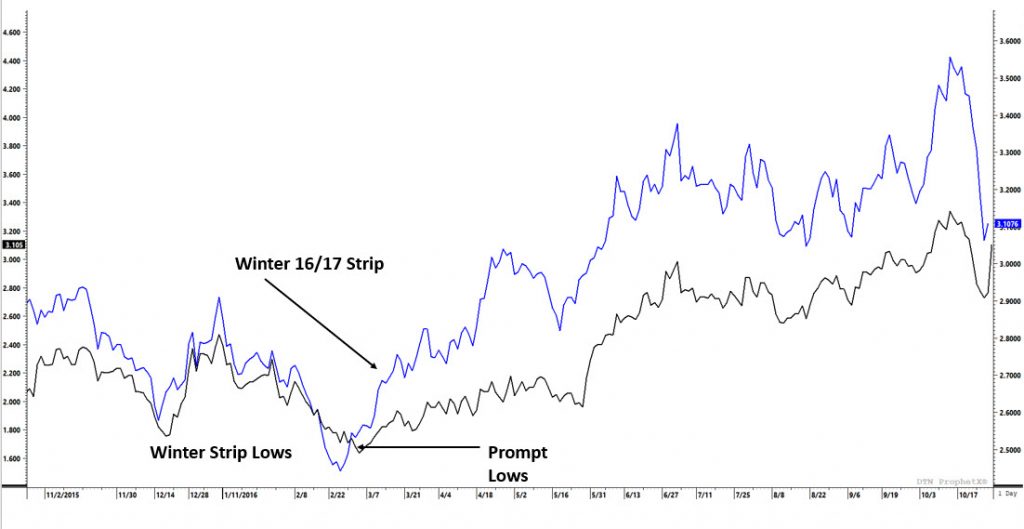

I wanted to bring to your attention the similarities to trade back in 2016 (last long term low) and this year. The two charts are clearly not identical, but often with natural gas, the trade action rhymes over time. In 2016 the market was coming off of a warm summer and the expectation of production overwhelming demand was evident in the price action. Do not want to go into the weeds about fundamental issues, I am more interested in highlighting the technical side of the trade and how history may be rhyming. In 2016 the low of the winter strip for winter 2016/17 traded in late February early March. Once that low had traded prices rallied from $2.45 and established an interim high of $3.04 in early May. This represents a 24% run in just 8 weeks. After a brief consolidation, prices extended the gains into Q2 (historically bullish period) and set the Q2 high for the winter strip at $3.37 in July (37.5% gain).

While the winter strip was behaving with this type of rally the prompt rallies into the summer were much stronger as prices ran from the lows of $1.61 to $2.17 (35% gain) in early May and then continued on to the Q2 high of $2.99 (86% gain) by July.

Look at the current chart comparing the winter 2020/21 to prompt. It looks like the lows were established last month at $2.35 and have been on a solid run since (similar to 2016). The winter now trades at $2.76 (a 17% gain) and should the trade equal the rally in 2016 it would take prices to $3.23 for the strip. While the prompt has not confirmed a low, there are indications that the selling is loosing steam (discussed here last week).

While no year copies a previous years price behavior, the similarities between this spring and 2016 are eye opening. 1) similar fundamental conditions, 2) similar price levels (lows at $1.61 in 2016 and $1.51 in 2020), 3) similar prices in the winter strips ($2.35 this year versus $2.45 in 2016), 4) winter 20/21 strip has started its run. I bring this information on history to your attention and hope it was insightful for your trading strategy.