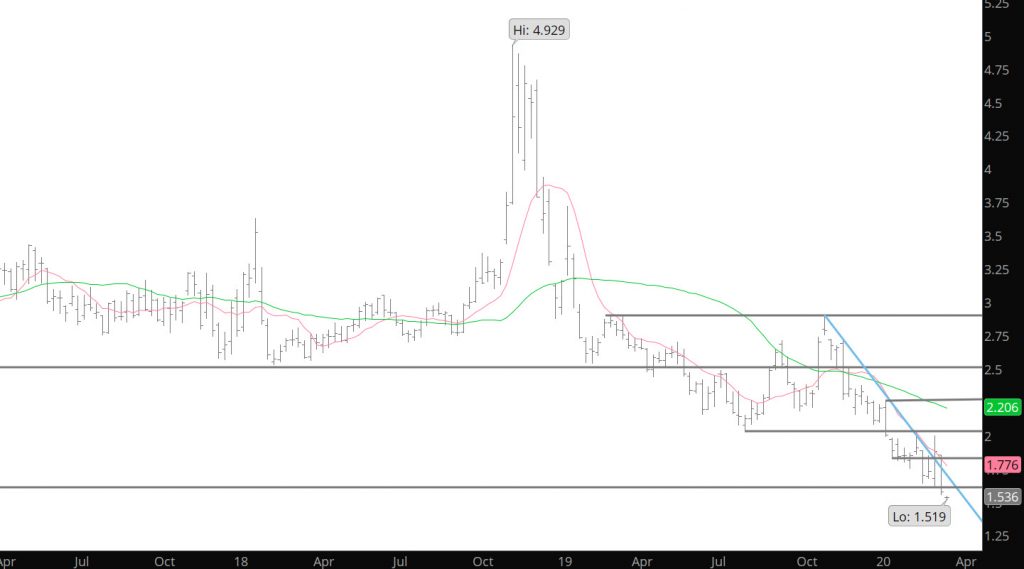

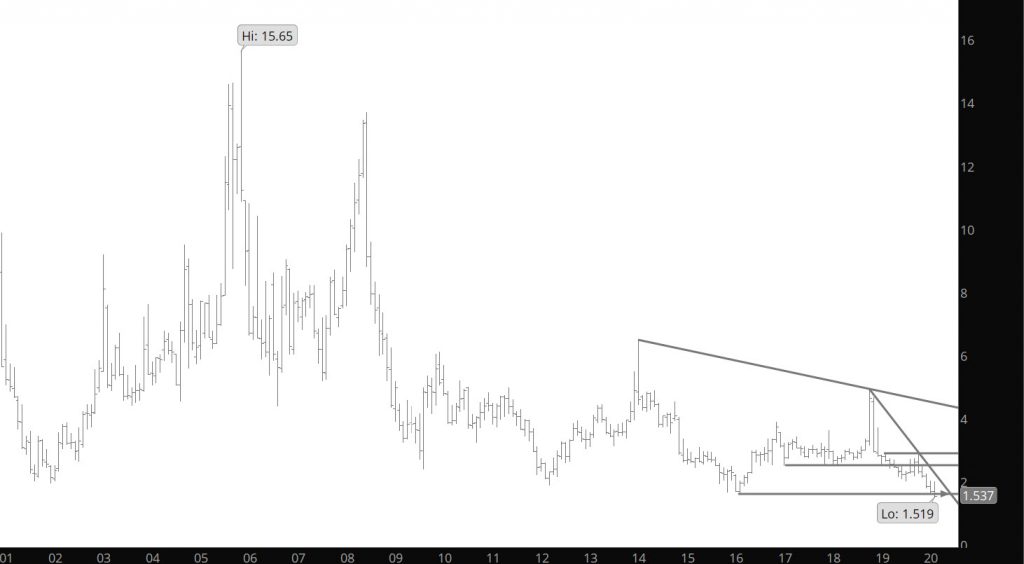

The trade last week left serious implications for future prices as the close near or below the long held (10+ year lows) will have longer impacts both up and down. The weakness is related (so I hear) to the effects of the virus and with the additional declines in crude oil prices. That tells me that declines due to the illness, there is less gas is used to keep homeowners warm than buildings which, not occupied, still need heat (avoiding frozen pipes) and therefore demand goes down. Seriously, you fundamental guys are twisted. Not sure where this goes down to but it will continue until this irrational perspective is concluded.

All fundamental noise to me, as I look at the markets, is the interpretation of the virus and the oil war that has commenced. The price action does not blend with the potential of the producer cutting production in the upcoming weeks and the effects of the coming summer that will start occurring. Technically, there is no support down to lows from the mid to early 1990’s so good luck picking those bottoms.

Major Support: $1.611, $1.555

Major Resistance: $1.99, $2.029, $2.08-$2.10, $2.34, $2.437, $2.48-$2.52,

Minor Resistance: $1.883,

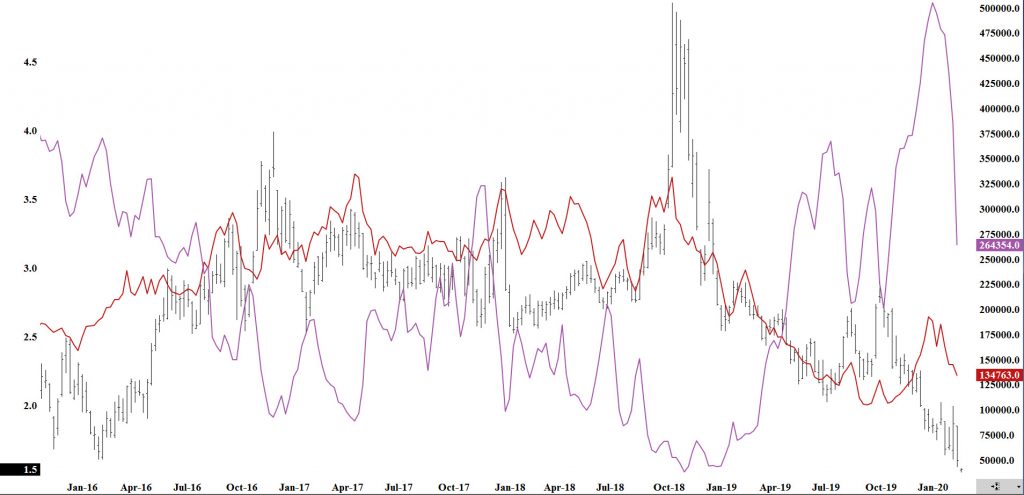

Commodity Futures Trading Commission

Natural Gas Managed Money Long (red) vs Managed Money Short (purple) positions

A serious reduction of the short position from the speculative crowd occurred from March 10th to the 17th and is reflective of the chart above. It should not be construed as the potential for a short covering rally being abated but rather the short speculative sector is reaching the conclusion that significant additional declines is now limited.