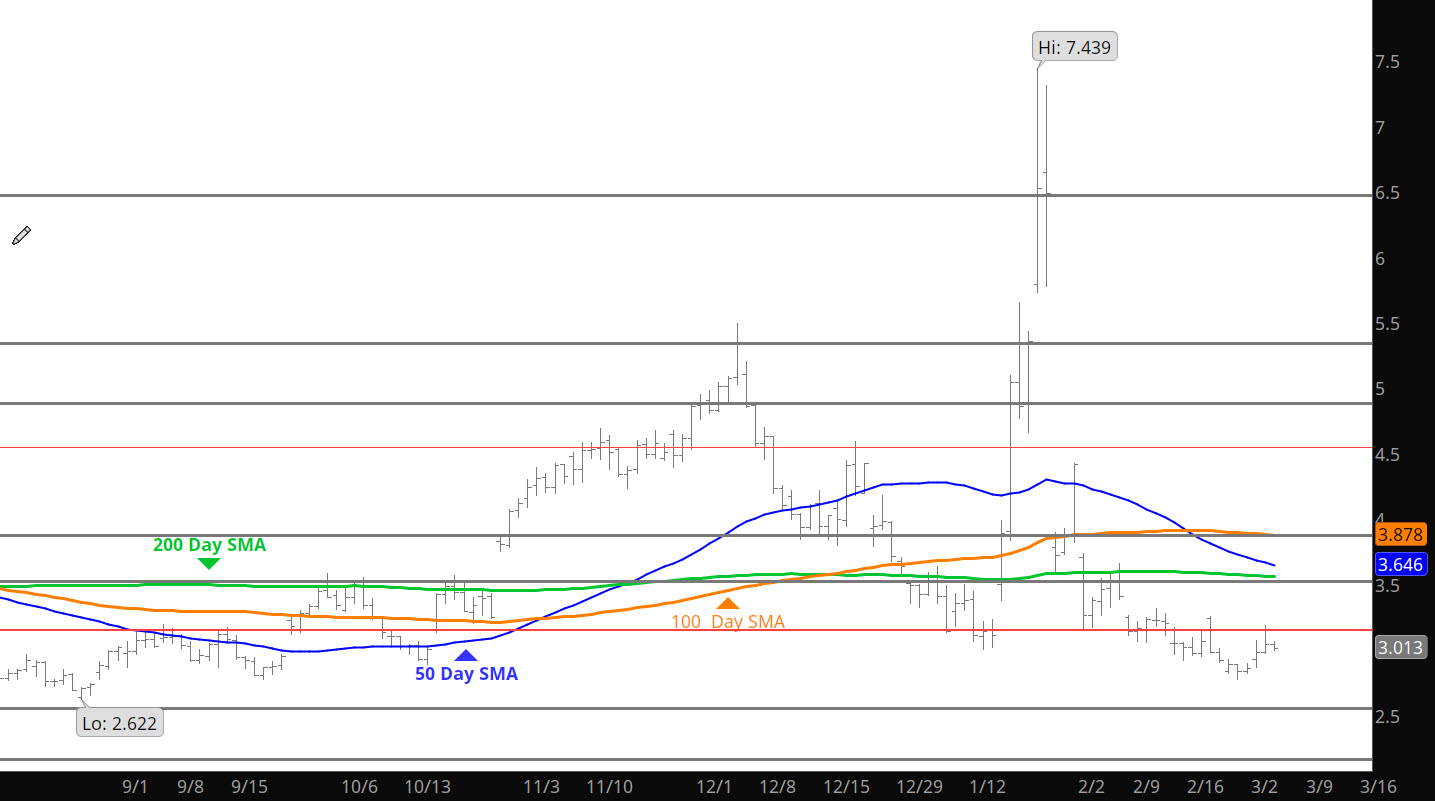

Daily Continuous

Welcomed my second granddaughter yesterday and of course she is just beautiful and healthy. The market got the initial run in prices with the middle east in war and crude up over ten percent. Now the trade will have to evaluate the impact of the war on the LNG markets and carry forward to the US market and during the evaluation would keep the range from Feb active in your mind for buying and selling,

Major Support: $2.87-$2.84, $2.640-$2.57

Minor Support/Resistance : $3.16-$3.148, $3.136

Major Resistance: $3.02, $2.97-$2.93, $3.787-$3.831, $4.063, $4.086, $4.593, $5.333, $5.496