was compliant toward targeted support. On Wednesday, September traded to a low of $7.550 (just about matching a 50% retracement of the rally from the July low to the August options expiration day high was $7.53) and the 50 – day SMA of September gas at $7.5494. After a brief test of the mathematical and moving average support prompt gas rallied $.93 in one hour, before fading to close $.56/dt higher, basically offsetting the previous day’s $.577 decline. September lost another $.202 on Thursday and Friday, ending the week $.1650 below the close a week earlier. Do you start to develop a sense that this market in volatile state going nowhere slowly.

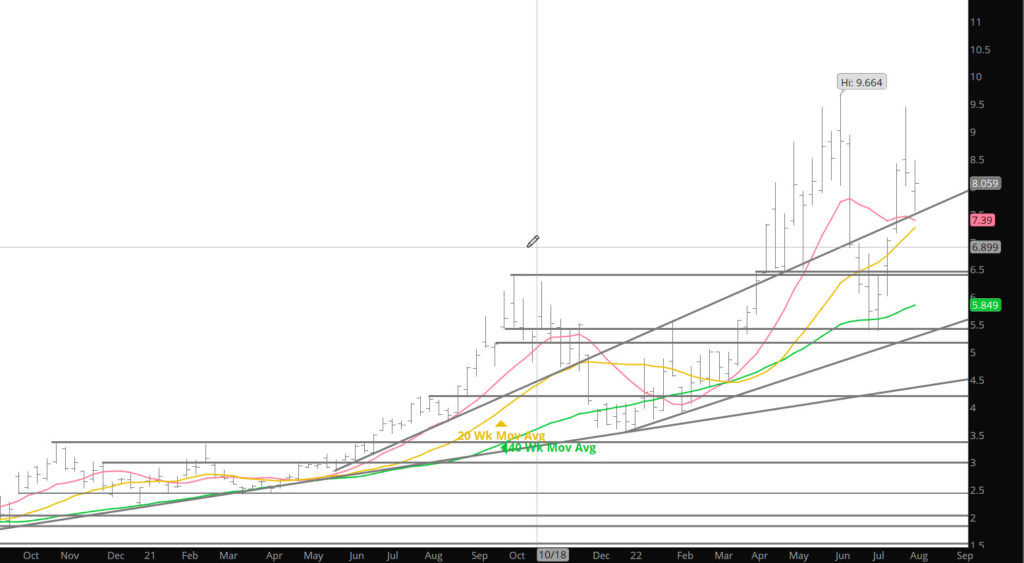

Open interest and volume were both marginally higher for the week which is a technical negative for prices in the upcoming week. The decline from the June high to the July low was an intermediate term downtrend within the long – term uptrend. That said, the late July trade to a higher high that intermediate term downtrend has morphed into an exceptionally wide trading range. Rarely if ever has substantial support and resistance been so well defined…or so far apart.

Major Support: $8.02, $7.55, $7.14, $6.88, $6.754,$6.38, $6.02, $5.623,

Minor Support: $7.41, $6.42, $5.548, $5.40-$5.45

Major Resistance: $8.95, $8.996-$9.057