Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

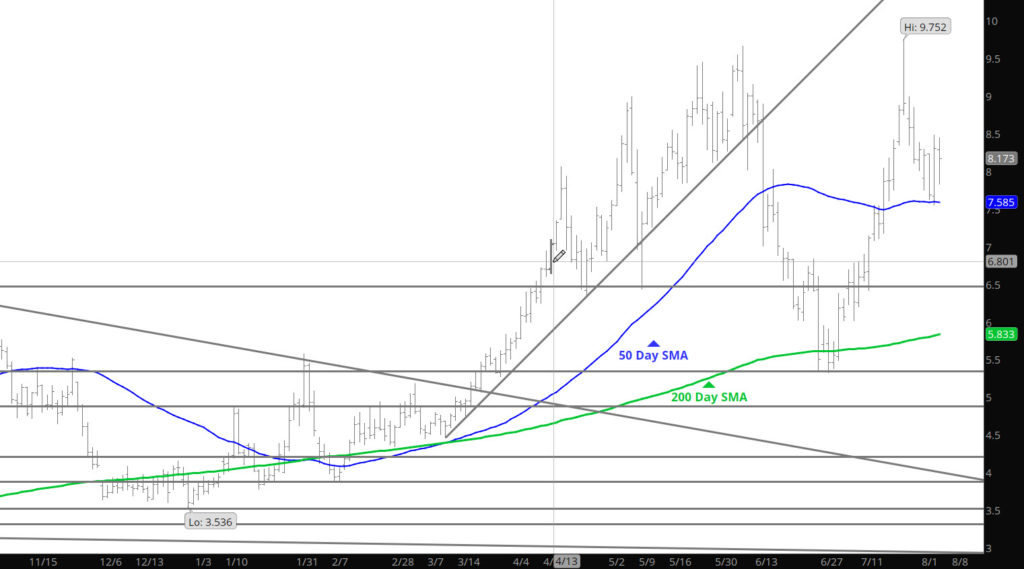

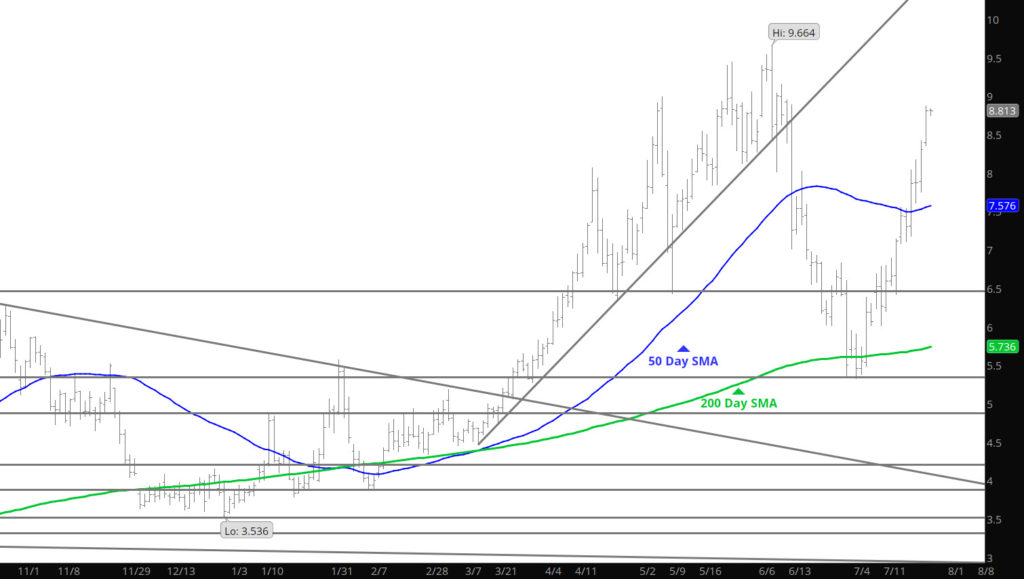

Test of Moving Average Holds — Prices Rebound

Very rarely do I utilize a moving average test as a serious test of support– but looking at the chart is very evident that buyers com in as prices test the 50 Day SMA since it broke out above last month. The range discussed now has to evaluate the high side as to where to profit, or hold for further gains.

Major Support:$8.02, $7.55, $7.14, $6.88, $6.754,$6.38, $6.02, $5.623,

Minor Support: $7.41, $6.42, $5.548, $5.40-$5.45

Major Resistance: $8.95, $8.996-$9.057

Wild Expiration Week With Potential Ramifications

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Strong Test of Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

September Open Weak

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Not Well Bid

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Now That is “Well Bid”

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Guess the Expiration Verdict Is In

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Expiration — A Mystery

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Second Higher Weekly Close

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.