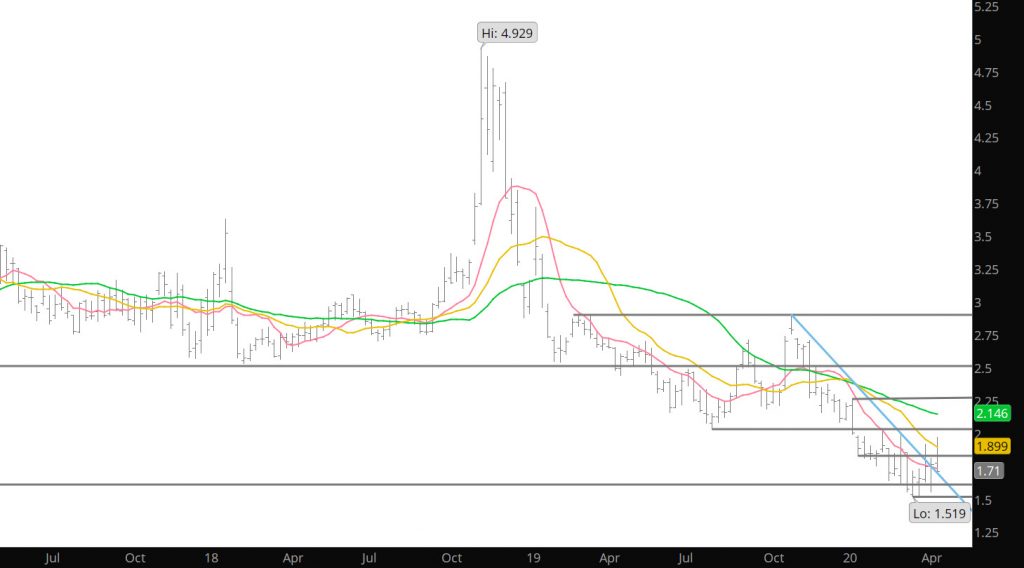

A series of close weekly closing prices have occurred during the May contract as prompt. Closing prices have been within a range of $.02 over the last three weeks ($1.733, $1.753 and $1.746). The two previous weeks were at $1.634 and $1.621. This type of price behavior usually precedes a significant price move as it has a tendency to bring attention to traders (yes we look at these elements in trade). In natural gas the last time this type of tight weekly closings was in December when there were four weekly closings ($2.281-$2.334) before prices before prices broke down and added to the recent Q1 declines. The previous tight weekly closes occurred last summer when prices constructed a tight weekly range between $2.119 and $2.169 over three weeks (July and August). This set up the rally to the September high ($2.71) and the eventual Q4 high of $2.905. I will be getting into the expectations of the June contract, as prompt, during this week with the final outlook next Sunday.