The lower low last week ($1.519) on the open of the trade on Sunday night was quickly replaced by subtle strength. The impacts from the virus may have short term expectations of demand destruction ( though not being a fundamental trader- I don’t care) are now being offset with serious implications of production issues from the declining crude price. Looking at the chart above – some folks supported the April contract into expiration which is contrary to the fundamental trade. It is likely that prices will decline to close the small differential from last weeks contract expiration (the lowest since Sept ’95) and the close of the May contract- from there the market will be fun to watch. Also, watch the nominations and flow data early in the month as any hedges from the winter are gone and if folks hedged they may not choose to show up with their gas in this price environment. The three month range remains the trade game.

I remain on the sideline for the fundamental arguments of whether prices are headed up due to oil price issues impact and the virus blues. All I can see in the technical data is that the price continues to have problems at major support and the fact prices are trending into 25 year lows suggests to me that things will change. Unfortunately for nat gas traders, those changes can be violent. Longer term, the weakness in the summer strip was met with strength in the winter strip — while speculative shorts declined. The market may be sending a strong signal for the upcoming summer.

Major Support: $1.611, $1.555, $1.481

Major Resistance: $1.99, $2.029, $2.08-$2.10, $2.34, $2.437, $2.48-$2.52,

Minor Resistance: $1.883,

Commodity Futures Trading Commission

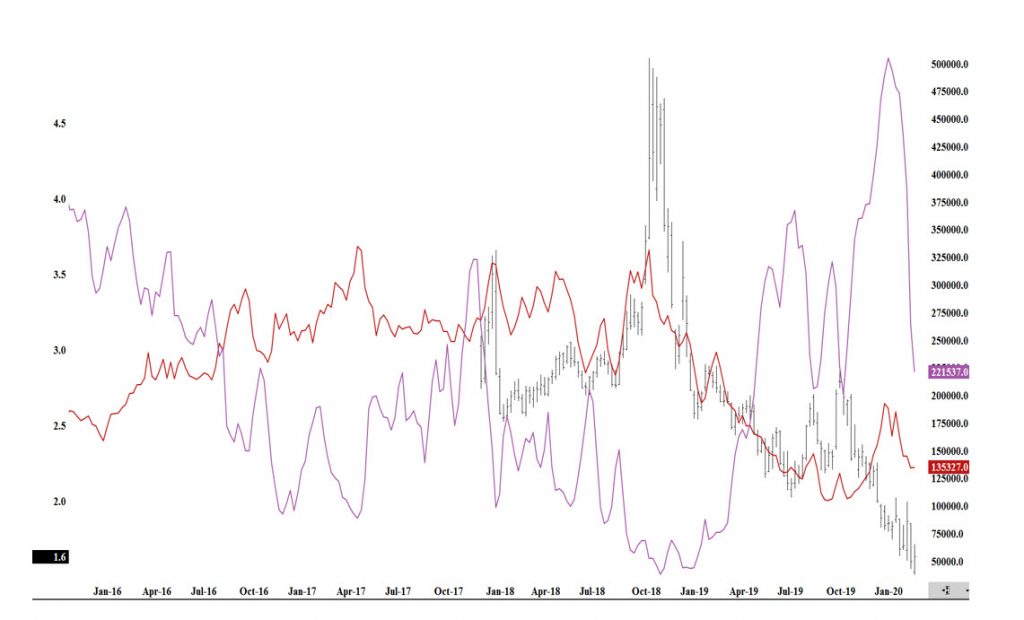

Natural Gas Managed Money Long (red) vs Managed Money Short (purple) positions

Additional short covering occurred last week but what was of interest to me, was the gains in the winter strip while the summer strip found just minimal support. The market is showing a slight change in long term bias with this action. Time will only tell, but it is beginning to look like the bears are becoming a little spooked and loosing impact.