Month: November 2021

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

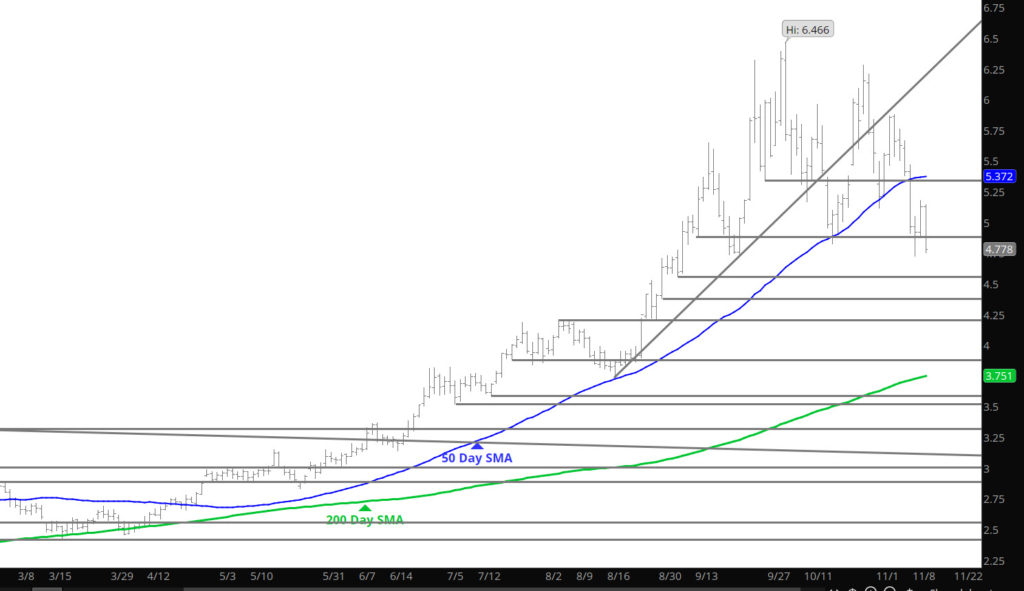

After Break Down, Late Rally Gets Snuffed

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

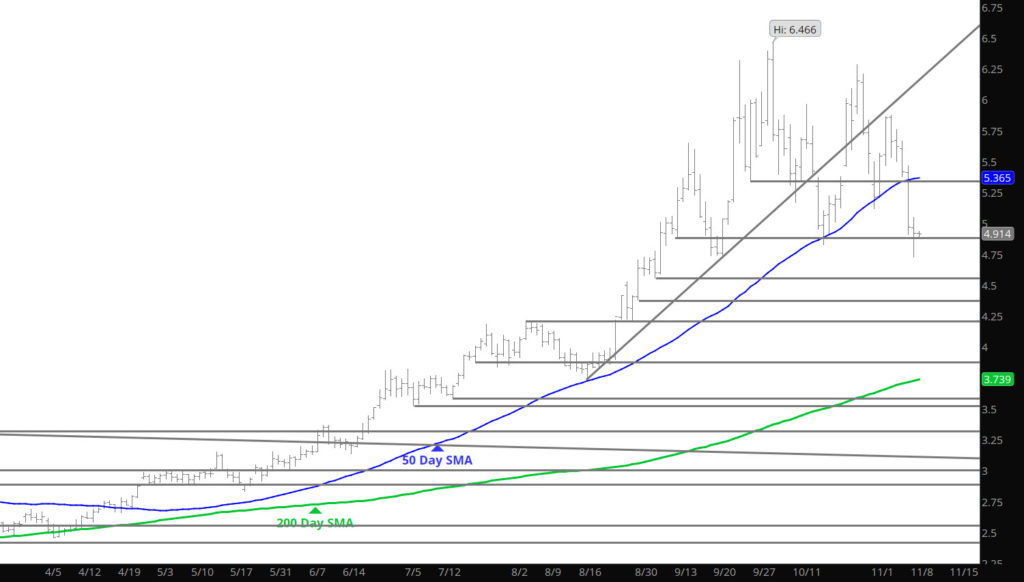

Breakdown Week in Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

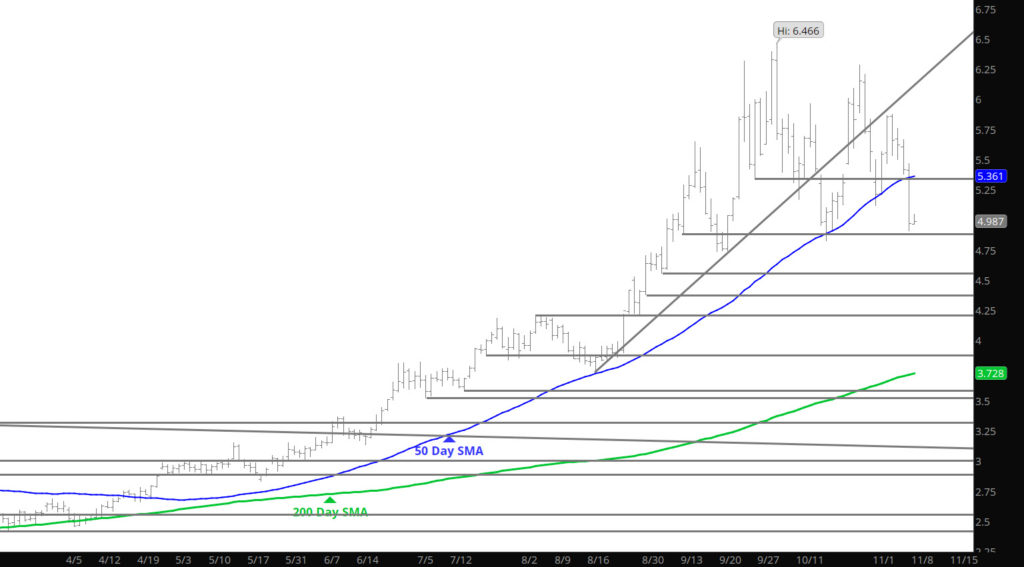

A Lower Low but Not on Close

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Now That is New and Exciting

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Nothing New Here

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Weekly Consolidation Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

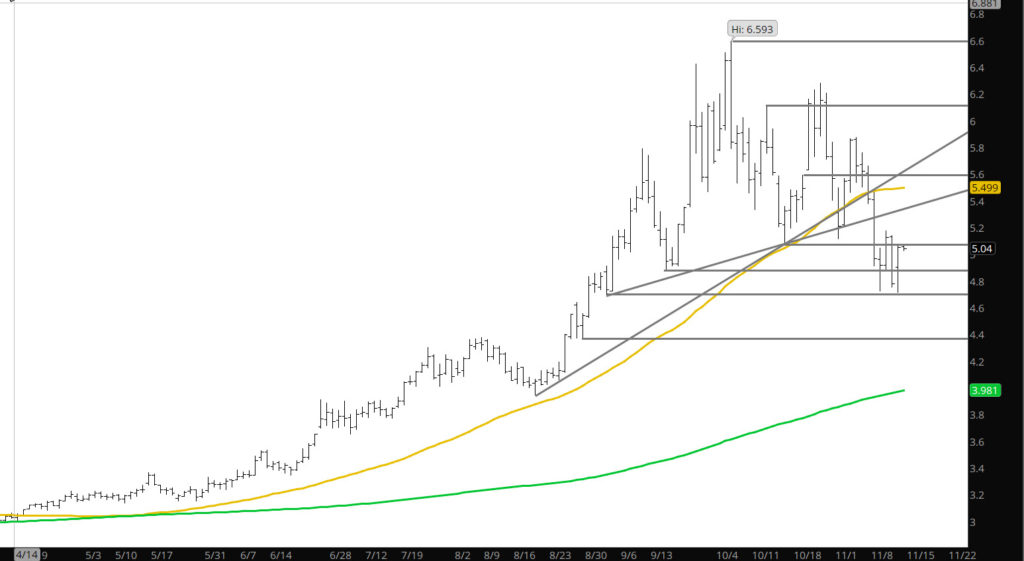

Funky Action in Natty

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Subtle Day

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Volatility Returns To the Upside

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.