Weekly Continuous

Taking a look at the longer term trends of the Natural Gas contract the market remains with a distinctive negative bias. This is consistent with market history as Nat Gas trades to weakness during Q1 of the calendar year. In the last 10 years, the market has traded to the low prior to the expiration of the Feb contract once. In four of the last ten the low was postponed until April (slightly beyond the end of the quarter). The other five traded to the low after the Feb contract expiration and in the last four years the low was establish between 02/15 and 03/04.

Not crazy

Monthly Continuous

Prices have started to gain limited support in the Monthly chart above. How long this support holds is the key for the upcoming annual second quarter run for prices. The average gain from Q1 lows to Q2 highs is nearly 40% over the last ten years. Last year’s run was well below the average, with just a paltry 8% gain. These gains in price have occurred in all stages of fundamental supply and demand imbalance levels – highlighting the supply situation of this winter may not have a muted impact this year. The key areas of resistance to the seasonal run will be the lows from August ’19 which held support from August to January when the support was broken. Should the run be delayed and weakness resumes – the lows from this month down to the multi-year low from March ’16.

Major Support: $1.753, $1.611

Minor Support: $1.705

Major Resistance: $1.983, $1.994, $2.029, $2.086

Minor Resistance: $2.124

Commodity Futures Trading Commission

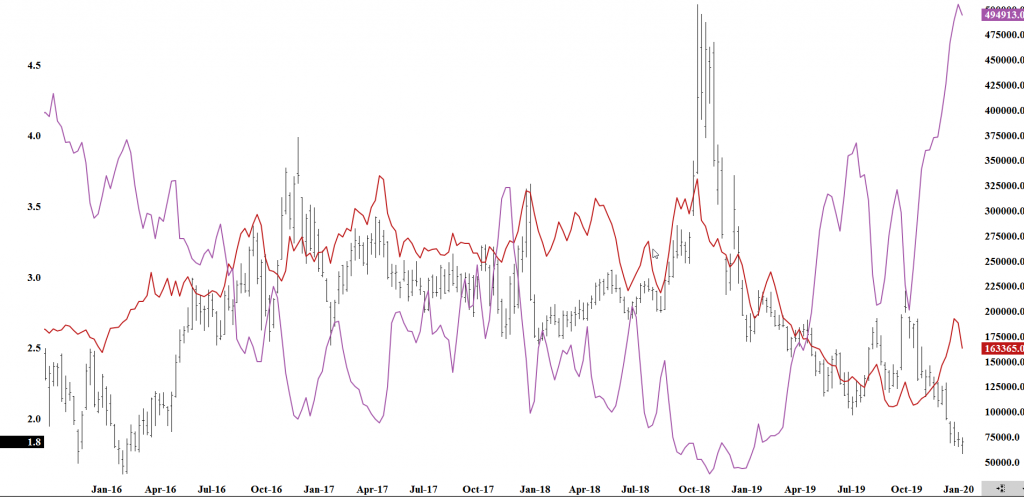

Natural Gas Managed Money Long (red) vs Managed Money Short (purple) positions

The chart above indicates the historical extreme short position of the speculative component to trade. History warns the traders that such extremes will not last long, though don’t indicate an immediate reversal. This information should be put into the perspective of what is likely to happen at some point in time (short covering rally). How far that rally takes prices is subject to where it starts and under what circumstances. Currently, the market remains under a bearish bias meaning that the short covering rallies may be slow and inconsistent.